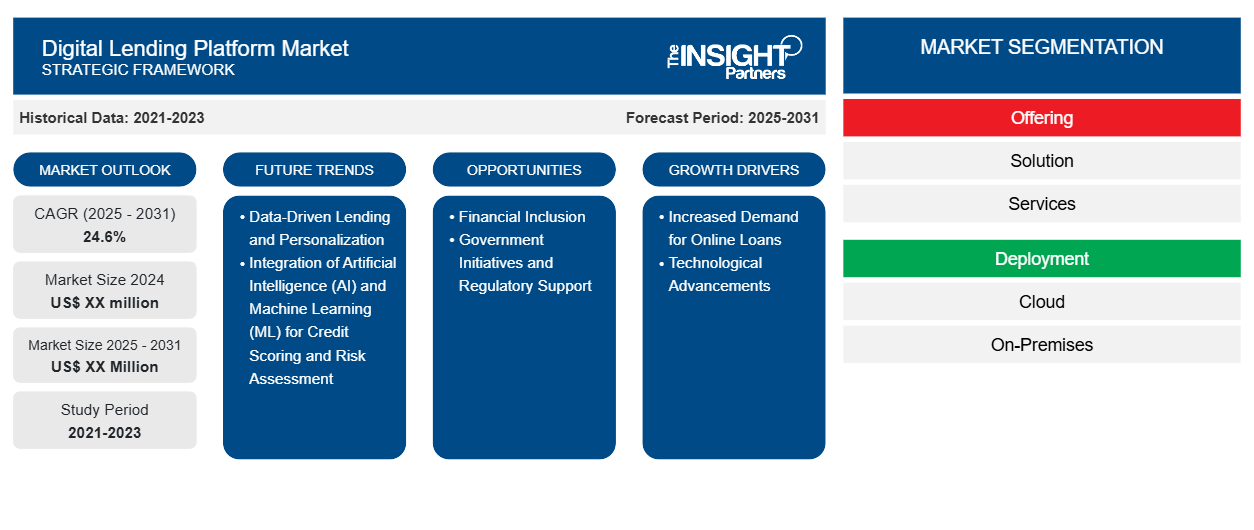

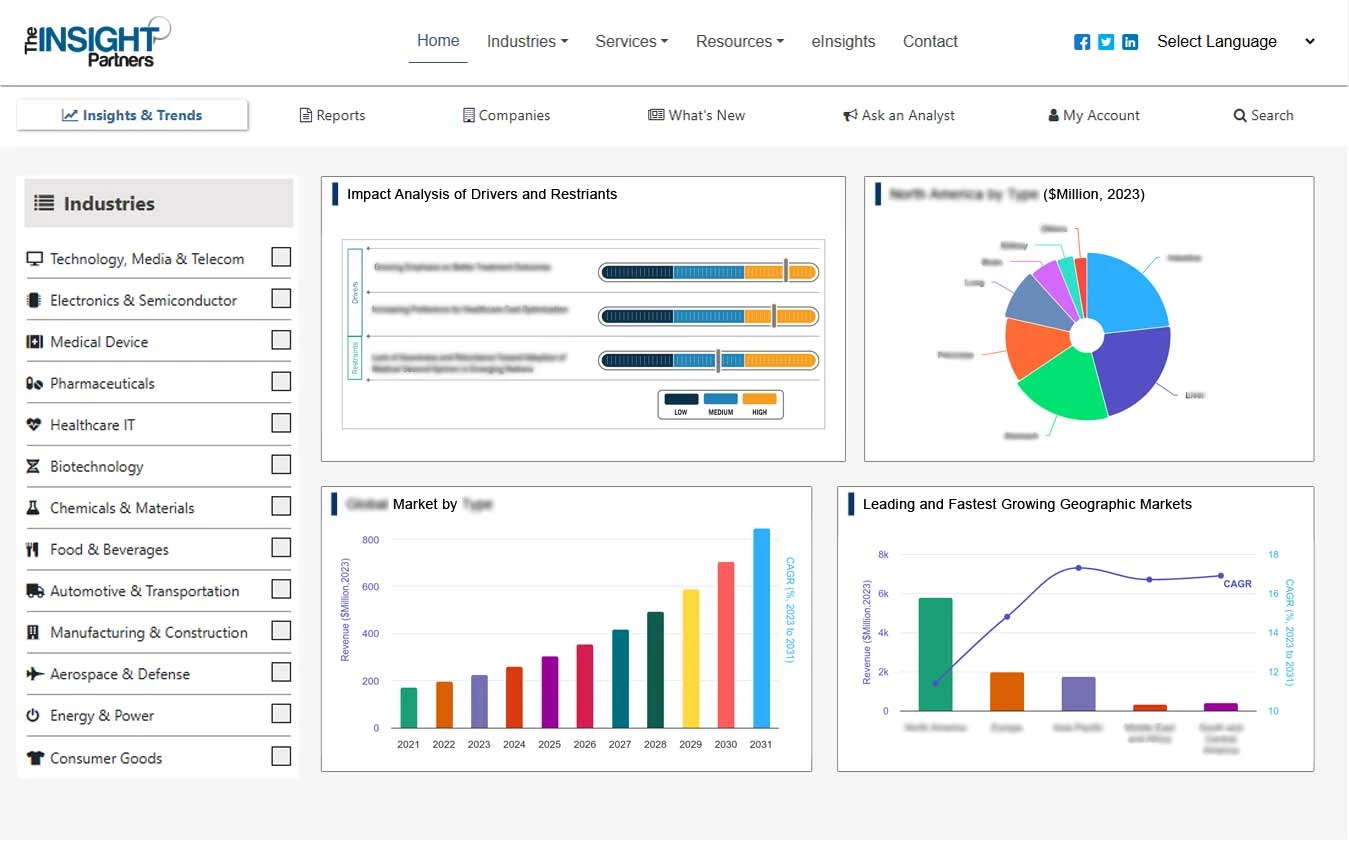

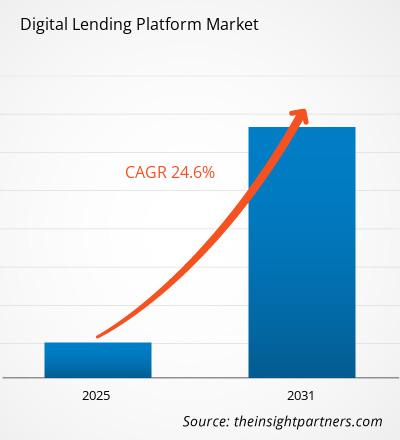

デジタル融資プラットフォーム市場は、2025年から2031年にかけて24.6%のCAGRで成長すると予想されており、市場規模は2024年のXX百万米ドルから2031年にはXX百万米ドルに拡大すると予想されています。

レポートは、提供内容(ソリューション、サービス)、エンドユーザー(BFSI、信用組合、P2P貸し手、その他)、展開(クラウド、オンプレミス)別にセグメント化されています。グローバル分析は、地域レベルと主要国別にさらに細分化されています。レポートは、上記の分析とセグメントに対して米ドルでの価値を提供します。

報告書の目的

The Insight Partners によるレポート「デジタル レンディング プラットフォーム市場」は、現在の状況と将来の成長、主な推進要因、課題、機会を説明することを目的としています。これにより、次のようなさまざまなビジネス ステークホルダーに洞察が提供されます。

- テクノロジープロバイダー/メーカー: 進化する市場の動向を理解し、潜在的な成長機会を把握することで、情報に基づいた戦略的意思決定が可能になります。

- 投資家: 市場の成長率、市場の財務予測、バリュー チェーン全体に存在する機会に関する包括的な傾向分析を実施します。

- 規制機関: 市場の乱用を最小限に抑え、投資家の信用と信頼を維持し、市場の完全性と安定性を維持することを目的として、市場における政策と警察活動を規制します。

デジタル融資プラットフォームの市場セグメンテーション

提供

- 解決

- サービス

展開

- 雲

- オンプレミス

エンドユーザー

- 英国

- 信用組合

- P2P貸し手

- その他

地理

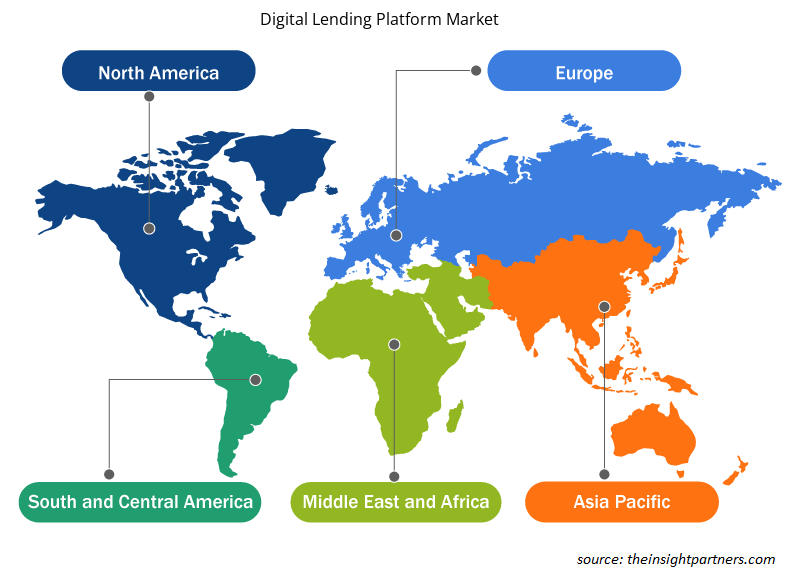

- 北米

- ヨーロッパ

- アジア太平洋

- 南米と中央アメリカ

- 中東およびアフリカ

要件に合わせてレポートをカスタマイズする

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

デジタル融資プラットフォーム市場:戦略的洞察

- このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

デジタル融資プラットフォーム市場の成長要因

- オンライン ローンの需要増加: デジタル融資プラットフォームの拡大を後押しする大きな要因の 1 つは、消費者からの迅速かつ簡単なローンへのアクセスに対する需要です。消費者は、特に個人、ビジネス、または学資ローンの提供において、より効率的な金融支援へのアクセス方法をますます求めています。従来の融資機関は、特に書類の取り扱いや承認を考慮すると、利用に時間がかかるのが一般的です。デジタル融資プラットフォームは、書類をほとんどまたはまったく必要とせず、ほぼ瞬時にローンを作成できます。この発展は消費者行動に深く影響を及ぼしており、主にデジタル化の進展により、人々は自宅にいながらオンラインで申請できるという利便性を好んでいます。

- 技術の進歩: Ryazanov 氏によると、人工知能、機械学習、ブロックチェーンの技術革新により、融資の効率と安全性の両方が劇的に向上しています。AI と ML で使用されるアルゴリズムは、信用力をリアルタイムで評価するのに役立ち、それによって債務不履行のリスクを軽減すると同時に、ユーザー エクスペリエンスを向上させます。一方、ブロックチェーン技術は、取引のセキュリティを確保し、融資の透明性を高めるのに役立ちます。このため、借り手と貸し手の両方にとって魅力的です。このような技術の進歩により、市場の新しいプレーヤーだけでなく、既存のプラットフォームにもさらなる革新の機会が開かれ続けています。

デジタル融資プラットフォーム市場の将来動向

- データ駆動型融資とパーソナライゼーション: 融資におけるデジタル プラットフォームのもう 1 つの大きなチャンスは、膨大な量のデータを処理し、融資体験をカスタマイズできることです。ソーシャル メディア、オンライン行動、取引履歴、その他のデジタル フットプリントから顧客情報を取得することで、貸し手は借り手のニーズとプロファイルに最適な非常にパーソナライズされたローン商品を確立できます。パーソナライゼーションにより、顧客満足度が向上するだけでなく、ローン商品が借り手の能力と財務ニーズに適合していることが保証されるため、リスクも軽減されます。

- 信用スコアリングとリスク評価のための人工知能 (AI) と機械学習 (ML) の統合: デジタル融資プラットフォーム市場における最も重要なトレンドの 1 つは、信用スコアリングとリスク評価プロセスを改善するための AI と機械学習の統合です。従来の融資モデルは信用スコアに依存することが多く、信用履歴のない特定の個人やグループが除外される可能性があります。デジタル融資プラットフォームは、AI/ML アルゴリズムを使用して、取引履歴、携帯電話の使用状況、社会的行動など、より広範なデータ ポイントを評価し、借り手の信用力を判断します。より包括的でデータ主導の融資プロセスへの移行により、信用リスクの評価方法が変革され、信用へのアクセスの障壁が軽減されています。

デジタル融資プラットフォームの市場機会

- 金融包摂: デジタル融資プラットフォームは、特に発展途上地域において、金融包摂を推進する上で真のゲームチェンジャーであることが判明しています。主に新興経済国の何百万人もの顧客は、インフラや信用履歴が不足しているため、従来の銀行を利用する選択肢がありません。しかし、デジタル融資は、そうでなければ主流の銀行から排除されていたであろう顧客に融資するために使用できます。したがって、これは未開拓の顧客の非常に大きな市場を構成し、金融機関への代替アクセスが限られている地域で成長の機会を提供します。

- 政府の取り組みと規制支援: この側面は、世界中の政府が金融包摂と経済成長を促進するために行っている一般的な取り組みの一環として、デジタル融資プラットフォームの急成長に貢献しています。多くの国が、デジタル融資などのフィンテック ソリューションの普及につながるよう、慎重に検討された規制枠組みを導入しています。この点で、免税や合理化されたライセンス プロセスを提供している国もあります。さらに、デジタル融資プラットフォームのビジネスを拡大するためのフィンテック企業ベースの規制サンドボックスもあります。

デジタル融資プラットフォーム市場の地域別分析

予測期間を通じてデジタル融資プラットフォーム市場に影響を与える地域的な傾向と要因は、Insight Partners のアナリストによって徹底的に説明されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東、アフリカ、南米、中米にわたるデジタル融資プラットフォーム市場のセグメントと地理についても説明します。

- デジタル融資プラットフォーム市場の地域別データを入手

デジタル融資プラットフォーム市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2024年の市場規模 | XX百万米ドル |

| 2031年までの市場規模 | XX百万米ドル |

| 世界のCAGR(2025年~2031年) | 24.6% |

| 履歴データ | 2021-2023 |

| 予測期間 | 2025-2031 |

| 対象セグメント | 提供することで

|

| 対象地域と国 | 北米

|

| 市場リーダーと主要企業プロフィール |

|

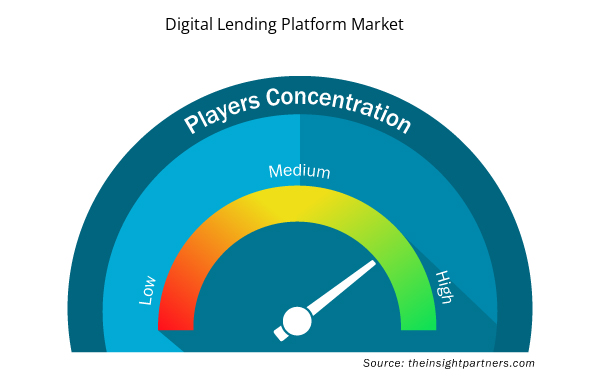

デジタル融資プラットフォーム市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

デジタル融資プラットフォーム市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認識の高まりなどの要因により、エンドユーザーの需要が高まり、急速に成長しています。需要が高まるにつれて、企業は提供内容を拡大し、消費者のニーズを満たすために革新し、新たなトレンドを活用し、市場の成長をさらに促進しています。

市場プレーヤー密度とは、特定の市場または業界内で活動している企業または会社の分布を指します。これは、特定の市場スペースに、その規模または総市場価値と比較して、どれだけの競合相手 (市場プレーヤー) が存在するかを示します。

デジタル融資プラットフォーム市場で事業を展開している主要企業は次のとおりです。

- ドキュテック LLC

- ICE モーゲージテクノロジー社

- 国際

- フィナストラインターナショナルリミテッド。

- ファイサーブ株式会社

免責事項:上記の企業は、特定の順序でランク付けされていません。

- デジタルレンディングプラットフォーム市場のトップキープレーヤーの概要を入手

主なセールスポイント

- 包括的なカバレッジ: レポートでは、デジタル融資プラットフォーム市場の製品、サービス、タイプ、エンドユーザーの分析を包括的にカバーし、全体的な展望を提供します。

- 専門家による分析: レポートは、業界の専門家とアナリストの深い理解に基づいてまとめられています。

- 最新情報: このレポートは、最新の情報とデータの傾向を網羅しているため、ビジネスの関連性を保証します。

- カスタマイズ オプション: このレポートは、特定のクライアント要件に対応し、ビジネス戦略に適切に適合するようにカスタマイズできます。

したがって、デジタル融資プラットフォーム市場に関する調査レポートは、業界のシナリオと成長の見通しを解読し理解する道の先導役となることができます。いくつかの正当な懸念があるかもしれませんが、このレポートの全体的な利点は欠点を上回る傾向があります。

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

- Latent TB Detection Market

- Medical and Research Grade Collagen Market

- Small Internal Combustion Engine Market

- Online Recruitment Market

- Dropshipping Market

- Enteral Nutrition Market

- Procedure Trays Market

- Health Economics and Outcome Research (HEOR) Services Market

- Medical Audiometer Devices Market

- Neurovascular Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

よくある質問

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

The major factors driving the digital lending platform market are:

1. Increased Demand for Online Loans

2. Technological Advancements

Data-Driven Lending and Personalization is anticipated to play a significant role in the global digital lending platform market in the coming years

The Digital Lending Platform Market is estimated to witness a CAGR of 24.6% from 2023 to 2031

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

1. Docutech, LLC

2. ICE Mortgage Technology, Inc.

3. FIS

4. Finastra International Limited.

5. Fiserv, Inc.

6. HES FinTech

7. Novopay Solutions Pvt Ltd.

8. Nucleus Software Exports Ltd.

9. Pegasystems Inc.

10. Tavant

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

このレポートの無料サンプルを入手する

このレポートの無料サンプルを入手する