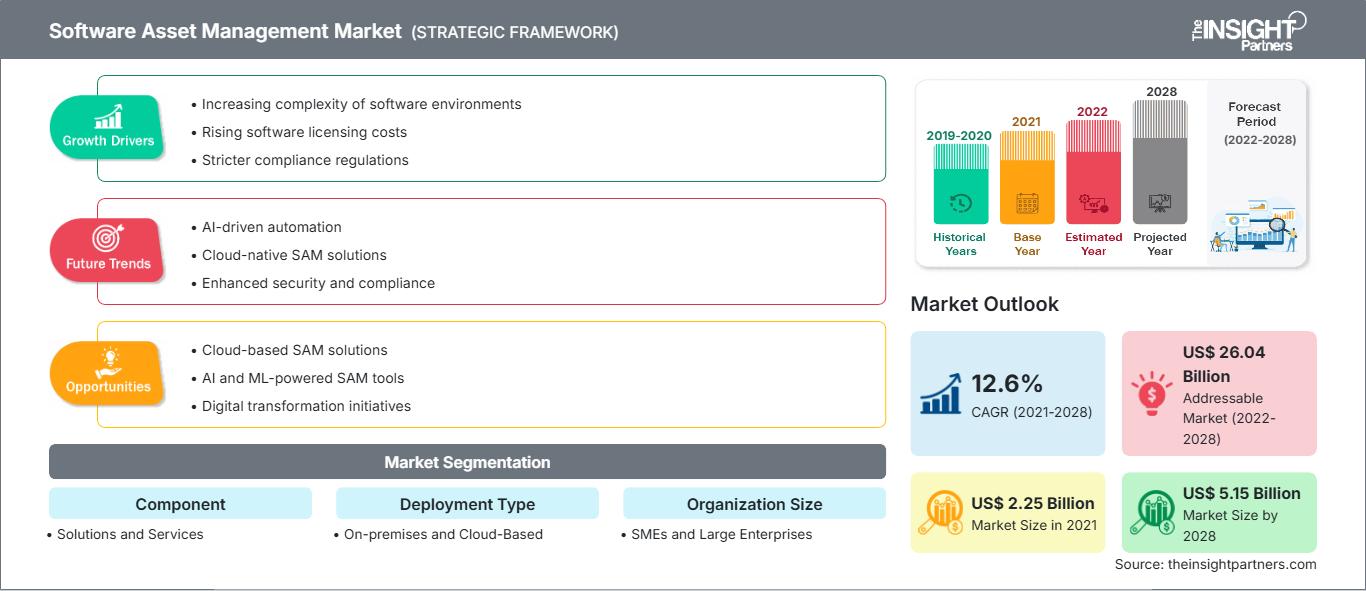

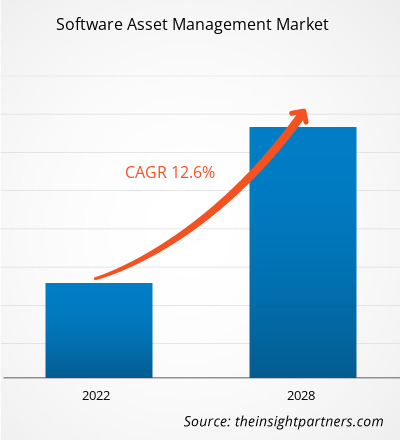

[Rapport de recherche] Le marché de la gestion des actifs logiciels devrait passer de 2 250,37 millions de dollars américains en 2021 à 5 150,51 millions de dollars américains en 2028 ; sa croissance devrait atteindre un TCAC de 12,6 % entre 2021 et 2028.

L'administration des systèmes, des règles et des procédures permettant l'acquisition, la mise en œuvre, l'utilisation, la maintenance et la mise au rebut des applications logicielles au sein d'une organisation est connue sous le nom de gestion des actifs logiciels (SAM). Le marché de la gestion des actifs logiciels est une composante de la gestion des actifs informatiques qui vise à garantir que l'entreprise respecte les accords de licence et ne dépense pas trop en logiciels. L'identification des actifs logiciels, la validité des contrats de licence d'utilisateur final (CLUF) et l'utilisation appropriée des logiciels libres sont autant d'objectifs cruciaux de toute initiative SAM. La documentation SAM peut protéger votre entreprise contre les poursuites pour piratage, minimiser les utilisations abusives de licences et assurer le contrôle des logiciels fantômes sur le réseau.

Dans une grande organisation, la gestion des actifs logiciels peut être si complexe qu'elle nécessite le développement et la maintenance d'une base de données contenant des informations sur les achats, les abonnements, les licences et les correctifs de logiciels. Une telle équipe est souvent chargée du renouvellement des licences logicielles, de la négociation de nouveaux contrats de licence, ainsi que de la détection et de la suppression des logiciels rarement, voire jamais, utilisés. Le marché de la gestion des actifs logiciels vérifie le nombre de licences logicielles achetées et le rapproche du nombre de licences installées afin d'automatiser l'obtention d'informations à partir de nombreuses sources d'inventaire mobiles, de bureau, de centres de données et de cloud. Les outils SAM permettent également de suivre le nombre de licences restantes. Afin de limiter les dépenses, ces informations peuvent être utilisées pour supprimer ou réaffecter les logiciels inutilisés.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché de la gestion des actifs logiciels: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Impact de la pandémie de COVID-19 sur le marché de la gestion des actifs logiciels

La pandémie de COVID-19 a profité au marché de la gestion des actifs logiciels. Les entreprises sont confrontées à de nouveaux défis en raison de la pandémie de COVID-19, tels que le développement des environnements de travail à distance. L'épidémie de COVID-19 a mis en évidence la nécessité d'adopter les technologies numériques et d'exploiter le potentiel des solutions et services de gestion des actifs logiciels pour optimiser les licences et les coûts et augmenter le retour sur investissement des actifs informatiques. De plus, l'arrivée de la pandémie en 2020 a entraîné une multitude de défis pour les opérations du marché mondial. Étant donné l'effondrement des infrastructures de santé des économies développées en raison de l'augmentation des cas, l'urgence sanitaire publique nécessitera l'intervention du gouvernement et des acteurs du marché pour contribuer à la relance des activités et des revenus du marché grâce à des efforts collaboratifs de recherche et développement entrepris pour récupérer les pertes au cours de la période de prévision, qui se termine en 2028. De plus, l'augmentation des investissements est de bon augure pour le secteur dans les années à venir.

Analyse du marché - Marché de la gestion des actifs logiciels

Le besoin croissant de gestion du cycle de vie des actifs stimule la demande pour le marché de la gestion des actifs logiciels

L'ensemble des procédures et des utilisateurs de l'infrastructure informatique doivent gérer, réguler et protéger les actifs logiciels de l'entreprise tout au long de leur cycle de vie. La gestion des actifs informatiques (ITAM), la gestion des services informatiques (ITSM) et la gestion des actifs matériels (HAM) sont toutes des sous-ensembles de la gestion des actifs logiciels (SAM). L'ITAM vise à améliorer la gestion des actifs logiciels et matériels tout en optimisant les économies de coûts et en limitant les risques d'audit. Les entreprises modernes considèrent les logiciels comme un élément essentiel de leurs opérations quotidiennes. En moyenne, une organisation utilise 288 applications pour assister ses employés dans diverses tâches. Grâce à la mise en œuvre d'une gestion du cycle de vie des actifs (LCAM) performante, les entreprises stratégiques peuvent déterminer quand un actif atteindra ses performances optimales et combien de temps il lui restera pour servir l'entreprise. Par exemple, Blissfully est une application de gestion des actifs logiciels et de gestion des logiciels en tant que service (SaaS) qui permet de réaliser des économies, de gérer tous les fournisseurs de logiciels, d'améliorer la productivité et de renforcer la sécurité des systèmes logiciels. Ainsi, le besoin croissant de gestion du cycle de vie des actifs stimule la demande sur le marché de la gestion des actifs logiciels.

Informations sur les segments de composants – Marché de la gestion des actifs logiciels

Le marché de la gestion des actifs logiciels est segmenté en solutions et services par composant. Les solutions de gestion des actifs logiciels aident les responsables des opérations des centres de données à identifier, localiser, visualiser et gérer tous les actifs et à planifier la capacité de croissance future. La mise en œuvre d'un programme de gestion des actifs logiciels a un objectif tactique : faire correspondre le nombre de licences logicielles acquises au nombre de licences réellement consommées ou utilisées. Un programme de gestion des actifs logiciels performant doit vérifier que tous les logiciels installés sont utilisés conformément aux conditions générales du contrat de licence du fournisseur et qu'il est équilibré entre le nombre de licences achetées et la quantité consommée. En cas d'audit par un éditeur de logiciels ou un tiers tel que la Business Software Alliance (BSA), les entreprises peuvent réduire leurs responsabilités liées au piratage de logiciels.

Analyse des segments de type de déploiement – Marché de la gestion des actifs logiciels

Selon le type de déploiement, la gestion des actifs logiciels est classée en deux catégories : sur site et dans le cloud. Les solutions de gestion des actifs logiciels dans le cloud sont plus pratiques à utiliser sur différents appareils avec différentes tailles d'écran (ordinateurs de bureau, ordinateurs portables, tablettes, appareils portables et smartphones). Les données RFID, codes-barres et NFC peuvent également être enregistrées dans le cloud, ce qui facilite leur récupération. Les systèmes dans le cloud sont idéaux pour les audits d'actifs multisites et les audits d'actifs internes et externes, grâce à leur facilité d'accès. Il est généralement plus simple de télécharger des photos d'actifs et d'ajouter des commentaires depuis plusieurs appareils. Une solution de gestion des actifs logiciels basée sur le cloud peut facilement faciliter le contrôle des versions, l'audit et les chaînes d'approbation multiples.

Analyse des segments par type d'organisation

Selon le type d'organisation, le marché de la gestion des actifs logiciels peut être classé en petites et moyennes entreprises (PME) et grandes entreprises (GPE). Les grandes entreprises peuvent investir massivement dans des logiciels haut de gamme pour accroître leur productivité. Un outil SAM sera nécessaire pour les plus grandes entreprises. Les processus manuels peuvent être automatisés, accélérés et améliorés grâce à un outil de gestion des actifs logiciels. De plus, la gestion des actifs logiciels aide les organisations de divers secteurs à améliorer efficacement les performances et l'agilité de leurs actifs informatiques.

Analyse des segments par secteur d'activité - Marché de la gestion des actifs logiciels

Selon le secteur d'activité, le marché de la gestion des actifs logiciels est segmenté en administration publique, commerce de détail et biens de consommation, santé et sciences de la vie, BFSI, médias et divertissement, industrie manufacturière, informatique et télécommunications, entre autres. Les technologies numériques transforment la façon dont l'industrie manufacturière aborde ses activités. On estime que la technologie jouera un rôle majeur dans l'Industrie 4.0. La gestion des actifs logiciels sera un élément clé de cette nouvelle ère de la fabrication.

Les acteurs du marché se concentrent sur les innovations et les développements de nouveaux produits en intégrant des technologies et des fonctionnalités avancées pour rester compétitifs. Selon Snow Software, leader mondial de la veille technologique, Snow Atlas est la seule plateforme intégrée développée de A à Z pour aider les entreprises à identifier, surveiller et optimiser leurs investissements technologiques, sur site et dans le cloud. Les intégrations de gestion des actifs logiciels (SAM), de gestion des logiciels en tant que service (SaaS) et de gestion des services informatiques (ITSM) fournies en tant que service sont les premières solutions accessibles sur la nouvelle plateforme cloud native, présentes dans les solutions de gestion des accès logiciels.

Le marché de la gestion des actifs logiciels est segmenté en solutions et services par composant. En termes de type de déploiement, la gestion des actifs logiciels est classée en sur site et dans le cloud. Selon le type d'organisation, le marché de la gestion des actifs logiciels peut être classé en petites et moyennes entreprises (PME) et en grandes entreprises. Par secteur d'activité, le marché de la gestion des actifs logiciels est segmenté en : administration publique, commerce de détail et biens de consommation, santé et sciences de la vie, BFSI, médias et divertissement, industrie manufacturière, informatique et télécommunications, etc. Par région, le marché mondial de la gestion des actifs logiciels est segmenté en : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique, et Amérique du Sud.

Marché de la gestion des actifs logiciels

Les tendances régionales et les facteurs influençant le marché de la gestion des actifs logiciels (GAS) tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la répartition géographique du marché de la GAS en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché de la gestion des actifs logiciels| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | US$ 2.25 Billion |

| Taille du marché par 2028 | US$ 5.15 Billion |

| TCAC mondial (2021 - 2028) | 12.6% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts |

By Composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de la gestion des actifs logiciels : comprendre son impact sur la dynamique des entreprises

Le marché de la gestion des actifs logiciels (SAM) connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché de la gestion des actifs logiciels Aperçu des principaux acteurs clés

Marché de la gestion des actifs logiciels - Profils d'entreprise

- Microsoft Corporation

- IVANTI

- SNOW LOGICIEL

- BMC SOFTWARE, INC.

- CERTERO

- FLEXERA

- IBM Corporation

- MICRO FOCUS

- SERVICENOW

- BROADCOM, INC.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de la gestion des actifs logiciels

Obtenez un échantillon gratuit pour - Marché de la gestion des actifs logiciels