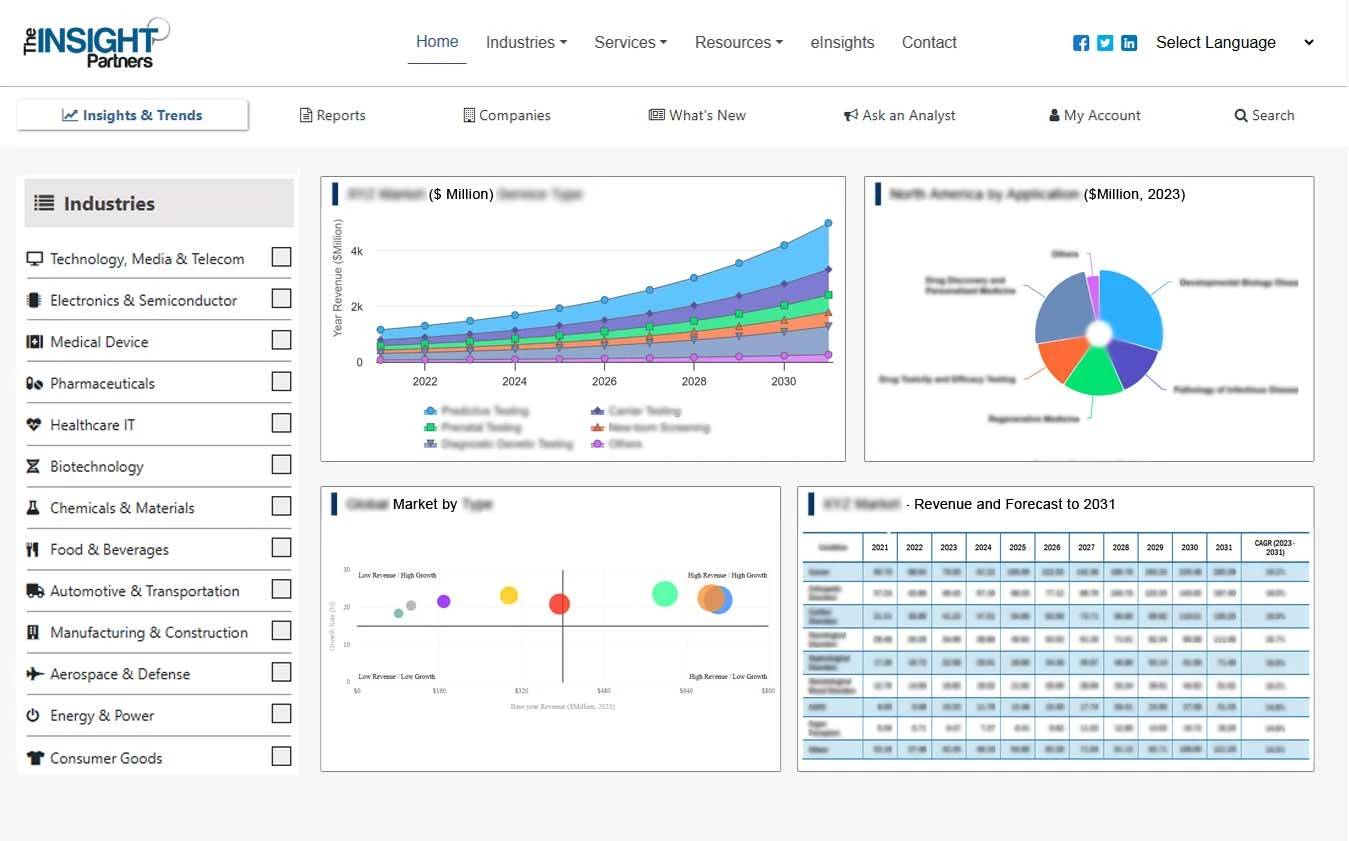

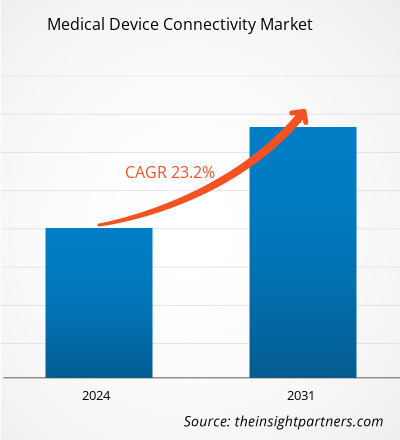

La taille du marché de la connectivité des dispositifs médicaux devrait atteindre 14,14 milliards de dollars américains d’ici 2031, contre 2,66 milliards de dollars américains en 2023. Le marché devrait enregistrer un TCAC de 23,20 % au cours de la période 2023-2031.La tendance aux soins de santé à domicile restera probablement une tendance clé du marché.

Analyse du marché de la connectivité des dispositifs médicaux

Pour partager les données des patients, la connectivité des dispositifs médicaux crée et maintient la connexion entre les équipements et les dispositifs médicaux dans les établissements de santé. Les options de connectivité de ces appareils incluent des connexions filaires hybrides et sans fil basées sur Bluetooth, RFID et le cloud. Les principales forces qui propulsent le marché vers l’avant sont l’omniprésence des DSE et des DME ainsi que l’expansion rapide des services de télésanté .

Aperçu du marché de la connectivité des dispositifs médicaux

The market for medical device connectivity is anticipated to grow as more people use electronic medical records. Furthermore, the medical device connectivity market should have plenty of opportunities to expand due to the rising use of telehealth services. For instance, according to the Centers for Disease Control and Prevention, 37.0% of adults in the US utilized telemedicine in 2021.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Medical Device Connectivity Market: Strategic Insights

CAGR (2023 - 2031)23.20%- Market Size 2023

US$ 2.66 Billion - Market Size 2031

US$ 14.14 Billion

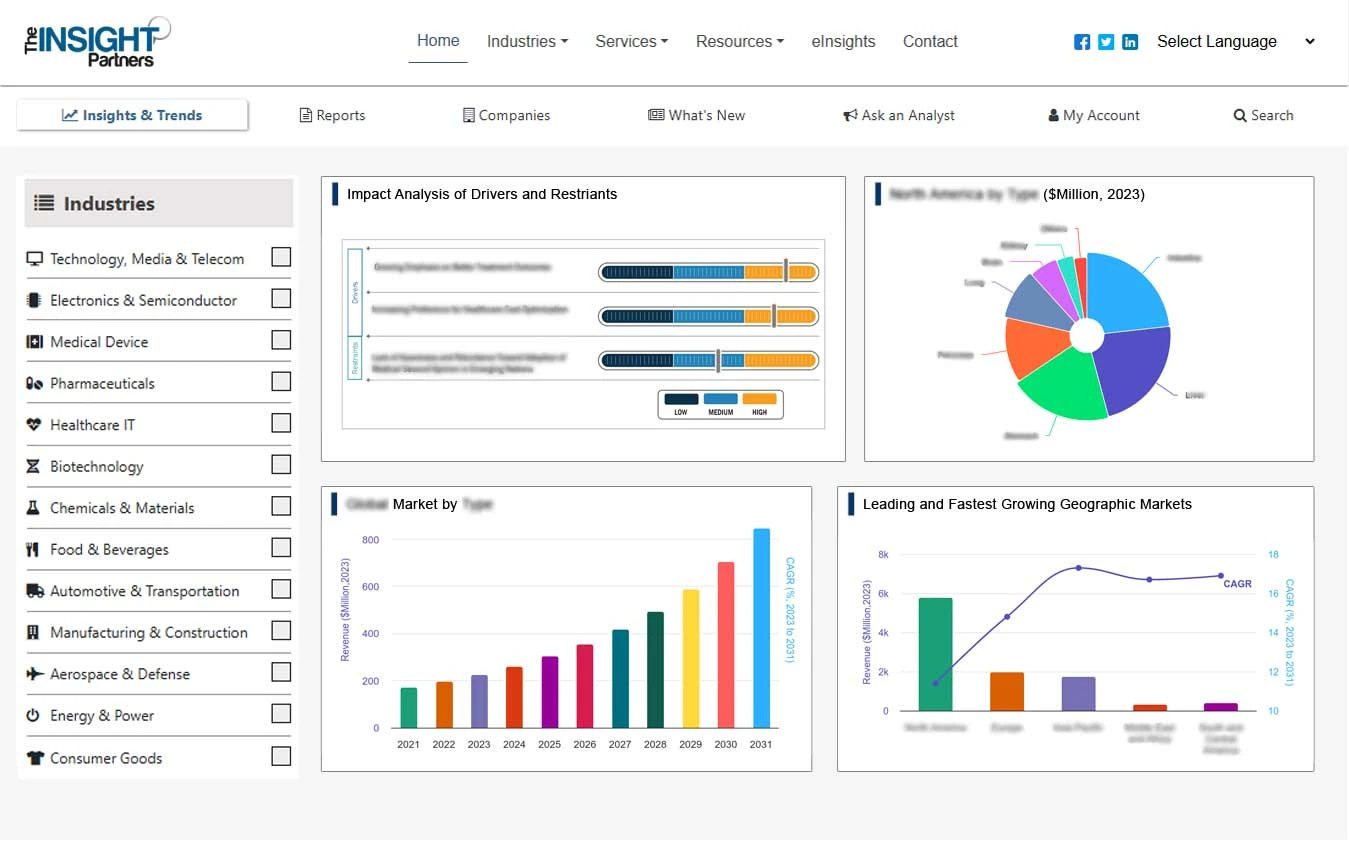

Market Dynamics

- Rapid Expansion of Telehealth Services augmenting the market growth

- Rising Use of EHR or EMR Favors the adoption rate

- Encouraging 5G Technology to Boost Medical Device Communication is Likely to Create Ample Opportunities in the Market

Key Players

- iHealth Labs Inc,

- Oracle Corp,

- Lantronix Inc,

- Infosys Ltd,

- Digi International Inc,

- Cisco System Inc,

- Medtronic Plc,

- Koninklijke Philips NV,

- GE HealthCare Technologies Inc,

Regional Overview

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Market Segmentation

Product and Services

Product and Services - Medical Device Connectivity Solutions

- Medical Device Connectivity Services

Technology

Technology - Wireless Technologies

- Hybrid Technologies

- Wired Technologies

Application

Application - Vital Signs and Patient Monitors

- Anesthesia Machines and Ventilators

- Infusion Pumps

- Others

End Use

End Use - Hospitals

- Ambulatory Surgical Centers

- Imaging and Diagnostic Centers

- Homecare Settings

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Medical Device Connectivity Market Drivers and Opportunities

Rising Use of EHR or EMR Favors the Market Growth

The ability to gather, handle, and use data from medical devices has grown more complicated as more devices are used in patient care. To enable data interchange, medical device connectivity refers to connecting medical devices to electronic health records (EHRs) or electronic medical records (EMRs). A patient's paper chart is digitally replicated in an electronic health record (EHR). EHRs are patient-centered, real-time records that give authorized users instant, secure access to information. A more comprehensive picture of a patient's care can be included in an EHR system designed to go beyond the typical clinical data gathered in a provider's office. Modern healthcare relies heavily on integrating clinical solutions and EMR systems with medical device and equipment data.

Based on information from Health IT, a US government website, US physicians used EHR software from 10% to 16% between 2019 and 2021. Physicians in developed nations are using EHR software more frequently, necessitating connecting medical devices to the software so doctors can access patient medical histories. EMR solutions are widely used, and governments in developed and developing nations are placing more and more emphasis on creating national healthcare information exchanges. These factors are predicted to drive demand for effective medical device connectivity solutions. Therefore, the market for medical device connectivity is expanding due to the rising use of EHR/EMR and medical devices.

Encouraging 5G Technology to Boost Medical Device Communication is Likely to Create Ample Opportunities in the Market

A network that can handle high-definition videos and real-time remote patient monitoring is necessary for telemedicine. It can take a while to transfer larger files between departments using 4G or older networks, forcing doctors to waste time waiting for the process to finish. These barriers can be removed by switching to 5G, giving healthcare providers a more efficient network that can keep up with emerging technologies. The next generation of wireless technology, or 5G, offers faster speeds, larger bandwidths, and more capacity to connect devices, which is advantageous to all devices within a network. Compared to standard hospital wireless networks, 5G technology offers 100–2,000 times faster speeds. Doctors can efficiently proceed with diagnosis, prescriptions, and treatment plans while monitoring a patient's vitals remotely due to intelligent data applications and artificial intelligence (Al) in conjunction with connected medical devices. 5G technology's quick speed, low latency, and enhanced data accuracy has the potential to change the healthcare industry completely. Altogether, 5G and Al can potentially advance the healthcare industry significantly. Furthermore, 5G is rapidly being integrated into various medical devices and is a critical enabling technology for digital health and the Internet of Things (loT). Connectivity between devices at home, in the hospital, and anywhere else a need arises is made possible by wireless technology. Wearables with 5G capabilities can send big data packets all day, leading to better patient outcomes from ongoing remote monitoring. Therefore, as the use of medical devices becomes more connected, there is a greater need for networks and technology. One such technology that presents growth opportunities for the market over the forecast period is 5G.

Medical Device Connectivity Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical device connectivity market analysis are Product and Services, application, and end user.

- Based on Product and Services, the medical device connectivity market is divided into medical device connectivity solutions, medical device connectivity services. The medical device connectivity solutions segment held the most significant market share in 2023.

- By technology, the market is categorized into wireless technologies, hybrid technologies, wired technologies. The wireless technologies segment held the largest share of the market in 2023.

- By application, the market is categorized into vital signs and patient monitors, anesthesia machines, ventilators, infusion pumps, others. The vital signs and patient monitors segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, ambulatory surgical centers, imaging and diagnostic centers, homecare settings. The hospitals segment held the largest share of the market in 2023.

Analyse de la part de marché de la connectivité des dispositifs médicaux par géographie

La portée géographique du rapport sur le marché de la connectivité des dispositifs médicaux est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

Le marché de la connectivité des dispositifs médicaux en Amérique du Nord est segmenté entre les États-Unis, le Canada et le Mexique. Les États-Unis devraient être le principal contributeur au marché de cette région. La croissance du marché en Amérique du Nord est attribuée aux changements rapides dans la réglementation des dispositifs médicaux dans la région. Selon un architecte système de Drägerwerk AG et Co. KGaA, à mesure que la technologie médicale continue de progresser, les capacités d'interopérabilité entre les appareils tels que les ventilateurs et les pompes à fusion ont pris du retard. Le bureau du coordonnateur national des technologies de l'information sur la santé du ministère américain de la Santé et des Services sociaux et les centres de services Medicare et Medicaid ont finalisé et approuvé les normes d'interopérabilité des dispositifs médicaux. Par ailleurs, divers facteurs tels que des scénarios de remboursement favorables pour la télésanté, les progrès technologiques, notamment l'utilisation de la 5G, l'adoption des soins à domicile, etc., sont des facteurs susceptibles de stimuler la croissance du marché dans la région.

Portée du rapport sur le marché de la connectivité des dispositifs médicaux

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 2,66 milliards de dollars américains |

| Taille du marché d’ici 2031 | 14,14 milliards de dollars américains |

| TCAC mondial (2023 - 2031) | 23,20% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts | Par produit et services

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d’entreprises clés |

|

- L'exemple de PDF présente la structure du contenu et la nature des informations avec une analyse qualitative et quantitative.

Actualités et développements récents du marché de la connectivité des dispositifs médicaux

Le marché de la connectivité des dispositifs médicaux est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d’importantes publications d’entreprise, des données d’association et des bases de données. Quelques-uns des développements sur le marché de la connectivité des dispositifs médicaux sont répertoriés ci-dessous :

- Siemens Healthineers annonce l'autorisation de la Food and Drug Administration (FDA) de syngo Virtual Cockpit, une plateforme de communication privée et sécurisée pour la visualisation, l'acquisition et la collaboration d'images en temps réel entre les professionnels de la santé sur plusieurs sites. Le logiciel permet aux utilisateurs de se connecter aux scanners de tomodensitométrie (CT), de résonance magnétique (MR), de tomographie par émission de positrons (PET), de tomodensitométrie à émission monophotonique (SPECT), de PET/CT, de SPECT/CT et de PET/MR de Siemens. Infirmiers ainsi que d’autres vendeurs d’équipements, quel que soit leur emplacement. syngo Virtual Cockpit est le premier et le seul logiciel de numérisation à distance multifournisseur à recevoir l'autorisation de la FDA en tant que produit médical. (Source : Siemens Healthineers, communiqué de presse, janvier 2024)

- Sur les plus de 500 appareils inclus par la FDA américaine sur une liste récemment mise à jour d'autorisations d'appareils compatibles avec l'IA, 42 proviennent de GE Healthcare, une étape importante qui met en évidence l'impact de la stratégie numérique de l'entreprise. (Source : GE HealthCare, communiqué de presse, octobre 2022)

Couverture et livrables du rapport sur le marché de la connectivité des dispositifs médicaux

Le rapport « Taille et prévisions du marché de la connectivité des dispositifs médicaux (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché de la connectivité des dispositifs médicaux aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d’application

- Tendances du marché de la connectivité des dispositifs médicaux ainsi que dynamiques du marché telles que les moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces et SWOT de PEST/Porter

- Analyse du marché de la connectivité des dispositifs médicaux couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché.

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l’analyse des cartes thermiques, les principaux acteurs et les développements récents du marché de la connectivité des dispositifs médicaux

- Profils d'entreprises détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

North America dominated the medical device connectivity market in 2023

Key factors driving the market are the rising use of EHR or EMR and the rapid expansion of telehealth services.

The inclination toward home healthcare will likely remain a key market trend.

iHealth Labs Inc, Oracle Corp, Lantronix Inc, Infosys Ltd, Digi International Inc, Cisco System Inc, Medtronic Plc, Koninklijke Philips NV, GE HealthCare Technologies Inc, Silicon & Software Systems Ltd.

The market is expected to register a CAGR of 23.20% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport