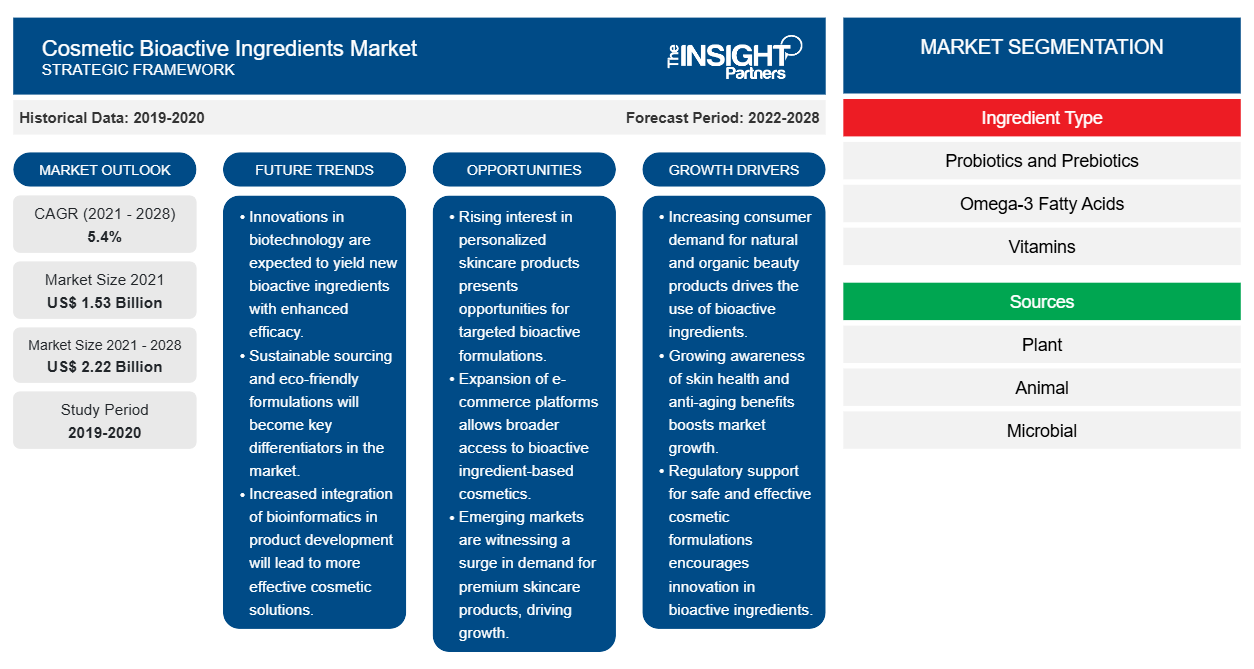

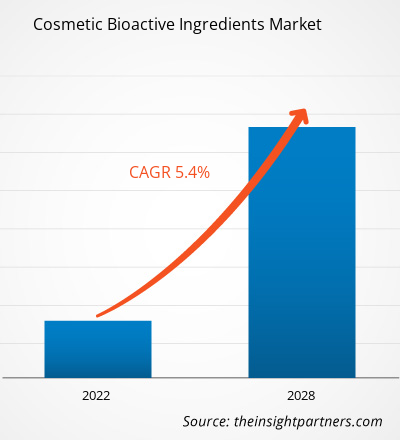

Si prevede che il mercato degli ingredienti bioattivi cosmetici raggiungerà i 2.215,96 milioni di dollari entro il 2028, rispetto ai 1.529,91 milioni di dollari del 2021; si stima che crescerà a un CAGR del 5,4% dal 2021 al 2028.

I cosmetici sono prodotti realizzati per essere applicati sulla pelle e sui capelli per detergerli, abbellirli, promuoverne l'attrattiva o migliorarne l'aspetto. Tra gli ingredienti attivi solitamente utilizzati in questo tipo di preparazione, c'è una tendenza globale a incorporare prodotti di origine vegetale per il loro appeal commerciale, la sicurezza e la ricca composizione, spesso correlata a un effetto sinergico o multifunzionale. Gli estratti botanici sono ricchi di metaboliti secondari che esistono nelle piante con elevata diversità strutturale. Sia i flavonoidi che i non flavonoidi sono correlati a interessanti proprietà cosmetiche come fotoprotezione, anti-invecchiamento, idratazione, antiossidante, astringente, anti-irritante e attività antimicrobica. Con i loro componenti bioattivi e le azioni farmacologiche, questi ingredienti bioattivi hanno dimostrato di fornire benefici dermatologici con potenziali applicazioni per il ringiovanimento della pelle, la fotoprotezione, la guarigione delle ferite e altro ancora. La crescita del mercato degli ingredienti bioattivi cosmetici è principalmente attribuita alla crescente preferenza per gli ingredienti naturali nei prodotti cosmetici e al crescente numero di ingredienti bioattivi lanciati. Tuttavia, rigidi quadri normativi stanno limitando la crescita del mercato degli ingredienti bioattivi cosmetici .

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti di mercato

La crescente domanda di prodotti naturali da parte dei consumatori sta alimentando la ricerca relativa alle sostanze bioattive che possono essere utilizzate nei cosmetici. L'Europa ospita alcuni dei più grandi produttori di ingredienti bioattivi e marchi di cura della persona, come BASF e DSM. Il lancio di ingredienti bioattivi per il settore della cura della persona sta guidando la crescita del mercato. A giugno 2019, BASF Care Creations ha lanciato tre nuovi ingredienti attivi per il mercato della bellezza, che utilizzano alberi di rambutan che forniscono idratazione e ringiovanimento della pelle. Allo stesso modo, ad aprile 2019, Lonza ha lanciato l'ingrediente bioattivo H2OBioEV, che è una combinazione unica di ingredienti di origine naturale, polisaccaridi di Aphanothece Sacrum e Galactoarabinan, con acqua e glicerina. L'ingrediente conferisce capacità di idratazione reintegrando gli umettanti essenziali, il che facilita l'ambiente ottimale per la formazione e il mantenimento di una forte barriera proteica epidermica.

Informazioni basate sul tipo di ingrediente

In base al tipo di ingrediente, il mercato degli ingredienti bioattivi cosmetici è suddiviso in probiotici e prebiotici, acidi grassi omega-3, vitamine, carotenoidi e antiossidanti, estratti vegetali, minerali, amminoacidi, proteine e peptidi e altri. È probabile che il segmento degli amminoacidi deterrà la quota maggiore del mercato nel 2021. Tuttavia, si prevede che il segmento degli estratti vegetali registrerà il CAGR più elevato nel mercato durante il periodo di previsione.

Approfondimenti basati sulla fonte

Il mercato degli ingredienti bioattivi cosmetici, in base alle fonti, è segmentato in vegetale, animale e microbico. È probabile che il segmento vegetale deterrà la quota maggiore del mercato nel 2021. Tuttavia, si prevede che il segmento microbico registrerà il CAGR più elevato nel mercato durante il periodo di previsione.

Le aziende che operano nel mercato degli ingredienti bioattivi cosmetici stanno adottando strategie quali lanci di prodotti, fusioni e acquisizioni, collaborazioni, innovazioni di prodotto e portafogli di prodotti per espandere la propria presenza in tutto il mondo, mantenere il marchio e soddisfare la crescente domanda degli utenti finali.

Approfondimenti regionali sul mercato degli ingredienti bioattivi cosmetici

Le tendenze regionali e i fattori che influenzano il mercato degli ingredienti bioattivi cosmetici durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti del mercato degli ingredienti bioattivi cosmetici e la geografia in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato degli ingredienti bioattivi cosmetici

Ambito del rapporto di mercato sugli ingredienti bioattivi cosmetici

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2021 | 1,53 miliardi di dollari USA |

| Dimensioni del mercato entro il 2028 | 2,22 miliardi di dollari USA |

| CAGR globale (2021 - 2028) | 5,4% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti | Per tipo di ingrediente

|

| Regioni e Paesi coperti | America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

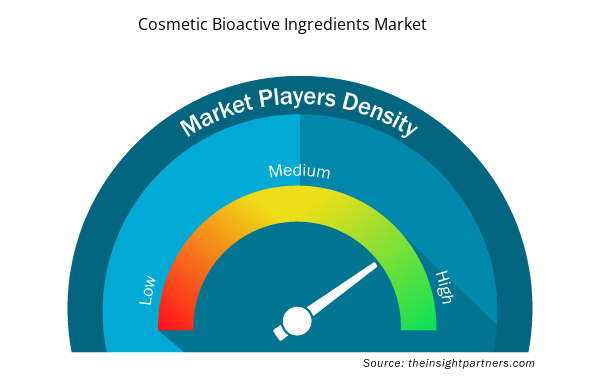

Densità degli attori del mercato degli ingredienti bioattivi cosmetici: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli ingredienti bioattivi cosmetici sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli ingredienti bioattivi cosmetici sono:

- Koninklijke DSM NV

- Società anonima Ajinomoto Co., Inc.

- Roquette Fratelli

- Direttore Generale

- BASF SE

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli ingredienti bioattivi cosmetici

Mercato degli ingredienti bioattivi cosmetici – diTipo di ingrediente

- Probiotici e prebiotici

- Acidi grassi omega-3

- Vitamine

- Carotenoidi e antiossidanti

- Estratti vegetali

- Minerali

- Aminoacidi

- Proteine e peptidi

- Altri

Mercato degli ingredienti bioattivi cosmetici – per fonte

- Pianta

- Animale

- Microbico

Mercato degli ingredienti bioattivi cosmetici – per area geografica

America del Nord

- NOI

- Canada

- Messico

Europa

- Francia

- Germania

- Italia

- Regno Unito

- Spagna

- Resto d'Europa

Asia Pacifico (APAC)

- Cina

- India

- Corea del Sud

- Giappone

- Australia

- Resto dell'Asia Pacifica

Medio Oriente e Africa (MEA)

- Sudafrica

- Arabia Saudita

- Emirati Arabi Uniti

- Resto del Medio Oriente e Africa

America del Sud (SAM)

- Brasile

- Argentina

- Resto del Sud e Centro America

Profili aziendali

- Koninklijke DSM NV

- Società anonima Ajinomoto Co., Inc.

- Roquette Fratelli

- Direttore Generale

- BASF SE

- Società FMC

- Biotecnologia Vytrus

- Azienda

- Sensibile Technologies Corporation

- DUPONT

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

- Legal Case Management Software Market

- Photo Editing Software Market

- Equipment Rental Software Market

- Environmental Consulting Service Market

- Batter and Breader Premixes Market

- Wheat Protein Market

- Extracellular Matrix Market

- Sleep Apnea Diagnostics Market

- Electronic Toll Collection System Market

- Smart Grid Sensors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

Global cosmetic bioactive ingredients market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for cosmetic bioactive ingredients. The growth of the region is attributed to increasing product launches coupled with increasing adoption of cosmetics.

The Europe region is expected to account for the fastest growth in the cosmetic bioactive ingredients market. Technological advancement for extraction of bioactive ingredients in this region contribute to this dominant share. Additionally, rising preference for natural ingredients in cosmetic products are said to be responsible for this growth.

The cosmetic bioactive ingredients market majorly consists of the players such BASF SE, DuPont de Nemours, Inc., FMC CORPORATION, Cargill, Incorporated, Sensient Technologies Corporation, DSM, Ajinomoto Co. Inc., Roquette Frères, ADM, and Vytrus Biotech amongst others.

The plant segment dominated the global cosmetic bioactive ingredients market and accounted for the largest revenue share of 62.50% in 2021.

The amino acids segment dominated the global cosmetic bioactive ingredients market and held the largest revenue share of 20.81% in 2021.

Key factors that are driving the growth of this market is rising preference for natural ingredients in cosmetic products and increasing launch of bioactive ingredients.

Cosmetics are products made to apply to the skin and hair to cleansing, beautifying, promoting attractiveness, or improving appearance. Amid the active ingredients usually used in this type of preparation, there is a global trend of incorporating vegetable source products due to their commercial appeal, safety, and rich composition, often related with a synergistic or multifunctional effect. Botanical extracts are high in secondary metabolites that exist in plants with high structural diversity. Both flavonoids and non-flavonoids are related to interesting cosmetic properties like photoprotection, anti-aging, moisturizing, antioxidant, astringent, anti-irritant, and antimicrobial activity. With their bioactive components and pharmacologic actions, these bioactive ingredients have been shown to provide dermatologic benefits with potential applications for skin rejuvenation, photoprotection, wound healing, and more.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Cosmetic Bioactive Ingredients Market

- Koninklijke DSM N.V.

- Ajinomoto Co., Inc.

- Roquette Freres

- ADM

- BASF SE

- FMC Corporation

- Vytrus Biotech

- Cargill, Inc.

- Sensient Technologies Corporation

- DUPONT

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot