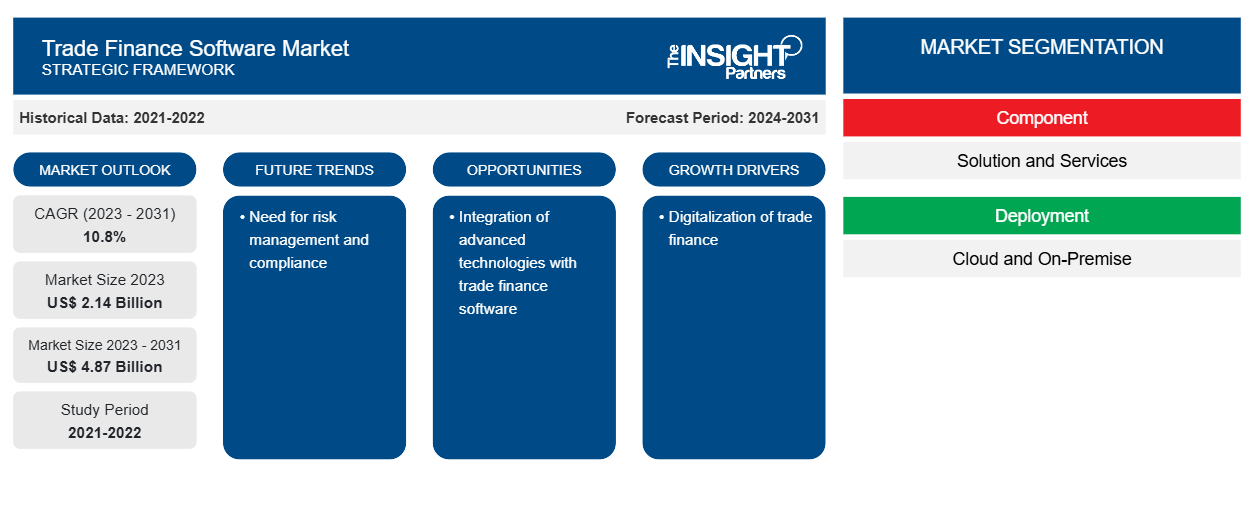

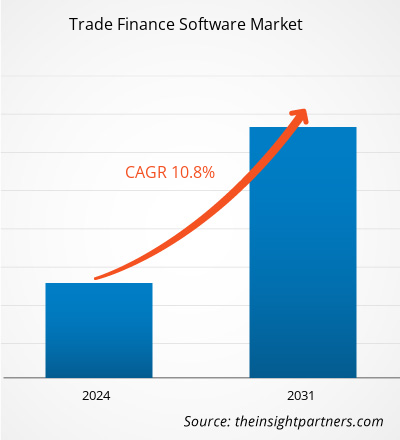

Le marché des logiciels de financement du commerce devrait atteindre 4,87 milliards de dollars d'ici 2031, contre 2,14 milliards de dollars en 2023. Le marché devrait enregistrer un TCAC de 10,8 % en 2023-2031. La numérisation croissante et l'adoption de technologies basées sur le cloud devraient rester les principales tendances du marché des logiciels de financement du commerce.

Analyse du marché des logiciels de financement du commerce

La numérisation croissante des processus de financement du commerce est un facteur majeur de croissance du marché des logiciels de financement du commerce. Avec une efficacité accrue et des coûts réduits, la documentation électronique et les solutions de financement du commerce basées sur le cloud remplacent de plus en plus les méthodes traditionnelles sur papier, contribuant ainsi à la croissance du marché.

Aperçu du marché des logiciels de financement du commerce

Le besoin de transparence et de respect des réglementations commerciales internationales a conduit à l'adoption de solutions logicielles dotées de fonctions de surveillance et de reporting en temps réel. En mettant l'accent sur la fourniture de solutions de pointe qui répondent aux besoins changeants du commerce international, le marché des logiciels de financement du commerce est prêt à connaître une nouvelle expansion à mesure que le paysage commercial mondial continue de changer et que les entreprises recherchent des opérations de financement du commerce plus sûres et plus efficaces.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des logiciels de financement du commerce

La numérisation du financement du commerce pour favoriser le marché

Alors que les entreprises de divers secteurs se rendent compte qu'elles ont besoin de solutions de pointe pour accélérer et améliorer leurs opérations de commerce international, le marché connaît une expansion significative. Ce marché comprend des logiciels conçus pour améliorer et automatiser les procédures de financement du commerce , telles que le financement de la chaîne d'approvisionnement, la gestion de la conformité, l'affacturage des factures et la gestion du crédit. Les organisations se sont tournées vers les logiciels de financement du commerce pour réduire les tâches manuelles et chronophages, améliorer la précision et minimiser les risques associés au commerce international en raison de la complexité et du volume croissants des transactions commerciales, ce qui conduit à l'adoption de logiciels de financement du commerce par les acteurs du marché. Par exemple, en novembre 2023, Finastra, un fournisseur mondial d'applications logicielles financières et de marchés, a annoncé que CQUR Bank, une banque d'entreprise internationale, s'était associée à Finastra pour mettre en œuvre sa stratégie technologique. Avec la mise en œuvre des solutions leaders du marché de Finastra, Trade Innovation et Corporate Channels, CQUR Bank offre à ses clients d'entreprise un nouveau portail bancaire en ligne pour une expérience utilisateur transparente, a introduit de nouveaux flux de travail numériques et fournit des solutions d'intégration d'hôte à hôte.

Nécessité de gestion des risques et de conformité

Le besoin croissant d’une meilleure gestion des risques et d’une meilleure conformité est un autre facteur qui stimule la croissance du marché des logiciels de financement du commerce. Les logiciels de financement du commerce offrent des outils sophistiqués, tels que la détection des fraudes, les contrôles anti-blanchiment d’argent (AML) et le respect des lois et sanctions commerciales, pour suivre et réduire les risques liés au commerce international. Le besoin de ces solutions logicielles ne cesse de croître à mesure que les entreprises et les institutions financières tentent de gérer les défis du commerce international tout en maintenant la conformité légale et réglementaire.

Analyse de segmentation du rapport sur le marché des logiciels de financement du commerce

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des logiciels de financement du commerce sont les composants, le déploiement, la taille de l’entreprise et l’utilisation finale.

- En fonction des composants, le marché est segmenté en solutions et services. Le segment des solutions détenait une part de marché plus importante en 2023.

- En termes de déploiement, le marché est segmenté en cloud et sur site. Le segment cloud détenait une part de marché plus importante en 2023.

- En fonction de la taille de l'entreprise, le marché est segmenté en grandes entreprises et en PME. Le segment des PME devrait connaître le TCAC le plus élevé.

- En fonction de l'utilisation finale, le marché est segmenté en banques, commerçants et autres. Le segment des banques détenait une part de marché plus importante en 2023.

Analyse des parts de marché des logiciels de financement du commerce par zone géographique

La portée géographique du rapport sur le marché des logiciels de financement du commerce est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

En termes de chiffre d'affaires, l'Amérique du Nord représentait la plus grande part de marché des logiciels de financement du commerce en 2023. L'Amérique du Nord est l'un des premiers pays à adopter des solutions technologiques, ce qui explique sa part de marché en plein essor. L'adoption de technologies basées sur le cloud par les PME entraîne une croissance du marché. La numérisation croissante des banques exige en outre des logiciels de financement du commerce, ce qui stimule la part de marché du financement du commerce en Amérique du Nord.digitalization in the banks further demands trade finance software, which drives North America trade finance market share.

Aperçu régional du marché des logiciels de financement du commerce

Les tendances et facteurs régionaux influençant le marché des logiciels de financement du commerce tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des logiciels de financement du commerce en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des logiciels de financement du commerce

Portée du rapport sur le marché des logiciels de financement du commerce

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 2,14 milliards de dollars américains |

| Taille du marché d'ici 2031 | 4,87 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 10,8% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts | Par composant

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des logiciels de financement du commerce : comprendre son impact sur la dynamique des entreprises

Le marché des logiciels de financement du commerce connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des logiciels de financement du commerce sont :

- CGI Inc

- Comarch SA

- IBSFINtech

- SYSTÈMES FINANCIERS ICS LTÉE

- MITech – Make Intuitive Tech SA

- Newgen Software Technologies Ltd.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des logiciels de financement du commerce

Actualités et développements récents du marché des logiciels de financement du commerce

Le marché des logiciels de financement du commerce est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent des publications d'entreprise importantes, des données d'association et des bases de données. Voici une liste des évolutions du marché :

- En septembre 2022, Newgen Software, l'un des principaux fournisseurs mondiaux de produits de transformation numérique, a lancé la première plateforme de financement du commerce low-code au monde lors de la réunion des clients à Mumbai. Le financement du commerce est un processus complexe car il implique beaucoup de paperasse, de multiples parties prenantes et des exigences de conformité. La plateforme de financement du commerce complète, configurable et évolutive de Newgen aide les banques à se passer du papier et à rationaliser leurs processus commerciaux de bout en bout tout en garantissant la conformité aux réglementations nationales et internationales. (Source : CXOtoday, communiqué de presse, 2022)

- En février 2024, Finastra, fournisseur mondial d'applications et de places de marché de logiciels financiers, et Tesselate, cabinet de conseil et intégrateur mondial en transformation numérique, ont annoncé le lancement d'un service pré-packagé de bout en bout pour une numérisation plus rapide et plus facile du financement du commerce. Tegula Trade Finance as a Service, optimisé par Finastra Trade Innovation et Corporate Channels, permet aux banques américaines d'automatiser les processus manuels et de s'adapter aux nouvelles demandes avec un délai de commercialisation et une valeur plus rapides. Grâce à FusionFabric.cloud de Finastra, les banques peuvent également intégrer de manière transparente des applications fintech qui utilisent les dernières technologies telles que l'intelligence artificielle, la blockchain et les outils d'automatisation. (Source : Finastra, communiqué de presse, 2024)

Rapport sur le marché des logiciels de financement du commerce : couverture et livrables

Le rapport « Taille et prévisions du marché des logiciels de financement du commerce (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

The global trade finance software market was estimated to be US$ 2.14 billion in 2023 and is expected to grow at a CAGR of 10.8% during the forecast period 2023 - 2031.

Rising digitalization and adoption of cloud-based technologies are the major factors that propel the global trade finance software market.

Integration of advanced technologies with trade finance software is anticipated to play a significant role in the global trade finance software market in the coming years.

The key players holding majority shares in the global trade finance software market are CGI Inc, Comarch SA, IBSFINtech, ICS FINANCIAL SYSTEMS LTD, and Finastra.

The global trade finance software market is expected to reach US$ 4.87 billion by 2031.

The incremental growth expected to be recorded for the global trade finance software market during the forecast period is US$ 2.73 billion.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

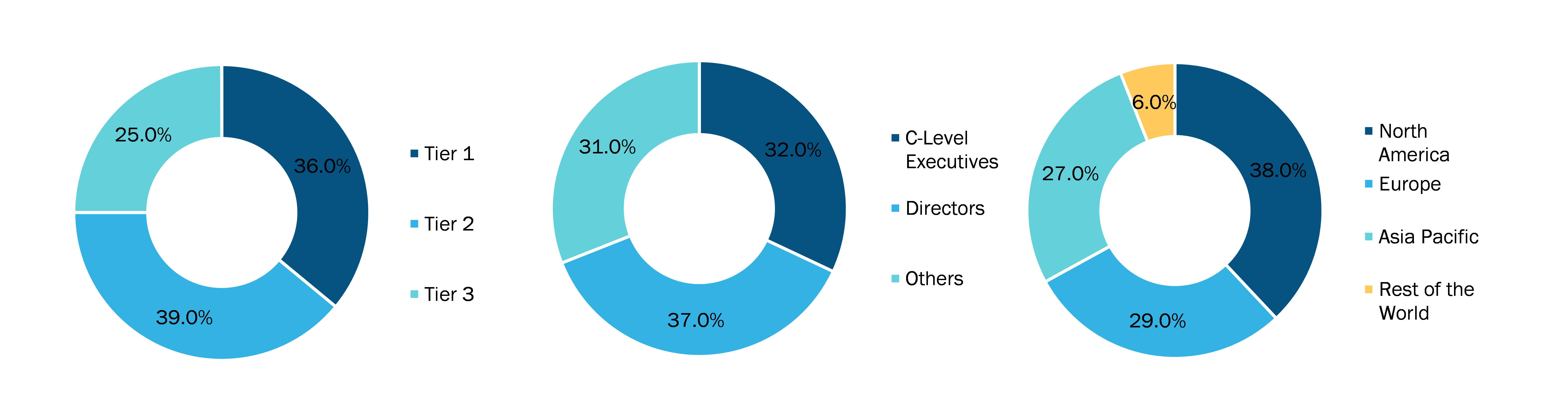

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport