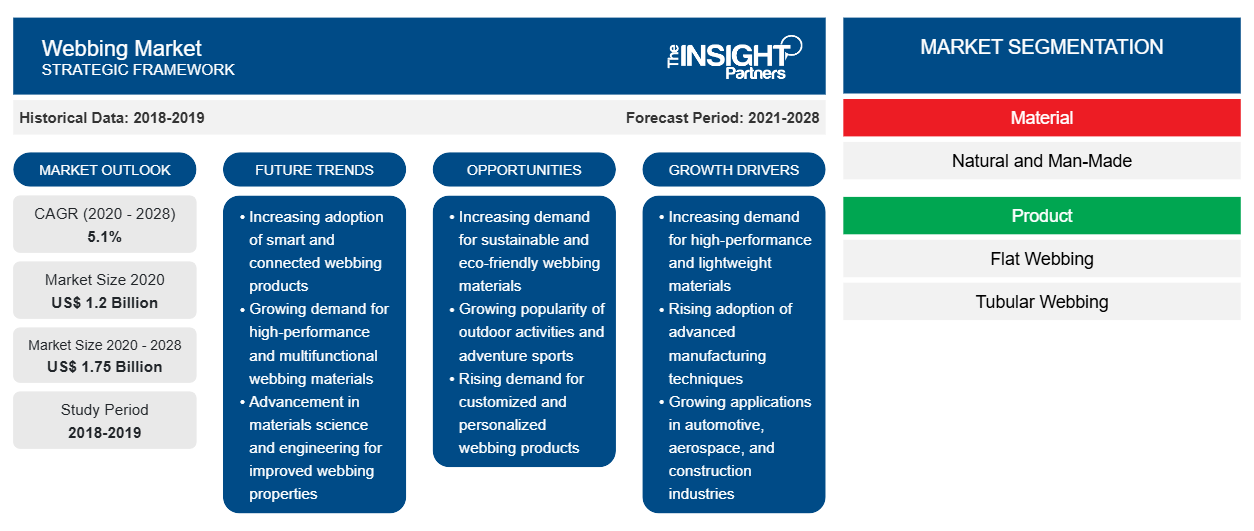

Le marché des sangles devrait atteindre 1 745,84 millions USD d'ici 2028, contre 1 195,35 millions USD en 2020 ; il devrait croître à un TCAC de 5,1 % de 2021 à 2028.CAGR of 5.1% from 2021 to 2028.

La sangle est une fibre tissée solide disponible sous forme de bandes plates ou de tubes ; elle est utilisée comme substitut de la corde. Traditionnellement, la sangle est produite à partir de coton et de soie, mais le polymère, le nylon et le polyester remplacent les matériaux traditionnels. La sangle est connue pour ses propriétés telles que la commodité, la résistance à la traction et la résistance chimique ; elle peut être utilisée en remplacement des fils d'acier, des cordes ou des chaînes dans diverses applications industrielles. Les sangles sont largement utilisées dans les vêtements militaires, les parachutes, l'escalade, le textile automobile, les équipements de sécurité incendie, les articles militaires, les harnais, les sacs à dos, le matériel de randonnée et autres. En dehors de cela, la sangle est largement utilisée pour produire des équipements de protection pour les travailleurs du pétrole et du gaz.

En 2021 , le secteur automobile détiendra la plus grande part du marché mondial des sangles , en termes d'utilisation finale. Les sangles sont un élément important de la fabrication de ceintures de sécurité, de harnais de sécurité, de sangles de traction, de bordures pour capotes décapotables, de sangles et de fixations pour filets à bagages, de ceintures de sécurité pour airbags, etc. L'augmentation de la demande de véhicules dans les économies en développement telles que l'Inde et la Chine soutient la croissance du marché. Selon le rapport sur la situation mondiale de la sécurité routière, l'importance croissante du port de la ceinture de sécurité pour minimiser le risque de décès parmi les passagers des sièges avant et arrière a favorisé la demande de sangles.seatbelt to minimize the risk of a fatality among front seat passengers and rear-seat passengers has promoted the demand for webbing.

En 2021, l'Asie-Pacifique représenterait la plus grande part du marché mondial des sangles. La domination de cette région sur le marché mondial est principalement attribuée à la présence d'un secteur industriel fort, notamment les unités de fabrication de plusieurs entreprises de premier plan. La demande de sangles est élevée dans des secteurs verticaux tels que l'automobile, l'aérospatiale et la défense, l'industrie et la sécurité, les accessoires de mode, le textile et les articles de sport. En outre, l'augmentation des investissements dans le secteur manufacturier offre des opportunités lucratives pour la croissance du marché des sangles en Asie-Pacifique. Les politiques favorables mises en œuvre par le gouvernement indien, telles qu'Atmanirbhar Bharat et Make in India, devraient créer des opportunités de croissance suffisantes pour les diverses bases industrielles, ce qui, à son tour, stimulerait la consommation de sangles dans la région.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Impact de la pandémie de COVID-19 sur le marché des sangles

En juin 2021, les États-Unis, l'Inde, le Brésil, la Russie, le Royaume-Uni, la France, l'Espagne, l'Italie, la Turquie, l'Allemagne, la Colombie et l'Argentine figuraient parmi les pays les plus touchés par la pandémie de COVID-19. Les mesures imposées pour contenir la propagation de la maladie, notamment le confinement, les interdictions de voyager et les fermetures d'entreprises, ont eu de graves répercussions sur les économies et les industries de plusieurs pays. Les produits chimiques et les matériaux sont l'une des principales industries qui connaissent de graves perturbations en raison de l'arrêt des chaînes d'approvisionnement et des opérations des usines. La fermeture des usines de fabrication dans des régions telles que l'Amérique du Nord, l'Europe et l'APAC a entravé les chaînes d'approvisionnement mondiales, affectant ainsi les processus de fabrication, les calendriers de distribution et les ventes de produits. Les conséquences de la pandémie de COVID-19 ont également entraîné un ralentissement de la production, de la demande et du commerce de sangles. La fermeture des frontières nationales et internationales a affecté les stratégies de développement commercial de diverses entreprises. Cependant, les économies prévoyant de relancer leurs opérations, d'assouplir les mesures de confinement et de mener des campagnes de vaccination de masse, le marché des sangles devrait rebondir dans les mois à venir.

Informations sur le marché

L'augmentation de la demande de sangles synthétiques contribue de manière significative à la croissance du marché des sangles

The demand for man-made webbing has significantly risen more significantly than in comparison to natural webbing materials. Aramid fibers, polybenzoxazole, polyester, polypropylene, and nylon are the several types of man-made synthetic materials used in webbing. Polyester is known for its various outstanding characteristics such as high tensile strength and, resistance toward water, abrasion and ultraviolet deterioration, easy in maintenance along with, resistance toward water, abrasions, and ultraviolet radiations, stretching, and shrinkage, resistance, and chemicals resistance. Therefore, amongst the other types of man-made webbing material, the use of polyester-based webbings is being used in has been extended across a diversified range of application bases such as marine fabric applications, bag handles, sail ties, and support straps. Moreover, slings made up of from synthetic polyester (fiber material) are comparatively lighter in weight than both wire rope and chain slings. Other than polyester, the demand for nylon is high owing to its better elasticity than other materials. Nylon-based webbings are being used Such property has enabled its use in numerous end-use applications such as airbags, seat belts, safety harnesses, and luggage nets, among others. Also, Remarkable features of carbon fibers have several features such as include limited thermal expansion, coupled with tolerance toward extreme temperature tolerance conditions, chemical resistance, high with tensile strength, and light low weight, and high tensile strength, which make them it an ideal webbing material. The carbon fiber-based webbings are used to be used in military and sporting goods.

Material Insights

On the basis of material, the webbing market is segmented into natural and man-made. The man-made segment is currently dominating the market, in terms of revenue share. The market growth of this segment is credited to lower prices and better availability of man-made materials used in webbing production. These materials include polyester, nylon, polypropylene, aramid fibers, polybenzoxazole, liquid crystal polymer yarn, and high-modulus polyethylene. Polyester webbing is commonly utilized in applications requiring low to high load-bearing capacities. Due to its superior fade resistance, polyester webbing is increasingly used in maritime fabric applications such as support straps, sail ties, and bag handles. In addition, polyester is well-known for its superior properties such as quick-drying, easy cleaning, and high tensile strength as well as resistance to ultraviolet deterioration, water, abrasions, stretching, shrinkage, chemical exposure, and mildew growth.

Product Insights

Based on product, the webbing market is categorized into flat webbing, tubular webbing, and other product. The flat webbing segment is currently dominating the market, in terms of revenue share. Flat webbing, often known as flat rope, is made of solidly woven fibers and is available in various thicknesses and widths. Flat webbing works effectively in applications where the material can be woven into a larger product, such as backpack straps, seatbelts, and reinforcing bindings. It is usually stiffer than tubular textiles.

End Use Insights

Based on end use, the webbing market is segmented into aerospace, automotive, military, industrial and safety, fashion accessories, e-textile, sport goods, marine, medical, and others. The aerospace segment is currently dominating the market, in terms of revenue share. The development and use of webbing have revolutionized the aerospace industry. Features of woven webbing such as high-performance and low weight help to meet rigorous industry standards applicable for the aerospace industry. The woven webbing also confer benefits such as heat, chemical rot and abrasion resistance, and easy cleaning to the aerospace applications. Further, the specialized narrow fabrics, 2D and 3D thermoset, thermoplastic fabrics, and novel e-webbings are suited for meeting specific strength requirements of the industry. In addition, the materials are widely used in crucial aerospace applications such as parachutes, cargo restraint systems, and seating, as well as in a few interior applications such as crew safety system components, flight suits, air slides, seatbelts, and flotation devices.

A few of the major key players operating in the webbing market are American Cord & Webbing Co, Inc.; Belt-tech; E. Oppermann GmbH; Narrowtex Australia; and National Webbing Products Co. These market players are highly focusing on the development of high-quality and innovative product offerings.

Report Spotlights

- Progressive webbings industry trends to help players develop effective long-term strategies

- Business growth strategies adopted by the webbing market players in developed and developing markets

- Quantitative analysis of the market from 2019 to 2028

- Estimation of global demand for webbings

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the webbings market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- Detailed overview and segmentation of the market, as well as the webbings industry dynamics

- Size of the webbings market in various regions with promising growth opportunities

Webbing Market Regional Insights

Les tendances régionales et les facteurs influençant le marché des sangles tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des sangles en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des sangles

Portée du rapport sur le marché des sangles

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2020 | 1,2 milliard de dollars américains |

| Taille du marché d'ici 2028 | 1,75 milliard de dollars américains |

| Taux de croissance annuel composé mondial (2020-2028) | 5,1% |

| Données historiques | 2018-2019 |

| Période de prévision | 2021-2028 |

| Segments couverts | Par matériau

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des sangles : comprendre son impact sur la dynamique des entreprises

Le marché des sangles connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des sangles sont :

- Société américaine de cordons et de sangles

- MOULINS À RUBAN BALLY

- CEINTURE TECHNOLOGIQUE

- E. OPPERMANN GMBH

- SOCIÉTÉ DE SANGLES MURDOCK, INC.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des sangles

Marché des sangles, par matériau

- Naturel

- Fabriqué par l'homme

Marché des sangles, par produit

- Sangle plate

- Sangle tubulaire

- Autres

Marché des sangles, par produit

- Aérospatial

- Automobile

- Militaire

- Industrie et sécurité

- Accessoires de mode

- Textile électronique

- Articles de sport

- Marin

- Médical

- Autres

Profils d'entreprise

- Cordon et Webbing Co., Inc. américain

- Usines de rubans Bally

- Ceinture-tech

- E. Oppermann GmbH

- Société de toiles Murdock, Inc.

- Narrowtex Australie

- Produits de sangles nationaux Co.

- Ohio Plastics Belting Co.

- Société de Webbing en Ruban

- Produits de sangles Tennessee

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

Automotive segment held the largest share in the global webbing market in 2020. Webbing is significantly used in preparation of production of seat belts, safety harnesses, pull straps, edge binding for convertible tops, straps and binding for luggage nets, catch belts for airbags and other such products in automotive industry. Rise in demand for vehicles in developing economies such as India and China are expected to proliferate the growth of the market. For instance, according to Global status report on road safety, the rising focus towards wearing a seatbelt to minimize the risk of a fatality among front seat passengers and rear-seat passengers has promoted the demand for webbing. Additionally, the significant growth in automotive industry is expected to complement the growth of webbing market.

The major players operating in the global webbing market are H AMERICAN CORD & WEBBING CO., INC.; BALLY RIBBON MILLS; BELT-TECH; E. OPPERMANN GMBH; MURDOCK WEBBING COMPANY, INC.; NARROWTEX AUSTRALIA; NATIONAL WEBBING PRODUCTS CO.; OHIO PLASTICS BELTING CO.; RIBBON WEBBING CORP; TENNESSEE WEBBING PRODUCTS; and among others.

In 2020, Asia Pacific contributed to the largest share in the global webbing market. The dominance of the webbing market in this region is primarily attributable to the presence of strong industrial base with prominent manufactures significantly contributing to market growth. High demand of webbing from applications such as automotive, aerospace and defense, industrial and safety, fashion accessories, textile, sport goods and other industries backed by significant growth in end-use industrial bases is stimulating the demand for webbing in regional market. The rise in investment in manufacturing sector across economies further, provides lucrative opportunities for the growth of the webbing market in Asia Pacific.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Webbing Market

- AMERICAN CORD & WEBBING CO., INC

- BALLY RIBBON MILLS

- BELT-TECH

- E. OPPERMANN GMBH

- MURDOCK WEBBING COMPANY, INC.

- NARROWTEX AUSTRALIA

- NATIONAL WEBBING PRODUCTS CO.

- OHIO PLASTICS BELTING CO.

- RIBBON WEBBING CORP

- TENNESSEE WEBBING PRODUCTS

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport