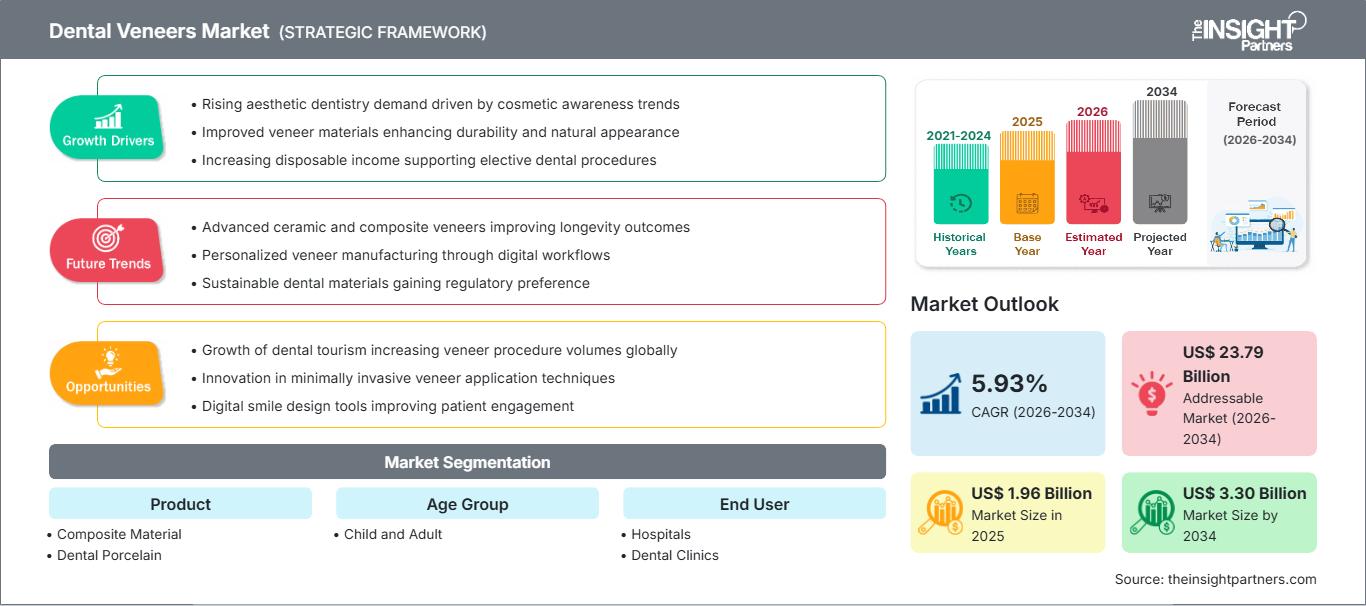

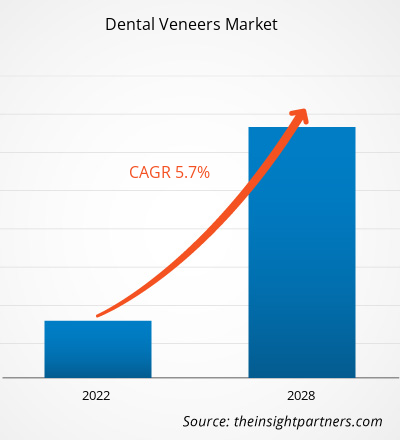

Si prevede che il mercato delle faccette dentali raggiungerà i 3,30 miliardi di dollari nel 2034, rispetto agli 1,96 miliardi di dollari del 2025. Si prevede che il mercato registrerà un CAGR del 5,93% nel periodo 2026-2034.

Analisi del mercato delle faccette dentali

Le previsioni per il mercato delle faccette dentali indicano una crescita, dovuta al crescente numero di patologie dentali, alla crescente consapevolezza dei consumatori in merito alle cure odontoiatriche e alla crescente attenzione rivolta all'odontoiatria estetica.

Altri fattori che supportano l'espansione del mercato includono:

- Maggiore richiesta di interventi di odontoiatria estetica poiché le persone danno sempre più priorità all'estetica del sorriso e all'aspetto orale.

- Espansione delle cliniche odontoiatriche a livello globale, rendendo più accessibili i servizi di odontoiatria estetica, comprese le faccette.

- Innovazioni nei materiali per faccette dentali (composito, porcellana, ecc.) e nelle tecniche di trattamento che migliorano i risultati e attraggono una base di pazienti più ampia.

Tuttavia, un limite degno di nota è il costo spesso elevato delle procedure odontoiatriche estetiche, che può limitarne l'adozione in determinati mercati o tra i pazienti attenti ai costi.

Panoramica del mercato delle faccette dentali

Le faccette dentali, note anche come faccette in porcellana o laminati in porcellana dentale, sono sottilissimi gusci realizzati su misura, realizzati in materiali dello stesso colore dei denti, progettati per ricoprire le superfici anteriori dei denti e migliorarne l'aspetto. Queste faccette vengono fissate con cemento resinoso. Il trattamento è personalizzato per ogni paziente e consente di modificare il colore, la forma, le dimensioni o la lunghezza dei denti, principalmente per migliorare l'estetica.

Le faccette rappresentano un segmento chiave dell'odontoiatria estetica, offrendo ai pazienti un modo per migliorare il proprio sorriso senza ricorrere a interventi ricostruttivi più invasivi. Con l'aumento delle preoccupazioni estetiche e della consapevolezza dell'igiene orale a livello globale, le faccette stanno svolgendo un ruolo importante negli studi dentistici moderni.

Personalizza questo report in base alle tue esigenze

Ottieni la PERSONALIZZAZIONE GRATUITAMercato delle faccette dentali: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Fattori trainanti e opportunità del mercato delle faccette dentali

Fattori trainanti del mercato:

- Aumento dell'incidenza di disturbi dentali e necessità estetiche: un numero sempre maggiore di persone soffre di problemi dentali (scolorimento, danni, disallineamento), con conseguente aumento della domanda di soluzioni correttive ed estetiche come le faccette.

- Crescente consapevolezza dei consumatori e richiesta di trattamenti estetici: oggi sempre più persone sono attente all'aspetto dei denti e all'estetica del sorriso, il che alimenta la domanda di faccette come procedura odontoiatrica estetica.

- Espansione delle cliniche odontoiatriche e accessibilità dei servizi: con l'aumento delle cliniche odontoiatriche in tutto il mondo, anche nei mercati emergenti, le faccette diventano accessibili a una popolazione più ampia, aumentando il potenziale di mercato.

Opportunità di mercato:

- Innovazione dei materiali (faccette in composito e porcellana): la disponibilità e l'adozione di diversi materiali per le faccette, come il composito e la porcellana, offrono opzioni per pazienti con esigenze e budget diversi.

- Crescita dell'odontoiatria estetica nei mercati emergenti: con l'aumento del reddito disponibile e la diffusione della consapevolezza estetica nelle economie emergenti, è probabile che la domanda di procedure odontoiatriche estetiche, comprese le faccette, aumenti, offrendo opportunità di crescita. (Sebbene non sia esplicitamente suddiviso per area geografica, la dimensione globale del mercato suggerisce opportunità al di fuori dei mercati tradizionali.)

- Aumento delle infrastrutture delle cliniche odontoiatriche e dei servizi estetici: con la proliferazione delle cliniche odontoiatriche in tutto il mondo e l'espansione dei loro servizi di odontoiatria estetica, le faccette potrebbero diventare una scelta di trattamento più diffusa e ampiamente accettata.

Analisi della segmentazione del rapporto di mercato delle faccette dentali

Per prodotto:

- Materiale composito

- Faccette dentali in porcellana

Per fascia d'età:

- Bambino

- Adulto

Da parte dell'utente finale:

- Ospedali

- Cliniche dentali

Per geografia:

- America del Nord

- Europa

- Asia-Pacifico

- America meridionale e centrale

- Medio Oriente e Africa

Approfondimenti regionali sul mercato delle faccette dentali

Le tendenze e i fattori regionali che hanno influenzato il mercato delle faccette dentali durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione analizza anche i segmenti e la distribuzione geografica del mercato delle faccette dentali in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto sul mercato delle faccette dentali

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2025 | 1,96 miliardi di dollari USA |

| Dimensioni del mercato entro il 2034 | 3,30 miliardi di dollari USA |

| CAGR globale (2026 - 2034) | 5,93% |

| Dati storici | 2021-2024 |

| Periodo di previsione | 2026-2034 |

| Segmenti coperti |

Per prodotto

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato delle faccette dentali: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle faccette dentali è in rapida crescita, trainato dalla crescente domanda da parte degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato delle faccette dentali

Analisi della quota di mercato delle faccette dentali per area geografica

Secondo il rapporto di The Insight Partners, le tendenze regionali e i fattori che influenzano il mercato delle faccette dentali vengono analizzati nelle principali regioni del mondo (Nord America, Europa, Asia Pacifico, Sud e Centro America, Medio Oriente e Africa).

- Nord America ed Europa: Storicamente, queste regioni hanno registrato un'adozione significativa dell'odontoiatria estetica e delle procedure estetiche dentali grazie all'elevata consapevolezza e al migliore accesso alle cliniche odontoiatriche. Ciò indica che continuano a detenere una quota sostanziale del mercato delle faccette.

- Asia-Pacifico: data la crescita della popolazione, l'aumento del reddito disponibile, la crescente urbanizzazione e l'espansione del settore odontoiatrico privato, l'Asia-Pacifico rappresenta una regione promettente per la crescita del mercato delle faccette, soprattutto con l'aumento della consapevolezza in materia di odontoiatria estetica.

- America Latina, Medio Oriente e Africa: queste regioni rappresentano mercati emergenti in cui l'adozione potrebbe aumentare gradualmente, soprattutto grazie al miglioramento delle infrastrutture odontoiatriche, alla crescente consapevolezza dell'estetica dentale e all'espansione dei servizi odontoiatrici.

Densità degli operatori del mercato delle faccette: comprendere il suo impatto sulle dinamiche aziendali

Questo ambiente competitivo spinge i giocatori a differenziarsi attraverso:

- Offriamo faccette in composito o porcellana di alta qualità che bilanciano costi, durata ed estetica

- Espansione della distribuzione attraverso cliniche odontoiatriche e fornitori di servizi di odontoiatria estetica a livello globale

- Investire nell'innovazione dei materiali e nelle tecniche di trattamento per attrarre i pazienti che cercano risultati estetici migliori

- Campagne di marketing e sensibilizzazione dei consumatori per evidenziare i vantaggi delle faccette rispetto alle tradizionali alternative cosmetiche o restaurative dentali

Opportunità e mosse strategiche

- Focus sui mercati emergenti e Asia-Pacifico: gli operatori del mercato possono espandere la propria presenza nelle regioni ad alto potenziale (Asia-Pacifico, America Latina, MEA) stabilendo partnership con cliniche odontoiatriche locali o lanciando opzioni di faccette a basso costo.

- Innovazione dei materiali: investire in materiali compositi o in porcellana e offrire faccette in composito o porcellana durevoli ma convenienti per soddisfare diverse sensibilità e preferenze in termini di prezzo.

- Espansione e accessibilità della rete clinica: collaborazioni con cliniche odontoiatriche e catene di odontoiatria estetica per offrire le faccette come parte di pacchetti più ampi per il restyling del sorriso.

- Campagne di marketing e sensibilizzazione: aumentare la consapevolezza dei consumatori sulle procedure odontoiatriche cosmetiche e sull'estetica dentale per soddisfare la crescente domanda di faccette dentali tra gli adulti.

I principali attori chiave del mercato sono:

- Glidewell

- Amann Girrbach AG

- 3M

- VladMiVa

- Ceramica di zircone

- DEN-MAT Holdings, LLC

- ULTRADENT PRODUCTS Inc.

- PLANMECA OY

- Centro Odontoiatrico Lion

Altri giocatori analizzati nel corso della ricerca:

- Ivoclar Vivadent AG

- Dentsply Sirona Inc.

- VITA Zahnfabrik

- Align Technology, Inc.

- Smile Brands Inc.

- Gruppo Coltene

- Kulzer GmbH

- Studi dentistici DaVinci

- Faccette MAC (MicroDental Laboratories)

Mercato delle faccette dentali, sviluppi recenti e tendenze

- Il segmento dei materiali compositi deteneva la quota maggiore (circa il 47,6%) del mercato.

- Nel 2025, il segmento degli utenti finali delle cliniche odontoiatriche ha detenuto la quota maggiore, grazie al crescente numero di cliniche odontoiatriche in tutto il mondo che offrono servizi di odontoiatria estetica.

- Si prevede che il segmento delle faccette in porcellana registrerà il CAGR più elevato durante il periodo di previsione (2021-2034), indicando una crescente preferenza per le faccette in porcellana nonostante i costi più elevati, probabilmente a causa della loro durata e del vantaggio estetico.

- Le aziende del mercato delle faccette si stanno concentrando sul lancio di prodotti, sull'espansione del portafoglio e sulle strategie di partnership per rafforzare la loro presenza globale.

Copertura del rapporto e risultati finali

Il rapporto "Previsioni del mercato delle faccette dentali fino al 2034 - Analisi globale" di The Insight Partners fornisce un'analisi dettagliata che copre:

- Dimensioni e previsioni del mercato a livello globale e regionale per tutti i principali segmenti di mercato.

- Dinamiche di mercato: tendenze, fattori trainanti, vincoli e opportunità chiave.

- Analisi della segmentazione per prodotto, fascia d'età, utente finale e area geografica.

- Panorama competitivo e profili aziendali dei principali attori del settore.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle faccette dentali

Ottieni un campione gratuito per - Mercato delle faccette dentali