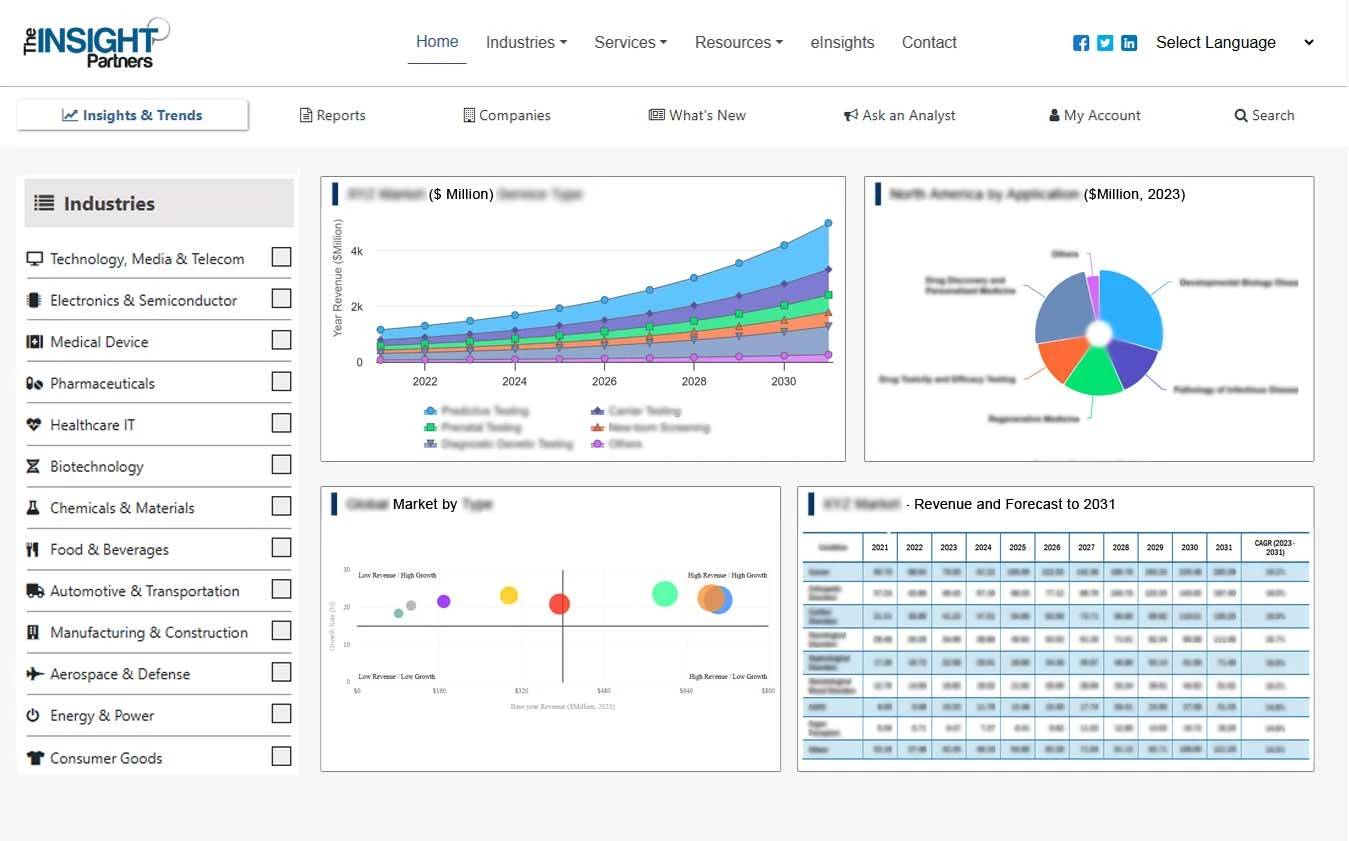

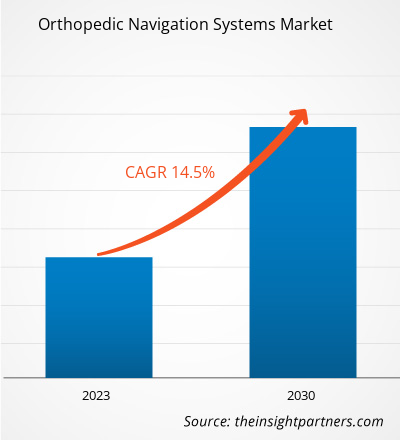

[Rapport de recherche] La taille du marché des systèmes de navigation orthopédique devrait passer de 2 532,47 millions USD en 2022 à 7 477,32 millions USD d'ici 2030 ; elle devrait enregistrer un TCAC de 14,5 % de 2022 à 2030.

Point de vue de l'analyste

L' analyse du marché des systèmes de navigation orthopédique explique les facteurs moteurs du marché tels que les avantages croissants des chirurgies orthopédiques assistées par ordinateur et l'incidence croissante des affections orthopédiques. En outre, l'intérêt croissant pour la chirurgie mini-invasive devrait introduire de nouvelles tendances sur le marché au cours de la période 2022-2030. Sur la base de la technologie, le marché des systèmes de navigation orthopédique est segmenté en électromagnétique, optique et autres. Le segment électromagnétique détenait la plus grande part de marché en 2022 et devrait enregistrer le TCAC le plus élevé de 15,4 % au cours de la période 2022-2030. Par application, le marché est segmenté en genou, hanche, colonne vertébrale et autres. Le segment du genou détenait la plus grande part de marché en 2022. Le segment de la hanche devrait enregistrer le TCAC le plus élevé de 14,9 % au cours de la période 2022-2030. Par utilisateur final, le marché est classé en hôpitaux, centres de chirurgie ambulatoire (ASC) et autres. Le segment hospitalier détenait la plus grande part de marché en 2022 et devrait enregistrer le TCAC le plus élevé du marché, soit 14,8 %, au cours de la période 2022-2030.

Les systèmes de navigation orthopédique permettent aux chirurgiens de suivre avec précision la position des instruments et de se projeter ensuite pendant la réalisation des interventions chirurgicales orthopédiques. Le système comprend un poste de travail informatique ainsi que du matériel de suivi de la position des instruments.

Informations sur le marché

Les avantages croissants des chirurgies orthopédiques assistées par ordinateur stimulent le marché des systèmes de navigation orthopédique

Selon un article intitulé « Planification préopératoire assistée par ordinateur de la chirurgie de fixation des fractures osseuses » publié dans la Bibliothèque nationale de médecine en octobre 2022, la chirurgie de fixation des fractures osseuses est connue pour être l'une des interventions chirurgicales les plus couramment pratiquées dans le domaine orthopédique. La source a déclaré que des techniques chirurgicales assistées par ordinateur ont été développées ces dernières années. Ces techniques sont utiles dans la planification préopératoire des opérations de fixation des fractures osseuses.

Les avantages de la chirurgie assistée par ordinateur (CAS), tels que la faible perte de sang, les séjours hospitaliers courts et la rééducation facile, stimulent sa demande. La CAS contribue à l'alignement précis de l'implant. Elle offre une fonctionnalité améliorée, améliore la durée de vie ajustée en fonction de la qualité, provoque moins de douleur et de lésions tissulaires et peut entraîner moins de complications. La navigation chirurgicale permet aux chirurgiens d'élaborer des plans cliniques détaillés pour les remplacements articulaires et les interventions sur la colonne vertébrale. Les plates-formes fournissent des mesures assistées par ordinateur à partir des tomodensitométries (TDM) préopératoires de chaque patient pour aider les chirurgiens à fournir des soins chirurgicaux personnalisés. Ainsi, les avantages des chirurgies orthopédiques assistées par ordinateur stimulent la croissance du marché des systèmes de navigation orthopédique.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Tendance future

L’intérêt croissant pour la chirurgie mini-invasive devrait devenir une tendance dans les années à venir

En chirurgie mini-invasive de la colonne vertébrale (MISS), l'utilisation de la technologie de navigation assistée par ordinateur permet aux chirurgiens de mieux visualiser l'anatomie des os et des tissus mous grâce à des incisions limitées de chirurgie mini-invasive (MIS). De plus, en raison des incisions plus petites, la cicatrisation postopératoire des plaies prend plus de temps dans les chirurgies conventionnelles que dans la MIS. L'intérêt pour la MISS augmente considérablement car son principe de base est de minimiser les blessures liées à l'insertion tout en obtenant des résultats similaires aux procédures ouvertes traditionnelles de la colonne vertébrale. Grâce aux avancées techniques et technologiques, la MISS peut étendre son utilité à la sténose rachidienne simple et aux pathologies rachidiennes complexes telles que les métastases, les traumatismes ou les déformations rachidiennes chez l'adulte.

In August 2023, Orthofix Medical Inc. announced the full commercial launch and successful completion of the first cases in the US with the 7D FLASH Navigation System Percutaneous Module 2.0. The system enables Orthofix to continue to operate MIS for the spine. Speed, accuracy, and efficiency of image processing technology are expected to provide significant economic added value and reduced radiation exposure for staff and patients in open procedures. This launch expands the clinical functionality and utility of the navigation system by providing surgeons with a fully integrated procedural solution for MIS, including implant planning and an expanded suite of navigated tools. The growing preference of patients and healthcare professionals for minimally invasive procedures that offer faster recovery times and reduced postoperative pain would support the adoption of orthopedic navigation systems. Thus, the rising adoption of orthopedic navigation systems in practice benefits patients and hospitals, which is expected to boost the orthopedic navigation system market growth in the coming years.

Technology-Based Insights

Based on technology, the orthopedic navigation systems market is segmented into electromagnetic, optical, and others. The electromagnetic segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 15.4% during 2022–2030. In electromagnetic tracking systems (EMTs), magnetic fields are generated, sensors are used to detect them, and finally, software is used to process them. In an electromagnetic field of known geometry, the coordinates of the pre-interventional patient scan and the coordinates of the tracking system are registered. By utilizing the sensor, the corresponding points in the image coordinates can be measured, and the electromagnetic tracking coordinates can plan about five to nine landmarks. EMTs utilize fluoroscopy to screen the patient without using ionizing radiation, and it does not expose the patient to any energy fields that are more harmful than ultrasounds.

In July 2021, TT Electronics—a provider of engineered electronics for performance-critical applications—partnered with US-based Radwave Technology to develop advanced electromagnetic tracking technology. This partnership will help bring a customizable electromagnetic tracking platform with minimally invasive diagnostic and therapeutic devices during orthopedic surgical procedures. In addition, Joimax, a Germany-based market leader in technologies and training methods for fully endoscopic and minimally invasive spine surgery, announced that the FDA cleared its Intracsem Navigation System, an electromagnetic navigation tracking and control system, in July 2020.

Application-Based Insights

Based on application, the global orthopedic navigation systems market is segregated into knee, hip, spine, and others. The knee segment held the largest market share in 2022. The hip segment is anticipated to register the highest CAGR of 14.9% during 2022–2030. Surgery is required if the knee has structural damage. The most common knee surgeries include arthroscopy or knee replacement. Hip arthroplasty or hip replacement surgery is a procedure in which an orthopedist replaces the affected hip joint parts with new artificial parts. HipNav is an image-guided surgical navigation system used in hip replacement surgery. With this system, prosthetic components can be measured and guided during total hip replacement surgery (THR). The system consists of a 3-dimensional preoperative planner, a simulator, and an intraoperative surgical navigator.

According to the American Academy of Orthopedic Surgeons, nearly one million knee and hip replacements are performed every year. An aging population and an increase in obesity and osteoarthritis will cause that number to rise to 4 million by 2050. Computer- and robot-assisted navigation is expected to continue to play an increasingly important role in helping patients' outcomes and lengthening the life of their implants as these procedures become increasingly common. DePuy Synthes offers a technology-assisted VELYS Hip Navigation platform for hip replacement. The surgeons use real-time data to improve surgical outcomes. Thus, the growing advancement in orthopedic surgery navigation systems boosts the growth of the global orthopedic navigation systems market for the hip segment.

End User-Based Insights

In terms of end user, the orthopedic navigation systems market is segmented into hospitals, ambulatory surgical centers (ASCs), and others. The hospital segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 14.8% in the market during 2022–2030.

Orthopedic navigation systems are routinely used in orthopedic surgeries to reach the target place more precisely. Hospitals are a vital part of the development of health systems. They play an important role in offering support to other healthcare providers. An increasingly large number of hospitals are attaining expertise to use orthopedic navigation systems for surgeries. With the rising number of orthopedic surgeries, the use of orthopedic navigation systems is expected to increase in hospital settings. Moreover, owing to rising number of hospitals worldwide, the hospitals segment is expected to continue its dominance in the global orthopedic navigation system market during 2022–2030.

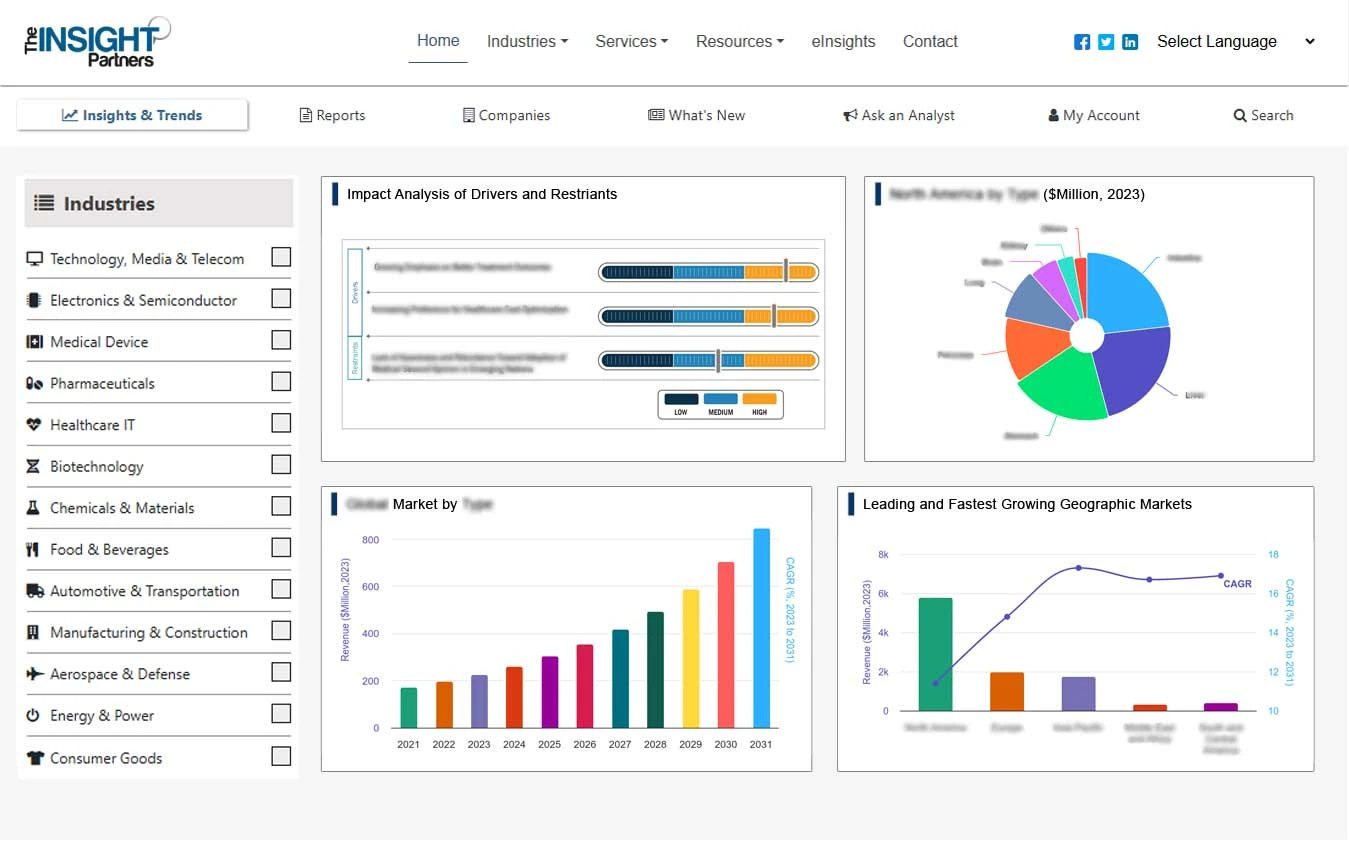

Regional Analysis

North America held the largest share of the orthopedic navigation system market in 2022. The orthopedic navigation system market in North America is expected to grow due to rising acceptance of the latest medical device technologies and increasing incidence of spinal disorders. Moreover, the growing prevalence of chronic diseases, rising cases of sports injury, and the increasing number of orthopedic procedures and ailments, especially among the aging population, propels the market's expansion. The US holds the largest share of the North America orthopedic navigation system market. The increasing aging population, growing prevalence of arthritis, and increasing number of sports injury cases drive the US orthopedic navigation system market growth. According to the United Nations Economic Commission for Europe (UNECE), around 2,740,000 people were injured in traffic accidents in the US in 2019. Additionally, the increasing prevalence of spinal diseases such as degenerative disc disease, spinal stenosis, and herniated discs in the US propels the demand for orthopedic spinal navigation systems. According to the 2021 National Spinal Cord Injury Statistical Center (NSCSC) estimates, ∼30% of individuals affected by spinal cord injuries are readmitted to hospitals within a year of their injury, with the average hospital stay for those requiring readmission being 22 days. Additionally, according to an article published by the University of Washington in January 2021, traumatic spinal cord injuries affect over 18,000 Americans annually. According to McLeod Health, the number of orthopedic procedures performed in the US was ∼18.6 million in 2022.

Asia Pacific would register the highest CAGR for the global orthopedic navigation systems market during the forecast period. The market in Asia Pacific is segmented into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. China holds the largest market share of the global orthopedic navigation system market. The orthopedic navigation system market in China is expected to grow during 2020–2030 owing to advancements in the Chinese healthcare system, an increasing number of robotic surgeries, and rising government funding in the healthcare system. The healthcare system in China provides clinical care and public health services to one-fifth of the world's population and has grown significantly. Chinese surgeons use robotic devices and artificial intelligence (AI) to perform minimally invasive surgeries for primary operations such as knee replacement surgeries. For instance, a study published in January 2022 by PubMed Central stated that 106 patients in China underwent hip and knee replacement surgeries where computer navigation significantly improved the accuracy of prosthesis implantation. Moreover, technological advancements related to surgical navigation system is rising in China.

Orthopedic Navigation Systems Market Regional Insights

The regional trends and factors influencing the Orthopedic Navigation Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthopedic Navigation Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthopedic Navigation Systems Market

Orthopedic Navigation Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.53 Billion |

| Market Size by 2030 | US$ 7.48 Billion |

| Global CAGR (2022 - 2030) | 14.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered | By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Orthopedic Navigation Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Navigation Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthopedic Navigation Systems Market are:

- Smith & Nephew

- Siemens Healthineers

- Brainlab AG

- Metronor

- Naviswiss AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthopedic Navigation Systems Market top key players overview

The report profiles leading players operating in the global orthopedic navigation systems market. B. Braun SE, Stryker Corporation, Medtronic PLC, Zimmer Biomet, DePuy Synthes, Smith & Nephew, Siemens Healthineers, Brainlab AG, Metronor, and Naviswiss AG are a few market players.

- In June 2023, Brainlab AG collaborated with AO Foundation to extend reality technology for best practices in education and training. This collaboration will increase knowledge acquisition, enhance decision making, and improve coordination of skills, all within a safe and engaging setting.

- En mai 2023, DePuy Synthes a présenté la navigation basée sur la réalité (RBN), un nouvel ajout à son offre pour la hanche en Europe, au Moyen-Orient et en Afrique. Le professeur David Beverland MD, chirurgien orthopédiste consultant FRCS, a été le pionnier du concept à Belfast, en Irlande du Nord, au cours des trois dernières décennies, en commençant par une bourse avec Mike Wroblewski en 1988 et en devenant une entreprise collaborative soutenue par plus de 40 boursiers. L'objectif de la RBN est de permettre aux chirurgiens d'obtenir des résultats plus reproductibles avec une approche simple et peu coûteuse, garantissant que chaque patient a accès au même niveau élevé de soins. La RBN a été créée pour limiter le nombre de valeurs aberrantes dans le positionnement des composants1, augmentant potentiellement la précision lors de l'arthroplastie totale de la hanche. L'un des objectifs clés sous-jacents à la notion de RBN étant de réduire ou d'éliminer les valeurs aberrantes, la mise en œuvre de la RBN est conçue pour aider les chirurgiens à réduire ces valeurs aberrantes dans leurs pratiques.

- En février 2023, Naviswiss a reçu l'autorisation de la FDA de commercialiser Naviswiss Knee aux États-Unis. La solution Naviswiss Knee est un outil de navigation basé sur des repères qui aide le chirurgien à insérer et à aligner les implants de remplacement du genou de la meilleure façon possible. Un chirurgien orthopédiste peut utiliser Naviswiss Knee pour choisir entre un flux de travail express qui navigue uniquement dans l'alignement Varus/Valgus et la flexion/extension, ou un flux de travail avancé qui navigue également dans les aperçus de la hauteur de résection médiale et latérale et de l'amplitude de mouvement.

- En novembre 2022, Corin Australia Pty Ltd et Naviswiss AG ont signé un accord de distribution exclusif pour l'Australie et la Nouvelle-Zélande. Corin Australia Pty Ltd est un inventeur majeur dans le domaine de la navigation miniaturisée pour la chirurgie de remplacement articulaire. L'ajout de cette technologie renforcera l'offre OPS et la valeur ajoutée pour les clients.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

- Oxy-fuel Combustion Technology Market

- Dropshipping Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Long Read Sequencing Market

- Collagen Peptides Market

- Glycomics Market

- Compounding Pharmacies Market

- Flexible Garden Hoses Market

- Energy Recovery Ventilator Market

- Smart Grid Sensors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

An orthopedic navigation system is a tool that allows a surgeon to visualize the surgical site with expanded views. It enables to make the precise decision for the surgery and plan surgery for a more effective outcome. The navigation system integrates surgical planning, instrument tracking, and intraoperative imaging in the operating room while performing surgery.

The factors driving the growth of the orthopedic navigation system market include the growing advantages of computer-assisted orthopedic surgeries and the increasing incidence of orthopedic conditions.

The orthopedic navigation system market was valued at US$ 2,532.47 million in 2022.

The orthopedic navigation system market is expected to be valued at US$ 7,477.32 million in 2030.

The orthopedic navigation system market majorly consists of the players such as B. Braun SE, Stryker Corporation, Medtronic PLC, Zimmer Biomet, DePuy Synthes, Smith & Nephew Siemens Healthineers, Brainlab AG, Metronor, Naviswiss AG

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Orthopedic Navigation Systems Market

- Smith & Nephew

- Siemens Healthineers

- Brainlab AG

- Metronor

- Naviswiss AG

- B. Braun SE

- Stryker Corporation

- Medtronic PLC

- Zimmer Biomet

- DePuy Synthes

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport