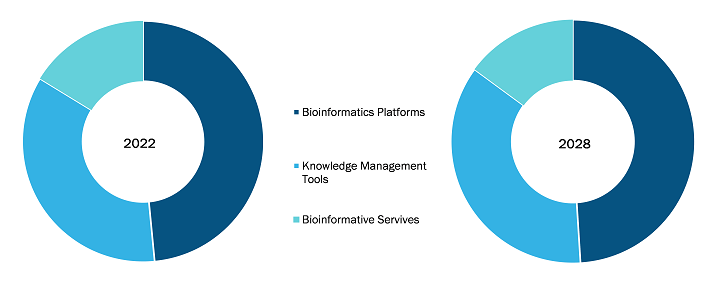

Bioinformatics Platforms Segment to Account for Largest Share in Bioinformatics Market During 2022–2028

According to our latest study on "Bioinformatics Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product, Application, and Sector," the market is expected to grow from US$ 12,609.39 million in 2021 to US$ 34,749.78 million by 2028; it is expected to grow at a CAGR of 15.7% from 2022 to 2028. The report highlights the key factors driving the market and prominent players with their developments in the market.

Based on product, the global bioinformatics market is segmented into bioinformatics platforms, knowledge management tools, and bio informative services. The bioinformatics platforms segment is likely to account for the largest market share during 2022–2028. In terms of application, the market is segmented into genomics, proteomics, chemoinformatics & drug design, transcriptomics, metabolomics, and others. The genomics segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period. Based on sector, the market is segmented into medical biotechnology, animal biotechnology, agricultural biotechnology, academics, environmental biotechnology, forensic biotechnology, and others. The medical biotechnology segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period.

In the field of genetics and genomics, bioinformatics aids in sequencing and annotating genomes. Bioinformatics plays a key role in the analysis of gene and protein expression and regulation. Bioinformatics tools aid in the comparison of genetic and genomic data and, more generally, in the understanding of evolutionary aspects of molecular biology. The role of human genomics research and related biotechnologies has the potential to achieve several public health goals, such as reducing global health inequalities by providing developing countries with efficient, cost-effective, and robust means of preventing, diagnosing, and treating major diseases that burden their populations. Currently, cancer treatment is also set to gain from genomic information to predict how an individual responds to drugs. Private and public initiatives across multiple countries are generating and collecting human genomic data and are evolving rapidly. Since 1990, the cost of sequencing a whole genome dropped from US$ 2.7 million to as low as US$ 300, opening new opportunities to build repositories of genomic data. By the start of 2020, there were 187 genomic initiatives globally, of which 50% originated in the US and 19% in Europe. Thirty-eight million genomes were analyzed using techniques ranging from genotyping to whole genome sequencing, which is expected to grow to 52 million by 2025.

The bioinformatics market witnessed a positive impact due to increased demand for COVID-19 detection kits during the pandemic. At the biological level, SARS-CoV-2 and COVID-19 research involves high-throughput technologies, such as next-generation sequencing for detecting the genome of SARS-CoV-2, databases storing SARS-CoV-2 genomes and variants, and bioinformatics software tools and databases for analyzing and storing host-virus interactions. At the medical level, the search for therapeutic strategies, the identification of COVID-19 biomarkers, the discovery of therapeutic targets for drugs, and the bioinformatics approaches for drug repurposing, i.e., the use of already available drugs for the COVID-19 disease, were the main research themes, which further escalated the market growth. Moreover, there has been an increase in the use of synthetic gene-based technologies for studying SAR-CoV-2 virulence and facilitating vaccine development.

Agilent Technologies, Inc; Biomax Informatics Ag; Bruker Corporation; Dassault Systems; Eurofins Scientific; Geneva Bioinformatics; Illumina; Perkinelmer; Qiagen; and Thermofisher Scientific, Inc. are among the leading companies operating in the global bioinformatics market.

Global Bioinformatics Market, by Region, 2022 (%)

Bioinformatics Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product (Bioinformatics Platforms, Knowledge Management Tools, and Bio Informative Services), Application (Genomics, Proteomics, Chemoinformatics & Drug Design, Transcriptomics, Metabolomics, and Others), and Sector (Medical Biotechnology, Animal Biotechnology, Agricultural Biotechnology, Academics, Environmental Biotechnology, Forensic Biotechnology, and Others)

Bioinformatics Market Size and CAGR by 2028

Download Free Sample

Various organic and inorganic strategies are adopted by companies operating in the global bioinformatics market. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios. A few significant developments by key players in the global bioinformatics market are listed below.

- In April 2022, Illumina, Inc. a global player in DNA sequencing and array-based technologies—announced the launch of its new state-of-the-art Solution Center in São Paulo, Brazil. The choice to bring the facility to Brazil reflects an increasing demand for and interest in clinical genomics, as well as Illumina's longstanding commitment to expanding global access to genomics in Latin America.

- In October 2021, QIAGEN announced the completion of the move of its European Center of Excellence for Precision Medicine into facilities in Manchester's CityLabs 2.0, a new genomics campus developed with Health Innovation Manchester. The new center will anchor this world-leading genomics campus in the heart of Manchester's health-innovation district and underline the city's role as QIAGEN's global hub for diagnostics development, a crucial element of the company's global success.