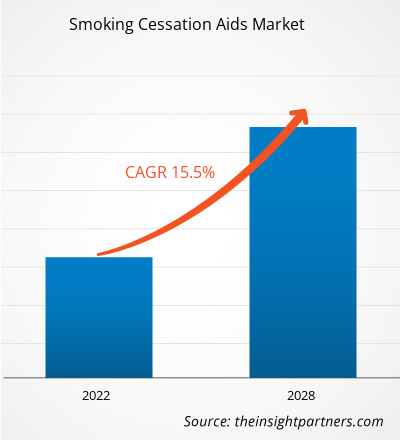

Si prevede che il mercato degli ausili per smettere di fumare raggiungerà la sbalorditiva cifra di 153,42 miliardi di dollari entro il 2034, con una crescita significativa rispetto ai 41,60 miliardi di dollari stimati nel 2025. Si prevede che il mercato registrerà un elevato tasso di crescita annuo composto (CAGR) del 15,62% nel periodo di previsione 2026-2034.

Analisi di mercato degli aiuti per smettere di fumare

Le previsioni del mercato globale degli ausili per la cessazione del fumo indicano una crescita eccezionale, trainata principalmente da un mandato di sanità pubblica mondiale per ridurre la mortalità e la morbilità correlate al tabacco. Questo è favorito da importanti iniziative governative e da una legislazione antifumo, soprattutto nelle economie sviluppate, abbinate a prodotti NRT sempre più sofisticati e alla controversa ma crescente categoria delle sigarette elettroniche. Altri fattori che contribuiscono all'accelerazione della penetrazione del mercato includono l'integrazione di soluzioni farmacologiche con piattaforme digitali scalabili di salute e terapia comportamentale, in grado di offrire programmi di cessazione completi e personalizzati. L'attenzione rimane rivolta a nuove formulazioni farmacologiche e a sistemi di somministrazione di nicotina alternativi e di facile utilizzo per migliorare i tassi di successo dei trattamenti.

Panoramica del mercato degli aiuti per smettere di fumare

Gli ausili per la cessazione del fumo sono prodotti diversificati dal punto di vista medico e tecnologico, progettati per aiutare le persone a superare la dipendenza da nicotina e a smettere di fumare. Questi ausili agiscono principalmente gestendo le sfide fisiche e psicologiche dell'astinenza da nicotina, aumentando così significativamente le probabilità di successo. La gamma di prodotti include terapie sostitutive della nicotina da banco (come gomme, cerotti e pastiglie), farmaci da prescrizione (come bupropione e vareniclina) e sistemi elettronici di somministrazione di nicotina (ENDS) di nuova generazione, tra cui sigarette elettroniche e prodotti per lo svapo. Il panorama del mercato è caratterizzato da rigidi contesti normativi che controllano il marketing e la distribuzione, da un elevato livello di investimenti in ricerca e sviluppo di nuovi farmaci non nicotinici e da una crescente dipendenza da canali accessibili come farmacie online e farmacie al dettaglio per la distribuzione dei prodotti.

Personalizza questo report in base alle tue esigenze

Ottieni la PERSONALIZZAZIONE GRATUITAMercato degli aiuti per smettere di fumare: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Aiuti per smettere di fumare: fattori trainanti e opportunità di mercato

Fattori trainanti del mercato:

- Crescente consapevolezza dei rischi per la salute correlati al fumo a livello globale: la diffusa pubblicazione di ricerche che collegano il fumo a gravi malattie croniche, tra cui cancro, malattie cardiovascolari e BPCO, sta aumentando la consapevolezza pubblica e spingendo a prendere decisioni proattive per smettere, aumentando così la domanda di efficaci strumenti per smettere.

- Iniziative governative e campagne di sanità pubblica che promuovono la cessazione del fumo: i governi di tutto il mondo stanno applicando tasse elevate sul tabacco, avviando campagne di sensibilizzazione su larga scala e fornendo programmi di cessazione sovvenzionati, che incentivano e facilitano direttamente l'uso della terapia sostitutiva della nicotina e dei farmaci da prescrizione.

- Crescente adozione della terapia sostitutiva della nicotina e dei farmaci da prescrizione: la terapia sostitutiva della nicotina rimane il fondamento dei programmi di cessazione grazie alla sua efficacia clinicamente provata e alla sua disponibilità senza ricetta. Allo stesso tempo, i farmaci da prescrizione forniscono un supporto vitale ai fumatori gravemente dipendenti, rafforzando il segmento farmacologico del mercato.

Opportunità di mercato:

- Espansione nei mercati emergenti con infrastrutture sanitarie in crescita: le economie emergenti nelle regioni Asia-Pacifico e America Latina stanno registrando un aumento della prevalenza delle malattie croniche. Con l'espansione delle infrastrutture sanitarie pubbliche, l'accesso e la consapevolezza di ausili efficaci e convenienti per smettere di fumare rappresentano una vasta opportunità di mercato inesplorata.

- Sviluppo di tecnologie innovative per le sigarette elettroniche e programmi digitali per la cessazione: l'innovazione nell'ambito delle sigarette elettroniche si concentra sul miglioramento dei profili di sicurezza e sulla personalizzazione dell'erogazione della nicotina. Inoltre, lo sviluppo di terapie digitali integrate (app, dispositivi indossabili) offre un supporto comportamentale scalabile e remoto, spesso cruciale per il successo a lungo termine nella cessazione.

- Partnership strategiche per campagne di distribuzione e sensibilizzazione globali: le collaborazioni tra i giganti farmaceutici e le organizzazioni sanitarie pubbliche senza scopo di lucro sono essenziali per lanciare campagne di sensibilizzazione su larga scala e garantire la distribuzione diffusa e accessibile di prodotti per la cessazione del fumo nelle regioni in via di sviluppo.

Analisi della segmentazione del rapporto di mercato degli aiuti per smettere di fumare

Il mercato degli ausili per smettere di fumare viene analizzato in base alle principali tipologie di prodotto e ai canali di distribuzione per fornire una comprensione più chiara delle preferenze dei consumatori e delle dinamiche del mercato.

Per prodotto:

- Terapia sostitutiva della nicotina (NRT):

- Droghe:

- Sigarette elettroniche (ENDS):

Da parte dell'utente finale:

- Farmacie al dettaglio:

- Canale online:

- Farmacie ospedaliere:

- Altri utenti finali:

Per geografia:

- America del Nord

- Europa

- Asia Pacifico

- America meridionale e centrale

- Medio Oriente e Africa

Approfondimenti regionali sul mercato degli aiuti per smettere di fumare

Le tendenze e i fattori regionali che hanno influenzato il mercato degli ausili per la cessazione del fumo durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la distribuzione geografica del mercato degli ausili per la cessazione del fumo in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto di mercato sugli aiuti per smettere di fumare

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2025 | 41,60 miliardi di dollari USA |

| Dimensioni del mercato entro il 2034 | 153,42 miliardi di dollari USA |

| CAGR globale (2026 - 2034) | 15,62% |

| Dati storici | 2021-2024 |

| Periodo di previsione | 2026-2034 |

| Segmenti coperti |

Per prodotto

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Smettere di fumare aiuta la densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli ausili per smettere di fumare è in rapida crescita, trainato dalla crescente domanda da parte degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato degli aiuti per smettere di fumare

Analisi della quota di mercato degli aiuti per smettere di fumare per area geografica

La traiettoria di crescita del mercato degli ausili per smettere di fumare è fortemente influenzata dai contesti normativi regionali, dai tassi di consumo di tabacco e dagli investimenti nella sanità pubblica. Di seguito è riportato un riepilogo delle quote di mercato e delle tendenze per regione:

America del Nord

- Quota di mercato: detiene la quota di mercato più ampia grazie a infrastrutture sanitarie avanzate, elevata consapevolezza da parte dei consumatori e un solido contesto normativo che supporta l'uso e il rimborso degli ausili per la cessazione del fumo.

- Fattori chiave: forti obblighi governativi (ad esempio, la regolamentazione FDA degli ENDS); elevata spesa sanitaria che faciliti l'accesso ai farmaci da prescrizione; e diffuse campagne di sanità pubblica.

- Tendenze: crescente attenzione all'integrazione della telemedicina e delle app digitali con gli ausili farmaceutici; dibattito e regolamentazione in corso sulla classificazione e la vendita dei prodotti per lo svapo.

Europa

- Quota di mercato: detiene una quota significativa, spinta dalle politiche proattive antifumo attuate dai sistemi sanitari nazionali (come il NHS) e dagli elevati tassi di adozione delle sigarette elettroniche come strategia di riduzione del danno.

- Fattori chiave: programmi di cessazione sostenuti dal governo; elevata penetrazione delle farmacie al dettaglio; e quadro normativo di supporto (ad esempio, direttiva UE sui prodotti del tabacco) per la terapia sostitutiva della nicotina.

- Tendenze: enfasi sullo sviluppo di politiche antifumo negli spazi pubblici; forte crescita del segmento delle sigarette elettroniche nonostante le normative più severe su aromi e marketing.

Asia Pacifico

- Quota di mercato: si prevede che sarà la regione in più rapida crescita durante il periodo di previsione. Questa rapida crescita è legata a una base demografica molto ampia, all'elevata prevalenza del fumo e al miglioramento dell'accesso ai trattamenti medici moderni.

- Fattori chiave: crescente consapevolezza sanitaria tra la popolazione della classe media; iniziative di informatica sanitaria sostenute dal governo; ed espansione delle reti di farmacie al dettaglio in paesi come Cina e India.

- Tendenze: opportunità significativa per i produttori di farmaci generici (ad esempio, Cipla, Dr. Reddy's) di offrire farmaci per smettere di fumare a prezzi accessibili; complesso panorama normativo per le sigarette elettroniche, con divieti in alcuni paesi in contrasto con i mercati aperti in altri.

America meridionale e centrale

- Quota di mercato: mercato emergente in crescita, subordinata al miglioramento delle condizioni economiche e della spesa sanitaria pubblica.

- Fattori chiave: crescenti campagne di sensibilizzazione da parte delle organizzazioni sanitarie regionali; espansione dell'accesso all'assistenza sanitaria privata; elevata disponibilità tra i fumatori a provare alternative.

- Tendenze: preferenza per prodotti NRT generici e a basso costo; le dimensioni del mercato sono strettamente correlate alla stabilità politica e agli investimenti nelle campagne di sanità pubblica.

Medio Oriente e Africa

- Quota di mercato: un mercato in via di sviluppo con una crescita concentrata nei paesi ad alto reddito del Consiglio di cooperazione del Golfo (GCC).

- Fattori chiave: piani Vision guidati dal governo che enfatizzano i miglioramenti della salute pubblica; aumento degli investimenti nelle infrastrutture ospedaliere e nelle cliniche specialistiche.

- Tendenze: adozione di sofisticati protocolli occidentali di terapia sostitutiva della nicotina e di farmaci da prescrizione nell'assistenza sanitaria privata; complessi fattori culturali influenzano l'efficacia delle campagne di sanità pubblica.

Panorama competitivo del mercato degli aiuti per smettere di fumare: prodotto e innovazione

Elevata densità di mercato e concorrenza

Il mercato degli ausili per smettere di fumare è caratterizzato da una forte concorrenza tra le principali aziende farmaceutiche, che dominano i segmenti dei farmaci da prescrizione e della terapia sostitutiva della nicotina, e le aziende tecnologiche specializzate incentrate sulle sigarette elettroniche.

La differenziazione si ottiene attraverso:

- Formulazione NRT di nuova generazione: sviluppo di forme di NRT ad azione più rapida o più discrete (ad esempio, film sublinguali specializzati, micro-pastiglie) per migliorare l'aderenza alla terapia da parte dell'utente.

- Innovazione nella pipeline dei farmaci: investire in farmaci non nicotinici con minori effetti collaterali o nuovi meccanismi d'azione per colmare le lacune terapeutiche.

- Integrazione digitale: collaborazione con aziende tecnologiche per integrare gli aiuti farmacologici in ecosistemi completi di supporto comportamentale digitale, massimizzando le possibilità di smettere di fumare con successo.

Le principali aziende che operano nel mercato degli ausili per smettere di fumare sono:

- Pfizer Inc. (Stati Uniti)

- GlaxoSmithKline plc. (Regno Unito)

- Laboratori del Dr. Reddy (India)

- Johnson and Johnson Services, Inc. (Stati Uniti)

- Cipla Inc. (India)

- Perrigo Company plc (Irlanda)

- Bausch Health Companies Inc. (Canada)

- Glenmark (India)

- NJOY (Stati Uniti)

Disclaimer: le aziende elencate sopra non sono classificate in un ordine particolare.

Notizie di mercato e sviluppi recenti sugli aiuti per smettere di fumare

- Bausch Health continua a fornire informazioni sull'etichettatura di Wellbutrin XL (bupropione), sottolineando le considerazioni sulla sicurezza neuropsichiatrica quando utilizzato per smettere di fumare.

- Nel novembre 2025 l'azienda ha inoltre lanciato il Breathefree Lung Wellness Center a Delhi, che offre diagnosi polmonari integrate e consulenza personalizzata per supportare gli sforzi per smettere di fumare.

- Nel giugno 2024, Dr. Reddy's ha annunciato un accordo definitivo per l'acquisizione di Nicotinell e dei suoi marchi globali NRT associati Nicotab, Habitrol e Thrive da Haleon plc, ampliando significativamente il suo portafoglio di farmaci da banco per la cessazione del fumo.

Copertura e risultati del rapporto di mercato sugli aiuti per smettere di fumare

Il rapporto "Dimensioni e previsioni del mercato degli ausili per la cessazione del fumo (2021-2034)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato degli aiuti per smettere di fumare a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato degli aiuti per smettere di fumare, insieme alle dinamiche del mercato, inclusi i principali fattori trainanti, le restrizioni e le opportunità emergenti

- Analisi PEST e SWOT dettagliate

- Analisi di mercato degli aiuti per smettere di fumare che copre le principali tendenze del mercato, le prospettive globali e regionali, i principali attori, il panorama normativo e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza, tra cui concentrazione del mercato, valutazione della mappa termica, aziende leader e sviluppi degni di nota nel mercato degli ausili per smettere di fumare

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli aiuti per smettere di fumare

Ottieni un campione gratuito per - Mercato degli aiuti per smettere di fumare