Guide Wires Segment to Bolster Chronic Total Occlusion Market Growth During 2024–2031

According to our new research study on "Chronic Total Occlusion Market Forecast to 2031 – Global Analysis – by Equipment and End User," the market was valued at US$ 24.46 billion in 2024 and is projected to reach US$ 42.21 billion by 2031; it is anticipated to record a CAGR of 8.2% from 2024 to 2031.

The report emphasizes the chronic total occlusion market trends, along with drivers and deterrents affecting the market growth. The increasing aging population and the rising prevalence of cardiovascular diseases are contributing to the growing chronic total occlusion market size. However, the high cost of occlusion devices hampers the market growth. Further, technological advancements in CTO devices is expected to emerge as a new market trend in the coming years.

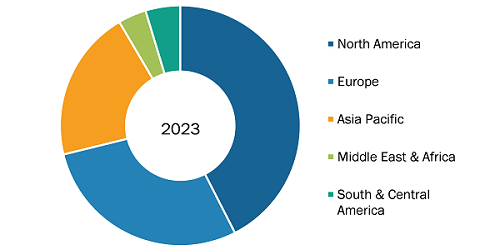

Chronic Total Occlusion Market Share, by Region, 2024 (%)

Chronic Total Occlusion Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Equipment (Guide Wires, Micro Catheters, Crossing Devices, Re-Entry Devices, and Others), End User (Hospitals, Ambulatory Care Centers, and Others), and Geography

Chronic Total Occlusion Market Strategies, Trends by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Aging Population Bolsters Chronic Total Occlusion Market Growth

The rising geriatric population is a key driver for the chronic total occlusion (CTO) market. As the world population grows older, cardiovascular diseases become more common.

According to the World Health Organization (WHO), by 2030, one in six people worldwide will be 60 years old or older. This number is projected to rise from 1 billion in 2020 to 1.4 billion in 2030 and 2.1 billion by 2050. The number of persons aged 80 or older is expected to triple between 2020 and 2050 to reach 426 million. WHO also stated that by 2050, 80% of older people will be living in low- and middle-income countries. In addition, as per the Population Reference Bureau, Asia and Europe have the oldest populations, including people aged 65 or older. With 28% of the geriatric population, Japan is leading worldwide, followed by Italy at 23%. Finland, Portugal, and Greece are among the top five countries with ~22% of the geriatric population.

Older adults, particularly those over 60 years of age, are at higher risk of cardiovascular disease due to age-related changes in the cardiovascular system, such as decreased blood vessel elasticity and arterial plaque. The growing elderly population worldwide is driving the need for efficient and minimally invasive treatments, such as percutaneous coronary intervention (PCI) for chronic total occlusion (CTO). Older adults often struggle to adjust to traditional surgical methods, which is why there is a rising preference for minimally invasive procedures that promote faster recovery and reduce risk. This is a phenomenon that can be seen in countries with high aging populations, such as the US, Japan, and European nations.

Market players such as Boston Scientific, Abbott Laboratories, and Medtronic are also more inclined to develop sophisticated CTO devices specifically designed for the aging population. These devices make treatments available, effective, and safe for this vulnerable group.

Chronic Total Occlusion Market Report Scope:

The chronic total occlusion market analysis has been carried out by considering the following segments: equipment, end user, and geography.

Based on equipment, the chronic total occlusion market is segmented into guide wires, micro catheters, crossing devices, re-entry devices, and others. The guide wires segment held the largest chronic total occlusion market share in 2024. As a critical element of chronic total occlusion (CTO) percutaneous coronary intervention (PCI) procedures, guidewires enable physicians to navigate through complex, blocked coronary arteries, enabling lifesaving treatments such as stent implantation, balloon angioplasty, and other therapeutic interventions. CTO guidewires are designed to overcome the complicated anatomy presented by total occlusions, often incorporating advanced features such as enhanced torque control, flexibility, and hydrophilic coatings to enable smoother advancement and higher accuracy during procedures. Further, market players are adopting various organic and inorganic growth strategies. A few instances are mentioned below.

- In February 2022, Teleflex Incorporated announced that the U.S. Food and Drug Administration (FDA) granted expanded indications for its specialty catheters and coronary guidewires, specifically for use in chronic total occlusion percutaneous coronary interventions (CTO PCI).

- In June 2024, MicroPort RotaPace's Intravascular Piezoelectric Guidewire System gained NMPA approval for entry into the special review procedures for innovative medical devices. This system was co-developed by a team led by Academician Junbo Ge from Zhongshan Hospital, Fudan University.

- In April 2020, Nitiloop Ltd. received FDA 510(k) clearance for its NovaCross chronic total occlusion (CTO) microcatheter. Nitiloop is based in Israel.

As CTO procedures become more advanced and prevalent, the demand for specialized guidewires continues to grow. The aforementioned advancements and FDA approvals underscore the continuous progress in the guidewire industry, which is driving the success of CTO PCI procedures. These guidewires are essential for increasing the effectiveness of CTO interventions, reducing operation time, and ultimately improving patient outcomes because they provide increased flexibility, improved control, and better maneuverability.

In terms of end user, the chronic total occlusion market is categorized into hospitals, ambulatory care centers, and others. The hospitals segment dominated the market in 2024. Hospitals are pivotal in driving the growth of the chronic total occlusion (CTO) market. As the primary healthcare providers for cardiovascular conditions, hospitals are increasingly adopting advanced CTO devices to treat coronary artery blockages. These devices, including guidewires, catheters, balloons, and stents, have become crucial in enhancing the success rates of percutaneous coronary intervention (PCI) procedures, offering patients a minimally invasive alternative to traditional surgery.

The increasing prevalence of coronary artery disease and the growing demand for minimally invasive treatments have encouraged hospitals to integrate cutting-edge CTO devices into their cardiac care offerings. These devices are particularly valuable in managing complex CTO cases, where navigating through total occlusions and restoring blood flow is challenging. By investing in these advanced technologies, hospitals can improve procedural outcomes, reduce complications, and shorten recovery times.

News regarding the adoption of CTO devices by hospitals:

- The Cleveland Clinic, renowned for its cardiac care, expanded its use of CTO PCI techniques to treat complex coronary blockages. Adopting advanced CTO devices, including specialized guidewires and balloons, has significantly increased the success rate of their CTO procedures.

- JOHNS Hopkins Hospital reported a marked improvement in its CTO PCI success rates after incorporating new CTO device technologies. These devices helped physicians treat previously challenging cases, enhancing patient outcomes.

- Hospital de la Santa Creu i Sant Pau in Barcelona reported successful outcomes in CTO procedures after adopting the latest CTO devices, leading to faster recovery times and improved patient satisfaction.

Hospitals' adoption of CTO devices is shaping the market, improving the treatment of chronic total occlusions and transforming interventional cardiology. As hospitals continue to integrate advanced CTO devices, the demand for these technologies will propel the CTO devices market growth for this segment.

Chronic Total Occlusion Market Analysis: Based on Geography

The geographic scope of the chronic total occlusion market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa).

US Census Bureau, World Health Organization (WHO), British Heart Foundation, French National Institute for Demographic Studies, National Institute of Statistics (NIS), National Library of Medicine, National Crime Records Bureau (NCRB), and National Center for Biotechnology Information are among the primary and secondary sources referred to while preparing the chronic total occlusion market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com