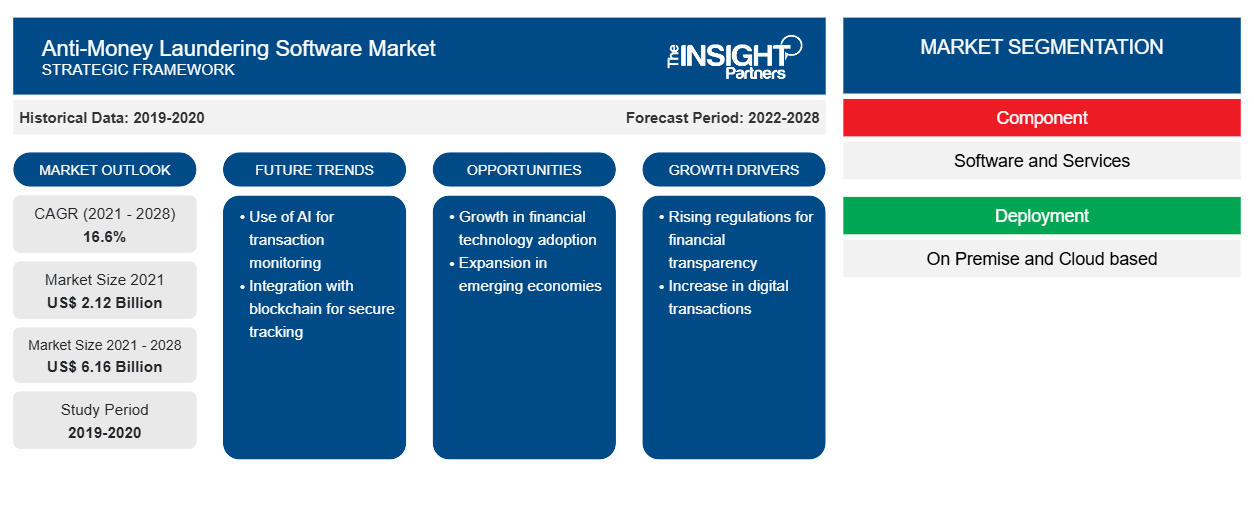

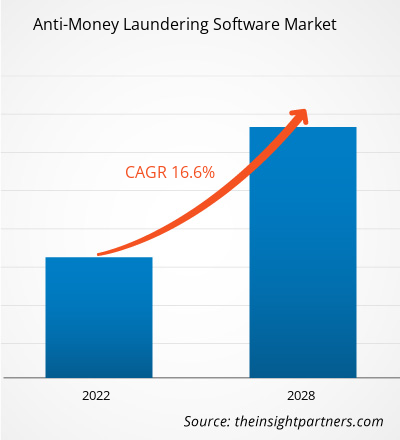

[Rapporto di ricerca] Si prevede che le dimensioni del mercato del software antiriciclaggio cresceranno da 2.116,3 milioni di dollari nel 2021 a 6.162,8 milioni di dollari entro il 2028; si stima che le dimensioni del mercato del software antiriciclaggio cresceranno a un CAGR del 16,6% dal 2022 al 2028.

I progressi tecnologici stanno innescando il numero di criminali informatici . Tuttavia, le aziende FinTech hanno il potenziale per aiutare le banche di tutto il mondo a rimanere competitive nel mercato globale. L'uso di sistemi più robusti combinati con tecnologie avanzate nel tracciamento della valuta digitale , nell'apprendimento automatico e nella connessione dei dati hanno aperto possibilità per combattere il riciclaggio di denaro. Con l'aumento dell'adozione da parte dei consumatori e dei successivi volumi di transazioni nelle aziende FinTech competitive nel 2019, molte aziende sono passate a pratiche antiriciclaggio automatizzate. I sistemi antiriciclaggio automatizzati forniscono un numero trascurabile di falsi positivi rispetto a quelli generati dai dati e dalla tecnologia tradizionali. Ciò riduce gli effetti negativi dei falsi positivi, mantenendo i costi operativi entro l'intervallo previsto.

Considerando la crescente connessione tra soluzioni FinTech e AML , a dicembre 2020, l'Associazione degli specialisti certificati antiriciclaggio ha annunciato il lancio di un nuovo programma di certificazione per le aziende FinTech che cercano di soddisfare gli standard normativi. L'associazione ha anche sviluppato il programma Certified AML FinTech Compliance Associate in collaborazione con FINTRAIL . Il programma è stato creato per aumentare il kit di strumenti di conformità del personale FinTech che lavora nella prevenzione dei reati finanziari a livello di ingresso. Pertanto, la crescente attenzione di FinTech all'implementazione di soluzioni AML sta spingendo la crescita del mercato dei software antiriciclaggio .

I clienti non hanno alcun controllo sulla posizione dell'infrastruttura; questo implica che se il data center di un fornitore viene violato, l'azienda non avrà alcun controllo sul periodo di interruzione o sui dati che possono essere concessi. Tutti i clienti sui cloud condividono lo stesso pool di infrastrutture con limitate protezioni di sicurezza, varianze di configurazione e accessibilità. Tralasciando le limitazioni di controllo, i rischi per la sicurezza e i vincoli di policy, ci sono diverse situazioni in cui un'implementazione cloud è più adatta. Tuttavia, i cloud sono più grandi rispetto al tipo di implementazione on-premise, grazie al quale le aziende associate al cloud beneficiano di una scalabilità fluida e on-demand. L'implementazione cloud è ideale per le organizzazioni che desiderano adottare soluzioni di analisi con un investimento ridotto. Consente principalmente alle aziende di procurarsi i dati con tutti i loro servizi, ma a una spesa economica.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti regionali sul mercato dei software antiriciclaggio

Le tendenze regionali e i fattori che influenzano il mercato del software antiriciclaggio durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti del mercato del software antiriciclaggio e la geografia in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato del software antiriciclaggio

Ambito del rapporto di mercato del software antiriciclaggio

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2021 | 2,12 miliardi di dollari USA |

| Dimensioni del mercato entro il 2028 | 6,16 miliardi di dollari USA |

| CAGR globale (2021 - 2028) | 16,6% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti | Per componente

|

| Regioni e Paesi coperti | America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

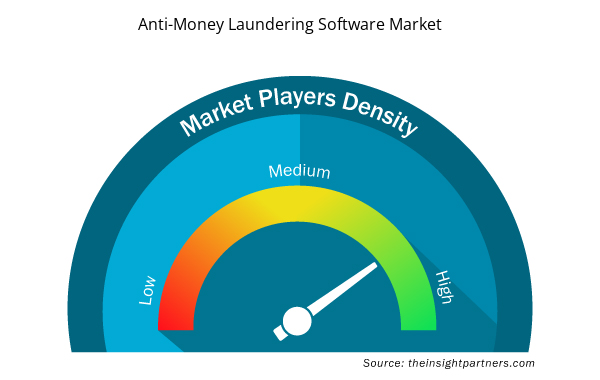

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del software antiriciclaggio sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei software antiriciclaggio sono:

- ACCENTURAZIONE

- ACI NEL MONDO

- CONSULENZA TECNOLOGICA ASCENT

- SISTEMI BAE

- SOCIETÀ REDATTIVA ASSOCIATA A ...

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei software antiriciclaggio

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

- Foot Orthotic Insoles Market

- Electronic Health Record Market

- Europe Industrial Chillers Market

- Playout Solutions Market

- Skin Tightening Market

- Architecture Software Market

- Retinal Imaging Devices Market

- Portable Power Station Market

- Personality Assessment Solution Market

- Saudi Arabia Drywall Panels Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

The Anti-money laundering software market is estimated to grow at 6162.8 million US dollars in 2028 at a CAGR of 16.6%.

The Increasing focus of FinTech on implementing automated anti-money laundering systems and Rising demand for sophisticated transaction monitoring solutions are driving the anti-money laundering software market

The Information sharing among banks and other financial institutions and Increased use of artificial intelligence are the future trends for the Anti-money laundering market.

Accenture, Open Text Corporation, Oracle, BAE Systems and SAS are the five key players holding the major market share in the Anti-money laundering software market.

North America is holding major market share of Anti-money laundering market.

Transaction Monitoring is the leading product segment in the Anti-money laundering software market.

The incremental growth of Anti-money laundering software market during the forecast period is US $ 3711.2 million.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Anti-Money Laundering Software Market

- ACCENTURE

- ACI WORLDWIDE

- ASCENT TECHNOLOGY CONSULTING

- BAE SYSTEMS

- EASTNETS HOLDING LTD.

- OPENTEXT CORPORATION

- ORACLE CORPORATION

- NICE Ltd.

- SAS INSTITUTE

- Nasdaq Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot