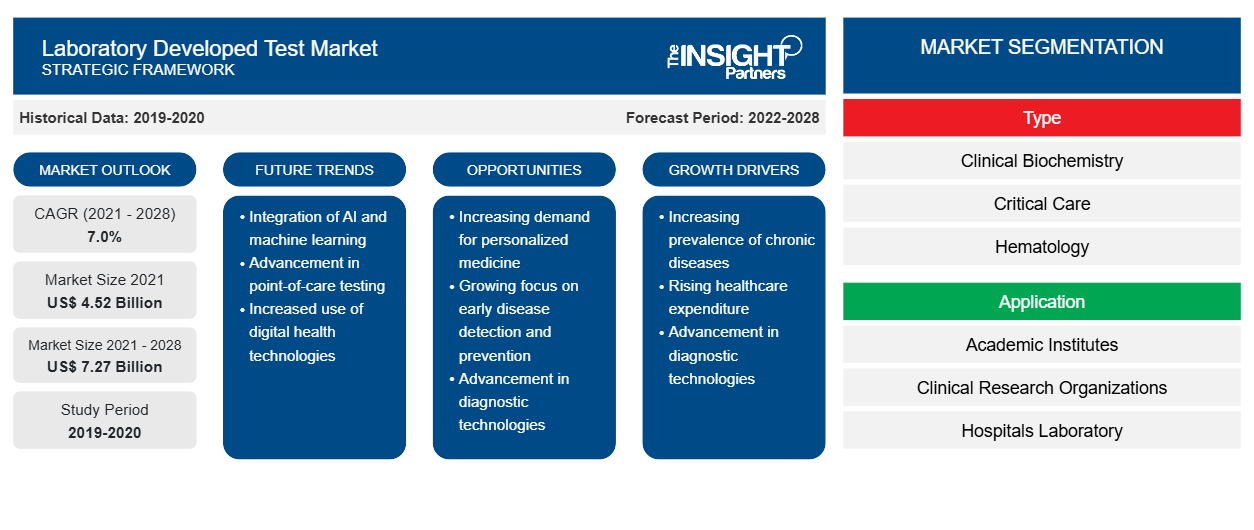

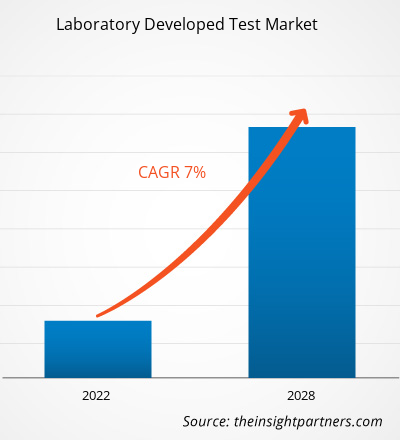

ラボ開発テスト市場は、2021年の45億2,475万米ドルから2028年には72億6,930万米ドルに達すると予想されており、2021年から2028年にかけて7.0%のCAGRで成長すると予想されています。

ラボ開発テスト (LDT) は、単一のラボ内で設計および使用される体外診断テストの一種です。これらのテストは、人間の被験者から収集された検体から抽出されたタンパク質、生体分子/化合物 (グルコース、コレステロールなど)、DNA などの分析対象物を推定または区別するために使用できます。ラボや薬局で正確でエラーのない分析を行うための自動化された体外診断 (IVD) 方法の拡大は、ラボ開発テスト市場の成長を促進しています。

臨床検査市場の成長は、主にがんや遺伝性疾患の発生率の増加、製品の大量発売などの要因によるものです。しかし、規制環境の変化が市場の成長を妨げています。たとえば、欧州では、2022年5月からすべての体外診断検査で体外診断デバイス規制(IVDR)の遵守が義務付けられます。この規制は、医療検査の臨床的有効性と安全性を確保することを目的としており、診断業界を変革することになり、市場関係者にとって大きな懸念事項となっています。

要件に合わせてレポートをカスタマイズする

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

- このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

市場分析

パーソナライズ医療に関する継続的な研究は、臨床検査市場のプレーヤーに成長の機会を提供します

LDT は、効果的な治療法や治療法がまだ見つかっていない病気に取り組む有望な手段として証明される可能性が高いパーソナライズド メディシンの開発において重要な役割を果たしています。パーソナライズド メディシン連合によると、パーソナライズド メディシンは 2005 年に FDA が新たに承認した分子実体のわずか 5% を占めていましたが、2016 年にはこの数字は 25% 以上に増加しました。さらに、パイプラインにある全化合物の 42% と腫瘍学化合物の 73% は、パーソナライズド メディシンとして機能する可能性があります。バイオ医薬品企業は、過去 5 年間でパーソナライズド メディシンへの研究開発投資をほぼ 2 倍に増やしており、今後 5 年間でさらに 33% の投資増加が見込まれています。バイオ医薬品の研究者は、今後 5 年間でパーソナライズド メディシンの開発が 69% 増加すると予測しています。臨床検査は、病気の診断や薬物反応の予測と監視、および複雑な予測アルゴリズムに必要な情報データの取得に使用されます。 play a vital role in the development of personalized medicines that are likely to prove as promising means of tackling diseases through far eluded effective treatments or cures. As per the Personalized Medicine Coalition, personalized medicines accounted for only 5% of the new FDA-approved molecular entities in 2005; however, in 2016, this number rose to more than 25%. Additionally, 42% of all compounds and 73% of oncology compounds in the pipeline have the potential to serve as personalized medicines. Biopharmaceutical companies have nearly doubled their R&D investments in personalized drugs in the last five years, and they are further expected to increase their investments by 33% in the next five years. Biopharmaceutical researchers also predict a 69% increase in the development of personalized medicines in the next five years. Laboratory tests are used to diagnose illness and predict and monitor drug response as well as to obtain informatics data needed for complex predictive algorithms.

パーソナライズされた医薬品は、がん治療のトレードマークになりつつあります。これは、個人の遺伝子構成に応じて治療をカスタマイズすることに基づく、常に進化するアプローチです。2019年、FDAは病気の根本原因を調査して対処するための12のパーソナライズされた医薬品を承認し、臨床ケアに精密医療を統合しました。パーソナライズされた医薬品の需要の高まりは、ラボ開発テスト市場で活動するプレーヤーの成長に大きな成長機会を提供しています。

タイプベースの洞察

臨床検査市場は、タイプ別に、臨床生化学、救命医療、血液学、微生物学、分子診断、免疫学、その他に分類されています。分子診断セグメントは、2021年に市場で最大のシェアを占めると予想されています。ただし、予測期間中、血液学セグメントは市場で最も高いCAGRを記録すると予想されています。CAGR in the market during the forecast period.

アプリケーションベースの洞察

アプリケーション別に見ると、検査室は学術機関、臨床研究機関、病院の検査室、専門診断センターなどにテスト市場のアプリケーションを展開しています。病院の検査室セグメントは、2021年に最大の市場シェアを占めると予測されています。ただし、専門診断センターセグメントは、予測期間中に市場で最も高いCAGRを記録すると予想されています。CAGR in the market during the forecast period.

製品の発売と承認は、企業が世界的な足跡と製品ポートフォリオを拡大するために一般的に採用されている戦略です。さらに、ラボ開発テスト市場のプレーヤーは、顧客を拡大するためのパートナーシップ戦略に重点を置いており、これにより、ブランド名を世界的に維持することができます。

このレポートでは、実験室開発テスト市場を以下のように分類しています。

タイプに基づいて、ラボ開発テスト市場は、臨床生化学、救命救急、血液学、微生物学、分子診断、免疫学、その他に分類されます。アプリケーションに基づいて、ラボ開発テスト市場は、学術機関、臨床研究組織、病院の検査室、専門診断センター、その他に分類されます。地理に基づいて、ラボ開発テスト市場は、北米(米国、カナダ、メキシコ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、その他のヨーロッパ)、アジア太平洋(中国、日本、インド、オーストラリア、韓国、その他のアジア太平洋)、中東およびアフリカ(UAE、サウジアラビア、南アフリカ、その他の中東およびアフリカ)、南米および中米(ブラジル、アルゼンチン、その他の中南米)に分類されます。

ラボ開発テスト市場の地域別分析

予測期間を通じてラボ開発テスト市場に影響を与える地域的な傾向と要因は、Insight Partners のアナリストによって徹底的に説明されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東、アフリカ、南米、中米にわたるラボ開発テスト市場のセグメントと地理についても説明します。

- 臨床検査市場に関する地域別データを入手

ラボ開発テスト市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2021年の市場規模 | 45億2千万米ドル |

| 2028年までの市場規模 | 72億7千万米ドル |

| 世界のCAGR(2021年~2028年) | 7.0% |

| 履歴データ | 2019-2020 |

| 予測期間 | 2022-2028 |

| 対象セグメント | タイプ別

|

| 対象地域と国 | 北米

|

| 市場リーダーと主要企業プロフィール |

|

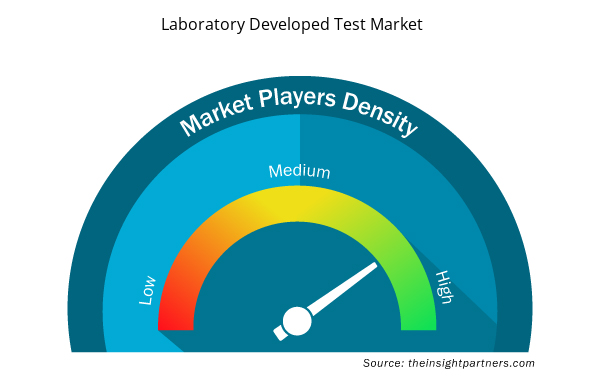

ラボ開発テスト市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

研究室開発テスト市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認識の高まりなどの要因により、エンドユーザーの需要が高まり、急速に成長しています。需要が高まるにつれて、企業は提供を拡大し、消費者のニーズを満たすために革新し、新たなトレンドを活用し、市場の成長をさらに促進しています。

市場プレーヤー密度とは、特定の市場または業界内で活動している企業または会社の分布を指します。これは、特定の市場スペースに、その規模または総市場価値と比較して、どれだけの競合相手 (市場プレーヤー) が存在するかを示します。

ラボ開発テスト市場で事業を展開している主要企業は次のとおりです。

- クエスト・ダイアグノスティクス株式会社

- F. ホフマン・ラ・ロッシュ株式会社

- キアゲン

- イルミナ株式会社

- ユーロフィンサイエンティフィック

免責事項:上記の企業は、特定の順序でランク付けされていません。

- ラボ開発テスト市場のトップキープレーヤーの概要を入手

企業プロフィール

- クエスト・ダイアグノスティクス株式会社

- F. ホフマン・ラ・ロッシュ株式会社

- キアゲン

- イルミナ株式会社

- ユーロフィンサイエンティフィック

- バイオデシックス

- 適応型バイオテクノロジー

- バイオセラノスティクス

- ロゼッタ・ジェノミクス株式会社

- ガーダントヘルス

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

よくある質問

The laboratory developed test market is led by type molecular diagnostics segment is growing significantly due to the increasing attention to the development of genetic therapeutics. The growing research in human genomics is playing a vital role in developing laboratory developed tests. The technological advantages of molecular tests make them compelling diagnostic tools, and they have become valuable for detecting a wide range of genetic diseases. For instance, in November 2017, Edico Genome launched the DRAGEN Clinical Genomics Information System (CGIS).

The automation of LDTs can significantly boost productivity and simplify compliance procedures. Clinical laboratories are under huge pressure to manage increasing test volumes and conduct more complex diagnostic assays, which further underlines the need for flexible automation systems. Many MedTech companies are offering automation solutions to help streamline clinical laboratory processes. For instance, Roche Cobas Omni–Utility Channel is beneficial for both IVD assays and high-volume LDTs. It is designed to meet the growing needs of efficient workflows in laboratories, as it can assist in different stages ranging from sample processing to quick data interpretation. It can run up to 96 results in about 3 hours and up to 864 results in 8 hours, thereby boosting the efficiency of laboratories.

The growth of the region is attributed to factors such as rising public–private partnerships, and increasing funding activities are widely enhancing the performance of medical devices. Moreover, presence of well-developed healthcare infrastructure and government support are some of the prominent factors propelling the market growth in Asia Pacific. In Asia Pacific, India is the largest market for laboratory developed test. The market growth in Asia Pacific is mainly attributed to factors such as the growing usage of laboratory developed test in combating Covid-19, increasing incidents of cancer and genetic disorders, large number of product launches. However concerns high capital investment for setting up advanced labs hinders the market growth in Asia Pacific.

A laboratory developed test (LDT) is a type of in vitro diagnostic test that is designed and used within a single laboratory. These tests can be utilized to estimate or distinguish an extensive assortment of analytes materials such as proteins, chemical compounds like glucose or cholesterol, or DNA, from a specimen received from human anatomy. The expansion of automated in vitro diagnostics (IVD) methods for labs and dispensaries to render precise, and error-free analysis is anticipated to fuel the increment.

The growth of the laboratory developed test market is mainly attributed to factors such as the increasing incidents of cancer and genetic disorders, large number of product launches. However, changing regulatory landscape for instance, in Europe, the In-Vitro Device Regulation (IVDR) compliance will be mandatory for all in vitro diagnostic tests from May 2022; the regulation aims to secure the clinical effectiveness and safety of medical tests, thus transforming the diagnostic industry is a great concern to hinder the market growth. In August 2021, eMed, a telehealth company democratizing healthcare through digital-point-of-care solutions, and Quest Diagnostics the world's leading provider of diagnostic information services, are collaborated to bring clinician-guided rapid antigen testing for COVID-19 to employers seeking to foster safer environments by decreasing the risk of COVID-19 exposure in their workplaces which is contributing to the growth of the target market. Such strategic steps are also projected to drive the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Laboratory Developed Test Market

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientific

- Biodesix

- Adaptive Biotechnologies

- Biotheranostics

- Rosetta Genomics Ltd.,

- Guardant Health

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

このレポートの無料サンプルを入手する

このレポートの無料サンプルを入手する