Increase in Livestock Production Drives Corn and Wheat-Based Feed Market

According to the latest market study on “Corn and Wheat-Based Feed Market Forecast to 2030 – Global Analysis – by Product Type and Livestock,” the market was valued at US$ 196.71 billion in 2022 and is projected to reach US$ 270.95 billion by 2030; it is expected to register a CAGR of 4.1% during 2022–2030. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Corn-based feed consists of products sourced from maize, including whole corn kernels; corn silage; and by-products of the wet milling process such as corn gluten feed and corn germ oil meal, corn distiller’s grains (DDGs), corn steep liquor, corn hominy, corn screenings, and steam flaked corn. The wheat-based feed consists of all the products sourced from wheat such as whole wheat grains, wheat gluten, wheat bran, wheat DDGs, and wheat pollard. Corn and wheat-based feeds also include various product formulations in which corn and wheat-sourced ingredients are among the significant components. Corn and wheat are considered important protein and energy sources in animal feed. The corn and wheat-based feed is easily digestible. Thus, the nutritional benefits associated with corn and wheat-based feed drive the corn and wheat-based feed market growth.

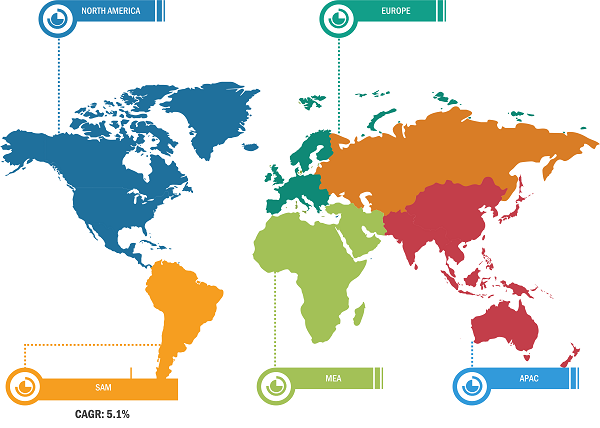

Global Corn and Wheat-Based Feed Market Breakdown – by Region

Corn and Wheat-Based Feed Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Corn and Wheat-Based Feed Market Research Report by 2030

Download Free Sample

The demand for livestock products is driven by increasing urbanization, changing lifestyles and food preferences, and the rapidly rising population across the world. According to the Food and Agriculture Organization (FAO), meat protein consumption across the world is predicted to increase by 14% by 2030. Animal protein accounts for 16% of energy and 34% of protein in human diets. World milk production is expected to rise by 1.6% annually between 2020 and 2029 and reach 997 million metric tons in 2029, according to a report by the Organization for Economic Co-operation and Development (OECD) and FAO.

The increasing consumption of protein-rich livestock products such as meat and increasing milk production propel the production of livestock. Livestock production accounts for ~19% of the value of food production and 30% of the global value of agriculture. This factor significantly contributes to the growing corn and wheat-based feed market size worldwide.

In 2022, Asia Pacific accounted for nearly 38% of the corn and wheat-based feed market share. The demand for corn and wheat-based feed is rising in Asia Pacific, driven by the rapid growth of the middle-class population and urbanization across many countries in the region. As a result of income rise and lifestyle change, there is a shift toward diets higher in protein, including meat and dairy products. This dietary transition fuels the demand for livestock products, leading to increased livestock production and a higher demand for corn and wheat-based feed to support the growing livestock industry. Also, the growth of the organized livestock industry in developing countries contributes to the growing corn and wheat-based feed market size.

In Asia Pacific, China holds the dominating revenue share of the corn and wheat-based feed market. The country's massive swine industry influences the demand for corn and wheat-based feed in China. According to the Food and Agriculture Organization of the United Nations, China, the mainland is the global leader in pig meat production, accounting for 45% of the global production between 2010 and 2021. Despite challenges such as disease outbreaks and regulatory changes, pork remains a staple protein source in the Chinese diet. As the Chinese Government works to rebuild its swine herd following the African Swine Fever outbreak and promote modernization in the livestock sector, there is an upsurge in demand for feed grains to support swine production, with corn and wheat-based feed being critical components of swine diets.

Thus, significant demand for corn and wheat-based feed in China for swine feed bolsters the corn and wheat-based feed market.

The production of corn and wheat is associated with various challenges, including climatic conditions, price fluctuation, and environmental impact due to carbon emissions. According to US Department of Agriculture (USDA) data from 2021, the carbon footprint of corn for about one pound of whole produce is 0.8 pounds of emissions, and one bushel of corn can yield 2.8 gallons of ethanol. From production to harvesting, each corn production step generates emissions. Moreover, the use of fertilizers for corn production is a major contributor to air pollution. Thus, the adverse impact of corn production on the environment significantly hampers the corn and wheat-based feed market.

Based on product type, the corn and wheat-based feed market is bifurcated into corn-based and wheat-based. The corn-based feed segment held a larger corn and wheat-based feed market share in 2022. Corn is one of the vital ingredients in livestock feed as it is a significant source of energy, protein, and fat. It is easily digestible and contains less amount of fiber. Corn provides balanced nutrition to the livestock animals, ensuring proper development and well-being. On average, corn contributes up to 65% of the metabolized energy and 20% of protein in poultry feed. According to the International Grains Council, 1,224.8 million metric tons of corn were produced globally in 2021, of which 723.3 million metric tons of corn were used in the feed industry. Corn is one of the largest traded feed grains globally, according to the United States Department of Agriculture (USDA). The increasing demand for corn-based feed in the animal feed industry due to its nutritional benefits for livestock animals drives the corn and wheat-based feed market growth for the corn-based segment. Corn-based animal feed is available in various types, including corn gluten meal, corn gluten feed, corn germ oil meal, corn dry distiller’s grains (DDGs), corn steep liquor, corn bran, corn screenings, corn hominy, and flaked corn.

Associated British Foods Plc, Jungbunzlauer Suisse AG, Nordfeed, Roquette Freres SA, BENEO GmbH, International Nutritionals Ltd, Interstarch Ukraine LLC, Agrana Beteiligungs AG, Grain St Laurent Inc, and Archer Daniels Midland Company are among the key players profiled in the corn and wheat-based feed market report.

The "Global Corn and Wheat-Based Feed Market Analysis and Forecast to 2030" is a specialized and in-depth study of the food & beverages industry, focusing on the global corn and wheat-based feed market trends analysis. The report aims to provide an overview of the market with detailed market segmentation. The market is segmented on the basis of product type, livestock, and geography. Based on product type, the corn and wheat-based feed market is bifurcated into corn-based and wheat-based. The market for the corn-based segment is further segmented into corn gluten meal, corn gluten feed, and other corn-based feed. The market for the wheat-based segment is further divided into wheat gluten, wheat bran, and other wheat-based feed. By livestock, the market is segmented into poultry, ruminants, swine, aquaculture, and others. The geographic scope of the corn and wheat-based feed market report includes North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com