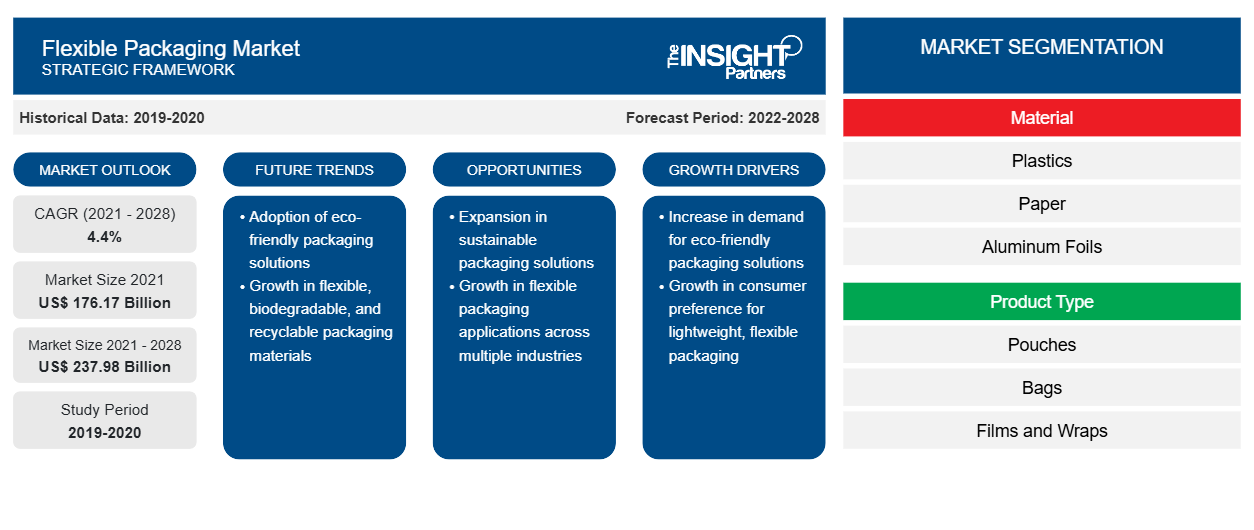

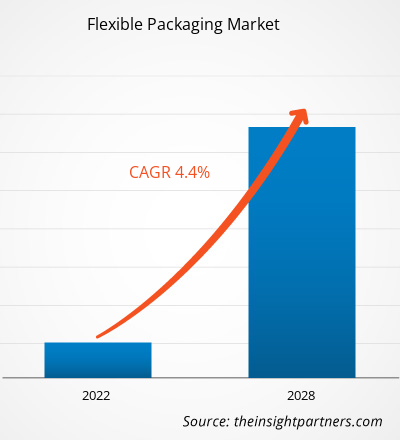

Si prevede che il mercato degli imballaggi flessibili raggiungerà i 237.975,67 milioni di dollari entro il 2028, rispetto ai 176.173,61 milioni di dollari del 2021; si prevede una crescita a un CAGR del 4,4% dal 2021 al 2028.

Gli imballaggi flessibili includono fodere, buste, sigilli, pacchetti campione e sacchetti. Possono essere composti da pellicola, plastica, carta, stagnola, ecc. Sono utilizzati per vari articoli alimentari e bevande, prodotti di consumo, CD musicali, prodotti farmaceutici, pacchetti software per computer e nutraceutici. La durevolezza offerta dagli imballaggi flessibili consente ai produttori di stampare design personalizzati accattivanti e di alta qualità, che aumentano la visibilità del prodotto in un ambiente di vendita al dettaglio.

Nel 2020, l'Asia Pacifica ha detenuto la quota di fatturato più grande del mercato globale degli imballaggi flessibili . Secondo l'Asia-Pacific Economic Cooperation, l'Australia è uno dei paesi sviluppati dell'APAC. Il settore alimentare e delle bevande è la più grande industria manifatturiera dell'Australia, rappresentando il 32% del fatturato manifatturiero totale del paese. Secondo il rapporto State of the Industry del 2019 dell'Australian Food and Grocery Council, il settore alimentare e delle bevande, dei generi alimentari e dei prodotti freschi vale 85,32 miliardi di dollari. Il settore è composto da 15.000 aziende di tutte le dimensioni che impiegano oltre 273.000 persone. La crescente industria alimentare e delle bevande guida il mercato degli imballaggi flessibili.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Impatto della pandemia di COVID-19 sul mercato degli imballaggi flessibili

La chiusura delle unità produttive, la difficoltà nell'approvvigionamento delle materie prime, le restrizioni alla logistica hanno avuto un impatto negativo sul mercato degli imballaggi flessibili. Tuttavia, il COVID-19 ha creato picchi enormi nella consegna di generi alimentari online. Inoltre, le industrie di alimenti e bevande confezionati stanno assistendo a un aumento della domanda di alimenti e bevande a lunga conservazione, compresi i prodotti lattiero-caseari, poiché i consumatori si precipitano a riempire le dispense. Milioni di famiglie hanno iniziato ad acquistare generi alimentari online per il ritiro o la consegna a domicilio e molti continueranno a utilizzare le opzioni di e-commerce dopo la fine della crisi. Inoltre, la crescente domanda di prodotti alimentari trasformati come alimenti orientati alla convenienza che generalmente utilizzano materiali di imballaggio di alta qualità e ad alta barriera per una maggiore durata di conservazione è destinata a incoraggiare la necessità di imballaggi flessibili.

Approfondimenti di mercato

Aumento del consumo di alimenti e bevande trasformati

Secondo il rapporto di Anu Food Brazil, il fatturato totale del settore della vendita al dettaglio di prodotti alimentari brasiliani è stato di 96 miliardi di dollari nel 2019. L'industria alimentare e delle bevande in Brasile ha raggiunto una crescita del 6,7% nel 2019 e del 12,8% nel 2020. Il mercato dei surgelati sta prosperando in Brasile. Il mercato dei surgelati sta prosperando in Brasile grazie all'espansione della classe media, all'aumento del potere d'acquisto e all'aumento del numero di persone che lavorano a tempo pieno. Quindi, la crescente preferenza dei consumatori per i cibi pronti guida il mercato degli imballaggi flessibili.

Approfondimenti sul settore dei materiali

In base al materiale, il mercato globale degli imballaggi flessibili è segmentato in plastica, carta, fogli di alluminio, altri. Il segmento della plastica ha detenuto la quota maggiore del mercato globale degli imballaggi flessibili nel 2020. Gli imballaggi in plastica flessibile comprendono vari tipi di materiale plastico utilizzati per l'imballaggio di diversi prodotti. Il tipo di materiale utilizzato nell'imballaggio dipende dall'applicazione e dal tipo di prodotto da confezionare. In genere, i materiali plastici, come polietilene, polipropilene, polistirene e cloruro di polivinile, sono utilizzati negli imballaggi in plastica flessibile. Gli imballaggi flessibili sono considerati il modo più conveniente ed economico per conservare, distribuire e confezionare prodotti alimentari, bevande, prodotti farmaceutici e diversi materiali di consumo.

Tra i principali attori che operano nel mercato globale degli imballaggi flessibili figurano Amcor plc, Huhtamaki, Mondi, Berry Global Inc., Sealed Air, Sonoco Products Company, Coveris, Constantia Flexibles, Flexpak services e Transcontinental Inc. Gli attori che operano nel mercato sono fortemente concentrati sullo sviluppo di offerte di prodotti innovativi e di alta qualità per soddisfare le esigenze del cliente.

Approfondimenti regionali sul mercato degli imballaggi flessibili

Le tendenze regionali e i fattori che influenzano il mercato degli imballaggi flessibili durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato degli imballaggi flessibili in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato degli imballaggi flessibili

Ambito del rapporto sul mercato degli imballaggi flessibili

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2021 | 176,17 miliardi di dollari USA |

| Dimensioni del mercato entro il 2028 | 237,98 miliardi di dollari USA |

| CAGR globale (2021 - 2028) | 4,4% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti | Per materiale

|

| Regioni e Paesi coperti | America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

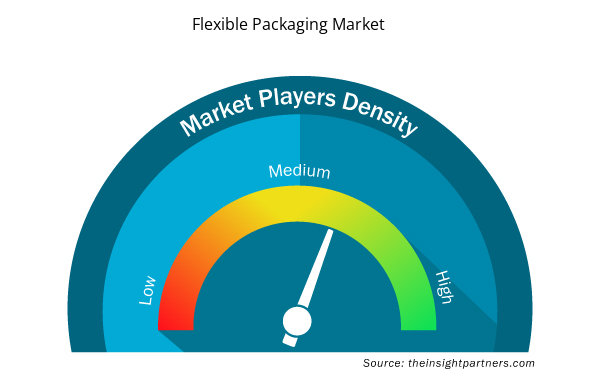

Densità degli operatori del mercato degli imballaggi flessibili: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del Flexible Packaging Market sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli imballaggi flessibili sono:

- Società per azioni Amcor

- Huhtamaki

- Mondi

- Berry Global Inc.

- Aria sigillata

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli imballaggi flessibili

Segnala i riflettori

- Tendenze progressive nel settore degli imballaggi flessibili per aiutare gli operatori a sviluppare strategie efficaci a lungo termine

- Strategie di crescita aziendale adottate dagli operatori del mercato nei paesi sviluppati e in via di sviluppo

- Analisi quantitativa del mercato degli imballaggi flessibili dal 2019 al 2028

- Stima della domanda globale di imballaggi flessibili

- Analisi delle cinque forze di Porter per illustrare l'efficacia degli acquirenti e dei fornitori che operano nel settore

- Sviluppi recenti per comprendere lo scenario competitivo del mercato

- Tendenze e prospettive di mercato, nonché fattori che guidano e frenano la crescita del mercato degli imballaggi flessibili

- Assistenza nel processo decisionale evidenziando le strategie di mercato che sostengono l'interesse commerciale, portando alla crescita del mercato

- La dimensione del mercato degli imballaggi flessibili in vari nodi

- Panoramica dettagliata e segmentazione del mercato, nonché dinamiche del settore

- Dimensioni del mercato degli imballaggi flessibili in diverse regioni con promettenti opportunità di crescita

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

The major players operating in the global flexible packaging market are Amcor plc; Huhtamaki; Mondi; Berry Global Inc.; Sealed Air; Sonoco Products Company; Coveris; Constantia Flexibles; Flexpak services; Transcontinental Inc.

In 2020, Asia-Pacific accounted for the largest share of the global flexible packaging market. The market for flexible packaging across Asia-Pacific has witnessed notable growth owing to the rapidly expanding packaging industry, growth of the food retail sector, and rising consumer awareness about sustainable packaging solutions across the region. The foodservice sector in Asia-Pacific is rapidly expanding owing to rapid economic growth, growth of the tourism sector, improving lifestyles of consumers, and rising disposable income levels. The region's food & beverage market is witnessing significant growth due to ample availability of various varieties of functional food and drinks and their growing demand among the millennial population. According to The Annual Report on Catering Industry Development of China 2019 (ARCIDC), China is the second-largest food and beverage economy across the world. The food and beverage revenue in China was over US$ 620 billion in 2018. The report further states that the online sales of food and beverages increased by US$ 44 billion from 2011 to 2017. Hence the growing demand for food & beverage in the region drives the flexible packaging market.

In 2020, the plastics segment accounted for the largest market share. Flexible plastic packaging delivers a wide range of protective properties while ensuring a minimum amount of material being used. It is made from high-grade polymers such as PVC, polyamide, polypropylene, and polyethylene. These polymers are FDA-approved and are contaminant-free. They can take on extreme temperatures and pressures. Furthermore, they also act as a protective layer for the food and beverage by protecting it from micro-organisms, UV rays, moisture, and dust.

The bags segment held the largest share of the market in 2020. These are commonly made of metal foil, plastic, and occasionally, paper. These bags are used in various packaging applications including food products, confectionery products, biscuits, coffee, powdered milk, snacks, etc. Also, these bags are easy for transport, material savings, and repeated use.

In 2020, Asia-Pacific is the fastest-growing region in the global flexible packaging market. According to Asia-Pacific Economic Cooperation, Australia is one of the developed countries in APAC. The food & beverage sector is Australia’s largest manufacturing industry, accounting for 32% of the country’s total manufacturing turnover. According to the Australian Food and Grocery Council’s 2019 State of the Industry Report, the food & beverage, grocery, and fresh produce sector is worth $122 billion. The industry is made up of 15,000 businesses of all sizes that employ over 273,000 people. The growing food & beverage industry drives the flexible packaging market.

The food and beverages segment held the largest share of the market in 2020. Flexible packaging is widely used for packaging food products such as eggs, fresh fruits and vegetables, and salad, among others. Flexible packaging protects products from moisture, UV rays, mold, dust, and other environmental contaminants that can negatively affect the product, thereby maintaining its quality and extending its shelf life. Also, with the growth of online food delivery channels the demand for flexible, affordable, and recyclable packaging is also on a rise.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Flexible Packaging Market

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- Coveris

- Constantia Flexibles

- Flexpak services

- Transcontinental Inc.

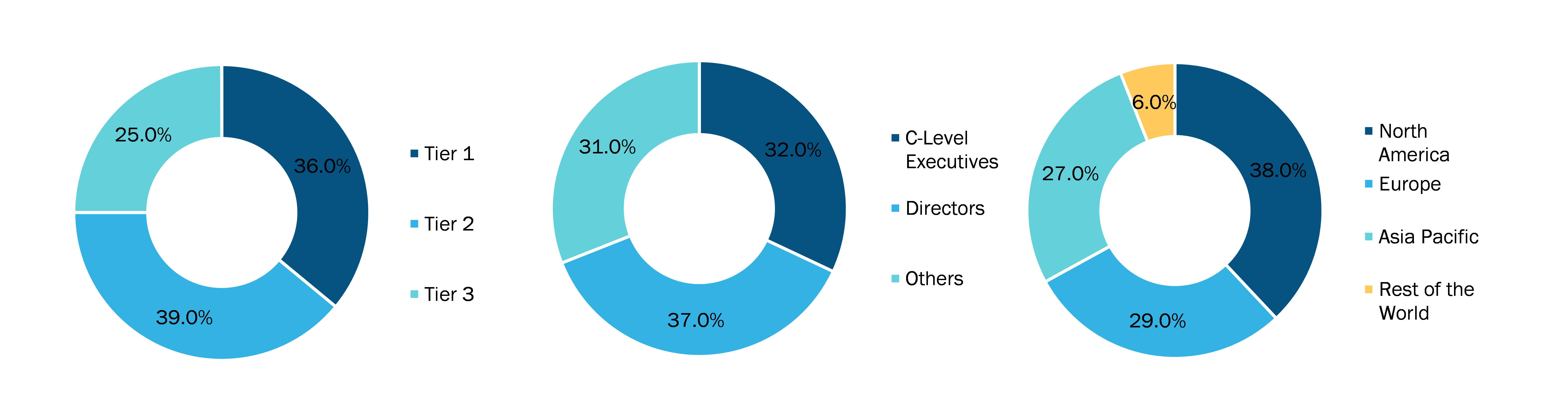

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot