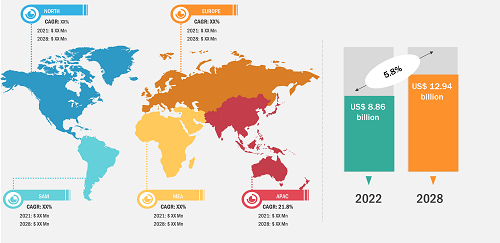

The Conveyor System Market size is expected to reach USD 12.94 billion by 2028; registering at a CAGR of 5.8% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Proliferation in Use of Industrial 4.0 will Bring Growth Prospects for Conveyor System Market

Various manufacturing industries are heavily investing in the adoption of automated solutions. Additionally, adopting data-driven solutions has gained significant popularity among leading manufacturers and business owners to mitigate unforeseen errors, faults, and damages. The increasing demand for conveyor systems with integrated technologies across various industrial applications will propel the conveyor system market growth in the coming years. The mounting implementation of Industry 4.0 has led to an extensive digital overhaul across the manufacturing industry. Digital technologies such as artificial intelligence (AI) and predictive maintenance are used by conveyor system providers to maintain visibility across the supply chain with improved operations, transparency, and productivity. Additionally, technologies such as automation, the Internet of Things (IoT), and robotics are also gaining more prominence. Development of such massive technologies will help in propelling the overall conveyor system market growth.

Coreal has developed a digital tool that can characterize the defects of all the elements of the conveyor belts, which makes it possible to move from the current corrective maintenance approach to predictive maintenance, where the damage can be anticipated, and action can be taken before the critical failure. It has designed a monitoring system for the different elements of the conveyor belt that would carry out a diagnosis in real time while generating a predictive maintenance plan. Such developments would result into growing conveyor system market.

Conveyor System Market – by Region, 2022

Conveyor System Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by System Type (Overhead, Floor, Roller, Belt, and Others), Belt Type (Light, Medium, and Heavy), and Industry (Food & Beverages, Automotive, Airports, Logistics, Metals & Mining, and Others, and Geography (North America, Europe, Asia Pacific, and South and Central America)

Conveyor System Market SWOT and PEST Analysis 2021-2031

Download Free Sample

Source: The Insight Partners Analysis

Additionally, different strategic decisions are taking place to promote the scope of conveyor systems. For instance, Roxon, a European surface and overland conveyor manufacturer, has unveiled its array of conveyor and materials handling solutions in Australia. The company has implemented its first project in Australia, a US$ 15 million fixed screening and crushing plant at the Lima South Quarry in Victoria. Such developments are contributing to the conveyor system market growth.

Based on geography, APAC dominated the with largest conveyor system market share in 2022. Rise in industrialization and availability of low-cost labor are encouraging gigantic multinational companies to move their plant operations to the Asian market, especially in countries such as China and India, which are the manufacturing hubs of APAC. Moreover, belt-style conveyors are heavily used in airports. These conveyor systems are easy to install and need little maintenance. Owing to the growing passenger traffic at the airports of different Asian countries, governments are continuously undertaking airport expansion and modernization activities. With projected rise in air passenger in the coming 20 years, the region requires US$1.3 trillion for new greenfield airports, airport development and modernization. Out of total 633, 228 airport projects globally, 228 projects are of APAC. The rise in the construction of new airports and modernization of existing airports would raise the demand for conveyor systems in APAC in the coming years and thereby impacting the APAC conveyor system market size. Similarly, the Indian government has planned to boost airport counts from 140 to 220 by 2025 since the aviation sector is witnessing increased passenger traffic.

Moreover, with businesses resumed their operations in mid-2021, the demand for conveyor systems is gradually increasing which will have a positive impact on conveyor system market. During the recovery phase, the demand for new warehouse spaces is growing in the region since business of pharmaceuticals, supermarkets, and online retailers got boosted drastically. To ensure inventory levels are sufficient and to meet the demand for supermarkets, vendors are keeping higher amounts of merchandise in stock, which is surging the demand for warehouse space. The mounting demand for goods bought online, especially food, would also fuel the need for distribution facilities. This will propel the conveyor system market growth.

Based on industry, the conveyor system market size is categorized into food & beverages, automotive, airports, logistics, metals & mining, and others. The food & beverages segment holds the second-largest conveyor system market share in 2022. During 2020, there was a robust demand for hygienic practices throughout the food & beverages industry, since the risk of food getting exposed to bacterial contaminants was high. Thus, companies are focused on designing hygienic equipment. For instance, Belt Technologies, Inc. offers conveyor solutions with hygienic solutions such as solid stainless steel belts and conveyor systems.

The food industry is dependent on rollers, mini conveyors, and industrial belt conveyors. These systems help lower human contact and material handling while making the entire food processing procedure safe and efficient. The adoption of conveyor belts has boosted the efficiency of various manufacturing facilities by increasing productivity and making things more manageable. The conveyor belt usage by the food industry has numerous prerequisites established by the Food and Drug Authority (FDA) that act as a platform for deploying more conveyor belts. The upcoming demand from food & beverages industries for roller, mini conveyors, and industrial belt conveyors will assist in fueling the conveyor system market.

The key conveyor system market players operating in the industry include Daifuku Co. Ltd., Dematic, Emerson Electric Co., Honeywell Intelligrated, Interroll Holding GmbH, Siemens AG, SSI Schafer, Swisslog Holding AG, TGW Logistics Group, and Vanderlande Industries.

- In March 2021, Redwave augmented its sensor-based sorting technology portfolio to include conveyor belts for the recycling sector. Conveyor belts deployed in Redwave systems include sliding belt conveyors, chain belt conveyors, and troughed belt conveyors. The modular design of the systems enables modification in the conveyor length and inclusion of additional equipment such as weighing systems, sensors, and scrapers.

- In June 2020, Fortress Technology and Sparc Systems rolled out their first-ever high-performance combination metal detector and checkweighing conveyor system. The system is majorly developed for high-care chocolate, confectionery, nutritional bars, bakery, cheeses, ready meals, and packaged meats.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com