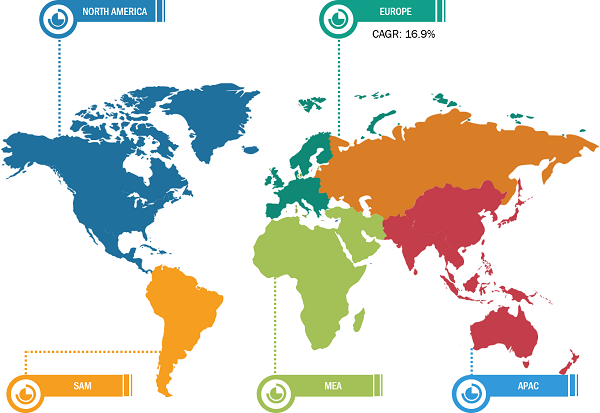

Europe, by Region, Dominated BIPV Glass Market in 2023

According to our latest market study on “BIPV Glass Market Forecast to 2030 – COVID-19 Impact and Global Analysis – by Material, Glazing Type, Component Type, and End Use,” the market was valued at US$ 4.63 billion in 2023 and is projected to reach US$ 17.62 billion by 2031; it is anticipated to record a CAGR of 18.2% from 2023 to 2031. The report highlights key factors driving the BIPV glass market growth and prominent players along with their developments in the market.

In 2023, Europe dominated the BIPV glass market share. The market growth in Europe is attributed to the growing green construction sector. The rising adoption of BIPV glass owing to its advantages and government initiatives promoting sustainable construction practices boost the Europe BIPV glass market. Countries such as France, Germany, and Luxembourg have strict regulations regarding incentives for photovoltaic (PV) buildings. This has accelerated the adoption of BIPV in these countries. Moreover, there is a growing interest in architectural solar applications in Europe. Architects are increasingly considering including BIPV glasses in designs to add value to their buildings and comply with new regulations. In the region, BIPV adoption is also being driven by regulations requiring new-build and renovated homes and offices to be as energy-efficient as possible. A growing number of architects and developers are resorting to BIPV components, including PV-integrated tiles and PV glass with crystalline or thin-film technology, for design and aesthetic reasons, which is driving the BIPV glass market in Europe.

Global BIPV Glass Market Breakdown – by Region

BIPV Glass Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Crystalline Silicone, Amorphous Silicone, and Others), Glazing Type (Single Module and Double Module), Component Type (BIPV Glass Roofs, BIPV Glass Facades, and Others), End Use (Residential, Commercial, Industrial, and Others)

BIPV Glass Market Dynamics and Analysis by 2031

Download Free Sample

In addition to policies and incentives to encourage green and renewable technology development and usage, two policy programs that have been instrumental to BIPV development and implementation in Europe are BIPVBOOST and PVSITES. BIPVBOOST is an Innovation Action at the European level, funded under the Horizon 2020 program. This aims to reduce the cost of multifunctional BIPV systems by 75% in 2030, limiting the additional cost with respect to traditional, non-PV construction solutions and non-integrated PV modules. Furthermore, a group of companies is taking part in Enabling Massive Integration of PV into Buildings and Infrastructure, a four-year initiative dubbed MASS-IPV. The project was kicked off in November 2023 to improve the penetration of BIPV in the global solar market. This project received funding from the European Union’s Horizon Europe program and is coordinated by Fraunhofer ISE. Such research projects are expected to provide opportunities for the BIPV glass market in Europe during the forecast period.

France is one of the most developed economies in the world and ranks at the top worldwide in terms of the BIPV glass market share. France is home to eco-friendly and some of the most innovative buildings in the world. The country has made significant efforts to reduce the environmental impact of its buildings with a focus on sustainable architecture, environmentally friendly construction, and green building practices. The government of France has also been at the forefront of promoting sustainable development and green building practices. The country's commitment to promote sustainable building practices has resulted in a flourishing market for green buildings, with the nonresidential segment leading the way. Thus, the growing market for green buildings in France fuels the BIPV glass market expansion.

Further, France has established various initiatives to encourage sustainable construction. The country incentivizes the use of solar heating in buildings through grants for installation, promoting energy efficiency and environmental sustainability. By using solar energy, buildings can decrease dependency on fossil fuels and minimize their carbon footprint. The grants encourage businesses and individuals to adopt solar heating systems, positively impacting both the environment and energy consumption. Thus, the progressive green construction industry contributes to the growing BIPV glass market size in France.

The BIPV glass market in Germany is one of the major markets in Europe, owing to the presence of a large number of photovoltaic (PV) companies that are engaged in BIPV product production. In Germany, there is a growing interest in the integration of photovoltaics into roofs and building facades. The strong incentives and policies in Germany are crucial to the expansion of the BIPV system business. The rising climate change concerns in the country have resulted in increasingly stringent energy efficiency requirements for buildings. This has resulted in growing interest from architects, building designers, and developers in the BIPV systems, including BIPV glass. The country's 'Buildings Energy Act (GEG),' which has been in force since 2020, stipulates renewable energy use and energy efficiency in the building sector. In Germany, public subsidies are available for building retrofits and new construction. The country also offers financial support to improve energy efficiency in buildings and use of renewable energy through the 'Federal Funding for Efficient Buildings.' All these factors positively impact the BIPV glass market growth in Germany.

The BIPV glass market trends include the rising adoption rate of renewable energy. Emerging economies such as Asia Pacific, the Middle East & Africa, and South & Central America are proactively accelerating the adoption of renewable energy. Investments in setting up solar energy capacity in countries such as Brazil, China, India, Indonesia, the Philippines, and Turkey have increased in recent years. In September 2021, Zhejiang-based China Southeast Space Frame Group (SSFG), a manufacturer of large-sized steel structures, and EVA & backsheet manufacturer ’First PV’ set up a joint venture to develop building-integrated photovoltaic (BIPV) projects across China. This venture is expected to deploy up to 950 MW of BIPV system in the next five years. The BIPV installation of this company is specified to government buildings, hospitals, schools, exhibition centers, and other public buildings. According to the International Renewable Energy Agency (IRENA), Brazil ranked for the first time on the list of the top ten countries with the highest accumulated installed capacity of photovoltaic solar. As per the data published by the Brazilian Solar Photovoltaic Energy Association (ABSOLAR), the new investments in the photovoltaic sector could exceed US$ 7.8 billion in 2024. The solar photovoltaic sector is expected to generate more than 281,600 new jobs in 2024 across all regions of Brazil. The solar photovoltaic developers in the country are expected to install more than 9.3 GW of solar capacity in 2024, which includes small and medium-scale systems such as roofs, building facades, and ground-mounted units and utility-scale systems such as large-scale plants, reaching a cumulative total of over 45.5 GW. In January 2024, Arctech, a leading solar tracking, racking, and BIPV solutions provider, entered a strategic partnership agreement with Alpon Energy in Istanbul, Turkey. The agreement will lead to the expansion of BIPV solutions in Turkey, which will result in the growth of the BIPV glass market in Turkey in the future. Moreover, in 2022, India ranked second behind China in the US Green Building Council's (USGBC) list of the top 10 Countries and Regions for LEED certification. India awarded LEED certification to 323 projects last year, covering more than 10.47 million gross area square meters (GSM) of space—an increase of more than twice the number of projects in 2021. BIPV glass is meant to be a substitute for traditional construction materials. Thus, the shift in trends toward the adoption of renewable energy solutions by developing nations is expected to boost the global BIPV glass market in the future.

The BIPV glass market analysis is carried out by identifying and evaluating key players in the market across different regions. Koch Industries Inc, AGC Inc, Nippon Sheet Glass Co Ltd, Vitro SAB de CV, Onyx Solar Group LLC, MetSolar, Mitrex, Roofit.Solar, Grenzebach Envelon GmbH, and Hanergy Holding Group Ltd. are among the key players profiled in the BIPV glass market report.

The BIPV glass market involves the segmentation of the market based on:

Based on material, the BIPV glass market is segmented into crystalline silicone, amorphous silicone, and others. By glazing type, the market is bifurcated into single module and double module. The BIPV glass market, based on component type, is segregated into BIPV glass roofs, BIPV glass facades, and others. On the basis of end use, the market is segmented into residential, commercial, industrial, and others. The scope of the BIPV glass market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com