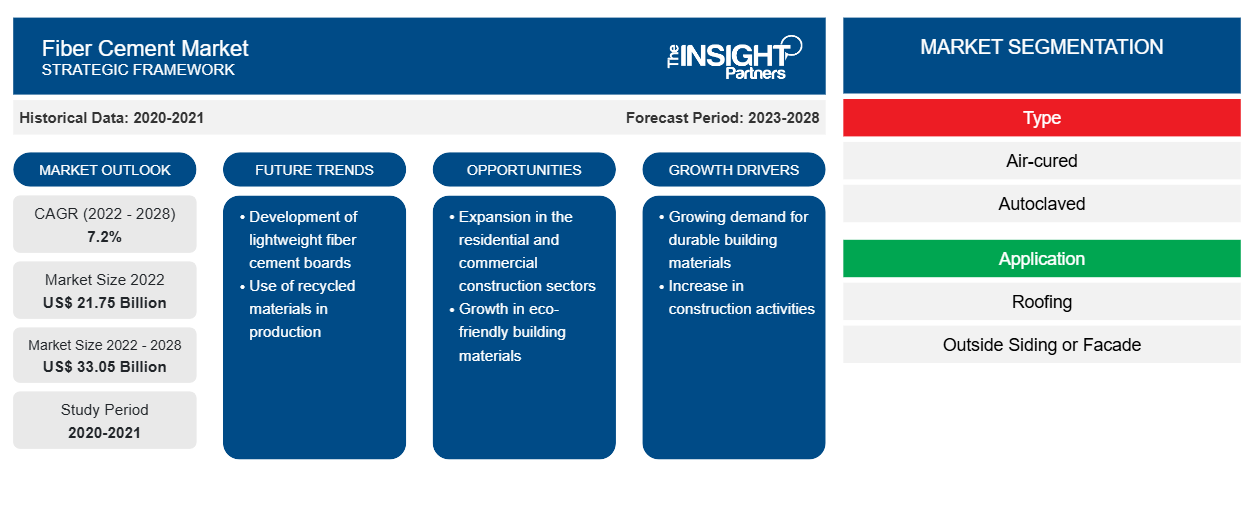

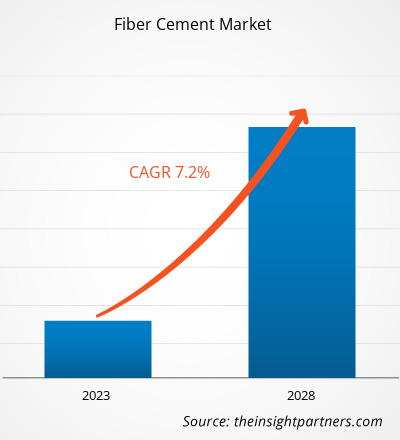

[Rapporto di ricerca] Si prevede che le dimensioni del mercato del fibrocemento cresceranno da 21.748,45 milioni di dollari nel 2022 a 33.052,23 milioni di dollari entro il 2028; si stima che registrerà un CAGR del 7,2% dal 2022 al 2028.

Il fibrocemento è comunemente usato come materiale di rivestimento esterno in quanto offre un'eccellente durevolezza e resistenza alle intemperie e al fuoco. Inoltre, il fibrocemento è spesso usato come materiale per tetti grazie alla sua capacità di resistere a condizioni meteorologiche avverse, come forti piogge, grandine e vento. Inoltre, il fibrocemento può anche essere usato per lavori di rifinitura e fascia, in quanto è facile da modellare e può essere verniciato o tinto per abbinarsi all'esterno dell'edificio. È anche frequentemente usato in edifici commerciali, come ospedali, scuole ed edifici per uffici, in quanto offre un'opzione durevole e a bassa manutenzione per i loro esterni.

Nel 2022, l'Asia Pacifica ha detenuto la quota di fatturato più grande del mercato globale del fibrocemento . La domanda di fibrocemento è in aumento nell'Asia Pacifica a causa della crescente consapevolezza dei vantaggi del fibrocemento. Questa regione è stata notata come uno dei mercati di spicco per l'utilizzo di pannelli in fibrocemento a causa dell'aumento delle attività di costruzione. Inoltre, iniziative e politiche governative come Make-in-India incoraggiano l'istituzione di diversi impianti di produzione in India. Anche l'aumento degli investimenti diretti esteri porta alla crescita economica nella regione. Si prevede che il crescente numero di utilizzi di pannelli in fibrocemento in numerosi settori residenziali e non residenziali aumenterà la domanda di pannelli in fibrocemento nell'Asia Pacifica nei prossimi anni. In India, l'industria delle costruzioni è la seconda industria più grande dopo l'agricoltura, rappresentando circa l'11% del PIL del paese. L'edilizia e l'edilizia contribuiscono fortemente alla crescita del mercato.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Impatto della pandemia di COVID-19 sul mercato del cemento fibroso

Il settore delle costruzioni è stato il principale contributore alla domanda di fibrocemento. La pandemia di COVID-19 ha influenzato negativamente la crescita del settore chimico e dei materiali e del mercato del fibrocemento. L'implementazione di misure per combattere la diffusione del SARS-CoV-2 ha avuto un impatto negativo sulla crescita di vari settori. Settori come imballaggio, beni di consumo, automotive e trasporti, tessile ed edilizia e costruzioni sono stati influenzati negativamente dalle interruzioni dell'efficienza operativa e delle catene del valore dovute alla chiusura improvvisa dei confini nazionali e internazionali. Durante la pandemia di COVID-19, il calo dei ricavi e le crescenti sfide nella consegna dei progetti hanno portato alla contrazione del settore nella maggior parte dei mercati, con un corrispondente impatto negativo sulla forza lavoro. I costruttori hanno subito ritardi e costi maggiori per le materie prime importate e i materiali da costruzione fuori sede a causa della chiusura di molte fabbriche per lunghi periodi. Il danno al settore dell'edilizia e delle costruzioni ha ostacolato la domanda di fibrocemento durante la pandemia.

Approfondimenti di mercato

La crescente domanda di edifici ad alta efficienza energetica sostiene la crescita del mercato del cemento fibroso

Secondo l'Energy Sector Management Assistance Program, quasi un terzo dell'energia globale viene consumata in edifici residenziali, pubblici e commerciali per il raffreddamento degli spazi, il riscaldamento, la ventilazione, la cottura, la refrigerazione, l'illuminazione, il riscaldamento dell'acqua e il funzionamento di dispositivi elettrici e meccanici. La modernizzazione delle città nei paesi in via di sviluppo e l'aumento del reddito pro capite spingono l'uso di energia negli edifici in tutto il mondo. L'elevato consumo di energia negli edifici pubblici, residenziali e commerciali crea la necessità di risparmi energetici. Secondo l'Agenzia Internazionale per l'Energia, si prevede che gli edifici rappresenteranno circa il 41% del potenziale di risparmio energetico globale entro il 2035, mentre il settore industriale e quello dei trasporti ne deterranno rispettivamente il 24% e il 21%. Uno strato di fibrocemento viene applicato all'edificio per ridurre il trasferimento di calore attraverso le pareti, mantenendo l'interno più caldo in inverno e più fresco in estate, il che aiuta a ridurre il consumo di energia. Secondo l'ASHRAE Fundamentals Handbook, il fibrocemento ha un valore R di 0,15, che è migliore del valore di mattoni e pietra.

Tipo Informazioni

In base al tipo, il mercato globale del fibrocemento è diviso in polimerizzato ad aria e autoclavato. Il segmento autoclavato ha detenuto una quota di mercato maggiore nel 2022. Il fibrocemento autoclavato è costituito da una miscela di cemento, sabbia, fibre di cellulosa e altri additivi. La miscela viene formata in fogli o pannelli e quindi polimerizzata in un'autoclave, che è un recipiente ad alta pressione che applica calore e vapore al materiale. Il processo di autoclavaggio provoca una reazione chimica che rafforza il materiale, rendendolo più durevole e resistente all'acqua, al fuoco e ai parassiti. È generalmente utilizzato in un'ampia gamma di applicazioni, tra cui coperture, rivestimenti, pavimenti e come supporto per piastrelle di ceramica . Inoltre, il fibrocemento autoclavato è anche noto per la sua versatilità e flessibilità di progettazione, in quanto può essere realizzato per imitare l'aspetto di altri materiali da costruzione, come legno o pietra. È inoltre disponibile in vari colori e texture, il che lo rende una scelta popolare per progetti di costruzione sia residenziali che commerciali.

James Hardie Industries plc, Etex NV, Swisspearl Group AG, CSR Ltd, NICHIHA Corp, Plycem Construsistemas Costa Rica SA, Compagnie de Saint Gobain SA, Century Plyboards Ltd, Everest Industries Ltd e Isam Khairi Kabbani Group sono alcuni dei principali attori che operano nel mercato globale del fibrocemento. Gli attori del mercato si concentrano sulla fornitura di prodotti di alta qualità per soddisfare la domanda dei clienti. Stanno anche adottando strategie come investimenti in attività di ricerca e sviluppo e lanci di nuovi prodotti.

Segnala i riflettori

- Tendenze industriali progressive nel mercato del cemento fibroso per aiutare gli operatori a sviluppare strategie efficaci a lungo termine

- Strategie di crescita aziendale adottate dai mercati sviluppati e in via di sviluppo

- Analisi quantitativa del mercato del fibrocemento dal 2020 al 2028

- Stima della domanda globale di fibrocemento

- Analisi delle cinque forze di Porter per illustrare l'efficacia degli acquirenti e dei fornitori che operano nel settore

- Sviluppi recenti per comprendere lo scenario competitivo del mercato

- Tendenze e prospettive del mercato, nonché fattori che guidano e frenano la crescita del mercato del fibrocemento

- Assistenza nel processo decisionale evidenziando le strategie di mercato che sostengono l'interesse commerciale, portando alla crescita del mercato

- La dimensione del mercato del fibrocemento in vari nodi

- Panoramica dettagliata e segmentazione del mercato, nonché dinamiche del settore del fibrocemento

- Le dimensioni del mercato del fibrocemento in varie regioni con promettenti opportunità di crescita

Approfondimenti regionali sul mercato del cemento fibroso

Le tendenze regionali e i fattori che influenzano il Fiber Cement Market durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del Fiber Cement Market in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato del cemento fibroso

Ambito del rapporto sul mercato del cemento fibroso

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2022 | 21,75 miliardi di dollari USA |

| Dimensioni del mercato entro il 2028 | 33,05 miliardi di dollari USA |

| CAGR globale (2022 - 2028) | 7,2% |

| Dati storici | 2020-2021 |

| Periodo di previsione | 2023-2028 |

| Segmenti coperti | Per tipo

|

| Regioni e Paesi coperti | America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

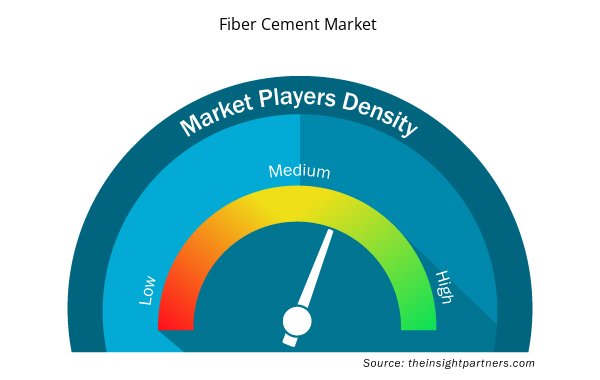

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del fibrocemento sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato del cemento fibroso sono:

- James Hardie Industries plc

- Etex NV

- Gruppo Swisspearl SA

- CSR Ltd

- Società NICHIHA

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato del cemento fibroso

Mercato globale del cemento fibroso

In base al tipo di fibra, il mercato globale del cemento fibroso è segmentato in base a tipo, applicazione e utilizzo finale. In base al tipo, il mercato globale del cemento fibroso è segmentato in air-cured e autoclavato. In base all'applicazione, il mercato del cemento fibroso è segmentato in coperture, rivestimenti esterni o facciate e altri. In base all'utilizzo finale, il mercato del cemento fibroso è segmentato in residenziale e non residenziale.

Profili aziendali

- James Hardie Industries plc

- Etex NV

- Gruppo Swisspearl SA

- CSR Ltd

- Società NICHIHA

- Plycem Construsistemas Costa Rica SA

- Compagnia di Saint Gobain SA

- Compensati del secolo Ltd

- Società per azioni Everest Industries Ltd.

- Gruppo Isam Khairi Kabbani

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

Asia Pacific accounted for the largest share of the global fiber cement market. Asia Pacific is one of the most significant regions for the fiber cement market owing to surging demand for energy-efficient buildings.

Durability is one of the most desirable qualities of fiber cement. Fiber cement siding, boards, and panels typically outlast vinyl siding and other alternative products in lifespan. Within 10 to 15 years, vinyl siding can show signs of aging, whereas fiber cement siding can last up to 30 to 50 years or more. Further, in cement production, carbon dioxide is a byproduct. However, manufacturing vinyl siding containing polyvinyl chloride (PVC) produces more carbon dioxide than cement production. Hence, fiber cement siding is a greener alternative to vinyl siding. Fiber cement products do not require frequent repainting as it holds paint well. Also, they do not dent unlike steel siding. Fiber cement products stand stronger in moisture and leaks than gypsum boards. These products possess excellent moisture-absorbing and drying properties, making them resistant to weather changes.

Based on type, autoclaved segment held the largest revenue share owing to the its durability and resistance to water, fire, and pests.

Based on the application, roofing segment is projected to grow at the fastest CAGR over the forecast period. Fiber cement roofing sheets and tiles are popular for their durability, resistance to weathering, and low maintenance requirements. They are also available in a variety of colors and styles to suit multiple architectural requirements and design preferences.

According to the World Bank, across the world, a large proportion of the population lives in cities. In 2011, 52.0% lived in urban areas. Over the last ten years, owing to urbanization in developing economies in Asia and Oceania, the urbanization rate increased from 43.3% in 2011 to 50.0% in 2021. Africa has seen a 4.6% increase in the same period. Governments of various countries across the world focus on supporting and increasing construction activities. Saudi Arabia launched its Saudi Vision 2030 to diversify its economy, modernize its administration, and introduce bold reforms in many sectors. The country is targeting to increase the contribution of its construction sector to the overall GDP. Due to its Saudi Vision 2030, the country's construction market reports significant growth in residential and nonresidential segments and offers lucrative potential to fiber cement.

The major players operating in the global fiber cement market are James Hardie Industries plc, Etex NV, Swisspearl Group AG, CSR Ltd, NICHIHA Corp, Plycem Construsistemas Costa Rica SA, Compagnie de Saint Gobain SA, Century Plyboards Ltd, Everest Industries Ltd, and Isam Khairi Kabbani Group.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Fiber Cement Market

- James Hardie Industries plc

- Etex NV

- Swisspearl Group AG

- CSR Ltd

- NICHIHA Corp

- Plycem Construsistemas Costa Rica SA

- Compagnie de Saint Gobain SA

- Century Plyboards Ltd

- Everest Industries Ltd

- Isam Khairi Kabbani Group

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot