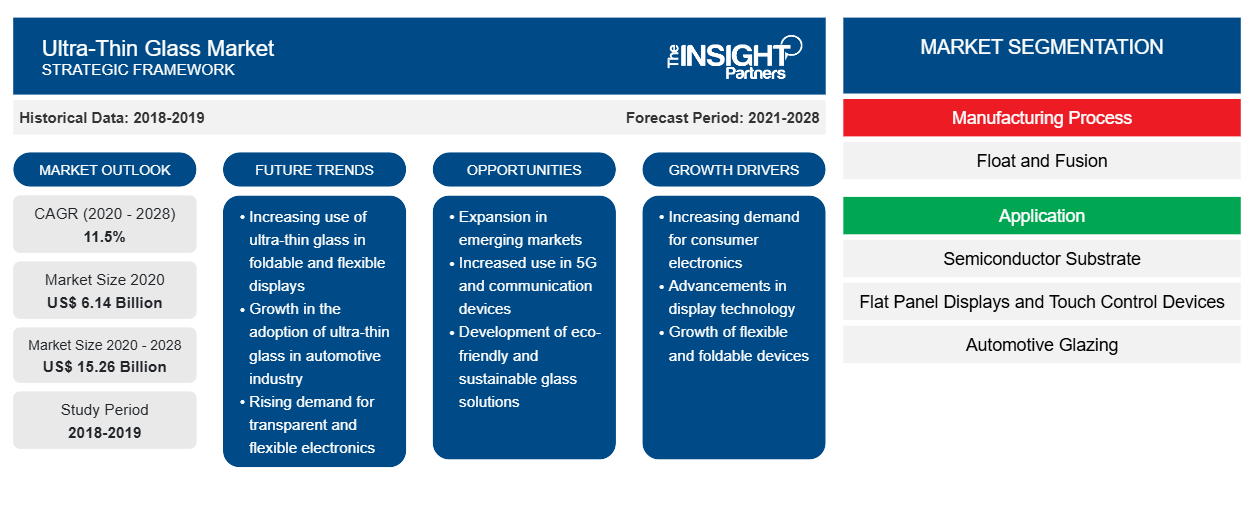

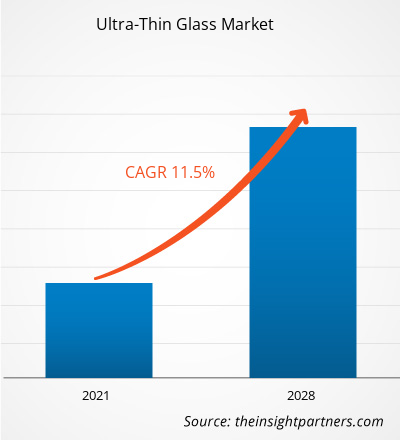

[調査レポート] 超薄型ガラス市場は2020年に61億3,956万米ドルと評価され、2028年には152億6,474万米ドルに達すると予測されており、2021年から2028年にかけて11.5%のCAGRで成長すると予想されています。

超薄板ガラスとは、厚さが1~2mm未満のガラスのことです。ハイテク用途に使用される超薄板ガラスの強化には、イオン交換による化学強化が一般的に使用されています。硬化した超薄板ガラスは傷がつきにくく、半径数ミリまで曲げることができます。耐腐食性、透明性、柔軟性、優れたガス・水バリア性、高い耐衝撃性などの超薄板ガラスの特性により、フラットパネルディスプレイ、自動車のガラスなど、さまざまな用途に適しています。2020年、アジア太平洋地域は世界の超薄板ガラス市場で最大の収益シェアを占めました。中国は超薄板ガラスの最大の消費国であり、アジア太平洋地域の市場シェアの50%以上を占めています。同国は、スマートフォンやLCDなど、あらゆる種類の消費者向け電子製品の主要な製造拠点です。

進行中のCOVID-19パンデミックは、化学品および材料セクターの状況を大幅に変え、超薄板ガラス市場の成長に悪影響を及ぼしました。新型コロナウイルスの蔓延に対抗するための対策の実施により、状況は悪化し、いくつかのセクターの成長に悪影響を及ぼしました。自動車や家電などの業界は、国境や国境の突然の閉鎖により、業務効率の急激な歪みやバリューチェーンの混乱により悪影響を受けています。いくつかのセクターの成長の低下は、世界市場における超薄板ガラスの需要に悪影響を及ぼしました。しかし、経済が事業の復活を計画しているため、今後数年間で超薄板ガラスの需要は世界的に増加すると予想されます。パンデミックにより、リモートワーク文化やオンライン教育の採用が拡大しています。そのため、ノートパソコン、スマートフォン、その他の通信機器などの製品の需要が高まっています。自動車や家電製品などさまざまな業界で超薄型ガラスの需要が拡大し、大手メーカーによる多額の投資も相まって、予測期間中に超薄型ガラス市場の成長が促進されると予想されます。

要件に合わせてレポートをカスタマイズする

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

- このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

市場分析

成長する家電業界

スマートフォン、ノートパソコン、テレビ、その他の電子製品などの電子機器の使用が増えているため、家電業界は活況を呈しています。家電製品は、テクノロジーの世界では必需品となっています。あらゆる世代の人々が、スマートフォン、スマートウォッチ、ノートパソコンに何らかの形で依存しています。家電業界の成長に伴い、メーカーは高度で高品質の製品の提供に継続的に注力しています。超薄板ガラスは、家電業界で重要な役割を果たしています。タッチパネル、ディスプレイパネル、センサー、カメラシステムに使用されています。耐腐食性、透明性、柔軟性、ガスバリア性など、超薄板ガラスのさまざまな特性により、家電業界のさまざまな用途に適しています。中国は、家電製品業界で優位に立っています。同国は、フラットパネルディスプレイの著名な製造国の一つです。中国製のスマートフォン、フィットネストラッカー、テレビ、その他の電子製品の需要が急速に増加しており、超薄板ガラスの製造業者に有利な機会を提供しています。中国は新しいインフラストラクチャの構築を強化しています。人工知能、産業インターネット、モノのインターネットの構築を推進し、5Gの商用化のペースを加速させ、電子情報製造業を新たな発展段階に押し上げ、関連産業のハイエンド開発をさらに促進しました。ワールドポピュレーションレビューによると、中国の携帯電話ユーザー数は16億人、インドの携帯電話ユーザー数は12億8千万人です。2018年、アップルはスマートウォッチを約2,250万台出荷しました。この数は2017年から増加しており、2017年には1,770万台を販売しました。2018年、フィットビットは約550万台のスマートウォッチを出荷し、サムスンは約530万台を出荷しました。このように、急速に成長する消費者向け電子産業は、超薄型メガネの需要を促進しています。

エンドユース産業の洞察

2020年、世界の超薄型ガラス市場では、民生用電子機器部門が最大のシェアを占めました。超薄型ガラスは、LCD、OLED、スマートフォン、ウェアラブルデバイスなど、さまざまなデバイス用のフラットパネルディスプレイやタッチパネルディスプレイなどの電子製品の製造に広く使用されています。世界中で革新的で技術的に高度な電子製品の需要が高まっているため、今後数年間で超薄型ガラスの需要が急増すると予想されています。

製造プロセスの洞察

製造プロセス別では、2020年の超薄板ガラス市場では、収益の面でフュージョンセグメントが優位を占めました。オーバーフローダウンドロー法とも呼ばれるフュージョンプロセスは、ディスプレイパネル用の平らな超薄板ガラスの製造に広く使用されています。コーニングは、空中に浮かぶ特殊なガラスを開発した最初の企業であり、これがフュージョン法の重要な特徴です。ガラスは溶融金属と接触しないため、フロートガラス法に対するフュージョン法の基本的な利点です。

超薄板ガラス市場で活動している主要な市場プレーヤーとしては、コーニング社、AGC株式会社、日本電気硝子株式会社、ショット社、セントラル硝子株式会社、CSGホールディングス株式会社、エマージグラス、日本板硝子株式会社、信義硝子ホールディングス株式会社、洛陽硝子株式会社などが挙げられます。市場の主要プレーヤーは、地理的プレゼンスと顧客基盤を拡大するために、合併や買収、新製品の発売などの戦略を採用しています。

超薄型ガラス市場の地域別分析

予測期間を通じて超薄型ガラス市場に影響を与える地域的な傾向と要因は、Insight Partners のアナリストによって徹底的に説明されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東、アフリカ、南米、中米にわたる超薄型ガラス市場のセグメントと地理についても説明します。

- 超薄型ガラス市場の地域別データを入手

超薄型ガラス市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2020年の市場規模 | 61.4億米ドル |

| 2028年までの市場規模 | 152.6億米ドル |

| 世界のCAGR(2020年 - 2028年) | 11.5% |

| 履歴データ | 2018-2019 |

| 予測期間 | 2021-2028 |

| 対象セグメント | 製造工程別

|

| 対象地域と国 | 北米

|

| 市場リーダーと主要企業プロフィール |

|

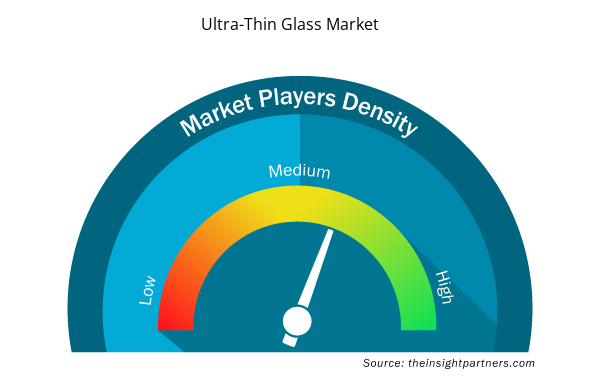

市場プレーヤーの密度:ビジネスダイナミクスへの影響を理解する

超薄型ガラス市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認識の高まりなどの要因により、エンドユーザーの需要が高まり、急速に成長しています。需要が高まるにつれて、企業は提供を拡大し、消費者のニーズを満たすために革新し、新たなトレンドを活用し、市場の成長をさらに促進しています。

市場プレーヤー密度とは、特定の市場または業界内で活動している企業または会社の分布を指します。これは、特定の市場スペースに、その規模または総市場価値と比較して、どれだけの競合相手 (市場プレーヤー) が存在するかを示します。

超薄型ガラス市場で事業を展開している主要企業は次のとおりです。

- コーニング株式会社

- AGC株式会社

- 日本電気硝子株式会社

- ショットAG

- セントラル硝子株式会社

免責事項:上記の企業は、特定の順序でランク付けされていません。

- 超薄型ガラス市場のトップキープレーヤーの概要を入手

レポートの注目点

- 超薄型ガラス業界の進歩的なトレンドは、プレーヤーが効果的な長期戦略を策定するのに役立ちます。

- 先進国市場と発展途上国市場での成長を確保するために企業が採用する事業成長戦略

- 2019年から2028年までの世界の超薄型ガラス市場の定量分析

- さまざまな業界における超薄板ガラスの需要予測

- ポーター分析は、業界で活動するバイヤーとサプライヤーが市場の成長を予測する有効性を示す

- 競争市場シナリオと超薄型ガラスの需要を理解するための最近の動向

- 超薄型ガラス市場の成長を牽引・抑制する要因と市場動向および展望

- 世界的な超薄板ガラス市場の成長に関する商業的関心を支える戦略を理解し、意思決定プロセスを支援する

- 市場のさまざまなノードにおける超薄型ガラスの市場規模

- 世界の超薄型ガラス市場の詳細な概要とセグメンテーション、およびその業界動向

- 有望な成長機会があるさまざまな地域の超薄型ガラス市場規模

超薄板ガラス市場(製造プロセス別)

- フロート

- 融合

超薄板ガラス市場、用途別

- 半導体基板

- フラットパネルディスプレイとタッチコントロールデバイス

- 自動車用ガラス

- その他

超薄板ガラス市場(最終用途産業別)

- 家電

- 自動車

- 医療とヘルスケア

- その他

企業プロフィール

- コーニング株式会社

- AGC株式会社

- 日本電気硝子株式会社

- ショットAG

- セントラル硝子株式会社

- CSGホールディングス株式会社

- エマージガラス

- 日本板硝子株式会社

- 信義ガラスホールディングス株式会社

- 洛陽ガラス株式会社

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

よくある質問

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. The rising demand for LED and OLED televisions is boosting the market growth across the region. Manufacturers of flat panel displays in China, South Korea, and Taiwan are dominating the global marketplace in terms of production and supply of flat panel displays. These displays can be found in cars, industrial equipment, personal computers, smartphones, and a variety of other goods. Liquid crystal displays are used in the majority of TV screens (LCDs). Other display types used in televisions include organic light-emitting diodes (OLEDs) and quantum dots. LCDs and OLEDs are used in smartphone displays. Thus, the high concentration of flat panel display manufacturers in Asia-Pacific, coupled with the high utilization of ultra-thin glass in designing flat panel displays, is the crucial factor anticipated to further drive the market in the coming years. Furthermore, the growing application of ultra-thin glass by automobile manufacturers in China, India, and South Korea is driving the market. China, as one of the significant producers of automobiles, has a high need for ultra-thin glass for use in various automotive interior panels. Furthermore, the existence of significant players such as AGC Inc. and Nippon Electric Glass Co., Ltd is projected to fuel the market expansion.

Based on end use, consumer electronics segment led the global ultra-thin glass market during the forecasted period. Consumer electronics is one of the prominent end-use industries contributing a major share in the growth of the ultra-thin glass market. Ultra-thin glass is widely used to manufacture electronic goods such as flat panel display devices, smartphones, wearable devices, and touch screen devices. It is extremely thin and flexible. Therefore, it is ideal for devices with wider displays and touch screen features. Moreover, it is used in microprocessors of smartphones as a substrate. Using ultra-thin glass in semiconductor substrates ensures the increased performance of microprocessors, which enables high data transfer rates. The growing utilization of ultra-thin glass in consumer electronic devices is expected to boost the market growth. Moreover, the rising demand for electronic gadgets such as smartphones, laptops, tablets, and televisions in emerging economies, owing to rise in disposable income, significant economic development, increase in adoption of emerging technologies, and improved lifestyles of people, is expected to boost the growth of global ultra-thin glass market in the coming years. Manufacturers of ultra-thin glass are focusing on launching innovative products. Recently, foldable ultra-thin glass was developed by Schott AG which is a Germany-based manufacturer of specialty glass products. This foldable glass was used by Samsung in its Z-fold 3 smartphone which is gaining huge popularity among people worldwide. Such innovations by the prominent manufactures of ultra-thin glass are expected to boost the consumer electronics segment’s growth.

On the basis of manufacturing process, fusion segment is leading the ultra-thin glass market during the forecast period. The fusion process, often known as the overflow downdraw method, is widely used to manufacture flat ultra-thin glass for display panels. Corning was the first company to create specialized glass that was suspended in mid-air, which is a key trait of the fusion method. Glass is not contacted by molten metal, which is a fundamental advantage of the fusion method over the float glass method. The raw materials, including pure sand and other inorganic elements, are fed into a massive melting tank that is heated to temperatures beyond 1000â° Celsius. The molten glass is homogenized and conditioned before being discharged into an isopipe, a huge collection trough with a V-shaped bottom. The isopipe is carefully heated to ensure optimum viscosity of the mixture and consistent flow. The molten glass flows uniformly over the isopipe's top edges, generating two thin, sheet-like streams along the outer surfaces. The two sheets meet at the bottom of the isopipe and are fused into a single glass sheet. As the sheet lengthens and cools in mid-air, it feeds into drawing equipment while still linked to the bottom of the isopipe. With precise control of the fusion glass process parameters, thinner glass panels can be produced. Commercial manufacturers such as Corning, Schott, AGC, and Nippon Electric Glass use the drawdown or fusion process for producing ultra-thin glass.

Based on application, flat-panel display segment is expected to grow at the fastest CAGR from 2021 to 2028. Flat panel displays are video devices that replace the conventional cathode ray tube (CRT) with a thin panel design. Ultra-thin glass is widely used to manufacture flat panel displays such as LCD, LED, OLED screens, smartphone displays, and monitor screens. Moreover, ultra-thin glass is used in the touch module of touch screen devices such as smartphones, tablets, and laptops. It provides fundamental functions for flat-panel display and touch screen devices such as high definition (HD) display, touch-control and scratch resistance, and protection to the screens. Consumer electronic goods are being upgraded at a faster rate as the technological landscape is changing rapidly. Panel display components used in flat-panel display and touch-control devices have emerged as the most important downstream application products for ultra-thin glass substrates with the highest market demand. The need for ultra-thin glass substrate is predicted to rise since it is a crucial component and key fundamental material for flat-panel display and touch-control systems. Moreover, ultra-thin glass substrates are non-substitutable and have a promising future as the entire electronic device market develops.

The major players operating in the ultra-thin glass market are Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; and Luoyang Glass Co., Ltd.

In 2020, Asia Pacific held the largest revenue share of the global ultra-thin glass market and is also expected to register the highest CAGR during the forecast period. The ultra-thin glass market across the region is projected to witness remarkable growth, owing to the rapidly expanding consumer electronics industry in countries such as China, Japan, and South Korea. China is one of the largest consumer electronics markets across the world, along with Japan and South Korea. Due to the high concentration of consumer electronics manufacturers in Asia-Pacific, the demand for ultra-thin glass from the manufacturers of electronic goods across the region is expected to grow significantly over the forecast period. Moreover, China and Japan are the leading exporters of semiconductor components used in electronic gadgets. Many leading manufacturers of smartphones and electronic gadgets heavily rely on Asia-Pacific countries for sourcing semiconductor components. For chip packing and interposer applications, the semiconductor industry is progressively designing products using thin glass substrates. When organic substrate materials are employed, the locally generated heat of the small core parts of mobile devices causes deflection and reliability issues. Ultra-thin glass has excellent dimensional stability over a wide range of temperatures while also providing the foundation for an exceedingly flat chip package. Thus, the increasing utilization of ultra-thin glass for designing electronic goods across the region is projected to potentially drive the market over the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Ultra-thin Glass Market

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

このレポートの無料サンプルを入手する

このレポートの無料サンプルを入手する