Clinical Research Services Segment to Bolster Contract Research Organization Market Growth During 2024–2031

According to our new research study on "Contract Research Organization Market Forecast to 2031 – Global Analysis – by Service Type, Product Type, Type, Application, and End User," the market was valued at US$ 65.39 billion in 2024 and is projected to reach US$ 113.79 billion by 2031; it is estimated to register a CAGR of 8.2% during 2024–2031. The contract research organization market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

Increased outsourcing of research and development and rising demand for clinical trials are contributing to the growing contract research organization market size. However, high competition among cros hampers the growth of the market. Further, sustainability initiatives are expected to bring new contract research organization market trends in the coming years.

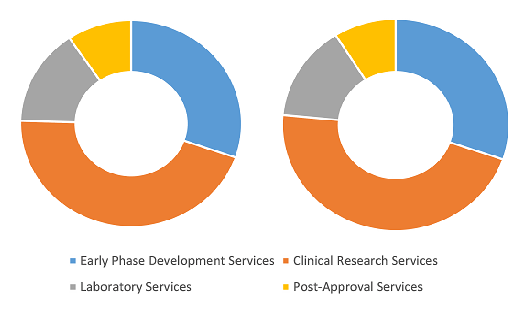

Contract Research Organization Market Share, by Service Type, 2024 (%)

Contract Research Organization Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Early Phase Development Services, Clinical Research Services, Laboratory Services, and Post-Approval Services), Product Type (Cell and Gene Therapy, Biosimilars, Antibody Drug Conjugates, and Others), Type (In-house and Outsource), Application (Oncology, Neurology, Cardiology, Infectious Diseases, Metabolic Disorder, Nephrology, Respiratory, Dermatology, Ophthalmology, Hematology, and Others), End User (Pharmaceutical and Biotech Companies, Medical Device Companies, Academic and Research Institutes, and Others) and Geography

Contract Research Organization Market Growth, Share by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increased Outsourcing of Research and Development Bolsters Contract Research Organization Market Growth

The Contract Research Organization (CRO) industry is growing notably across the globe, owing to the rising outsourcing of research and development operations in pharmaceutical, biotechnology, and medical device firms. With the healthcare sector becoming increasingly competitive and innovation-driven, firms are under tremendous pressure to speed up drug discovery. Contracting R&D to CROs enables companies to access their specialized expertise, sophisticated infrastructure, and global connectivity without significant investments. CROs offer full-service solutions, from preclinical research to clinical trials, regulatory affairs, and post-marketing surveillance, and help sponsors concentrate on their core competencies. In addition, the increasing complexity of clinical trials due to the commonality of chronic diseases, orphan diseases, and personalized medicine has raised the demand for niche CROs with specialized knowledge and technological capacities. Syngene has a dedicated research facility: BBRC for Amgen, and Baxter and Bristol-Myers Squibb for specialist discovery, development, and manufacturing facilities in Bangalore.

Discovery CROs are forming long-term strategic partnerships with pharmaceutical and biotechnology companies, academic institutions, and other CROs. These collaborations can involve co-developing drugs, joint ventures, or preferred provider agreements, allowing both parties to leverage each other’s strengths. In November 2024, Novotech (a global full-service clinical CRO) formed a long-term partnership with Beijing Biostar Pharmaceuticals Co., Ltd. This collaboration was aimed to advance clinical research by utilizing Novotech’s expertise to support Biostar’s clinical development plans for novel therapeutics.

Such partnerships can significantly reduce the time required to bring a drug to market, accelerating the process by months compared to traditional outsourcing. It typically takes 10–15 years and over US$ 2.5 billion to develop a single drug, with most costs arising from the discovery and development phases in the US. By sharing expertise, resources, and technologies, these collaborations foster innovation, as well as help mitigate risks and distribute research costs.

Therefore, the market is well positioned for continued growth due to rising dependence on R&D outsourcing to achieve efficiency, save costs, and get life-saving drugs to patients more quickly.

The contract research organization market analysis has been carried out by considering the following segments: service type, product type, type, application, end user, and geography. The contract research organization market, based on service type, is divided into early phase development services, clinical research services, laboratory services and post-approval services. The clinical research services segment held the largest share of the contract research organization market in 2024, and it is expected to register the highest CAGR during 2024–2031. The verified and tested compounds in the preclinical studies undergo a long evaluation procedure to determine the safety and efficacy of the compound. Clinical trials comprise a long duration and can require six–seven years for successful completion. These trials include the use of placebos with randomization and follow-up of double-blinded protocols to minimize biases of the drug. The outsourcing of clinical trial research services helps drug manufacturers to invest in expensive research infrastructure and use the available capital in profitable areas. Moreover, the clinical trials outsourcing facilitates a wider range of expertise and increased flexibility than that of the in-house activities.

There are four major phases of clinical trials as follows:

Phase I Clinical Trials:

Phase I clinical trials are focused on the basic safety and pharmacology of the drug. This trial is completed with the help of 20–100 healthy human volunteers. These studies help to evaluate human metabolic and pharmacologic reactions to the compounds, the duration of effectiveness and activity. Moreover, it helps to understand the effects of other drugs, their toleration and absorbency, and their breakdown and excretion from the body.

Phase II Clinical Trials:

Phase II clinical trials are focused on efficacy evaluation, safety testing as well as optimal dosage level determination. Phase II trials, also known as proof-of-concept studies, are completed with 100–500 patients afflicted with the targeted disease, syndrome, or condition. The clinical trials at this stage also determine dosage schedules and administration routes. Phase II studies are one of the most crucial stages in drug development, as the majority of drugs fail at this stage.

Phase III Clinical Trials:

Phase II clinical trials are completed at a larger scale among ~1000–5000 patients that are afflicted by target disease. These trials are conducted at multiple centers that collect sufficient data to validate statistical conclusions required by the FDA and other regulatory bodies. In this stage, an adequate basis for product labeling and dosage formulations is conducted. Phase III clinical trials are usually the longest and most expensive of all the trial phases.

Phase IV Clinical Trials:

Post successful completion of phase III clinical trials, the sponsor submits a biologic license application (BLA) or new drug application (NDA) to the FDA or respective regulatory authority for market approval of the drug. On approval of the drug, the regulatory and surveillance body may require additional studies to test the compound for other potential indications, dosage formulations, and other parameters. Moreover, risk management plans and product risk plans are also prepared and submitted in this phase.

By product type, the market is segmented into outsourced management models, cell and gene therapy, biosimilars, antibody-drug conjugates, and others. The European Medicines Agency (EMA) has built a strong regulatory system for biosimilars, enabling the entry of cheaper alternatives to expensive biologics. CROs are critical to enable biosimilar development and execute comparative clinical trials to prove biosimilarity. Rising concerns about patent expirations on original biologics, the growing cost-effectiveness of biosimilars, and increasing demand for biosimilars drive the market. In April 2023, STADA Arzneimittel and its partner Xbrane Biopharma launched Ximluci, a ranibizumab biosimilar, in several countries in Europe for the treatment of several ophthalmic conditions.

The geographic scope of the contract research organization market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

The US holds the largest market share, followed by Canada. The growth in North America is characterized by growing demand for contract research organizations by the healthcare market players, growing support from the government to provide cost-effective healthcare service, increasing strategic developments by the market players to enhance services, and a growing healthcare industry that demands frameworks and guidelines based on the real-world data for their business models. The US is the largest market for contract research organizations and is estimated to continue its dominancy owing to the presence of leading contract research organizations, a well-established healthcare industry that provides a broader scope for contract research organizations, and a growing shift toward outsourcing R&D and clinical trial services.

Contract research organizations are crucial to the biotechnology, pharmaceutical, and medical device industries owing to their offering of outsourced research services that help accelerate the typically prolonged and complicated drug development process. Due to the need for quicker drug development and technical developments, the landscape for contract research organizations in the US is evolving quickly. The regulatory environment heavily impacts the operation of contract research organizations. Initiatives such as real-time assessment, which permits simultaneous data assessment during clinical trials, have been established by the US FDA. Contract research organizations manage and evaluate data in real time related to this change.

There are a growing number of clinical trials with increasing investments in research and development in the country. According to an article published in the United States National Library of Medicine in May 2023, 437,533 clinical trials were registered in 221 countries in 2023, an increase from 399,499 in 2022, among which 140,492 (31%) were registered in the US. Contract research organizations help lower the risks of trial delays and regulatory obstacles by assisting pharmaceutical businesses in navigating this environment.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com