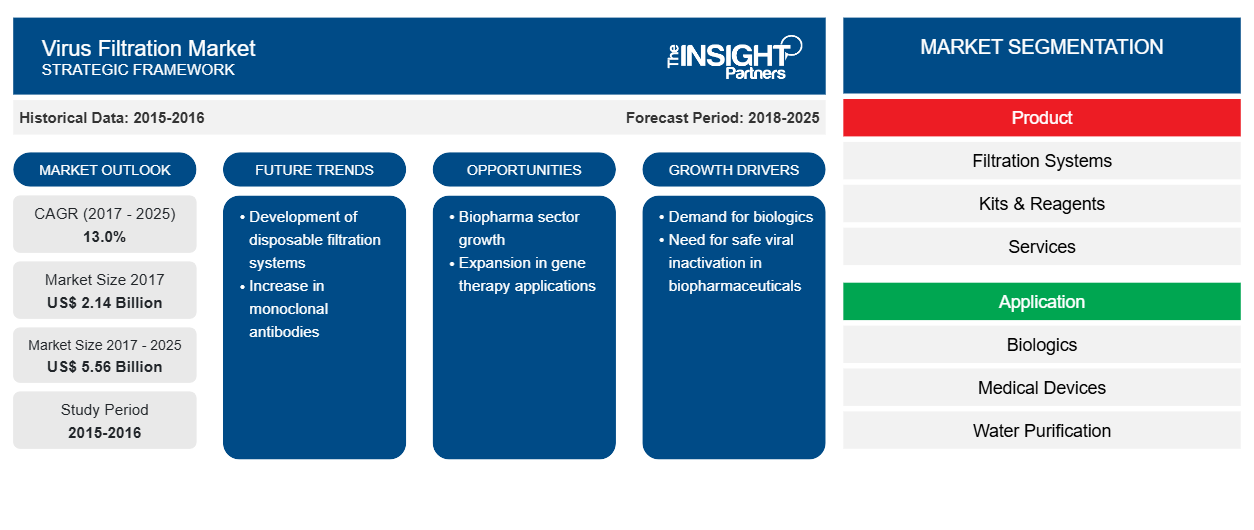

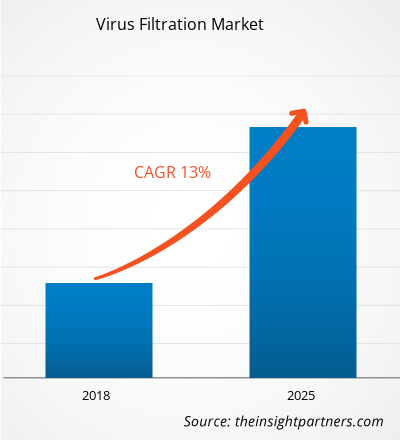

바이러스 여과는 여러 생물학 분야에서 응용되는 효과적인 바이러스 제거 기술입니다. 글로벌 바이러스 여과 시장은 2017년 2,139.4백만 달러에서 2025년까지 5,555.4백만 달러에 도달할 것으로 예상됩니다. 이 시장은 2018년에서 2025년 사이에 13.0%의 CAGR로 성장할 것으로 추산됩니다.

생물제약 산업은 만성 질환의 유병률 증가로 인해 최근 몇 년 동안 급속한 성장을 보였습니다. 소분자와 달리 생물학적 약물은 동물, 식물 및 합성 원료를 혼합하여 제형화됩니다. 일부 생물학적 치료제는 포유류 세포주 또는 인간 혈장을 사용하여 생산됩니다. 이 모든 것이 오염 가능성을 10배 증가시킵니다. 이러한 제품에서 바이러스로 오염될 위험은 위험하므로 규제 기관은 제조업체가 바이러스 오염 위험을 평가하고 이를 완화하기 위한 필요한 조치를 취하도록 명령했습니다. 바이러스 여과 시장은 위험을 피하고 규제 기관에서 정한 안전 기준을 준수하기 위해 생물제약 제품의 정제에 광범위하게 사용됩니다. 제약 회사는 바이러스 여과에 대한 투자를 늘렸는데, 이는 바이러스 여과가 생물제약 의약품의 안전에 기념비적인 역할을 할 것이기 때문입니다.

실험실에서 바이러스는 공기, 물, 검사 샘플을 쉽게 오염시킵니다. 따라서 바이러스 여과의 필요성은 필수적입니다. 지속적인 생물 처리가 mAb 생산에서 빠르게 추진력을 얻고 있으며, 더 작은 시설 면적, 낮은 투자 비용, 유연성, 공정 경제성과 같은 잠재적 이점을 제공합니다. 지속적인 하류 처리에서는 이 공정 중에 바이러스 여과에 의존합니다. 바이러스 여과 시장 방법은 멤브레인 장벽을 사용하여 바이러스 입자를 유지하여 오염 없는 환경을 유지합니다. 다양한 최종 사용자 수직 분야에서 사용되는 강력하고 신뢰할 수 있는 바이러스 제거 기술입니다. 글로벌 바이러스 여과 시장 성장은 생물학 및 생물 약품 제조 증가, 엄격한 규제 규범, R&D 및 아웃소싱 활동에 대한 투자 증가에 의해 촉진됩니다.

운전자

제약 및 생명공학 산업의 급속한 성장

제약 산업은 지난 몇 년 동안 엄청나게 발전해 왔습니다. 새로운 의약품, 첨단 치료법, 빠른 디지털화, 변화하는 규정에 대한 수요는 제조업체와 계약 연구 기관(CRO) 에 의료 문제를 제기합니다 . 세계보건기구(WHO)에 따르면, 세계 인구는 연간 1.24%씩 증가하고 있으며, 이로 인해 약물과 의약품에 대한 잉여 수요가 발생합니다. 제약 산업은 2017년까지 이전 추정치보다 30% 더 성장하여 상위 5대 산업 중 하나의 지위를 유지하고 세계 경제 가치를 높였습니다. 여러 제약 제조업체가 개발 도상국의 중산층 인구를 대상으로 저렴한 의약품을 생산합니다. 모든 새로운 약물 제형에는 알려지거나 알려지지 않은 바이러스 흔적을 제거하는 것을 평가하기 위한 필수 바이러스 제거 테스트가 함께 제공됩니다.

엄격한 규제 프레임워크

식품의약국(FDA), 유럽의약품청(EMA) 및 기타 주요 규제 기관은 제약 및 생명공학 산업의 발전을 지속적으로 추적하고 모니터링합니다. 제조업체는 최신 규정을 준수하여 현재의 우수 제조 관행(GMP) 및 우수 실험실 관행(GLP)을 따릅니다. 규정된 프로토콜에서 벗어나는 경우 해당 제조업체 또는 아웃소싱 조직의 임상 시험이 종료될 수 있습니다. 미국 FDA는 인간 세포주 또는 동물 유래 제품의 바이러스 안전성 평가와 관련하여 제약 회사에 대한 지침을 발표했습니다. 의료 관리 기관에서 시행하는 이러한 엄격한 규정은 약물 개발 프로세스 중에 바이러스 제거 테스트를 의무화합니다.

제약

바이러스 제거를 위한 대체 기술의 가용성

우연한 바이러스 제제는 생물학적 약물 생산에서 오염의 고유한 위험을 가지고 있습니다. 규제 기관은 이미 이러한 문제를 사전에 해결했습니다. 바이러스 여과의 성공은 적합한 방법에 대한 선호도에 달려 있습니다. 적합한 방법은 다양한 생물학적 및 임상적 요인의 함수입니다. 몇 가지 눈에 띄는 방법에는 낮은 pH 완충액 추가, 온도 유지 및 생물학적 처리 용액에서 바이러스를 불활성화하는 세제 처리가 있습니다. 이러한 실행 가능한 방법 중 바이러스 여과 기술은 용액을 오토클레이브를 통해 살균할 수 없는 경우에만 사용됩니다. 이는 여과에 대한 요구 사항을 중단하여 글로벌 바이러스 여과 시장의 성장을 방해합니다.

귀하의 요구 사항에 맞게 이 보고서를 사용자 정의하세요

이 보고서의 일부 또는 국가 수준 분석, Excel 데이터 팩을 포함하여 모든 보고서에 대한 사용자 정의를 무료로 받을 수 있으며 신생 기업 및 대학을 위한 훌륭한 혜택과 할인 혜택을 이용할 수 있습니다.

- 이 보고서의 주요 시장 동향을 알아보세요.이 무료 샘플에는 시장 동향부터 추정 및 예측까지 다양한 데이터 분석이 포함됩니다.

시장 세분화

제품별로

생물제약 공정에서의 높은 여과 수준은 세그먼트 우위를 지원합니다.

제품 기준으로 글로벌 바이러스 여과 시장은 여과 시스템, 키트 및 시약, 서비스 등으로 구분됩니다. 이 중 키트 및 시약 부문은 2017년에 상당한 시장 점유율을 차지했습니다. 실험실 규모의 테스트 및 생물제약 제조 중에 키트 및 시약은 재조합 단백질, 단일클론 항체 및 조직 추출물에서 바이러스를 효과적으로 제거합니다. 바로 사용할 수 있는 상업용 키트는 바이러스 DNA 정제, qPCR 및 면역학적 응용 분야에 특별히 사용됩니다. 이러한 키트의 멤브레인은 수용액 및 기질에서 특정 크기의 바이러스를 제거하도록 설계되었습니다. 특히, 키트와 시약은 전문 지식이 거의 없고 프로토콜이 간단하여 쉽고 안전합니다.

여과 시스템 부문은 2017년 글로벌 바이러스 여과 시장에서 두 번째로 큰 점유율을 차지했습니다. 이러한 여과 시스템은 일반적으로 파보바이러스나 단백질 코트를 함유한 다른 특정 유형을 제거하는 데 사용됩니다. 여과 시스템은 샘플의 단백질을 변성시키지 않기 때문에 다른 바이러스 제거 기술보다 유리합니다. 게다가 이러한 시스템은 총 처리량을 늘리고 전체 바이러스 여과 비용을 줄이는 데 도움이 됩니다. 그 결과, 의료 기기 제조 및 연구 절차 수립에 엄청나게 채택되고 있습니다.

응용 프로그램으로

여러 임상 시험을 실시하는 제약 회사들이 세그먼트의 시장 점유율을 확대합니다.

응용 프로그램에 따르면, 바이러스 여과 시장 도메인은 생물학, 의료 기기, 정수 및 공기 정화로 구분됩니다. 이 중 생물학 세그먼트는 2017년에 가장 큰 매출 점유율로 시장을 이끌었습니다. 생물학적 치료 요법에서 몇 가지 물질은 신체에서 자연적으로 이용 가능하거나 실험실에서 배양됩니다. 이러한 프로세스에는 바이러스 오염으로 이어지는 여러 가지 사례가 포함됩니다. 따라서 플라스마 유래 치료제와 관련된 바이러스 안전성은 규제 기관에 테스트 결과를 제출하기 전에 바이러스 제거 테스트를 통해 평가됩니다. 임상 시험을 위한 테스트를 수행하는 모든 제약 회사와 CRO는 향후 몇 년 동안 해당 세그먼트의 성장을 강화할 것으로 예상됩니다.

물 정화 부문은 예측 기간 내내 상당히 확대될 것으로 예상됩니다. 물 속의 장내 바이러스는 인간과 동물에게 심각한 건강 위험을 초래할 수 있습니다. 이들은 수생 환경에 대한 저항성이 매우 강하고 물 오염을 일으킵니다. 여과는 비용 효율적이고 투명한 방법으로, 우수한 살균 효과를 제공하고 바이러스가 물에서 번성하는 것을 방지합니다. 또한 대량의 물이 포함된 배양 배지에서 바이러스 항원을 정화하는 것도 필수적입니다. 물에서 바이러스체를 제거하면 최적의 예방 접종 결과를 얻을 수 있습니다.

지역 시장

북미는 바이러스 여과의 가장 큰 시장으로, 미국이 가장 큰 시장 점유율을 차지하고 있으며, 그 다음은 캐나다입니다. 생물제약 및 생명공학 기업, 주요 시장 참여자, 다양한 학술 및 연구 기관이 바이러스 여과 시스템에 대한 수요를 높여 북미의 글로벌 바이러스 여과 시장 성장을 더욱 자극했습니다.

유럽은 글로벌 바이러스 여과 시장에서 중요한 위치를 차지하고 있으며, 생물학 및 의약품에 대한 정부 및 민간 연구 자금 지원으로 인해 강력한 성장률을 기록할 것으로 예상됩니다. 또한, 혁신적인 기술의 출시는 유럽에서 이 시장 성장을 주도하는 주요 요인이 될 가능성이 높습니다. 독일은 대형 바이오 기술 기업, 첨단 연구 실험실, 연구 개발을 위한 막대한 자금 지원 덕분에 유럽에서 전 세계적으로 가장 큰 바이오 기술 허브입니다.

유럽과 북미에서 많은 발전이 목격되었습니다. 이것이 예측 기간 동안 이 지역에서 시장이 매우 잘 될 것으로 예상되는 이유일 것입니다.

아시아 태평양 지역에서 연구 센터와 정부 자금 지원이 증가하면서 이 지역의 시장 성장이 촉진되고 있습니다. 정부 기관은 젊은 연구자들의 참여를 늘리기 위해 보조금을 제공합니다.

중동 및 아프리카는 아랍에미리트(UAE), 사우디 아라비아, 남아프리카 공화국의 세 주요 국가로 구성되어 있습니다. 이 지역의 시장은 여러 연구 기관에서 수행한 광범위한 연구 프로젝트와 인프라의 가용성, 연구 시설에 의해 주도됩니다. 연구 개발, 의료 및 기술적으로 진보된 장치의 가용성에 대한 정부 이니셔티브는 바이러스 여과 시장의 성장을 촉진합니다. 남미 및 중미 바이러스 여과 시장은 최근의 기술 개발로 인해 성장했습니다. 저렴한 비용의 이점과 더 높은 작업 효율성은 제조 회사가 남미에 기반을 구축하는 주요 매력 포인트입니다.

주요 시장 참여자:

- MERCK KGAA(독일)

- Sartorius AG(독일)

- Danaher(Pall Corporation)(미국)

- Thermo Fisher Scientific Inc(미국)

- 제너럴 일렉트릭(미국)

- 찰스 강(미국)

- 우시 앱텍(중국)

- 론자(스위스)

- 아사히카세이(일본)

- 클린 셀(프랑스)

바이러스 여과 시장 지역 통찰력

Insight Partners의 분석가들은 예측 기간 동안 바이러스 여과 시장에 영향을 미치는 지역적 추세와 요인을 철저히 설명했습니다. 이 섹션에서는 북미, 유럽, 아시아 태평양, 중동 및 아프리카, 남미 및 중미의 바이러스 여과 시장 세그먼트와 지리에 대해서도 설명합니다.

- 바이러스 여과 시장에 대한 지역별 특정 데이터 얻기

바이러스 여과 시장 보고서 범위

| 보고서 속성 | 세부 |

|---|---|

| 2017년 시장 규모 | 21억 4천만 달러 |

| 2025년까지 시장 규모 | 55억 6천만 달러 |

| 글로벌 CAGR (2017-2025) | 13.0% |

| 역사적 데이터 | 2015-2016 |

| 예측 기간 | 2018-2025 |

| 다루는 세그먼트 | 제품별로

|

| 포함된 지역 및 국가 | 북아메리카

|

| 시장 선도 기업 및 주요 회사 프로필 |

|

바이러스 여과 시장 참여자 밀도: 비즈니스 역학에 미치는 영향 이해

바이러스 여과 시장 시장은 소비자 선호도의 변화, 기술 발전, 제품의 이점에 대한 인식 증가와 같은 요인으로 인해 최종 사용자 수요가 증가함에 따라 빠르게 성장하고 있습니다. 수요가 증가함에 따라 기업은 제품을 확장하고, 소비자의 요구를 충족하기 위해 혁신하고, 새로운 트렌드를 활용하여 시장 성장을 더욱 촉진하고 있습니다.

시장 참여자 밀도는 특정 시장이나 산업 내에서 운영되는 회사나 기업의 분포를 말합니다. 주어진 시장 공간에 얼마나 많은 경쟁자(시장 참여자)가 존재하는지 그 규모나 전체 시장 가치에 비해 나타냅니다.

바이러스 여과 시장에서 활동하는 주요 회사는 다음과 같습니다.

- 머크 KGaA

- 사르토리우스 AG

- 다나허(Pall Corporation)

- 써모 피셔 사이언티픽 주식회사

- 제너럴 일렉트릭

면책 조항 : 위에 나열된 회사는 어떤 특별한 순서에 따라 순위가 매겨지지 않았습니다.

- 바이러스 여과 시장 주요 업체 개요를 알아보세요

주요 개발 사항:

- 2018년 2월: Merck는 생물 반응기 오염 위험을 줄이기 위해 Viresolve Barrier 캡슐 필터를 출시했습니다. 이 캡슐은 세포 배양 배지에서 바이러스, 마이코플라스마, 박테리아를 제거합니다.

- 2017년 9월

:

Sartorius는 저울, 초순수 시스템, 수분 분석기 등의 실험실 기기를 제조하기 위해 괴팅겐에 새로운 시설 센터를 설립했습니다. - 2016년 9월: Pall Corporation은 중요한 제조 공정에서 작은 바이러스를 제거하는 Pegasus Prime 바이러스 제거 필터를 출시했습니다.

- 2016년 4월: 찰스 리버 연구소는 안전성 평가, 계약 개발 및 제조 서비스 분야의 선도적 공급업체인 WIL Research를 인수했습니다.

보고서 범위

글로벌 바이러스 여과 시장 조사 보고서는 시장 점유율, 규모, 추세 및 기회에 대한 자세한 통찰력을 제공합니다. 시장 변동에 영향을 미치는 동인과 제약의 역할에 대해 간략하게 설명합니다. 또한 산업 환경, 시장 개요 및 글로벌 비즈니스 분석이 미래의 비즈니스 투자를 결정하는 데 도움이 되도록 자세히 설명되었습니다. 최근 개발로 주요 시장 참여자가 강조되었으며 제품 출시, 확장 및 인수가 언급되었습니다.

- 역사적 분석(2년), 기준 연도, CAGR을 포함한 예측(7년)

- PEST 및 SWOT 분석

- 시장 규모 가치/양 - 글로벌, 지역, 국가

- 산업 및 경쟁 환경

- Excel 데이터 세트

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

자주 묻는 질문

The growth of the Virus filtration in market is attributed to the rising application of Virus filtration, launch of new virus filtration system, adoption of inorganic strategies by market players and rising demand for virus filtration technologies in biotechnology and pharmaceuticals.

The services segment is anticipated to witness the fastest growth rate of 14.9% during the forecast period, 2018 to 2025.

In 2017, the kits & reagents segment held a largest market share of 54.4% of the virus filtration market, by product. This segment is also expected to dominate the market in 2025 owing to increasing demand for kits and reagents in biotechnology and pharmaceutical companies.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Merck KGaA

2. Sartorius AG

3. Danaher (Pall Corporation)

4. Thermo Fisher Scientific, Inc.

5. General Electric

6. Charles River

7. Wuxi Apptec

8. Lonza

9. Asahi Kesai Corporation

10. Clean Cells

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

이 보고서에 대한 무료 샘플을 받으세요

이 보고서에 대한 무료 샘플을 받으세요