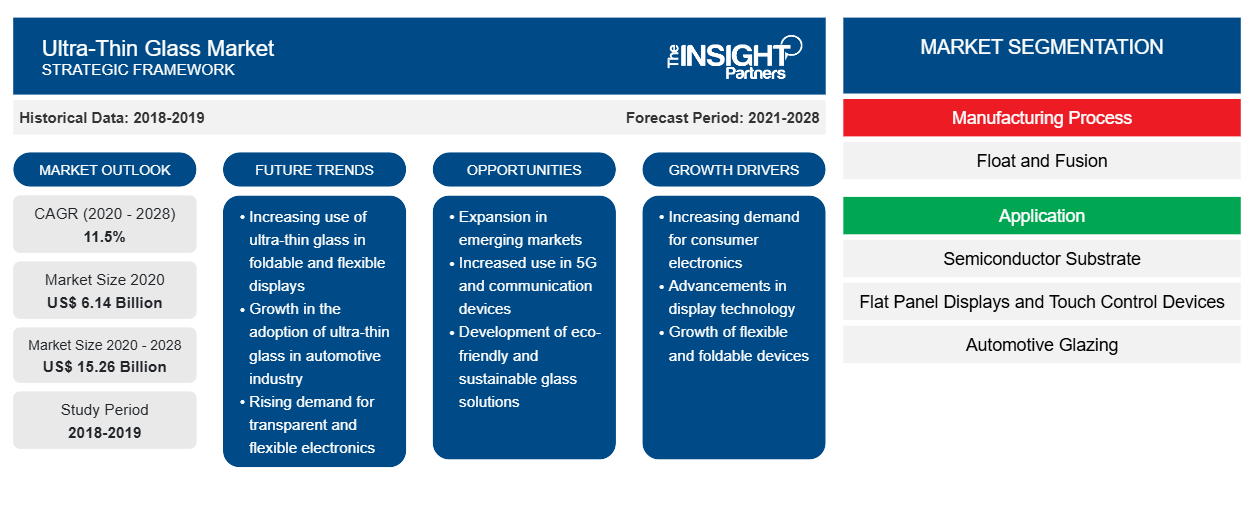

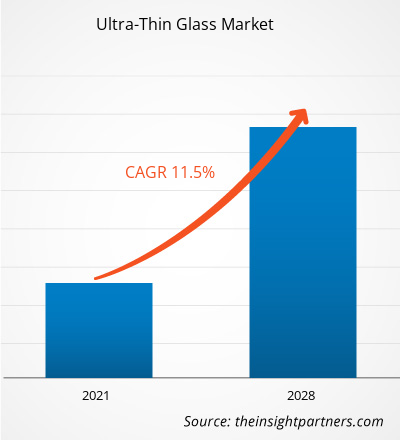

[Rapport de recherche] Le marché du verre ultra-mince était évalué à 6 139,56 millions USD en 2020 et devrait atteindre 15 264,74 millions USD d'ici 2028 ; il devrait croître à un TCAC de 11,5 % de 2021 à 2028.

Le verre ultra-mince est un verre dont l'épaisseur est inférieure à 1 à 2 mm. Le renforcement chimique par échange d'ions est couramment utilisé pour renforcer le verre ultra-mince utilisé pour les applications de haute technologie. Le verre ultra-mince durci est résistant aux rayures et pliable jusqu'à un rayon de quelques millimètres. Les propriétés du verre ultra-mince telles que la résistance à la corrosion, la transparence, la flexibilité, une excellente barrière au gaz et à l'eau et une résistance élevée aux chocs le rendent adapté à diverses applications telles que les écrans plats, le vitrage automobile, entre autres. En 2020, l'Asie-Pacifique détenait la plus grande part de revenus du marché mondial du verre ultra-mince . La Chine est le plus grand consommateur de verres ultra-minces, représentant plus de 50 % de la part de marché en Asie-Pacifique. Le pays est le principal centre de fabrication de tous les types de produits électroniques grand public, tels que les smartphones et les écrans LCD.

La pandémie de COVID-19 en cours a radicalement modifié la situation du secteur des produits chimiques et des matériaux et a eu un impact négatif sur la croissance du marché du verre ultra-mince. La mise en œuvre de mesures pour lutter contre la propagation du nouveau coronavirus a aggravé la situation et a eu un impact négatif sur la croissance de plusieurs secteurs. Des industries telles que l'automobile et l'électronique grand public ont été affectées négativement par la distorsion soudaine de l'efficacité opérationnelle et les perturbations des chaînes de valeur en raison de la fermeture soudaine des frontières nationales et internationales. Le déclin de la croissance de plusieurs secteurs a eu un impact négatif sur la demande de verre ultra-mince sur le marché mondial. Cependant, alors que les économies prévoient de relancer leurs opérations, la demande de verre ultra-mince devrait augmenter à l'échelle mondiale dans les années à venir. En raison de la pandémie, l'adoption de la culture du travail à distance et de l'éducation en ligne augmente. Par conséquent, la demande de produits tels que les ordinateurs portables, les smartphones et autres appareils de télécommunication augmente. La demande croissante de verre ultra-mince dans diverses industries, telles que l'automobile et l'électronique grand public, ainsi que les investissements importants des principaux fabricants devraient stimuler la croissance du marché du verre ultra-mince au cours de la période de prévision.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Informations sur le marché

Croissance de l'industrie de l'électronique grand public

L'industrie de l'électronique grand public est en plein essor en raison de l'utilisation croissante d'appareils électroniques, tels que les smartphones, les ordinateurs portables, les téléviseurs et autres produits électroniques. Les produits électroniques grand public sont devenus une nécessité dans le monde technologique. Les gens de toutes les générations dépendent d'une manière ou d'une autre de leurs smartphones, montres intelligentes et ordinateurs portables. Avec la croissance de l'industrie de l'électronique grand public, les fabricants se concentrent en permanence sur la fourniture de produits avancés et de haute qualité. Le verre ultra-mince joue un rôle important dans l'industrie de l'électronique grand public. Il est utilisé dans les panneaux tactiles et d'affichage, les capteurs et les systèmes de caméra. Diverses propriétés du verre ultra-mince telles que la résistance à la corrosion, la transparence, la flexibilité et la capacité de barrière aux gaz le rendent adapté à de nombreuses applications dans l'industrie de l'électronique grand public. La Chine domine l'industrie des produits électroniques grand public. Le pays est l'un des principaux fabricants d'écrans plats. La demande de smartphones, de trackers de fitness, de téléviseurs et d'autres produits électroniques chinois augmente rapidement, ce qui offre des opportunités lucratives aux fabricants de verre ultra-mince. La Chine a renforcé la construction de nouvelles infrastructures, promu la construction de l'intelligence artificielle, de l'Internet industriel et de l'Internet des objets ; et a accéléré le rythme de la commercialisation de la 5G, ce qui propulse l'industrie de la fabrication d'informations électroniques vers une nouvelle étape de développement et favorise davantage le développement haut de gamme des industries connexes. Selon World Population Review, la Chine compte 1,6 milliard d'utilisateurs de téléphones portables et l'Inde 1,28 milliard d'utilisateurs de téléphones portables. En 2018, Apple a enregistré environ 22,5 millions d'expéditions de montres intelligentes. Ce nombre a augmenté par rapport à 2017, puisque la société a vendu 17,7 millions d'unités en 2017. En 2018, Fitbit a expédié environ 5,5 millions d'unités de montres intelligentes, tandis que Samsung en a expédié environ 5,3 millions. Ainsi, l'industrie de l'électronique grand public en pleine croissance propulse la demande de lunettes ultra-minces

Informations sur l'industrie d'utilisation finale

Le segment de l’électronique grand public détenait la plus grande part du marché mondial du verre ultra-mince en 2020.Le verre ultra-mince est largement utilisé dans la fabrication de produits électroniques, tels que les écrans plats et les écrans tactiles pour divers appareils, tels que les écrans LCD, les OLED, les smartphones et les appareils portables. Avec la demande croissante de produits électroniques innovants et technologiquement avancés dans le monde entier, la demande de verres ultra-minces devrait augmenter dans les années à venir.

Informations sur les processus de fabrication

En termes de procédé de fabrication, le segment de la fusion a dominé le marché du verre ultra-mince en termes de chiffre d'affaires en 2020. Le procédé de fusion, souvent appelé méthode de tirage par débordement, est largement utilisé pour fabriquer des verres plats ultra-minces pour les panneaux d'affichage. Corning a été la première entreprise à créer du verre spécialisé suspendu dans les airs, ce qui est une caractéristique clé de la méthode de fusion. Le verre n'est pas en contact avec du métal en fusion, ce qui constitue un avantage fondamental de la méthode de fusion par rapport à la méthode du verre flotté.

Français Quelques-uns des principaux acteurs du marché opérant sur le marché du verre ultra-mince sont Corning Incorporated ; AGC Inc. ; Nippon Electric Glass Co., Ltd. ; SCHOTT AG ; Central Glass Co., Ltd. ; CSG Holding Co., Ltd. ; Emerge Glass ; Nippon Sheet Glass Co., Ltd ; Xinyi Glass Holdings Limited ; et Luoyang Glass Co., Ltd. Les principaux acteurs du marché adoptent des stratégies telles que les fusions et acquisitions et les lancements de produits pour étendre leur présence géographique et leur base de consommateurs.

Aperçu régional du marché du verre ultra-mince

Les tendances et facteurs régionaux influençant le marché du verre ultra-mince tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché du verre ultra-mince en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché du verre ultra-mince

Portée du rapport sur le marché du verre ultra-mince

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2020 | 6,14 milliards de dollars américains |

| Taille du marché d'ici 2028 | 15,26 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2020-2028) | 11,5% |

| Données historiques | 2018-2019 |

| Période de prévision | 2021-2028 |

| Segments couverts | Par procédé de fabrication

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché du verre ultra-mince connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché du verre ultra-mince sont :

- Corning Incorporated

- AGC Inc.

- Verre électrique Nippon Co., Ltd.

- SCHOTT AG

- Verre Central Co., Ltd.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché du verre ultra-mince

Rapports en vedette

- Tendances progressistes dans l'industrie du verre ultra-mince pour aider les acteurs à développer des stratégies efficaces à long terme

- Stratégies de croissance commerciale adoptées par les entreprises pour assurer leur croissance sur les marchés développés et en développement

- Analyse quantitative du marché mondial du verre ultra-mince de 2019 à 2028

- Estimation de la demande en verre ultra-mince dans diverses industries

- Analyse de Porter pour illustrer l'efficacité des acheteurs et des fournisseurs opérant dans l'industrie pour prédire la croissance du marché

- Développements récents pour comprendre le scénario concurrentiel du marché et la demande de verre ultra-mince

- Tendances et perspectives du marché associées aux facteurs qui stimulent et freinent la croissance du marché du verre ultra-mince

- Compréhension des stratégies qui sous-tendent l'intérêt commercial à l'égard de la croissance du marché mondial du verre ultra-mince, aidant au processus de prise de décision

- Taille du marché du verre ultra-mince à différents nœuds du marché

- Aperçu détaillé et segmentation du marché mondial du verre ultra-mince ainsi que de sa dynamique industrielle

- Taille du marché du verre ultra-mince dans diverses régions avec des opportunités de croissance prometteuses

Marché du verre ultra-mince, par procédé de fabrication

- Flotter

- Fusion

Marché du verre ultra-mince, par application

- Substrat semi-conducteur

- Écrans plats et dispositifs de contrôle tactile

- Vitrage automobile

- Autres

Marché du verre ultra-mince, par industrie d'utilisation finale

- Électronique grand public

- Automobile

- Médical et soins de santé

- Autres

Profils d'entreprise

- Corning Incorporated

- AGC Inc.

- Verre électrique Nippon Co., Ltd.

- SCHOTT AG

- Verre Central Co., Ltd.

- CSG Holding Co., Ltd.

- Verre émergent

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Verrerie Luoyang Co., Ltd.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. The rising demand for LED and OLED televisions is boosting the market growth across the region. Manufacturers of flat panel displays in China, South Korea, and Taiwan are dominating the global marketplace in terms of production and supply of flat panel displays. These displays can be found in cars, industrial equipment, personal computers, smartphones, and a variety of other goods. Liquid crystal displays are used in the majority of TV screens (LCDs). Other display types used in televisions include organic light-emitting diodes (OLEDs) and quantum dots. LCDs and OLEDs are used in smartphone displays. Thus, the high concentration of flat panel display manufacturers in Asia-Pacific, coupled with the high utilization of ultra-thin glass in designing flat panel displays, is the crucial factor anticipated to further drive the market in the coming years. Furthermore, the growing application of ultra-thin glass by automobile manufacturers in China, India, and South Korea is driving the market. China, as one of the significant producers of automobiles, has a high need for ultra-thin glass for use in various automotive interior panels. Furthermore, the existence of significant players such as AGC Inc. and Nippon Electric Glass Co., Ltd is projected to fuel the market expansion.

Based on end use, consumer electronics segment led the global ultra-thin glass market during the forecasted period. Consumer electronics is one of the prominent end-use industries contributing a major share in the growth of the ultra-thin glass market. Ultra-thin glass is widely used to manufacture electronic goods such as flat panel display devices, smartphones, wearable devices, and touch screen devices. It is extremely thin and flexible. Therefore, it is ideal for devices with wider displays and touch screen features. Moreover, it is used in microprocessors of smartphones as a substrate. Using ultra-thin glass in semiconductor substrates ensures the increased performance of microprocessors, which enables high data transfer rates. The growing utilization of ultra-thin glass in consumer electronic devices is expected to boost the market growth. Moreover, the rising demand for electronic gadgets such as smartphones, laptops, tablets, and televisions in emerging economies, owing to rise in disposable income, significant economic development, increase in adoption of emerging technologies, and improved lifestyles of people, is expected to boost the growth of global ultra-thin glass market in the coming years. Manufacturers of ultra-thin glass are focusing on launching innovative products. Recently, foldable ultra-thin glass was developed by Schott AG which is a Germany-based manufacturer of specialty glass products. This foldable glass was used by Samsung in its Z-fold 3 smartphone which is gaining huge popularity among people worldwide. Such innovations by the prominent manufactures of ultra-thin glass are expected to boost the consumer electronics segment’s growth.

On the basis of manufacturing process, fusion segment is leading the ultra-thin glass market during the forecast period. The fusion process, often known as the overflow downdraw method, is widely used to manufacture flat ultra-thin glass for display panels. Corning was the first company to create specialized glass that was suspended in mid-air, which is a key trait of the fusion method. Glass is not contacted by molten metal, which is a fundamental advantage of the fusion method over the float glass method. The raw materials, including pure sand and other inorganic elements, are fed into a massive melting tank that is heated to temperatures beyond 1000â° Celsius. The molten glass is homogenized and conditioned before being discharged into an isopipe, a huge collection trough with a V-shaped bottom. The isopipe is carefully heated to ensure optimum viscosity of the mixture and consistent flow. The molten glass flows uniformly over the isopipe's top edges, generating two thin, sheet-like streams along the outer surfaces. The two sheets meet at the bottom of the isopipe and are fused into a single glass sheet. As the sheet lengthens and cools in mid-air, it feeds into drawing equipment while still linked to the bottom of the isopipe. With precise control of the fusion glass process parameters, thinner glass panels can be produced. Commercial manufacturers such as Corning, Schott, AGC, and Nippon Electric Glass use the drawdown or fusion process for producing ultra-thin glass.

Based on application, flat-panel display segment is expected to grow at the fastest CAGR from 2021 to 2028. Flat panel displays are video devices that replace the conventional cathode ray tube (CRT) with a thin panel design. Ultra-thin glass is widely used to manufacture flat panel displays such as LCD, LED, OLED screens, smartphone displays, and monitor screens. Moreover, ultra-thin glass is used in the touch module of touch screen devices such as smartphones, tablets, and laptops. It provides fundamental functions for flat-panel display and touch screen devices such as high definition (HD) display, touch-control and scratch resistance, and protection to the screens. Consumer electronic goods are being upgraded at a faster rate as the technological landscape is changing rapidly. Panel display components used in flat-panel display and touch-control devices have emerged as the most important downstream application products for ultra-thin glass substrates with the highest market demand. The need for ultra-thin glass substrate is predicted to rise since it is a crucial component and key fundamental material for flat-panel display and touch-control systems. Moreover, ultra-thin glass substrates are non-substitutable and have a promising future as the entire electronic device market develops.

The major players operating in the ultra-thin glass market are Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; and Luoyang Glass Co., Ltd.

In 2020, Asia Pacific held the largest revenue share of the global ultra-thin glass market and is also expected to register the highest CAGR during the forecast period. The ultra-thin glass market across the region is projected to witness remarkable growth, owing to the rapidly expanding consumer electronics industry in countries such as China, Japan, and South Korea. China is one of the largest consumer electronics markets across the world, along with Japan and South Korea. Due to the high concentration of consumer electronics manufacturers in Asia-Pacific, the demand for ultra-thin glass from the manufacturers of electronic goods across the region is expected to grow significantly over the forecast period. Moreover, China and Japan are the leading exporters of semiconductor components used in electronic gadgets. Many leading manufacturers of smartphones and electronic gadgets heavily rely on Asia-Pacific countries for sourcing semiconductor components. For chip packing and interposer applications, the semiconductor industry is progressively designing products using thin glass substrates. When organic substrate materials are employed, the locally generated heat of the small core parts of mobile devices causes deflection and reliability issues. Ultra-thin glass has excellent dimensional stability over a wide range of temperatures while also providing the foundation for an exceedingly flat chip package. Thus, the increasing utilization of ultra-thin glass for designing electronic goods across the region is projected to potentially drive the market over the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Ultra-thin Glass Market

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd.

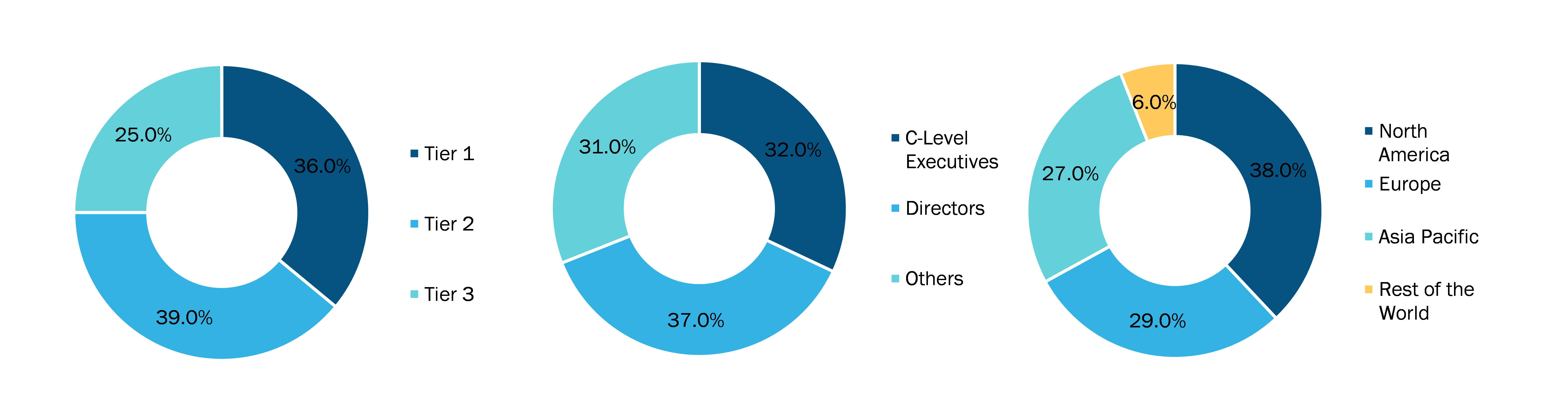

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport