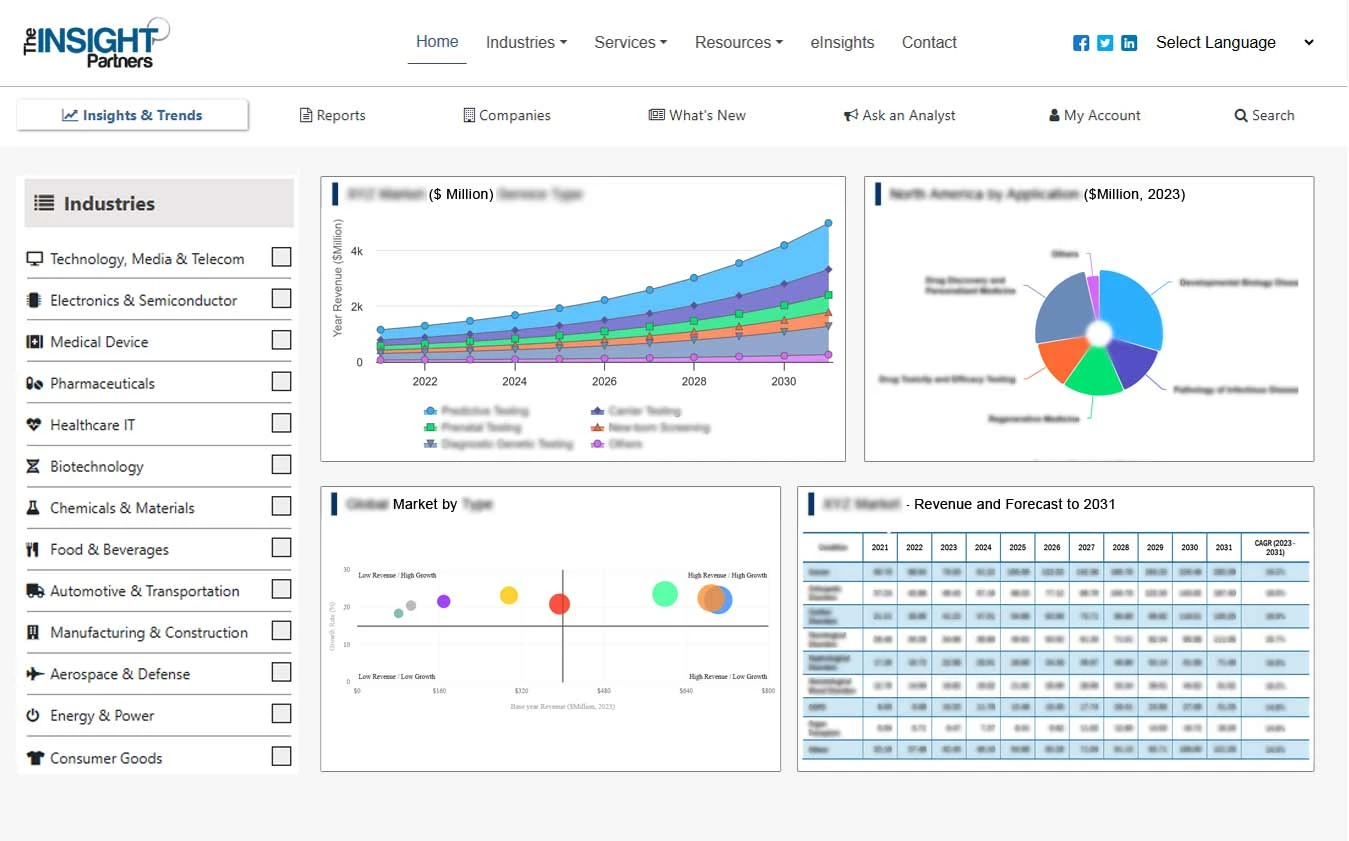

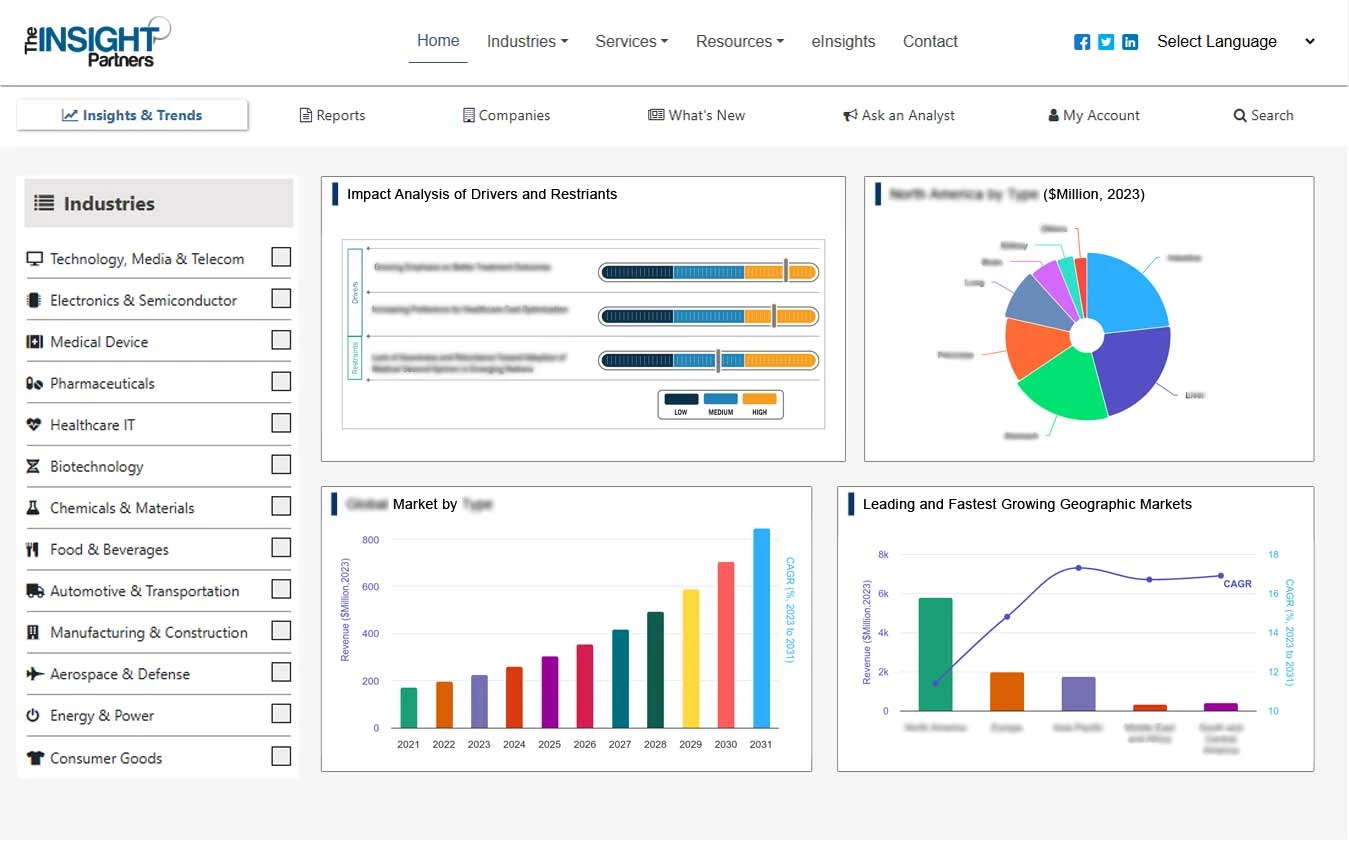

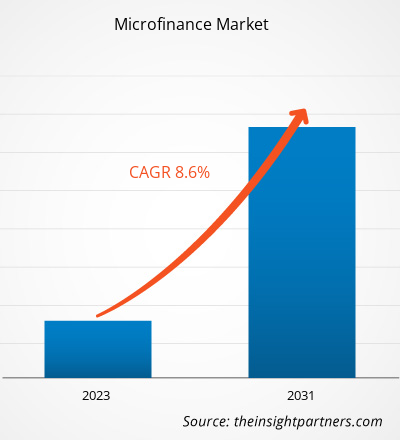

マイクロファイナンス市場規模は、2023年の2,743億米ドルから2031年には5,287億米ドルに成長すると予想されており、2023年から2031年にかけて8.6%のCAGRで拡大すると予想されています。従来の融資からマイクロファイナンスへの移行により、市場が拡大すると予想されています。

マイクロファイナンス市場分析

マイクロファイナンス業界は、サービスとリーチを強化するために技術の進歩を取り入れています。これには、モバイル バンキング、デジタル決済、革新的な金融技術の使用が含まれます。これらのマイクロファイナンス市場のトレンドにより、マイクロファイナンス機関とその顧客の両方にとって、アクセス性、効率性、利便性が向上します。市場内では、社会的影響と持続可能性に重点が置かれています。

マイクロファイナンス市場の概要

- マイクロファイナンスとは、通常、従来の銀行システムから除外されている低所得の個人またはグループに対する金融サービスのことです。マイクロファイナンスは、小額の運転資金ローン、マイクロローン、またはマイクロクレジットを提供することで、疎外された人々、特に女性や疎外された人々の金融ニーズに焦点を当てることを目的としています。ただし、マイクロファイナンス機関 (MFI) は、送金、保険、貯蓄口座などの他の金融サービスも提供する場合があります。

- マイクロファイナンスの主な目的は、経済的に疎外されている人々の金融サービスへのアクセスを改善し、自立と経済的自立を促進することです。マイクロファイナンスは、個人やコミュニティに事業の開始や拡大、リスク管理、経済的回復力の構築の手段を提供することで、個人やコミュニティに力を与える上で重要な役割を果たします。

- マイクロファイナンスは、人口の相当数が正式な融資や貯蓄を利用できない発展途上国では特に重要です。マイクロファイナンス機関は、ニーズに合わせた金融サービスや非金融サービスを提供することで、貧困の緩和、経済発展、国連の持続可能な開発目標の達成に貢献しています。

- 近年、市場は着実に成長しており、この成長は金融包摂の重要性とマイクロファイナンスが個人や企業に与えるプラスの影響に対する認識の高まりを反映しています。

マイクロファイナンス市場の推進力

従来の融資からマイクロファイナンスへの移行がマイクロファイナンス市場を牽引

- 市場では、いくつかの要因により、従来の融資からマイクロファイナンスへの大きな移行が見られました。この移行は、特に以前は正式な金融サービスへのアクセスから除外されていた低所得の個人やグループにとって、金融環境に前向きな変化をもたらしました。マイクロファイナンスへの移行の主な要因の 1 つは、金融包摂を促進するという目的です。

- 従来の融資機関は、厳しい資格基準を設け、担保を要求することが多く、低所得者層が融資を受けることが困難です。一方、マイクロファイナンス機関は、金融サービスが十分に行き届いていない人々に金融サービスを提供することに重点を置き、小口融資、マイクロクレジット、その他の金融商品へのアクセスを可能にしています。

- マイクロファイナンスは、貧困を軽減し、持続可能な開発に貢献する可能性を秘めていると認識されています。個人に事業を開始または拡大する手段を提供することで、マイクロファイナンスは収入創出の機会を創出し、失業を減らし、生活水準を向上させます。この社会的影響は、政府、国際機関、インパクト投資家からの注目と支援を集め、マイクロファイナンス市場の成長をさらに促進しています。

マイクロファイナンス

市場レポートのセグメンテーション分析

- プロバイダーに基づいて、市場は銀行、マイクロファイナンス機関(MFI)、非銀行金融機関(NBFI)、その他に分類されます。銀行セグメントは、2023年にマイクロファイナンス市場で大きなシェアを占めると予想されています。

- 銀行は、ローン、普通預金口座、その他の銀行商品など、幅広い金融サービスを提供する伝統的な金融機関です。マイクロファイナンスの分野では、銀行は低所得者や小規模企業に金融サービスを提供する上で重要な役割を果たします。銀行は、サービスが行き届いていない層のニーズに合わせたマイクロクレジット、マイクロ保険、その他の金融商品を提供する場合があります。

- 銀行は多くの場合、より広範な顧客基盤と広範なインフラストラクチャを備えているため、市場において重要なセグメントとなっています。マイクロファイナンス機関は、従来の銀行サービスへのアクセスが不十分な低所得者層に金融サービスを提供する専門組織です。

- MFI は金融包摂に焦点を当て、マイクロローン、マイクロクレジット、貯蓄口座、保険、その他の金融商品を提供することで、金融サービスを受けられない人々に力を与えることを目指しています。MFI は女性、農村地域、小規模起業家など、社会的に疎外された人々をターゲットにしていることが多く、これによりマイクロファイナンス市場の成長がさらに促進されると期待されています。

マイクロファイナンス市場シェアの地域別分析

マイクロファイナンス市場レポートの範囲は、主に北米、ヨーロッパ、アジア太平洋、中東およびアフリカ、南米の 5 つの地域に分かれています。アジア太平洋 (APAC) は急速な成長を遂げており、マイクロファイナンス市場で大きなシェアを占めると予想されています。この地域の著しい経済発展、人口増加、多様な経済圏における金融包摂への注目の高まりが、この成長に貢献しています。APAC の新興市場は、銀行口座を持たない人口が多く、起業家文化が高まっていることが特徴で、マイクロファイナンス機関や非銀行金融機関 (NBFI) にとって、サービスを拡大し、これまで十分なサービスを受けられなかったコミュニティにリーチする大きな機会となっています。

マイクロファイナンス

市場レポートの範囲

「マイクロファイナンス市場分析」調査は、プロバイダー、エンドユーザー、および地理に基づいて実施されました。プロバイダーの面では、市場は銀行、マイクロファイナンス機関(MFI)、非銀行金融機関(NBFI)などに分割されています。エンドユーザーに基づいて、市場は中小企業、マイクロ企業、および個人起業家または自営業に分割されています。地理に基づいて、市場は北米、ヨーロッパ、アジア太平洋、中東およびアフリカ、および南米に分割されています。

マイクロファイナンス

市場ニュースと最近の動向

企業は市場において合併や買収などの無機的戦略と有機的戦略を採用します。マイクロファイナンス市場の予測は、主要な企業の出版物、協会データ、データベースなど、さまざまな二次および一次調査結果に基づいて推定されています。最近の主要な市場動向をいくつか以下に示します。

- 2024年2月、エリクソンとテレノールマイクロファイナンス銀行(TMB)はパートナーシップをさらに強化し、パキスタンにおける金融包摂とエンパワーメントの促進に向けた取り組みを共有しました。両社は最近、easypaisaが提供する金融サービスを強化し、フィンテック分野におけるサービス範囲を拡大することを目的として、パートナーシップの複数年延長に署名しました。このパートナーシップは、両社の専門知識とリソースを活用して、パキスタンの個人と企業向けの金融サービスの成長とアクセスを促進することを目的としています。

[出典: Telefonaktiebolaget LM Ericsson、企業ウェブサイト]

マイクロファイナンス

市場レポートの対象範囲と成果物

「マイクロファイナンス市場の規模と予測(2021〜2031年)」に関する市場レポートでは、以下の分野をカバーする市場の詳細な分析を提供しています。

- 調査対象範囲に含まれるすべての主要市場セグメントについて、世界、地域、国レベルでの市場規模と予測。

- 推進要因、制約、主要な機会などの市場の動向。

- 今後の主な動向。

- 詳細なPESTおよびSWOT分析

- 主要な市場動向、主要プレーヤー、規制、最近の市場動向を網羅した世界および地域の市場分析。

- 市場集中、ヒートマップ分析、主要プレーヤー、最近の動向を網羅した業界の状況と競争分析。

- 詳細な企業プロフィール。

マイクロファイナンスレポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2023年の市場規模 | 2,743億米ドル |

| 2031年までの市場規模 | 5,287億米ドル |

| 世界のCAGR(2023年~2031年) | 8.6% |

| 履歴データ | 2021-2023 |

| 予測期間 | 2023-2031 |

| 対象セグメント | プロバイダー別

|

| 対象地域と国 | 北米

|

| 市場リーダーと主要企業プロフィール |

|

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

よくある質問

The key players holding majority shares in the market are Bandhan Financial Services Pvt. Ltd.; CDC Small Business Finance Corp.; Cashpor Micro Credit; Grameen America Inc.; and KIVA.

The market is expected to reach US$ 528.7 billion by 2031.

The market was estimated to be US$ 274.3 billion in 2023 and is expected to grow at a CAGR of 8.6% during the forecast period 2023 - 2031.

Increased focus on social impact and sustainability is anticipated to play a significant role in the market in the coming years.

Shift from traditional loaning to microfinance and lower operating costs and reduced market risk are the major factors that propel the market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Bank Rakyat Indonesia (BRI)

- Annapurna Microfinance Pvt. Ltd.

- Bandhan Financial Services Pvt. Ltd.

- CDC Small Business Finance Corp.

- Cashpor Micro Credit

- Grameen America Inc.

- KIVA

- Madura Microfinance Ltd.

- Pacific Community Ventures

- ESAF Small Finance Bank

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

このレポートの無料サンプルを入手する

このレポートの無料サンプルを入手する