Rising Adoption from Application Sectors Bolsters Aramid Fiber Market Growth

According to our latest study on “Aramid Fiber Market Forecast to 2030 – Global and Regional Share, Trends, and Growth Opportunity Analysis – by Product Type and End-Use Industry,” the aramid fiber market size was valued at US$ 3.61 billion in 2022 and is expected to reach US$ 6.49 billion by 2030; it is estimated to register a CAGR of 7.6% from 2022 to 2030. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Aramid fiber, a class of synthetic fibers, is renowned for its exceptional strength, heat resistance, and lightweight properties. Derived from a combination of “aromatic” and “polyamide,” aramid fibers have a distinct molecular structure contributing to their remarkable performance. The two major types of aramid fibers are para-aramid fiber and meta-aramid fiber. Para-aramid fibers, such as Kevlar, are known for high tensile strength and impact resistance, making them suitable for applications such as ballistic armor and reinforcement in composites. Meta-aramid fibers, including Nomex, excel in thermal and flame resistance, finding use in protective clothing for firefighting and industrial workers.

In the aerospace & defense sectors, para-aramid fibers are widely utilized in the production of ballistic vests, helmets, and composite materials for aircraft structures. The high tensile strength and impact resistance of these fibers make them invaluable for enhancing protection without compromising on weight, a critical factor in aerospace applications. Aramid fibers are also extensively employed in various components to improve safety and performance in the automotive industry. They are used in the manufacturing of tires, brake pads, and other friction materials due to their resistance to abrasion and high temperatures. Additionally, these fibers contribute to reducing the weight of vehicles, promoting fuel efficiency and overall sustainability.

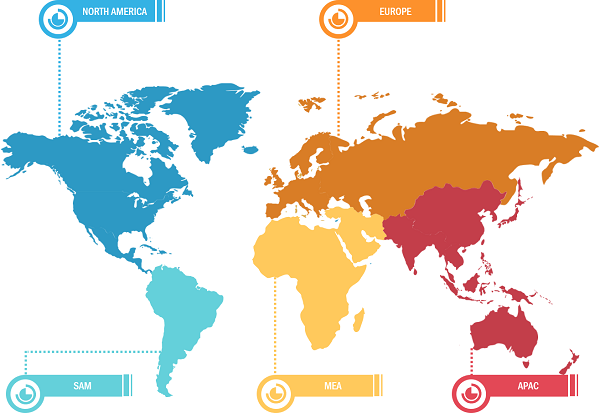

Aramid Fiber Market Breakdown – by Region

Aramid Fiber Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Para-Aramid Fiber and Meta-Aramid Fiber) and End-Use Industry (Safety & Protection Equipment, Aerospace, Automotive, Electronics & Telecommunication, and Others)

Aramid Fiber Market Overview and Forecast by 2030

Download Free Sample

The demand for aramid fiber is also growing due to increasing emphasis on miniaturization and lightweight design in electronic devices. Aramid fibers, known for their high strength-to-weight ratio, enable the production of lighter and more compact components without compromising structural integrity. This is particularly crucial in portable electronic devices, where weight reduction is a priority. These fibers also play a vital role in enhancing the mechanical performance and durability of electrical components. These fibers are used as reinforcing materials in applications such as flexible printed circuit boards (FPCBs) and connectors. Their high tensile strength and resistance to abrasion help prevent mechanical failure and extend the lifespan of these components, ensuring reliable performance in demanding electronic environments.

DuPont de Nemours Inc, Teijin Limited, Yantai Tayho Advanced Materials Company, Hyosung Corporation, Toray Industries Inc, Kolon Industries, Huvis Corporation, China National Bluestar (Group) Co Ltd, Taekwang Industrial Co Ltd, and Kermel SAS are among the players operating in the global aramid fiber market. The market players focus on providing high-quality products to fulfill customer demand.

Impact of COVID-19 Pandemic on Aramid Fiber Market

Before the onset of the COVID-19 pandemic, the aramid fiber market was experiencing steady growth, driven by the increasing demand across various industries. The automotive sector, in particular, was a significant contributor to the rising demand for these fibers. The pandemic-induced disruptions in supply chains and manufacturing processes have posed challenges for the market. The implementation of lockdowns and restrictions on movement to curb the spread of the virus led to a slowdown in production activities across industries. This directly affected the demand for these fibers, particularly in sectors such as automotive and aerospace, which experienced a decline in manufacturing and sales. As these industries are major consumers of these fibers, the overall market witnessed a contraction. Moreover, the uncertainty in global economic conditions during the pandemic prompted many companies to reevaluate their budgets and investment plans. This cautious approach further contributes to a dip in the demand for these fibers as end users postpone or scale back projects. The construction industry, another significant consumer of aramid fiber, also faced setbacks due to project delays and disruptions in the supply chain. On the positive side, the pandemic highlighted the importance of certain applications where these fibers play a crucial role, such as protective gear and medical equipment. The demand for personal protective equipment (PPE) surged, leading to increased usage of aramid fibers in the production of masks, gloves, and other protective gear.

In 2021, the economies started reviving as various industries resumed business activities. As a result, several industries, including aerospace & defense, automotive, and electrical & electronics, showed signs of recovery in their operations. As the global economy gradually recovers from the impact of COVID-19, the aramid fiber market is expected to rebound, driven by the resumption of stalled projects, increased investments in infrastructure, and the ongoing emphasis on safety and protection.

The report includes the segmentation of the aramid fiber market as follows:

The global aramid fiber market is segmented on the basis of product type, end-use industry, and geography. Based on product type, the market is segmented into para-aramid fiber and meta-aramid fiber. On the basis of the end-use industry, the market is bifurcated into safety & protection equipment, aerospace, automotive, electronics & telecommunication, and others. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The North America market is further segmented into the US, Canada, and Mexico. The market in Europe is sub-segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The market in the Middle East & Africa is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The South & Central America market is sub-segmented into Brazil, Argentina, and the Rest of South & Central America. On the basis of geography, Asia Pacific emerged as the dominant player in the aramid fiber market, holding the largest share, owing to several key factors that shaped the region’s industrial landscape. The robust growth of end-use industries such as automotive, aerospace, and electronics plays a pivotal role. Countries such as China, Japan, and South Korea are the major manufacturing hubs for these industries, driving substantial demand for these fibers in the production of lightweight and high-performance components.

The growing emphasis on infrastructure development in Asia Pacific further fuelled the demand for aramid fibers. These fibers found applications in construction materials, reinforcing concrete, and asphalt to enhance the durability and resilience of structures. As urbanization and industrialization accelerated in the region, the construction industry became a significant consumer of aramid fiber.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com