The global cold pain therapy market is expected to reach US$ 3,143.88 million by 2028; registering at a CAGR of 5.3% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Over-the-Counter Segment to Lead Cold Pain Therapy Market During 2022–2028

The report highlights the key factors driving the market and prominent players with their developments. The market growth is primarily attributed to an increase in sports injury cases, a surge in orthopedic surgeries, and a significant rise in a geriatric and obese population. However, lack of awareness, unfavorable reimbursement scenarios, and cold pain therapy side effects hinder the market growth.

During COVID-19 pandemic, many companies manufacturing cold pain therapy devices were responding to the health crisis by manufacturing PPE kits and distributing pharmaceutical drugs. Additionally, the pandemic disrupted the supply chain across the world, which adversely affected the supply and production of cold pain therapy devices. Furthermore, many nonurgent surgical treatments and consultations were canceled or postponed during the COVID-19 outbreak to limit the spread of the virus infection and reserve and reallocate resources for COVID-19 management. Elective surgery was suspended in many institutions, and the overall volume of orthopedic cases fell dramatically. The "stay at home" strategy in Europe resulted in a significant reduction in orthopedic surgeries, as well as decrease in trauma cases during the outbreak. Moreover, there has been a constant increase in incidence of orthopedic conditions and musculoskeletal disorders, which creates high demand for cold pain therapy. Thus, the COVID-19 pandemic moderately hindered the market.

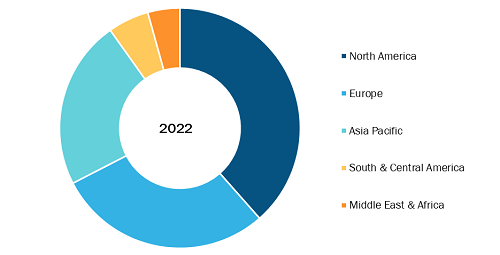

Cold Pain Therapy Market, by Geography, 2021 (%)

Cold Pain Therapy Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Application (Runner's Knee, Tendonitis, Sprains/Sports Sprain, Arthritis Pain, Pain and Swelling After Hip or Knee Replacement, Pain or Swelling Under Cast or Splint, Surgery Recovery, Lower Back Pain, and Others), Offering (Over-the-Counter, Prescription Products, Rehabilitation Exercises, Ice Wrap and Cold Packs, Pads, Compression Therapy, Ice Buckets without Compression, and Others), and End User (Hospitals, Clinics, Rehabilitation Centers, Ambulatory Surgical Centers, Individuals, and Others)

Cold Pain Therapy Market Growth Report and Size by 2028

Download Free Sample

Source: The Insight Partners Analysis

Based on application, the cold pain therapy market is segmented into Runner's knee, tendonitis, sprains/sports sprain, arthritis pain, pain & swelling after a hip or knee replacement, pain & swelling under a cast or a splint, surgery recovery, lower back pain, and others. The surgery recovery segment held the largest share of the market in 2021, and the market in the same segment is expected to grow rapidly during the forecast period. According to the Centers for Disease Control and Prevention (CDC) report, ~300,000 hip replacement procedures are performed on individuals aged 45 and above in the US in 2021. According to the CDC report, hip replacement surgery is becoming common among patients in their 30s and 40s.

Adopting cold and compression therapy machines is one of the most recommended rehabilitation methods for hip replacement surgeries. Traditional ice and compression therapies following hip replacement surgery can be improved due to the adoption of cold therapy machines. Top competitive players offer innovative product. For instance, Breg, Inc. designed the Polar Care Cube Cold Therapy System, a simple and reliable product utilized by clinics, hospitals, and home care. The product is the best fit for post-operative surgery among patients, generally involving reconstructive procedure, general surgery, post-trauma, chronic pain, and others. With the high volume of procedural surgeries, ice machines without compression increase and other innovative products are acting as a standalone factor responsible for market growth in the surgery segment.

Brownmed Inc., Bruder Healthcare Co LLC., DJO Global Inc, Ossur HF, Cardinal Health Inc, Vive Health LLC, Battle Creek Equipment Co, Thermotek Inc., Advanced Therapeutics of LI LLC, and Sichuan Jiuyuan Medical Technology Co Ltd. are among the leading companies operating in the cold pain therapy market.

The report segments the cold pain therapy market as follows:

Based on application, the cold pain therapy market is segmented into runner's knee, tendonitis, sprains/sports sprain, arthritis pain, pain and swelling after a hip or knee replacement, pain or swelling under a cast or a splint, surgery recovery, lower back pain, and others. Based on offering, the market is segmented into over-the-counter, prescription products, rehabilitation exercises, ice wrap and cold packs, pads, compression therapy, ice buckets without compression, and others. Based on end user, the market is segmented into hospitals, clinics, rehabilitation centers, ambulatory surgical centers, individuals, and others. By geography, the cold pain therapy market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, Africa, and the Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com