Equipment Segment to Bolster Cleanroom Technology Market Growth During 2023–2031

According to our new research study on "Cleanroom Technology Market Forecast to 2031 – Global Analysis – by Type, Construction Type, and End User," the market was valued at US$ 43.65 billion in 2023 and is expected to reach US$ 77.60 billion by 2031; it is estimated to record a CAGR of 7.5% during 2023–2031. The cleanroom technology market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

Increasing adoption in the biopharmaceuticals industry and rising advancements in cleanroom technology are contributing to the cleanroom technology market growth. However, complexity and high costs hamper the market growth. Further, the integration of smart technologies with cleanroom technology is expected to bring new cleanroom technology market trends in the coming years.

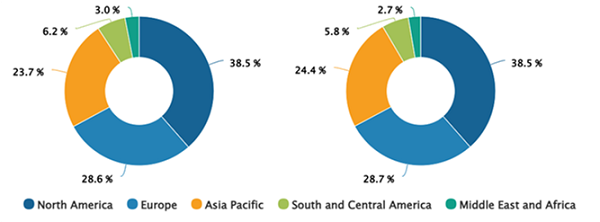

Cleanroom Technology Market Share, by Region, 2023 (%)

Cleanroom Technology Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis Report Coverage: by Type {Equipment [Cleanroom Air showers, HVAC Systems, Laminar Air Flow Systems, High Efficiency Filters, Desiccator Cabinets, Fan Filter Units, Isolators, RABS, Dry Box, and Others] and Consumables [Apparels, Gloves, Wipes, Vacuum Systems, Cleaning Utensils (Mopping, ATFT, Trolley, and Automated Cleaning), Disinfectants, and Others]}, Construction Type (Standard Cleanrooms, Hardwall Cleanrooms, Softwall Cleanrooms, Pass-Through Cabinets), End User (Pharmaceutical Industry, Biotechnology Industry, Medical Device Manufacturers, Hospitals, Microelectronics, and Other End Users), and Geography

Cleanroom Technology Market Drivers and Opportunities by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Adoption in Biopharmaceuticals Industry Bolsters Cleanroom Technology Market

Cleanroom technology offers controlled environments where specific parameters, such as temperature, pressure, humidity, and air filtration, are carefully maintained. These settings minimize the introduction and retention of particles, the risk of infections among people, and contamination in products. In the pharmaceutical industry, cleanrooms are critically important in preventing airborne particles from affecting the microbiological and physical properties of drugs. The need for pharmaceuticals and biologics development and manufacturing processes to comply with several local and international standards for product approvals and the demand for therapeutic drugs and vaccines across the world is growing. As a result, biopharmaceutical and pharmaceutical companies are adopting cleanroom technology to ensure maximum cleanliness and minimal contamination in the products, production sites, and equipment. In May 2022, Termovent, a Serbia-based cleanroom technology company, completed cleanroom expansion for Bionika, a pharmaceutical company in North Macedonia. In November 2022, INCOG BioPharma partnered with AES Clean Technology for its modular cleanroom technology. Under this partnership, INCOG BioPharma leveraged the AES Compass and AES Faciliflex modular cleanroom solutions offered by AES Clean Technology, facilitating the quick and safe construction of production facilities. In December 2020, WHP, a multi-disciplinary engineering company, built a new viral vector manufacturing center for Oxford Biomedica. Furthermore, Phase 1 of the expansion of this new manufacturing site includes the renovation of the building into four GMP cleanroom suites and fill and finish production areas, offices, warehousing, and quality-controlled laboratories. The new GMP facility is suitable for the production of vaccines, such as the large-scale manufacturing of COVID-19 vaccine and gene therapy products. The facility design comprises cleanroom architecture; heating, ventilation, and air conditioning (HVAC) system; and other process and critical utility systems. Thus, the rising adoption of cleanroom technology among key pharmaceutical manufacturers is contributing to the growing cleanroom technology market size.

The cleanroom technology market analysis has been carried out by considering the following segments: type, construction type, end user, and geography. The cleanroom technology market, based on type, is divided into equipment and consumables. The equipment segment held a larger share of the cleanroom technology market in 2023, and it is expected to register a higher CAGR during 2023–2031. Cleanroom technology helps in developing standardized products that ensure regulatory norms in healthcare industries. The cleanroom equipment ensures a controlled environment to minimize contamination and maintain product integrity across manufacturing industries such as pharmaceutical, biotechnology, electronics, etc. Technological advancement has increased the demand for cleanroom equipment, including heating, ventilation, and air conditioning (HVAC) systems; laminar airflow units; air showers; fume hoods; desiccating cabinets; and air filter systems.

- Air showers are installed at the entry point of cleanrooms to reduce particle contamination. This equipment uses high-pressure filtered air to remove dust and other contaminants from personnel or surfaces.

- Cleanroom HVACs provide increased air supply and various airflow patterns, use high-efficiency cleanroom filters, and offer room pressurization unlike conventional systems.

- HEPA filters are a type of air filter designed to control contamination by removing dust and other particles. They are primarily used in manufacturing applications in the semiconductor and pharmaceutical industries. Several market players are launching products owing to the high demand for these filters. In 2020, Clean Rooms International (CRI), a leading manufacturer of cleanrooms, workstations, and air filtration equipment, introduced Guardiair (a mobile air filtration system) that minimizes airborne contagions and collects particles at the most penetrating size of 0.3 µm with 99.99% efficiency. Similarly, in October 2024, Nortek Air Solutions CleanSpace, a US-based cleanroom air management system specialist, relaunched SERVICOR, its modular cleanroom solution.

- The fan filter unit (FFU) is another type of air filter system that provides filtered, recirculated air to the cleanroom. FFU offers a flexible and economical solution to remove particles from the recirculated air of turbulent or unidirectional ventilated cleanrooms. Also, FFU creates a positive room pressure that reduces the contamination risk from potential ceiling bypasses.

- Laminar flow systems direct filtered air downward or in a horizontal direction in a constant stream using HEPA filters. Laminar filters are mostly made of stainless steel or other non-shedding materials to ensure the number of particles that enter the facility remains low.

A desiccator cabinet provides clean, dry storage to protect sensitive materials from moisture exposure and particle contamination. Nitrogen desiccator cabinet configurations maintain low-humidity environments, making them ideal for microelectronics, pharmaceutical, biological, and chemical storage.

The market, based on construction type, is segmented into standard cleanrooms, hardwall cleanrooms, softwall cleanrooms, and pass-through cabinets. The standard cleanrooms segment held the largest cleanroom technology market share in 2023. Standard cleanrooms (drywall cleanrooms) are required for products that are sensitive to moisture. While constructing a dry room environment, there is a high requirement for components that help maintain low humidity levels and provide temperature controls for moisture. The number of pharmaceuticals and biotechnological industries, technological advancements, and awareness about advanced procedures is increasing rapidly, thereby favoring the growth of the segment.

The geographic scope of the cleanroom technology market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, South and Central America. North America accounted for the largest cleanroom technology market share in 2023. The presence of key market players and pharmaceutical, biopharmaceutical, and medical device companies; early adoption of advanced technologies; and well-established healthcare infrastructure are a few of the key factors anticipated to fuel the market growth in the coming years. In the pharmaceutical and biotechnology sector, manufacturing involves strict norms that require the utilization of cleanrooms for the safety and effectiveness of products. To create a regulatory environment, companies are compelled to invest in modern cleanroom technologies for full compliance with these norms. Biologics development requires highly controlled environments to prevent contamination and ensure the integrity of sensitive products. For instance, biopharmaceutical companies spent approximately US$ 97 billion in research and development in the US in 2017, which is more than any other industry, as per the Pharmaceutical Research and Manufacturers Association (PhRMA).

According to the Advanced Medical Technology Association, more than 6,500 medtech companies in the US, mainly small- and medium-sized enterprises, are working toward their medical innovation every day. Increased investments into research and development in the pharmaceutical sectors are driving innovation, which further creates the need to establish cleanrooms for safe experiments and product development.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com