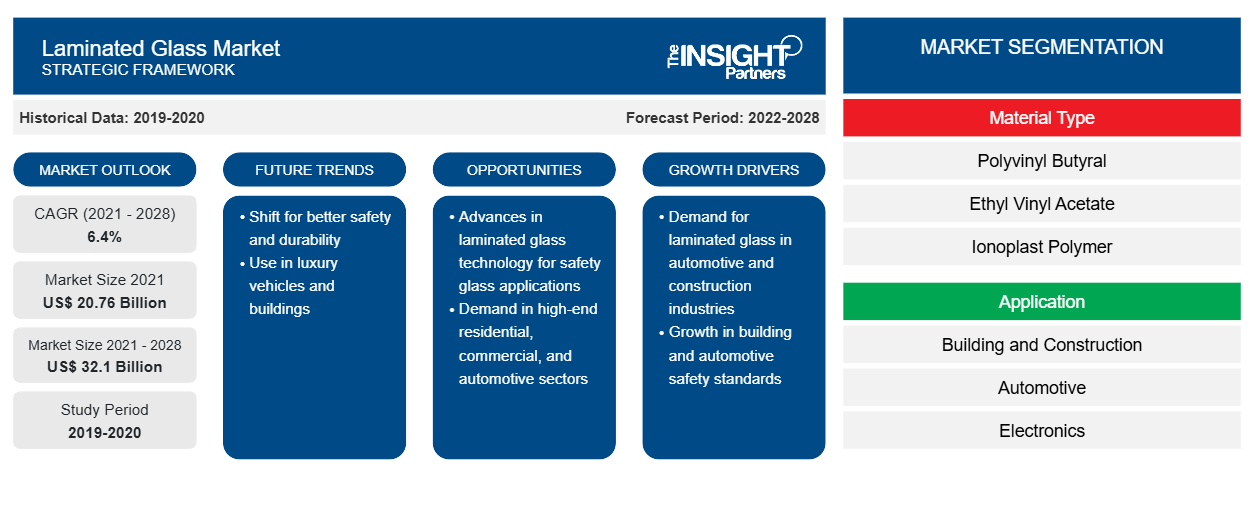

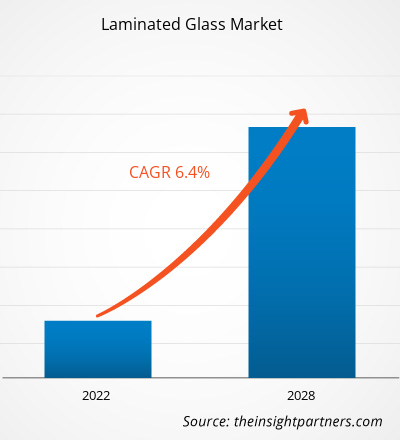

Si prevede che il mercato del vetro laminato raggiungerà i 32,10 miliardi di dollari entro il 2028, rispetto ai 20,76 miliardi di dollari del 2021, con un CAGR del 6,4% dal 2021 al 2028.

Il vetro laminato viene preparato applicando pressione e calore a più strati di vetro temprato o rinforzato termicamente. Il vetro laminato è separato da uno strato intermedio. Lo strato intermedio aiuta a tenere insieme i frammenti di vetro quando vengono colpiti da un impatto. Il vetro ha ampie applicazioni in settori quali edilizia e costruzioni, automotive ed elettronica.

Nel 2020, l'Asia Pacifica ha detenuto la quota di fatturato più grande del mercato globale del vetro laminato . Il crescente numero di progetti di costruzione residenziali e commerciali è il fattore principale che contribuisce alla crescita del mercato in questa regione. La conseguente crescita del settore delle costruzioni sta alimentando la domanda di vetro laminato nella regione. Inoltre, l'Asia Pacifica ha un'industria automobilistica dominante e registra la più alta produzione di veicoli tra tutte le regioni. Il vetro laminato è ampiamente utilizzato nelle coperture del parabrezza nell'industria automobilistica, il che crea opportunità commerciali favorevoli per i produttori di vetro laminato.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Impatto della pandemia di COVID-19 sul mercato del vetro laminato

La pandemia di COVID-19 ha colpito economie e industrie in vari paesi a causa di lockdown, divieti di viaggio e chiusure aziendali. L'industria chimica e dei materiali è stata una delle principali industrie che ha subito gravi conseguenze, come interruzioni nelle catene di fornitura e chiusure degli impianti di produzione. Si prevede che il deficit del mercato del vetro laminato durerà fino al 2021, causando interruzioni in varie attività. Inoltre, molte fabbriche e produttori hanno dovuto sospendere o rallentare la produzione di vetro, rendendo estremamente difficile soddisfare la domanda attuale. L'industria edile è stata la principale vittima della scarsità di vetro. Durante la chiusura, i residenti hanno investito tempo e denaro nella ricostruzione o ristrutturazione delle loro case, aumentando la domanda di materiali. Inoltre, a causa delle difficoltà nell'approvvigionamento del vetro, il settore del vetro laminato ha subito una battuta d'arresto significativa. Pertanto, una bassa domanda da parte delle industrie utilizzatrici finali durante la pandemia di COVID-19 ha portato a un rallentamento della crescita del mercato del vetro laminato.

Approfondimenti di mercato

L'aumento delle applicazioni nel settore dell'edilizia e delle costruzioni alimenta la crescita del mercato del vetro laminato

La domanda di vetro laminato nel settore edile e delle costruzioni ha acquisito un notevole slancio grazie al crescente utilizzo del vetro come elemento strutturale e alla preferenza per progetti architettonici più creativi. L'uso del vetro come elemento strutturale nei progetti edilizi tradizionali sta diventando sempre più popolare. Il vetro laminato trova ampio utilizzo in varie applicazioni interne ed esterne nel settore edile e delle costruzioni. Inoltre, aumenta la sicurezza e la durata dei progetti moderni. La necessità di proteggere le abitazioni e gli edifici commerciali ha alimentato la domanda di vetro di sicurezza e altri prodotti per vetrate.

Approfondimenti sulle applicazioni

In base all'applicazione, il mercato globale del vetro laminato è segmentato in edilizia e costruzioni, automotive, elettronica, pannelli solari e altri. Il segmento dell'edilizia e delle costruzioni ha detenuto la quota maggiore del mercato nel 2020. Il vetro laminato è ampiamente utilizzato negli edifici residenziali e commerciali grazie alla sua resistenza e natura infrangibile. Il vetro laminato è sempre più utilizzato in hotel, terminal aeroportuali e studi di registrazione grazie alle sue proprietà di isolamento acustico. La crescita del settore dell'edilizia e delle costruzioni, in particolare nelle regioni emergenti come l'Asia-Pacifico, probabilmente aumenterà la domanda di vetro laminato nei prossimi anni.

Tra i principali attori del mercato globale del vetro laminato figurano Asahi India Glass Limited; Cardinal Glass Industries, Inc.; Central Glass Co., Ltd.; Fuyao Group; Guardian Glass Llc; Press Glass Sa; Saint Gobain SA; Schott Ag; Taiwan Glass Group; e Xinyi Glass Holdings Limited. Gli attori che operano nel mercato sono fortemente concentrati sullo sviluppo di offerte di prodotti innovativi e di alta qualità per soddisfare i requisiti del cliente.

Segnala i riflettori

- Tendenze industriali progressive nel mercato del vetro laminato per aiutare gli operatori a sviluppare strategie efficaci a lungo termine

- Strategie di crescita aziendale adottate dai mercati sviluppati e in via di sviluppo

- Analisi quantitativa del mercato del vetro stratificato dal 2019 al 2028

- Stima della domanda globale di vetro stratificato

- Analisi delle cinque forze di Porter per illustrare l'efficacia degli acquirenti e dei fornitori che operano nel settore

- Sviluppi recenti per comprendere lo scenario competitivo del mercato

- Tendenze e prospettive del mercato, nonché fattori che guidano e frenano la crescita del mercato del vetro laminato

- Assistenza nel processo decisionale evidenziando le strategie di mercato che sostengono l'interesse commerciale, portando alla crescita del mercato

- La dimensione del mercato del vetro laminato in vari nodi

- Panoramica dettagliata e segmentazione del mercato, nonché dinamiche del settore del vetro laminato

- Dimensioni del mercato del vetro stratificato in diverse regioni con promettenti opportunità di crescita

Approfondimenti regionali sul mercato del vetro laminato

Le tendenze regionali e i fattori che influenzano il mercato del vetro laminato durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato del vetro laminato in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato del vetro laminato

Ambito del rapporto sul mercato del vetro laminato

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2021 | 20,76 miliardi di dollari USA |

| Dimensioni del mercato entro il 2028 | 32,1 miliardi di dollari USA |

| CAGR globale (2021 - 2028) | 6,4% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti | Per tipo di materiale

|

| Regioni e Paesi coperti | America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

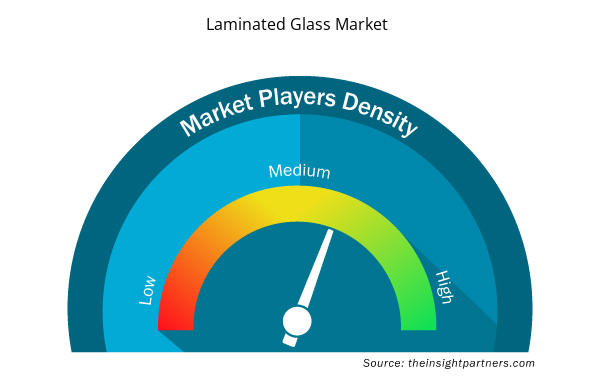

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del vetro laminato sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato del vetro laminato sono:

- Asahi India Vetro Limited

- CARDINAL GLASS INDUSTRIES, INC

- Vetro centrale Co., Ltd

- Gruppo Fuyao

- GUARDIAN GLASS LLC.

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato del vetro laminato

Segmentazione del mercato del vetro laminato:

Tipo di materiale

- Polivinilbutirrale

- Etilvinilacetato

- Polimero ionoplasto

- TPU alifatico

- Altri

Applicazione

- Edilizia e costruzione

- Automobilistico

- Elettronica

- Pannelli solari

- Altri

Profili aziendali

- Asahi India Vetro Limited

- Cardinal Glass Industries, Inc.

- Vetro temperato temperato

- Gruppo Fuyao

- Vetro Guardiano LLC

- Pressa Vetro Sa

- Società a responsabilità limitata Saint-Gobain SA

- Azienda Schott

- Gruppo di vetro di Taiwan

- Società controllata da Xinyi Glass Holdings Limited.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

- Virtual Pipeline Systems Market

- Flexible Garden Hoses Market

- Nuclear Waste Management System Market

- Environmental Consulting Service Market

- Skin Tightening Market

- Resistance Bands Market

- Skin Graft Market

- Nitrogenous Fertilizer Market

- Aircraft MRO Market

- Quantitative Structure-Activity Relationship (QSAR) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

Increasing usage of laminated glass in building & construction industry along with associated advantages of laminated glass are the key factors driving the market growth over the forecast period. With the increasing use of glass as a structural element and the preference for more creative architecture designs, the demand for laminated glass in the building & construction industry has gained significant momentum. The laminated glass has various advantageous features which includes safety, security, reduced noise pollution, reduced emissions, UV control, durability, weather/natural disasters protection, and design versatility. Thus, growing prospectus in constructing modern buildings and structures coupled with its beneficial advantages drives the laminated glass market over the forecast period.

In 2020, China held the largest market share in the global laminated glass market. China is the world’s largest vehicle market across the globe, as per the International Trade Administration (ITA). The Chinese government has taken several initiatives for automobile manufacturers for augmenting the production capacity of the country to 35 million by 2025. The growing prospects of construction industry in China is further fueling the market growth. For instance, in 2019, the government of China had invested US$ 1.9 billion in 13 public housing projects. Thus, increasing construction activities and automotive production is anticipated to propel the laminated glass market in China in the coming years.

In 2020, the polyvinyl butyral (PVB) segment accounted for the largest market share. The growth of the segment is primarily attributed to its tough and ductile interlayers which makes it an excellent sound insulator. The PVB interlayer joins with both layers of the glass and holds it together to produce one strong and uniform layer. As the bond between the PVB sheet and the glass is a chemical bond, it does not shatter easily. Thus, wide scope application in automotive industry for windshields applications, PVB segment is augmenting the market growth.

On the basis of application, automotive segment is the fastest growing segment. Laminated glass is most widely used in car windshields in the automotive industry. It provides various advantageous features such as high strength, soundproofing, resistance to shattering, and security. As laminated glass does not shatter, it minimizes the risk of cuts and injuries and ensures the safety of the driver and passengers. Thus, growing adoption of laminated glass in the automotive industry is projected to drive the market growth over the forecast period.

The major players operating in the global laminated glass market are Asahi India Glass Limited, Cardinal Glass Industries, Central Glass Co., Ltd., Fuyao Group, Guardian Glass LLC, PRESS GLASS SA, Saint-Gobain, Schott AG, Taiwan Glass Ind. Corp, and Xinyi Glass Holdings Co., Ltd.

In 2020, Asia Pacific accounted for the largest share of the global laminated glass market. Rapid development in construction & automotive industry has propelled the demand of laminated glass in the region. In addition, growing investments by governments in infrastructural development projects such as airports, and public transit systems is driving the demand for laminated glass in Asia Pacific region.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Laminated Glass Market

- Asahi India Glass Limited

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd

- Fuyao Group

- GUARDIAN GLASS LLC.

- PRESS GLASS SA

- SCHOTT AG

- SAINT GOBAIN S.A.

- Taiwan Glass Group

- Xinyi Glass Holdings Limited

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot