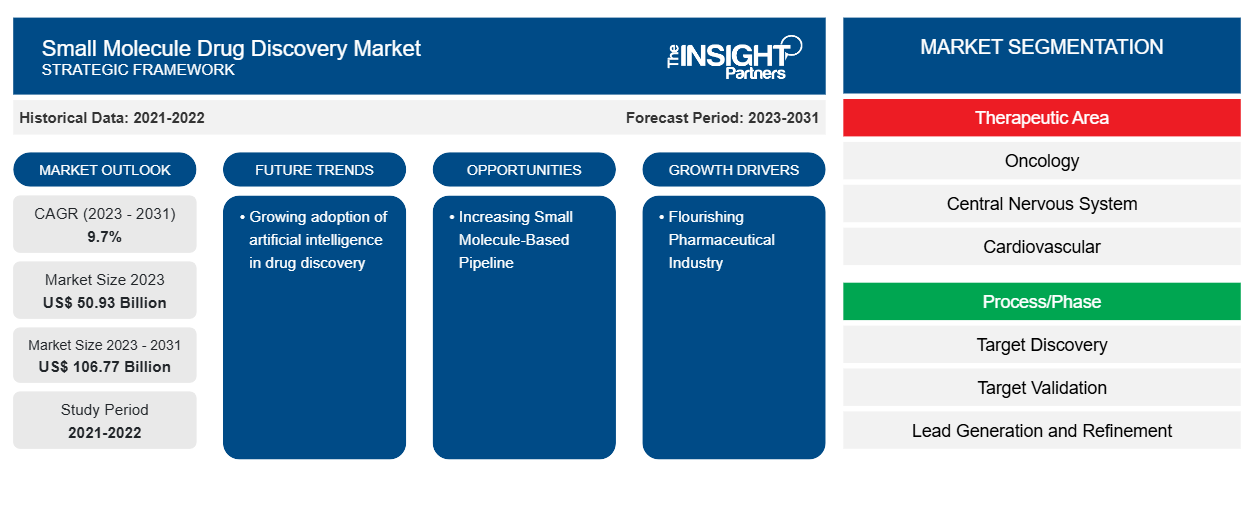

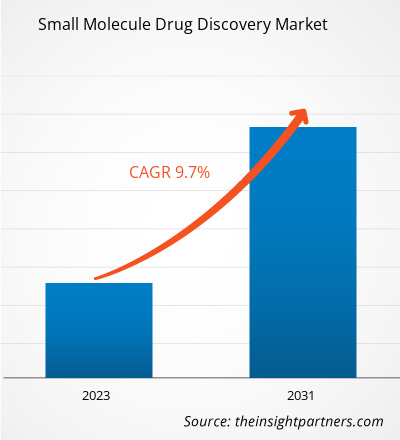

Si prevede che la dimensione del mercato della scoperta di farmaci a piccole molecole raggiungerà i 106,77 miliardi di dollari entro il 2031, rispetto ai 50,93 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 9,7% nel periodo 2023-2031. È probabile che la crescente adozione dell'intelligenza artificiale nella scoperta di farmaci agisca come una tendenza futura nel mercato.

Analisi di mercato della scoperta di farmaci a piccole molecole

Il mercato della scoperta di farmaci a piccole molecole è guidato principalmente dall'aumento della R&S da parte di aziende farmaceutiche e biotecnologiche nella scoperta di nuovi farmaci, iniziative governative e prevalenza del cancro. Altri fattori che contribuiscono all'espansione del mercato includono la globalizzazione delle sperimentazioni cliniche, rapidi progressi nelle tecnologie associate e un aumento della domanda di CRO per la conduzione di sperimentazioni cliniche. Inoltre, l'aumento della pipeline basata su piccole molecole funge da opportunità per la crescita del mercato della scoperta di farmaci a piccole molecole.

Panoramica del mercato della scoperta di farmaci a piccole molecole

Si prevede che l'Asia Pacifica registrerà il CAGR più elevato durante il periodo di previsione. Un'impennata nei progressi tecnologici, un'impennata nelle collaborazioni (per lo sviluppo della ricerca genomica) tra i paesi asiatici e occidentali, una diminuzione nei prezzi del sequenziamento del DNA e una crescente prevalenza di malattie genetiche e altre malattie target stanno spingendo il mercato della scoperta di farmaci a piccole molecole dell'Asia Pacifica. Si prevede che il mercato nell'Asia Pacifica si svilupperà grazie al PIL in crescita che si traduce nella crescita dell'industria farmaceutica. Inoltre, l'aumento del reddito disponibile sta stimolando l'adozione di tecniche sanitarie avanzate . Pertanto, c'è un enorme potenziale per il mercato della scoperta di farmaci a piccole molecole grazie ai fattori sopra menzionati.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

- Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità di mercato per la scoperta di farmaci a piccole molecole

Industria farmaceutica in crescita con aumento delle attività di ricerca e sviluppo

L'industria farmaceutica è una delle industrie più intensive in R&S al mondo. Si stanno compiendo sforzi per ottenere una maggiore efficacia ed efficienza nel soddisfare le esigenze dei pazienti. Il costo dei medicinali è stato una preoccupazione primaria per le aziende farmaceutiche , poiché contano sulle loro attività di R&S per raggiungere gli obiettivi di costo previsti. Nell'ultimo decennio, il numero di nuovi farmaci a piccole molecole approvati ogni anno è aumentato drasticamente. La Food and Drug Administration (FDA) ha approvato 55 nuovi farmaci nel 2023. Le piccole molecole hanno dominato le approvazioni di nuovi farmaci nel 2023, rappresentando il 62% di tutte le nuove entità molecolari (NME) approvate. A livello globale, gli Stati Uniti sono un paese leader in termini di investimenti in R&S e il paese ha prodotto oltre il 50% delle nuove molecole del mondo nell'ultimo decennio. Un aumento delle approvazioni ha portato a crescenti investimenti da parte delle aziende per lo sviluppo di farmaci a piccole molecole a causa del loro potenziale nel trattamento di diverse gravi malattie.NME) approved. Globally, the US is a leading country in terms of R&D investments, and the country produced over 50% of the world's new molecules in the past decade. An increase in approval has led to growing investments by companies for the development of small molecule drugs due to their potential in treating several severe diseases.

Investimenti in R&S delle principali aziende farmaceutiche

Azienda | 2022 (miliardi di dollari USA) | 2023 (miliardi di dollari USA) |

Takeda Pharmaceutical Co Ltd Pharmaceutical Co Ltd | 4.2 | 5.08 |

Pfizer Inc | 11.4 | 10.6 |

Grifols SA SA | 427.05 | 432.71 |

Nota: per la presentazione delle valute viene preso in considerazione il tasso di conversione corrente.

Fonte: Relazioni annuali e analisi di The Insight Partners

La spesa in R&S è fondamentale negli sforzi delle aziende per scoprire, esaminare e produrre nuovi prodotti; effettuare pagamenti anticipati; migliorare i risultati esistenti; e dimostrare l'efficacia del prodotto e la conformità normativa prima del lancio. Questi investimenti variano in base alla necessità e alla domanda di scoperta di farmaci. Il costo include materiali, forniture utilizzate e stipendi dei dipendenti, insieme al costo di sviluppo del controllo di qualità. Secondo il rapporto PhRMA Member Companies 2021, le prime 15 aziende farmaceutiche più grandi per fatturato hanno investito 133 miliardi di dollari in R&S cumulativamente e circa il 44% dell'investimento totale in R&S è stato destinato alla scoperta di farmaci. Pertanto, i crescenti investimenti in R&S da parte delle aziende stanno alimentando la crescita del mercato della scoperta di farmaci a piccole molecole.

Aumento della pipeline basata su piccole molecole per offrire opportunità di crescita del mercato

L'industria farmaceutica è in continua evoluzione e c'è sempre bisogno di nuovi approcci terapeutici innovativi nel trattamento di varie indicazioni croniche. Le approvazioni di farmaci a base di piccole molecole sono aumentate negli ultimi cinque anni grazie alla loro efficacia contro un'ampia gamma di indicazioni. Le pipeline basate su farmaci candidati a base di piccole molecole stanno crescendo per un'ampia gamma di applicazioni terapeutiche, tra cui oncologia, ipertensione, diabete e disturbi infiammatori. Molte grandi e piccole aziende farmaceutiche sono impegnate nello sviluppo di diversi farmaci a base di piccole molecole.

La crescente pipeline di farmaci basati su piccole molecole per varie indicazioni sta, a sua volta, stimolando le attività di scoperta di nuovi farmaci in tutto il settore.

Nome composto | Tipo di composto | Nome dell'azienda | Fase clinica | Indicazione |

Codice PF-06821497 | Piccola molecola | Pfizer Inc. | Phase 1 | Cancer |

PF-06873600 | Small Molecule | Pfizer Inc. | Phase 1 | Breast Cancer Metastatic |

PF-06939999 | Small Molecule | Pfizer Inc. | Phase 1 | Solid Tumors |

PF-06952229 | Small Molecule | Pfizer Inc. | Phase 1 | Cancer |

PF-06826647 | Small Molecule | Pfizer Inc. | Phase 1 | Ulcerative Colitis |

PF-07038124 | Small Molecule | Pfizer Inc. | Phase 1 | Atopic Dermatitis |

PF-06842874 | Small Molecule | Pfizer Inc. | Phase 1 | Pulmonary Arterial Hypertension |

PF-06865571 | Small Molecule | Pfizer Inc. | Phase 1 | Non-alcoholic Steatohepatitis (NASH) with Liver Fibrosis |

PF-06882961 | Small Molecule | Pfizer Inc. | Phase 1 | Diabetes Mellitus-Type 2, Obesity |

PF-07081532 | Small Molecule | Pfizer Inc. | Phase 1 | Diabetes Mellitus-Type 2, Obesity |

R835 | Small Molecule | Rigel Pharmaceuticals, Inc. | Phase 1 | Inflammatory Disorders |

R552 | Small Molecule | Rigel Pharmaceuticals, Inc. | Phase 1 | Inflammatory Disorders |

SY-1425 | Small Molecule | Syros Pharmaceuticals, Inc. | Phase 2 | AML |

Source: Company News and The Insight Partner Analysis

Small Molecule Drug Discovery Market Report Segmentation Analysis

Key segments that contributed to the derivation of the small molecule drug discovery market analysis are therapeutic area and process/phase.

- Based on therapeutic area, the small molecule drug discovery market is segmented into oncology, central nervous system, cardiovascular, respiratory, orthopedics, immunology, rare diseases, and other therapeutic areas. The oncology segment held the largest share of the market in 2023.

- By process/phase, the market is segmented into target discovery, target validation, lead generation and refinement, and preclinical development. The lead generation and refinement segment dominated the market in 2023.

Small Molecule Drug Discovery Market Share Analysis by Geography

The geographic scope of the small molecule drug discovery market report is mainly divided into five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2023. Increasing research and development by pharmaceutical and biotechnology companies in discovering novel drugs, growing investments in pharmaceuticals, and prevalence of cancer are among the factors that are projected to accelerate the growth of the North America small molecule drug discovery market. The US is the largest and fastest-growing market for small molecule drug discovery. The increasing prevalence of chronic diseases such as cardiovascular diseases and cancer primarily drives the market growth in the country. As per the American Cancer Society, in 2024, ~2 million people are projected to suffer from new cancer cases, and ~611,000 death cases are expected to be registered in the US. Owing to this scenario, the US health system witnesses massive investments in research and developments for novel drug molecules. Further, a strong drug pipeline, along with therapeutic area approvals for small molecule drugs, is expected to drive the regional market. Apart from the rising number of approved drugs, increasing awareness of advanced therapeutics is likely to be responsible for the growth of the small molecule drug discovery market during the forecast period.

Small Molecule Drug Discovery Market Regional Insights

The regional trends and factors influencing the Small Molecule Drug Discovery Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Small Molecule Drug Discovery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Small Molecule Drug Discovery Market

Small Molecule Drug Discovery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 50.93 Billion |

| Market Size by 2031 | US$ 106.77 Billion |

| Global CAGR (2023 - 2031) | 9.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered | By Therapeutic Area

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Small Molecule Drug Discovery Market Players Density: Understanding Its Impact on Business Dynamics

The Small Molecule Drug Discovery Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Small Molecule Drug Discovery Market are:

- Bristol-Myers Squibb Co

- Merck KGaA

- GSK Plc

- Boehringer Ingelheim International GmbH

- Thermo Fisher Scientific Inc

- ICON Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Small Molecule Drug Discovery Market top key players overview

Small Molecule Drug Discovery Market News and Recent Developments

The small molecule drug discovery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Oncodesign Services (ODS) ha acquisito ZoBio, un CRO olandese esperto nella scoperta di farmaci a piccole molecole basata sulla biofisica. Questa acquisizione consente a ODS di rafforzare ed estendere la propria competenza e capacità nel campo della scoperta di farmaci a piccole molecole a un'offerta completamente integrata per supportare i programmi innovativi dei propri clienti dalla convalida del target alla selezione dei candidati. (Fonte: Oncodesign Services, sito Web aziendale, gennaio 2024)

- Merck ha avviato nuove collaborazioni strategiche per la scoperta di farmaci volte a sfruttare le potenti capacità di progettazione e scoperta basate sull'intelligenza artificiale (IA), promuovendo ulteriormente gli sforzi di ricerca dell'azienda. Si prevede che la partnership tra BenevolentAI (Londra, Regno Unito) ed Exscientia (Oxford, Regno Unito) genererà diversi nuovi candidati farmaci per lo sviluppo clinico con potenziale first-in-class e best-in-class in aree terapeutiche chiave di oncologia, neurologia e immunologia. (Fonte: Merck, sito Web aziendale, settembre 2023)

Copertura e risultati del rapporto di mercato sulla scoperta di farmaci a piccole molecole

Il rapporto "Small Molecule Drug Discovery Market Size and Forecast (2021–2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato della scoperta di farmaci a piccole molecole a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato della scoperta di farmaci a piccole molecole, nonché dinamiche di mercato quali fattori trainanti, limitazioni e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi di mercato sulla scoperta di farmaci a piccole molecole che copre le principali tendenze di mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato della scoperta di farmaci a piccole molecole

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, regionale, nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Domande frequenti

The market is expected to register a CAGR of 9.7% during 2023–2031.

The small molecule drug discovery market value is expected to reach US$ 106.77 billion by 2031.

Bristol-Myers Squibb Co, Merck KGaA, GSK Plc, Boehringer Ingelheim International GmbH, Thermo Fisher Scientific Inc, ICON Plc, Danaher Corp, Charles River Laboratories International Inc, Oncodesign Services, and Revvity Inc are among the key players in the market.

The growing adoption of artificial intelligence in drug discovery is expected to be a prime trend in the market in the coming years.

The flourishing pharmaceutical industry with a surge in R&D activities and the growing inclination toward outsourcing are among the most significant factors fueling the market growth.

North America dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Small Molecule Drug Discovery Market

- Bristol-Myers Squibb Co

- Merck KGaA

- GSK Plc

- Boehringer Ingelheim International GmbH

- Thermo Fisher Scientific Inc

- ICON Plc

- Danaher Corp

- Charles River Laboratories International Inc

- Oncodesign Services

- Revvity Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Ottieni un campione gratuito per questo repot

Ottieni un campione gratuito per questo repot