Increasing Popularity of Convenience and Ready-To-Eat Products Bolster Bread Market Growth

According to our latest study on “Bread Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Type, Nature, Category, and End Use,” the market size is expected to grow from US$ 249.27 billion in 2024 to US$ 330.81 billion by 2031; the market is estimated to register a CAGR of 4.1% from 2024 to 2031. The report highlights key factors driving market growth and prominent players along with their developments in the market. Apart from the growth in drivers, the report covers the bread market trends and their foreseeable impact during the forecast period.

Companies in the global bread market are experiencing a surge in demand due to the increasing preference for convenience and ready-to-eat products. The strikingly hectic lifestyle of consumers, along with the need for quick and simplified meal solutions, has led to a significant rise in bread consumption. Convenience-driven factors such as ease of preparation, longer shelf life, and portability make bread popular among individuals. Additionally, the availability of a wide variety of bread options, including loaves, sandwich bread, baguettes, and burger buns, caters to consumers with diverse preferences and dietary requirements.

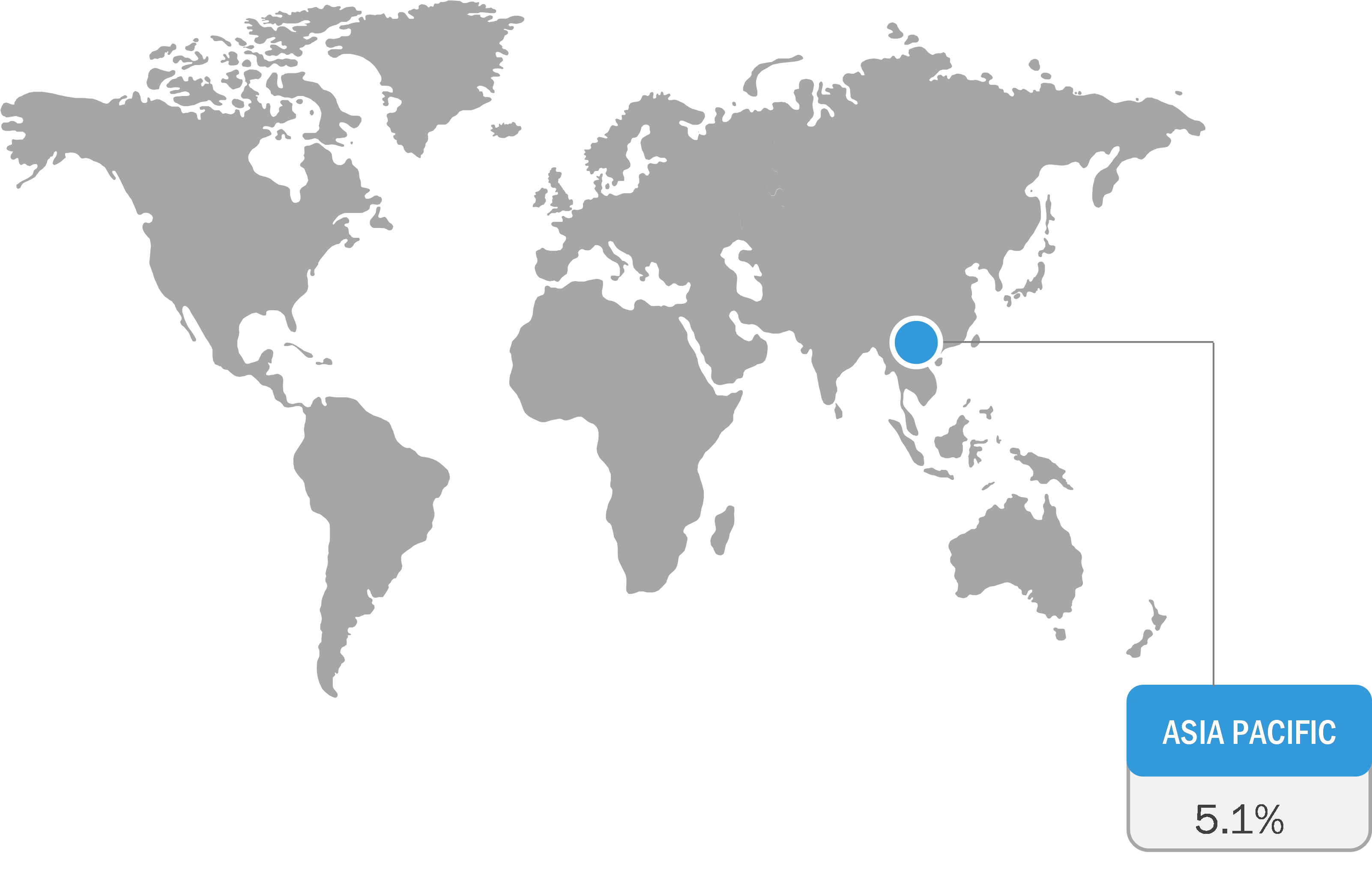

Bread Market Breakdown – by Region

Bread Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Sandwich Bread, Brioche Buns, Ciabatta Rolls, Baguettes, Panini and Focaccia Bread, Hamburger Buns, Hotdog Buns, and Others), Nature (Gluten-Free and Conventional), Category (Frozen and Ambient, and Refrigerated), End Use [Retail and Foodservice (Cafes, Quick Service Restaurants, Fast Casual Restaurants, and Others)], and Geography

Bread Market Drivers and Trends by 2030

Download Free Sample

Ready-to-eat products such as bread save the effort and time spent on food preparation and provide the convenience of storage. According to the "2023 Food and Health Survey" conducted by the International Food Information Council in 2023, out of 1,022 American participants (aged 18–80), 61% chose convenience as a major factor impacting their food-buying decisions in 2023; the reported share was 56% in 2022. Preprocessed food allows consumers to save time and effort associated with food preparation and reduces baking time. As a result, bakeries and bread manufacturers recorded a spike in their sales, which further encouraged them to expand their product offerings to cater to changing consumer preferences. Thus, the increasing demand for convenience and ready-to-eat products significantly contributes to the growth of the global bread market. As the market evolves, manufacturers are likely to innovate further to meet the changing needs and preferences of consumers in the coming years as well.

The bread market analysis has been performed by considering the following segments: type, nature, category, and end use. In terms of type, the market is segmented into sandwich bread, brioche buns, ciabatta rolls, baguettes, panini and focaccia bread, hamburger buns, hotdog buns, and others. The sandwich bread segment held the largest bread market share in 2024. This segment primarily includes soft, sliced bread and bread loaves used for making sandwiches, toast, and other quick meals, making it a staple in households, cafes, and quick service restaurants (QSRs). Its popularity stems from its adaptability to different flavors, fillings, and culinary applications, ensuring consistent demand. The attractiveness of sandwich bread is attributed to its ability to cater to diverse consumer preferences, as it is usually available in plain, whole-grain, multigrain, and gluten-free options. Additionally, manufacturers focus on offering innovative, fortified versions enriched with vitamins, minerals, and fibers to align with the surging demand for functional and healthier food options. Thus, the versatility, convenience, and nutritional profile of different types of bread drive the bread market growth.

Based on nature, the market is bifurcated into gluten-free and conventional. The gluten-free segment is expected to register a higher CAGR during the forecast period. Gluten-free bread is combined with white rice flour, tapioca starch, and soy flour to replace traditional wheat-based ingredients. Bread manufacturers are focused on expanding their product portfolios with the addition of gluten-free products to attract a broader consumer base by including individuals who might be allergic to gluten or those who want to cut down their gluten intake. In addition, gluten-free bread allows individuals to indulge in a range of baked treats without the need for meticulous baking preparations.

Europe dominated the bread market share in terms of revenue in 2024. A rise in the working population and dual-income families promotes the consumption of processed foods such as bread in Europe. For instance, Eurostat reported that ~75.3% of the population in the region was working professionals in 2023. The strong presence of the retail sector and inclination toward online shopping further contribute to the demand for bread in Europe. As part of strategic investments, companies are expanding their production capacities to meet elevating consumer demands. Moreover, with the growing demand for specific ingredients incorporated in bread categories, coupled with the increased spending on premium and nutritious food products, manufacturers are introducing innovative bread products, such as gluten-free, organic, fortified, and premium bread, to cater to specific dietary requirements and preferences of consumers. For instance, in October 2022, Kingsmill, a UK-based baked goods manufacturer, launched two new premium bread categories—the Great White Bloomer with Sourdough and the Malted Bloomer loaf. The company made these new loaves available in selected Tesco and Asda stores across Europe.

The bread market forecast can help stakeholders plan their growth strategies. Lantmannen Unibake, Rich Products Corp, La Brea Bakery, Flowers Foods Inc, Grupo Bimbo SAB de CV, Fiera Foods Company, La Lorraine Bakery Group, EUROPASTRY, SA, Bäckerhaus Veit GmbH, Schripps European Bread, Vandemoortele NV, Upper Crust, FGF Brands Inc, VIVESCIA, and Conagra Brands Inc. are among the prominent players profiled in the bread market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market.

The bread market is segmented on the basis of type, nature, category, end use, and geography. Based on type, the market is segmented into sandwich bread, brioche buns, ciabatta rolls, baguettes, panini and focaccia bread, hamburger buns, hotdog buns, and others. Based on nature, the market is bifurcated into gluten-free and conventional. Based on category, the market is bifurcated into frozen and ambient, and refrigerated. In terms of end use, the market is segmented into retail and food service.

The geographic scope of the bread market report focuses on North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The bread market in the Middle East & Africa is subsegmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The market in South & Central America is further subsegmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com