Rising Deliveries of General Aviation Aircraft and Helicopters Boosting Aircraft Brackets Market Growth

According to our latest study on "Aircraft Brackets Market Analysis and Forecast to 2031 – by Material, Aircraft Type, Application, and End Use," the market is expected to grow from US$ 324.2 million in 2023 to US$ 512.2 million by 2031; it is anticipated to record a CAGR of 5.9% from 2023 to 2031. The report includes growth prospects owing to the current aircraft brackets market trends and their foreseeable impact during the forecast period.

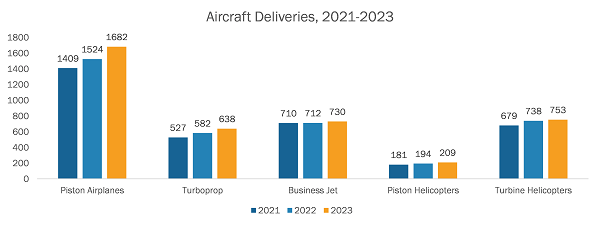

The rise in orders for general aviation aircraft and helicopters from airlines in 2022 and 2023 across the globe increased deliveries of these aircraft in 2023. As per the General Aviation Manufacturers Association (GAMA) data, 3,050 airplanes and 962 helicopters were delivered in 2023, with an increase of 9% and 9.8%, respectively, compared to 2022. In addition, the increase in backlogs for all segments of general aviation aircraft and helicopters is expected to further surge deliveries from 2023 to 2031. As per the data from GAMA, the number of deliveries of different types of general aviation aircraft and helicopters from 2021 to 2023 is shown in the figure below.

Aircraft Brackets Market Share — by Region, 2023

Aircraft Brackets Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Commercial Aircraft, General Aviation, Military Aircraft, and Helicopter), Application (Aircraft Fuselage, Aircraft Wings, Aircraft Control Surfaces, Engine, and Others), Material (Aluminum, Steel, and Others), End Use (OEMs and Aftermarket), and Geography

Aircraft Brackets Market Scope, Trends, and Size by 2031

Download Free Sample

Source: The Insight Partners Analysis

As per the data from GAMA, the deliveries of airplanes and helicopters have increased from 2021 to 2023, resulting in a rise in demand for aircraft brackets in applications such as wings assembly, engine mounts, fuel tanks, electrical wire installation, and landing gears.

The market, in terms of application, is categorized into aircraft fuselage, aircraft wings, aircraft control surfaces, and others. Based on material, the aircraft brackets market is segmented into aluminum, steel, and others. Based on aircraft type, the market is segmented into commercial aircraft, general aviation, military aircraft, and helicopter. The development in commercial and general aviation is anticipated to drive the application of aircraft brackets globally. The commercial aircraft segment held the largest aircraft brackets market share in 2023.

Commercial aircraft consist of narrow body aircraft, wide body aircraft, and regional aircraft. In a commercial aircraft, aircraft brackets are used in a wide range of applications, such as fuselage airframe assembly, landing gears, wings assembly, fuel tanks, engine mounts, and electrical wire installations. Boeing Commercial Airplanes, a business division of The Boeing Company, offers airplanes that deliver commercial aircraft to customers globally. There are over 10,000 Boeing commercial jetliners in operation, flying passengers and freight globally. Over 5,700 Boeing airplanes are currently on order, which is anticipated to drive the application of aircraft brackets in the commercial aircraft segment. In June 2024, Airbus' A330-900 flight-test aircraft – MSN1795 / F-WTTN flew to Toluca in Mexico and then to La Paz in Bolivia. The test was a part of the Airbus's high-altitude test campaign. Airbus is focusing on increasing production of the A350 and A330neo and is working on the potential launch of an A330neo-based freighter. Airbus supplied 735 commercial aircraft in 2023, which is an increase of ~11% from 2022. Airbus accounted for overall 2,319 orders of commercial aircraft, comprising 1,835 A320 Family and 300 A350 Family aircraft. In 2023, Boeing delivered a total of 528 aircraft, that includes 396 Boeing 737 jets and 73 Dreamliners. Additionally, in May 2024, IndiGo collaborated with Embraer, ATR, and Airbus to order approximately 100 smaller planes as it targets to widen its regional network. Thus, the continuous development in the commercial aircraft sphere is projected to contribute to the growing global aircraft brackets market size.

The scope of the aircraft brackets market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). APAC held the largest aircraft brackets market share in 2023 and is projected to maintain its dominance during the forecast period. North America is the second-largest contributor to the global aircraft brackets market, followed by Europe.

The US, Canada, and Mexico are the major economies in North America. The expansion of aircraft fleets across the region primarily drives the aircraft brackets industry in North America. Additionally, the growing aviation industry in countries such as the US and Canada drives the aircraft brackets market. The aviation industry is one of the most notable industries in the US. According to data released by Airlines for America in 2023, commercial aviation accounted for 5% of US GDP and US$ 1.25 trillion in 2022. In addition to the rise in air passenger traffic, government initiatives to increase aircraft fleets in defense and commercial aviation sectors are expected to fuel the demand for aircraft brackets during the forecast period.

According to The Insight Partners analysis, in 2023, North America had a fleet of more than 8,000 operational commercial aircraft, which is expected to reach ~10,000 by the end of 2033. Such a large number of operating commercial aircraft will further generate the demand for aircraft brackets in the region. Additionally, the increase in the number of aircraft fleets across North America is expected to increase the need for aircraft brackets for key aircraft components such as engines and airframes. Furthermore, the global aircraft brackets market size is expected to surge owing to the continued emphasis on increasing expenditure on maintenance and repair activities of various components. Thus, a rise in expenditure on maintenance and repair activities and aircraft fleet expansion is anticipated to propel the aircraft brackets market growth from 2023 to 2031.

Hexagon AB, Singapore Technologies Engineering Ltd, Legend Aerospace, RTP Company, Triumph Group Inc, Spirit AeroSystems Holdings Inc, Premium Aerotec GmbH, Hutchinson SA, Arconic Corp, SEKISUI Aerospace, Godrej & Boyce Manufacturing Co Ltd, Avantus Aerospace Inc, Precision Castparts Corp, Meena cast Pvt Ltd, and STROCO are among the key players profiled in the aircraft brackets market report. Companies in the aircraft brackets market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com