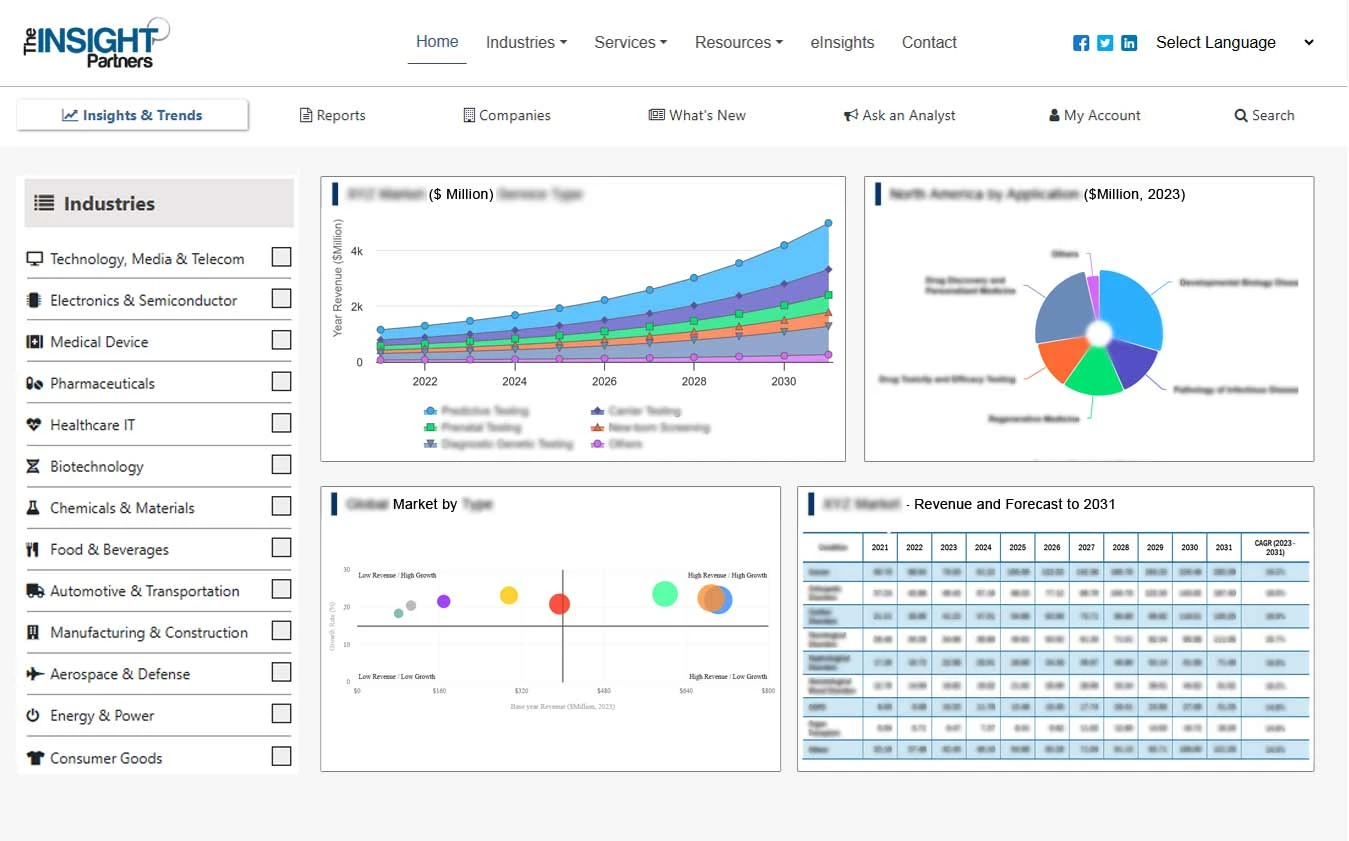

法人向け融資プラットフォーム市場は、2024年から2035年にかけて年平均成長率(CAGR)24.0%を記録し、市場規模は2024年のXX百万米ドルから2031年にはXX百万米ドルに拡大すると予想されています。

本レポートは、提供内容(ソリューションとサービス)、導入形態(クラウドとオンプレミス)、組織規模(中小企業、大企業)別にセグメント化されています。グローバル分析は、地域レベルと主要国別にさらに細分化されています。本レポートでは、上記の分析とセグメントの値を米ドルで提供しています。

レポートの目的

The Insight Partnersによる本レポート「法人向け融資プラットフォーム市場」は、現在の市場状況と将来の成長、主な推進要因、課題、そして機会を説明することを目的としています。これにより、次のようなさまざまなビジネス関係者に洞察が提供されます。

- テクノロジープロバイダー/メーカー: 進化する市場のダイナミクスを理解し、潜在的な成長機会を把握して、情報に基づいた戦略的決定を下せるようにします。

- 投資家: 市場の成長率、市場の財務予測、バリューチェーン全体に存在する機会に関する包括的なトレンド分析を実施します。

- 規制機関: 乱用を最小限に抑え、投資家の信頼と信用を維持し、市場の完全性と安定性を維持することを目的として、市場におけるポリシーと警察活動を規制します。

法人向け融資プラットフォーム市場セグメント オファリング

- ソリューションとサービス

導入モード

- クラウドとオンプレミス

組織規模

- 中小企業

- 大企業

地域

- 北米

- ヨーロッパ

- アジア太平洋地域

- 中東およびアフリカ

- 南米および中米

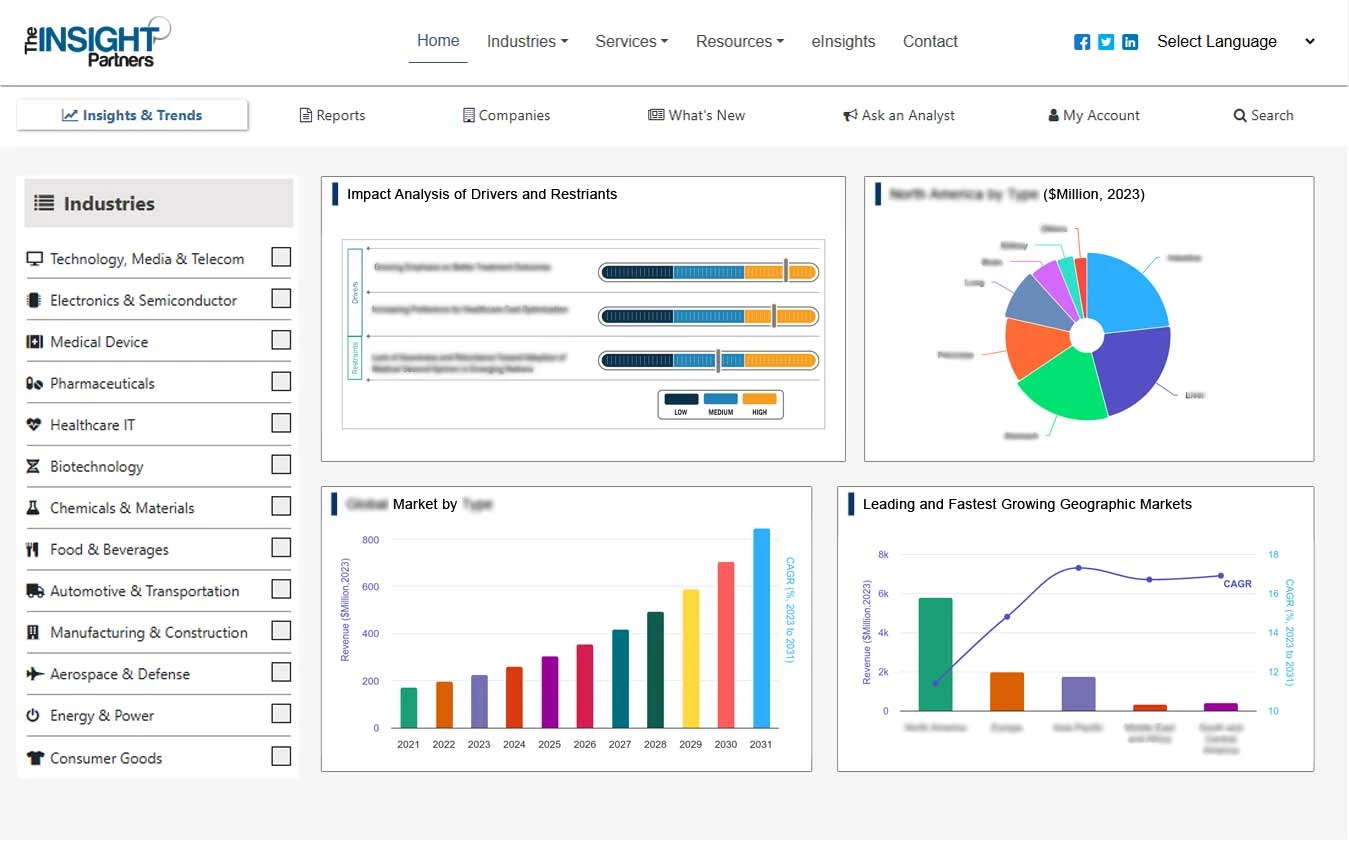

Strategic Insights

法人向け融資プラットフォーム市場の成長要因

- デジタル融資の需要増加:金融のデジタル化への移行により、法人向け融資プラットフォームの採用が促進され、企業はより迅速かつ効率的な融資処理を利用できるようになります。

- 中小企業の成長:中小企業は、よりアクセスしやすい融資を必要としています。

法人向け融資プラットフォーム市場の将来動向

- AI主導型信用スコアリング:AIの統合により信用スコアリングモデルが強化され、融資承認やリスク管理のためのより正確でデータに基づいた評価が提供されます。

法人向け融資プラットフォーム市場の将来動向

- AI主導型信用スコアリング:AIの統合により信用スコアリングモデルが強化され、融資承認やリスク管理のためのより正確でデータに基づいた評価が提供されます。

- 透明性のためのブロックチェーン:ブロックチェーン技術は、法人向け融資の透明性とセキュリティを高め、取引を合理化し、詐欺リスクを軽減します。

- クロスボーダー融資の拡大:法人向け融資プラットフォームは、クロスボーダー融資をますますサポートするようになり、企業がグローバル資本市場にアクセスし、金融ネットワークを拡大することを可能にします。

法人向け融資プラットフォーム市場の機会

- フィンテックエコシステムとの統合:フィンテック企業とのコラボレーションにより、

- データ駆動型融資ソリューション:ビッグデータと分析を活用してパーソナライズされた融資オプションを提供することで、サービス提供を改善し、より多くの顧客を引き付ける機会が生まれます。

- 持続可能性重視の融資:環境社会ガバナンス(ESG)基準に適合する企業を対象に、グリーンまたは持続可能な企業融資を提供する機会が拡大しています。

Market Report Scope

主なセールスポイント

- 包括的なカバレッジ:レポートでは、企業融資プラットフォーム市場の製品、サービス、タイプ、エンドユーザーの分析を包括的にカバーし、全体的な展望を提供しています。

- 専門家の分析:レポートは、業界の専門家とアナリストの深い理解に基づいて編集されています。

- 最新情報:レポートは、最新の情報とデータ傾向を網羅しているため、ビジネスの関連性を保証します。

- カスタマイズオプション:本レポートは、特定の顧客要件やビジネス戦略に合わせてカスタマイズ可能です。

したがって、法人向け融資プラットフォーム市場に関する本調査レポートは、業界の状況と成長見通しを解明し、理解するための先導役となります。いくつかの妥当な懸念事項はあるものの、本レポートの全体的なメリットはデメリットを上回る傾向にあります。

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

よくある質問

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

AI-Driven Credit Scoring and Blockchain for Transparency are anticipated to play a significant role in the global Corporate Lending Platform Market in the coming years.

The global Corporate Lending Platform Market is expected to grow at a CAGR of 24.0 % during the forecast period 2024 - 2031.

Increased Demand for Digital Financing and SMB Growth: are the major factors driving the Corporate Lending Platform Market

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

NA

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

このレポートの無料サンプルを入手する

このレポートの無料サンプルを入手する