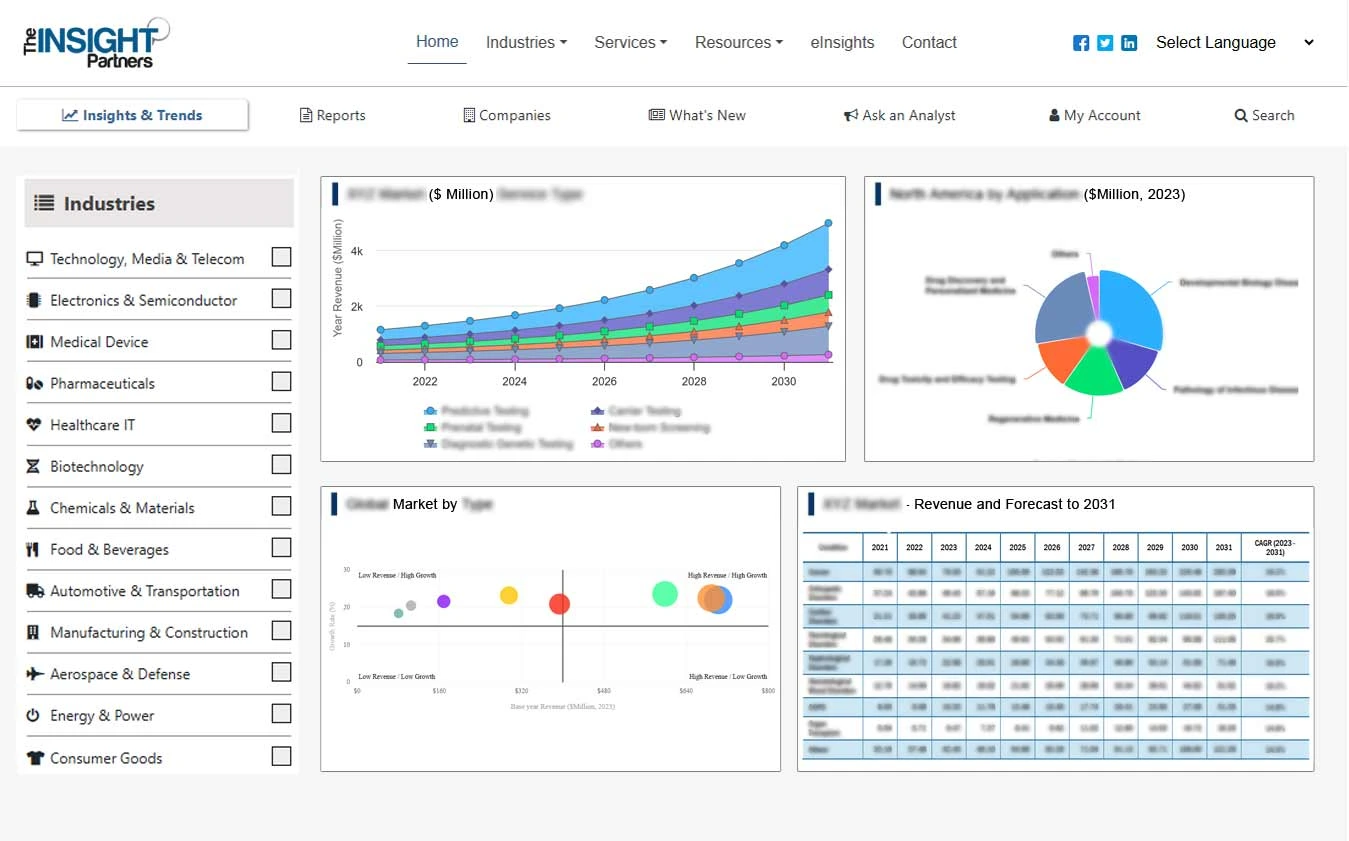

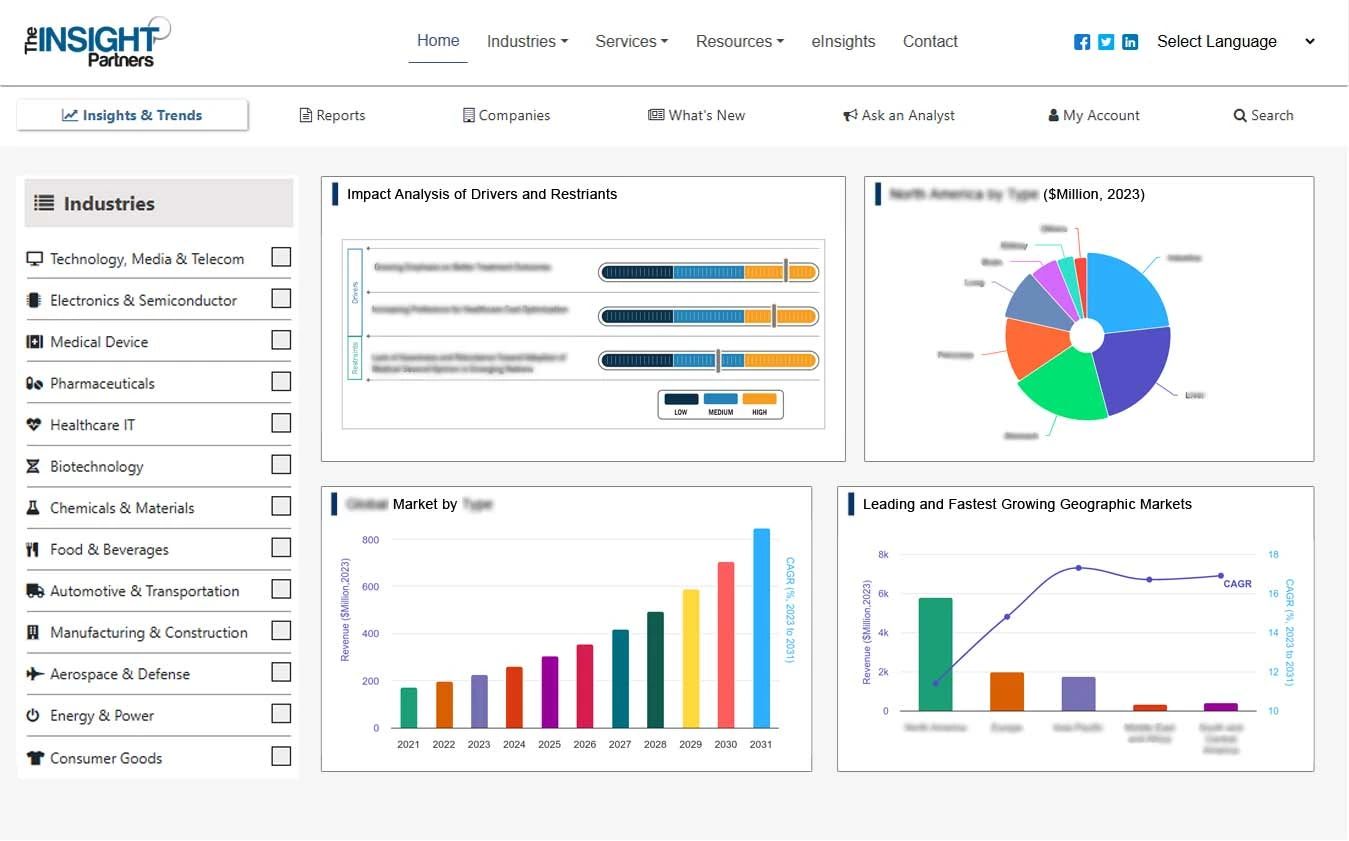

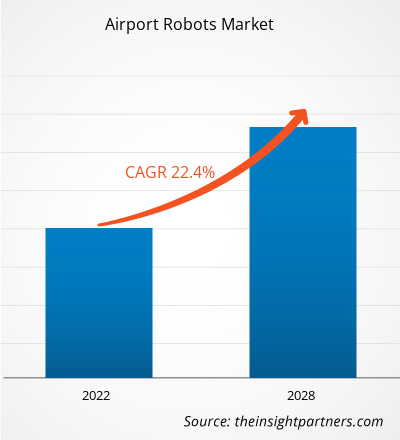

[연구보고서] 공항로봇 시장은 2021년 5억1256만달러에서 2028년 21억829만달러로 성장할 것으로 예상된다. 2021년부터 2028년까지 연평균 성장률(CAGR) 22.4%로 성장할 것으로 예상됩니다.

국가 안보에 대한 실질적인 위협과 인식된 위협이 증가함에 따라 이러한 위협을 식별하기 위한 혁신적인 적극적 심문 접근 방식을 마련하기 위한 지속적인 노력이 이루어지고 있습니다. 가장 즉각적으로 감지되는 위협과 그 필수 재료는 재래식 폭발물, 무기, 화학 작용제 및 밀수품으로 구성됩니다. 불확실한 사건을 예방하기 위해 전 세계 당국은 공항의 보안을 강화하기 위해 로봇을 비롯한 첨단 시스템을 배치하는 데 적극적으로 주력하고 있습니다. 공항 보안 애플리케이션에 사용되는 로봇에는 안면 인식 시스템, 센서, 카메라 등의 기능이 통합되어 원격으로 맥박수를 측정하여 의심스러운 사람, 화폐, 무기 및 폭발물, 버려진 물건 및 기타 불법 물질을 탐지하지 않고도 탐지할 수 있습니다. 공항에서 승객의 운영이나 흐름을 방해하는 행위. 또한, 다양한 국가의 정부는 신공항 건설을 비롯한 교통 인프라 개발에 투자하고 있습니다. 예를 들어 중국 정부는 2035년까지 215개의 공항을 추가로 건설할 계획이다. 또한 인도 정부는 2024년까지 전국에 100개의 신규 공항을 건설할 계획이다.

귀하의 요구 사항에 맞게 연구를 맞춤화하십시오

우리는 표준 제품을 통해 충족되지 않는 분석과 범위를 최적화하고 조정할 수 있습니다. 이러한 유연성은 비즈니스 계획 및 의사 결정에 필요한 정확한 정보를 얻는 데 도움이 됩니다.

공항 로봇 시장:

CAGR(2021~2028)22.4%- 시장 규모 2021년

US$ 5억 1256만 - 시장 규모 2028

US$ 2,108.29 백만

시장 역학

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

주요 선수

- (주)유진로봇

- 아비드봇(Avidbots)

- 사이버다인 주식회사

- 소프트뱅크 로보틱스

- 스탠리 로보틱스 SAS

- 시타

- ABB 주식회사

- ECA 그룹

- LG전자

지역 개요

- 북아메리카

- 유럽

- 아시아 태평양

- 남미 및 중미

- 중동 및 아프리카

시장 세분화

애플리케이션

애플리케이션- 랜드사이드/대리 주차 및 터미널

지리학

지리학- 북아메리카

- 유럽

- 아시아 태평양

- 중동 및 아프리카

- 남미 및 중미

- 샘플 PDF는 정성적, 정량적 분석을 통해 콘텐츠 구조와 정보의 성격을 보여줍니다.

COVID-19 전염병이 공항 로봇 시장에 미치는 영향

코로나19(COVID-19) 대유행과 그에 따른 봉쇄 조치는 제조 공정의 일시적인 중단으로 이어지면서 2020년 공항 로봇 시장에 미미한 영향을 미쳤습니다. 그러나 2020년 3분기부터 점진적으로 제조 공정이 재개되면서 공항 로봇에 대한 수요가 증가하기 시작했다. 따라서 제조업체는 전체 수익과 현금 흐름을 안정화할 수 있었습니다.

공항 로봇 시장 통찰력

첨단 로봇에 대한 수요 증가로 공항 로봇 시장 성장 촉진

OEM은 동급 최고의 첨단 로봇을 개발하기 위해 R&D에 투자해 왔습니다. 지난 10년 동안 공항에서 경험한 엄청난 일일 유동인구로 인해 공항에서는 다양한 운영을 최적화해야 했습니다. 이러한 운영을 단순화하기 위해 공항 로봇을 제공하는 많은 회사가 있기 때문에 공항에서는 노동력을 최적화하고 운영 성과를 향상하며 위험을 완화하고 여행자 경험을 개선하기 위해 자율 로봇을 채택하는 데 초점을 맞추고 있습니다. 결과적으로 많은 기업은 보안, 수하물 처리, 승객 안내, 청소 등의 응용 분야에 동급 최고의 첨단 로봇을 제공할 수 있는 로봇 공급업체와의 파트너십을 기대하고 있습니다.

애플리케이션 기반 시장 통찰력

공항 로봇 시장은 애플리케이션별로 지상/대리주차 및 터미널로 분류됩니다. 터미널 부문은 2020년 공항 로봇 시장을 주도했습니다. 공항 터미널은 승객이 착륙 시 도착하고 비행기를 타고 출발하는 공항의 건물입니다. 일반적으로 터미널에는 쇼핑, 식사, 화장실, 라운지 및 기타 시설로 가득 찬 중앙 홀이라는 구역으로 나누어진 여러 개의 게이트가 있습니다. 터미널에서 승객은 항공권 구매, 예정된 항공편 체크인, 수하물 확인 또는 수령, 보안 검색대 또는 세관 통과, 연결 항공편 검색 등을 수행할 수 있습니다.

공항 로봇 시장에서 활동하는 플레이어는 시장에서의 입지를 유지하기 위해 인수 합병 및 시장 이니셔티브와 같은 전략에 중점을 둡니다. 주요 플레이어의 몇 가지 개발 사항은 다음과 같습니다.

- 2021년 SITA는 프라하 바츨라프 하벨 공항에 차세대 승객 처리 인프라 설치를 완료했다고 발표하여 완전히 접촉이 적고 모바일화된 미래 승객 여행의 길을 열었습니다.

- 2020년에는 Stanley Robotics와 VINCI 공항이 건설한 로봇으로 완전히 운영되는 세계 최초의 야외 주차장 배치가 리옹 공항에서 계속 진행되며, 접근 가능한 주차 공간의 수가 500개에서 2,000개로 확장될 것으로 예상됩니다. 7대의 자율 로봇이 동시에 서비스를 운영할 예정이며, 28개의 캐빈에서 차량을 승하차할 수 있습니다.

공항 로봇 시장 보고서 범위

| 보고서 속성 | 세부 |

|---|---|

| 2021년 시장 규모 | 미화 5억 1,256만 달러 |

| 2028년까지 시장 규모 | 21억 829만 달러 |

| 글로벌 CAGR(2021~2028) | 22.4% |

| 과거 데이터 | 2019-2020 |

| 예측기간 | 2022년부터 2028년까지 |

| 해당 세그먼트 | 애플리케이션 별

|

| 해당 지역 및 국가 | 북아메리카

|

| 시장 리더 및 주요 회사 프로필 |

|

- 샘플 PDF는 정성적, 정량적 분석을 통해 콘텐츠 구조와 정보의 성격을 보여줍니다.

전 세계 공항 로봇 시장은 다음과 같이 분류됩니다.

공항 로봇 시장 – 애플리케이션별

- 랜드사이드/대리 주차

- 단말기

공항 로봇 시장 – 지역별

북아메리카

- 우리를

- 캐나다

- 멕시코

유럽

- 프랑스

- 독일

- 이탈리아

- 러시아

- 영국

- 유럽의 나머지 지역

아시아 태평양(APAC)

- 중국

- 인도

- 일본

- 호주

- 대한민국

- APAC의 나머지 지역

중동 및 아프리카(MEA)

- 사우디 아라비아

- UAE

- 남아프리카

- MEA의 나머지 부분

남미(SAM)

- 브라질

- SAM의 나머지 부분

회사 프로필

- (주)유진로봇

- 아비드봇(Avidbots)

- 사이버다인 주식회사

- 소프트뱅크 로보틱스

- 스탠리 로보틱스 SAS

- 시타

- ABB 주식회사

- ECA 그룹

- LG전자

- UVD 로봇

- 역사적 분석(2년), 기준 연도, CAGR을 포함한 예측(7년)

- PEST 및 SWOT 분석

- 시장 규모 가치/양 - 글로벌, 지역, 국가

- 산업 및 경쟁 환경

- Excel 데이터 세트

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

자주 묻는 질문

Original equipment manufacturers (OEMs) have been investing in research and development (R&D) to develop best in class and advanced robots. Enormous daily foot traffic experienced by airports over the last decade is compelling them to optimize various operations at airports. With many companies offering airport robots for simplifying these operations, = airports are shifting their focus on adopting autonomous = robots to optimize labor, enhance operational performance, mitigate risk, and improve traveler experiences. As a result, many of them are looking forward to partnering with robot suppliers that can offer the best in class advanced robots for applications such as security, luggage handling, passenger guidance, and cleaning. Moreover, airports are facing issues in terms of significantly rising labor costs as well as the shortage of qualified, experienced, and reliable employees. Thus, the burgeoning complexity of airport operations is resulting in overburdening of existing personnel, compelling them to make tradeoffs between the quantity and quality of their work, which might hamper their reputation. To address this issue, airports are switching toward more advanced and autonomous robots that not only reduce the burden on personnel, but also work more efficiently than humans, without facing the issues such as excessive workload and fatigue.

Developing countries have become a hub of opportunities for various markets, including airport robots market. Government authorities in these countries are planning and investing huge amount in the advancement of technologies to improve the overall infrastructure. Transportation and logistics activities are huge contributors to the development of any country, and therefore, developing countries are extensively focusing on enhancing and improving their transportation and logistics infrastructure, including air, road, and sea transport. Airways is an important mode of transportation; hence, governments of developing countries have planned development and revamping of various mid-size and large airports. For instance, in India, Netaji Subhas Chandra Bose International Airport in Kolkata has laid down expansion plan of the airport. Similarly, Vietnam is planning to build one of the largest airports near its economic hub Ho Chi Minh City. Other developing countries including the Philippines and Kuwait are also expanding and revamping airports. As a part of expansion and revamping strategy, these airports would also be passing tenders on acquiring technologically advanced equipment including robots for ensuring convenience and providing superior experience to passengers. Hence, the airport robot market players have huge opportunities to offer best-in-class, and highly reliable and cost-efficient robots for such new airport projects.

The terminal segment led the airport robots market with a share of 74.8% in 2020. It is further expected to account for 77.0% of the total market by 2028.

The airport robots market is led by terminal segment with highest share and is expected to dominate in the forecast period. An airport terminal is a building at an airport where passenger arrive upon landing and depart on a flight. Typically, terminals have several gates divided into sections known as concourses that are filled with shopping, dining, restroom, lounge, and other facilities. Passengers at terminals can purchase tickets, check in for the scheduled flight, check or collect luggage, pass through security or customs, find connecting flights, and others.

ABB Ltd; Cyberdyne Inc.; LG Electronics Inc.; SoftBank Corp.; and Stanley Robotics SAS are among the key companies with significant market share.

The overall cost of procuring and maintaining advanced robots is quite high, which limits their adoption at airport, especially in cost-sensitive countries. These robots require frequent maintenance and servicing, which adds to the overall operating cost of running an airport. Airport deploy a large number of such advanced systems for various operations, based on the size and the requirement of the airport, and with the multiple deployments, the overall procurement and maintenance cost increases further. Small airports, operating in developed and developing countries, therefore, resist deploying such high-end robots and rely on conventional practices. Considering this restraint, airport robot manufacturers need to focus on offering a range of robots, starting from low end to high end, without compromising on the incorporation of the necessary and vital features in the low- and mid-range robots. The COVID-19 pandemic has changed the ways of operations of various sectors, including the transportation sector and airport industry. Airport authorities are willing to deploy autonomous robots to, ultimately, meet the social distancing norms imposed by the respective governments; however, the initial costs and maintenance costs are limiting their investments in robotic solutions.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Airport Robots Market

- YUJIN ROBOT Co., Ltd.

- Avidbots Corp.

- CYBERDYNE INC.

- SoftBank Robotics

- Stanley Robotics SAS

- SITA

- ABB Ltd

- ECA Group

- LG Electronics

- UVD ROBOTS

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

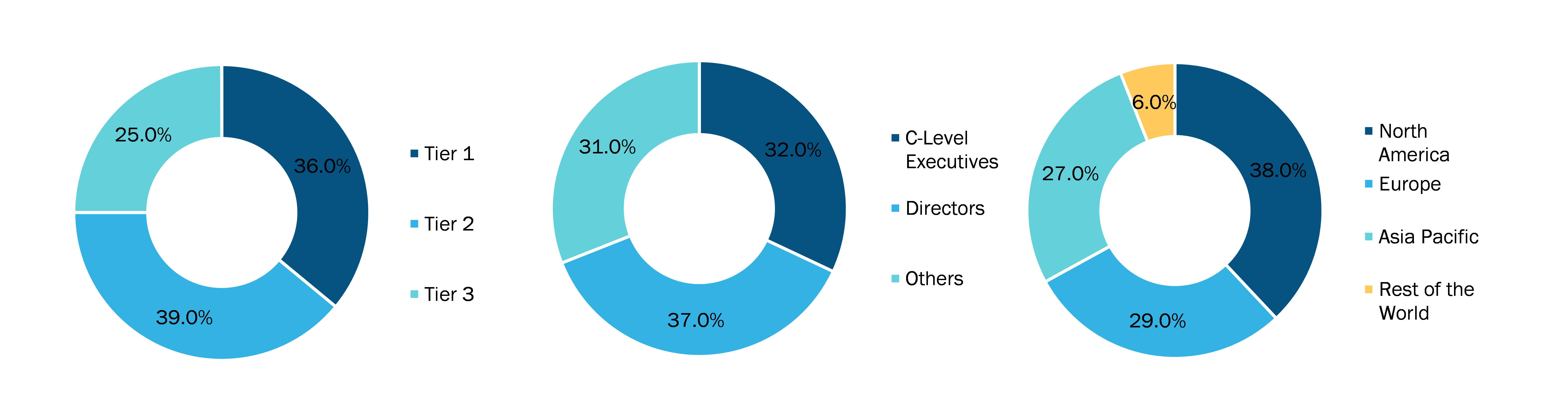

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

이 보고서에 대한 무료 샘플을 받으세요

이 보고서에 대한 무료 샘플을 받으세요