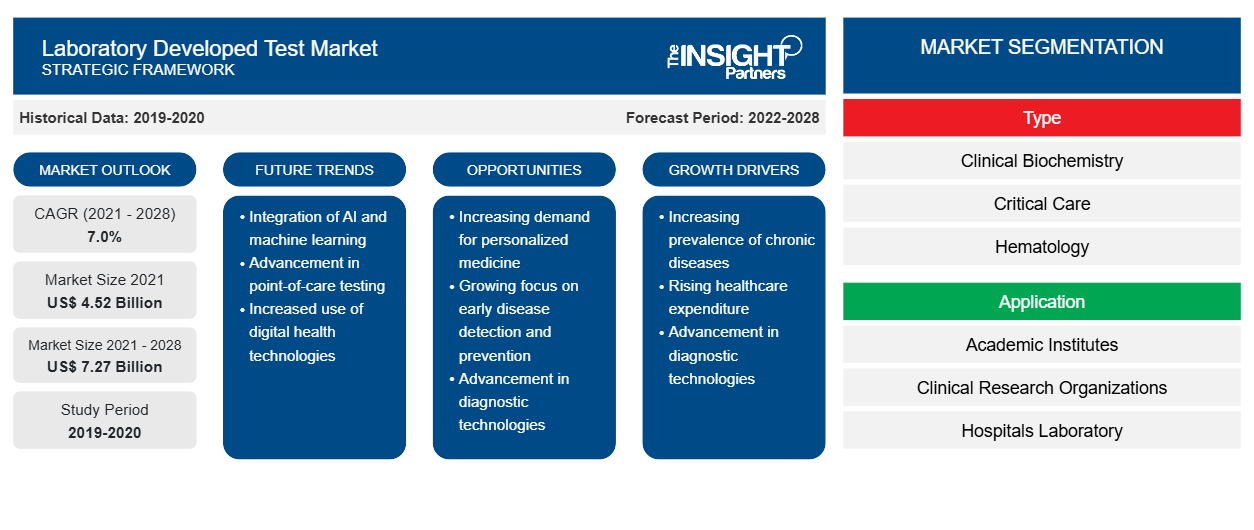

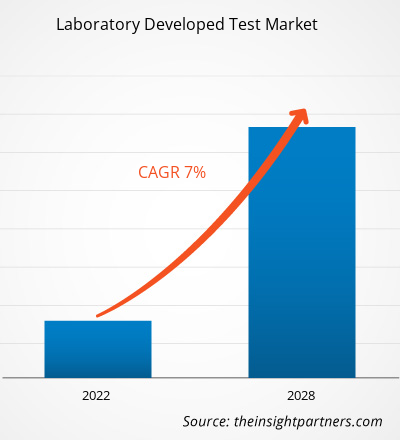

Le marché des tests développés en laboratoire devrait atteindre 7 269,3 millions USD d'ici 2028, contre 4 524,75 millions USD en 2021 ; il devrait croître à un TCAC de 7,0 % au cours de la période 2021-2028.

Un test développé en laboratoire (LDT) est un type de test de diagnostic in vitro conçu et utilisé dans un seul laboratoire. Ces tests peuvent être utilisés pour estimer ou distinguer des analytes tels que des protéines, des biomolécules/composés (glucose, cholestérol, etc.) et de l'ADN extraits d'échantillons prélevés sur des sujets humains. L'expansion des méthodes de diagnostic in vitro automatisées (DIV) pour les laboratoires et les dispensaires afin de rendre des analyses précises et sans erreur alimente la croissance du marché des tests développés en laboratoire.

La croissance du marché des tests développés en laboratoire est principalement attribuée à des facteurs tels que l'augmentation des cas de cancer et de troubles génétiques et le grand nombre de lancements de produits. Cependant, l'évolution du paysage réglementaire freine la croissance du marché. Par exemple, en Europe, la conformité au règlement sur les dispositifs in vitro (IVDR) sera obligatoire pour tous les tests de diagnostic in vitro à partir de mai 2022 ; le règlement vise à garantir l'efficacité clinique et la sécurité des tests médicaux, transformant ainsi l'industrie du diagnostic, ce qui constitue une grande préoccupation pour les acteurs du marché.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Informations sur le marché

La recherche continue sur les médicaments personnalisés offre des opportunités de croissance aux acteurs du marché des tests développés en laboratoire

Les LDT jouent un rôle essentiel dans le développement de médicaments personnalisés qui sont susceptibles de s'avérer être des moyens prometteurs de lutter contre les maladies grâce à des traitements ou des remèdes efficaces jusqu'ici inexistants. Selon la Personalized Medicine Coalition, les médicaments personnalisés ne représentaient que 5 % des nouvelles entités moléculaires approuvées par la FDA en 2005 ; cependant, en 2016, ce chiffre est passé à plus de 25 %. En outre, 42 % de tous les composés et 73 % des composés oncologiques en cours de développement ont le potentiel de servir de médicaments personnalisés. Les sociétés biopharmaceutiques ont presque doublé leurs investissements en R&D dans les médicaments personnalisés au cours des cinq dernières années, et elles devraient encore augmenter leurs investissements de 33 % au cours des cinq prochaines années. Les chercheurs biopharmaceutiques prévoient également une augmentation de 69 % du développement de médicaments personnalisés au cours des cinq prochaines années. Les tests de laboratoire sont utilisés pour diagnostiquer les maladies et prédire et surveiller la réponse aux médicaments, ainsi que pour obtenir les données informatiques nécessaires aux algorithmes prédictifs complexes. play a vital role in the development of personalized medicines that are likely to prove as promising means of tackling diseases through far eluded effective treatments or cures. As per the Personalized Medicine Coalition, personalized medicines accounted for only 5% of the new FDA-approved molecular entities in 2005; however, in 2016, this number rose to more than 25%. Additionally, 42% of all compounds and 73% of oncology compounds in the pipeline have the potential to serve as personalized medicines. Biopharmaceutical companies have nearly doubled their R&D investments in personalized drugs in the last five years, and they are further expected to increase their investments by 33% in the next five years. Biopharmaceutical researchers also predict a 69% increase in the development of personalized medicines in the next five years. Laboratory tests are used to diagnose illness and predict and monitor drug response as well as to obtain informatics data needed for complex predictive algorithms.

Les médicaments personnalisés sont en train de devenir la marque de fabrique du traitement du cancer. Il s’agit d’une approche en constante évolution qui repose sur la personnalisation des traitements en fonction de la constitution génétique individuelle. En 2019, la FDA a approuvé 12 médicaments personnalisés pour étudier et traiter les causes profondes de la maladie, combinant ainsi la médecine de précision aux soins cliniques. La demande croissante de médecine personnalisée offre des opportunités de croissance importantes pour la croissance des acteurs opérant sur le marché des tests développés en laboratoire.

Informations basées sur les types

Le marché des tests développés en laboratoire, par type, est segmenté en biochimie clinique, soins intensifs, hématologie, microbiologie, diagnostic moléculaire, immunologie et autres. Le segment du diagnostic moléculaire devrait détenir la plus grande part du marché en 2021. Cependant, le segment de l'hématologie devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.CAGR in the market during the forecast period.

Informations basées sur les applications

En termes d'application, le laboratoire a développé des applications de marché de test dans les instituts universitaires, les organismes de recherche clinique, les laboratoires hospitaliers, les centres de diagnostic spécialisés et autres. Le segment des laboratoires hospitaliers devrait représenter la plus grande part de marché en 2021. Cependant, le segment des centres de diagnostic spécialisés devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.CAGR in the market during the forecast period.

Les lancements et les approbations de produits sont des stratégies couramment adoptées par les entreprises pour étendre leur présence mondiale et leurs portefeuilles de produits. De plus, les acteurs du marché test développés en laboratoire se concentrent sur la stratégie de partenariat pour élargir leur clientèle, ce qui leur permet à leur tour de maintenir leur nom de marque à l'échelle mondiale.

Le rapport segmente le marché des tests développés en laboratoire comme suit

Français En fonction du type, le marché des tests développés en laboratoire est segmenté en biochimie clinique, soins intensifs, hématologie, microbiologie, diagnostic moléculaire, immunologie et autres. En fonction de l'application, le marché des tests développés en laboratoire est segmenté en instituts universitaires, organismes de recherche clinique, laboratoires hospitaliers, centres de diagnostic spécialisés et autres. Sur la base de la géographie, le marché des tests développés en laboratoire est segmenté en Amérique du Nord (États-Unis, Canada et Mexique), Europe (Royaume-Uni, Allemagne, France, Italie, Espagne et reste de l'Europe), Asie-Pacifique (Chine, Japon, Inde, Australie, Corée du Sud et reste de l'Asie-Pacifique), Moyen-Orient et Afrique (Émirats arabes unis, Arabie saoudite, Afrique du Sud et reste du Moyen-Orient et de l'Afrique) et Amérique du Sud et centrale (Brésil, Argentine et reste de l'Amérique du Sud et centrale).

Aperçu régional du marché des tests développés en laboratoire

Les tendances et facteurs régionaux influençant le marché des tests développés en laboratoire tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des tests développés en laboratoire en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des tests développés en laboratoire

Portée du rapport sur le marché des tests développés en laboratoire

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 4,52 milliards de dollars américains |

| Taille du marché d'ici 2028 | 7,27 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2021-2028) | 7,0% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par type

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

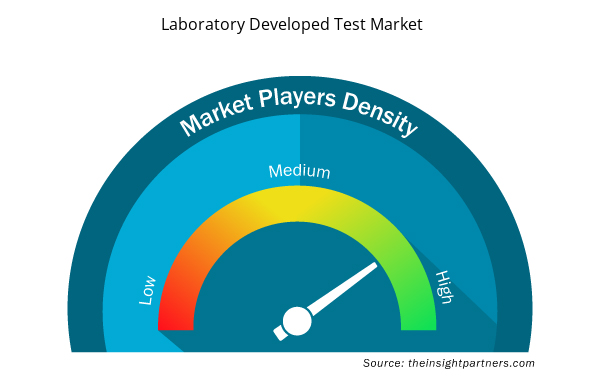

Densité des acteurs du marché des tests développés en laboratoire : comprendre son impact sur la dynamique des entreprises

Le marché des tests développés en laboratoire connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des tests développés en laboratoire sont :

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTÉE,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientifique

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des tests développés en laboratoire

Profils d'entreprise

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTÉE,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientifique

- Biodesix

- Biotechnologies adaptatives

- Biothéranostique

- Rosetta Genomics Ltd.,

- Santé de Guardant

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

The laboratory developed test market is led by type molecular diagnostics segment is growing significantly due to the increasing attention to the development of genetic therapeutics. The growing research in human genomics is playing a vital role in developing laboratory developed tests. The technological advantages of molecular tests make them compelling diagnostic tools, and they have become valuable for detecting a wide range of genetic diseases. For instance, in November 2017, Edico Genome launched the DRAGEN Clinical Genomics Information System (CGIS).

The automation of LDTs can significantly boost productivity and simplify compliance procedures. Clinical laboratories are under huge pressure to manage increasing test volumes and conduct more complex diagnostic assays, which further underlines the need for flexible automation systems. Many MedTech companies are offering automation solutions to help streamline clinical laboratory processes. For instance, Roche Cobas Omni–Utility Channel is beneficial for both IVD assays and high-volume LDTs. It is designed to meet the growing needs of efficient workflows in laboratories, as it can assist in different stages ranging from sample processing to quick data interpretation. It can run up to 96 results in about 3 hours and up to 864 results in 8 hours, thereby boosting the efficiency of laboratories.

The growth of the region is attributed to factors such as rising public–private partnerships, and increasing funding activities are widely enhancing the performance of medical devices. Moreover, presence of well-developed healthcare infrastructure and government support are some of the prominent factors propelling the market growth in Asia Pacific. In Asia Pacific, India is the largest market for laboratory developed test. The market growth in Asia Pacific is mainly attributed to factors such as the growing usage of laboratory developed test in combating Covid-19, increasing incidents of cancer and genetic disorders, large number of product launches. However concerns high capital investment for setting up advanced labs hinders the market growth in Asia Pacific.

A laboratory developed test (LDT) is a type of in vitro diagnostic test that is designed and used within a single laboratory. These tests can be utilized to estimate or distinguish an extensive assortment of analytes materials such as proteins, chemical compounds like glucose or cholesterol, or DNA, from a specimen received from human anatomy. The expansion of automated in vitro diagnostics (IVD) methods for labs and dispensaries to render precise, and error-free analysis is anticipated to fuel the increment.

The growth of the laboratory developed test market is mainly attributed to factors such as the increasing incidents of cancer and genetic disorders, large number of product launches. However, changing regulatory landscape for instance, in Europe, the In-Vitro Device Regulation (IVDR) compliance will be mandatory for all in vitro diagnostic tests from May 2022; the regulation aims to secure the clinical effectiveness and safety of medical tests, thus transforming the diagnostic industry is a great concern to hinder the market growth. In August 2021, eMed, a telehealth company democratizing healthcare through digital-point-of-care solutions, and Quest Diagnostics the world's leading provider of diagnostic information services, are collaborated to bring clinician-guided rapid antigen testing for COVID-19 to employers seeking to foster safer environments by decreasing the risk of COVID-19 exposure in their workplaces which is contributing to the growth of the target market. Such strategic steps are also projected to drive the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Laboratory Developed Test Market

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientific

- Biodesix

- Adaptive Biotechnologies

- Biotheranostics

- Rosetta Genomics Ltd.,

- Guardant Health

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport