Sugar Free Segment to Bolster Cough Drops Market Growth During 2023–2031

According to our new research study on "Cough Drops Market Forecast to 2031 – Global Analysis – by Product, Application, and Distribution Channel," the market was valued at US$ 2,231.58 million in 2023 and is projected to reach US$ 3,600.88 million by 2031; it is estimated to record a CAGR of 6.2% during 2023–2031. The cough drops market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The rising burden of respiratory diseases causing soar throat and the increasing shift toward self-medication are contributing to the growing cough drops market size. However, the inability to provide long-term relief and the availability of alternatives hamper the market growth. Further, the adoption of innovative marketing strategies is expected to bring new cough drops market trends in the coming years.

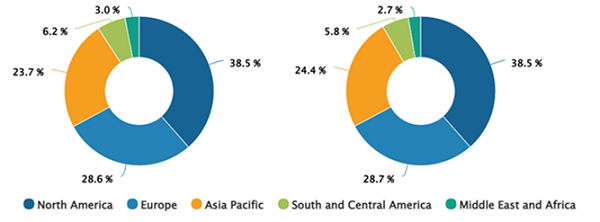

Cough Drops Market Share, by Region, 2023 (%)

Cough Drops Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis Report Coverage: Product (Gluten Free, Sugar Free, and Others), Application (Adults and Children), Distribution Channel [Offline (Retail Pharmacies, Supermarkets/Hypermarkets, and Hospital Pharmacies) and Online], and Geography

Cough Drops Market 2031 | Size, Share, Growth & Scope Analysis

Download Free Sample

Source: The Insight Partners Analysis

Rising Burden of Respiratory Diseases Causing Soar Throat Bolsters Cough Drops Market Growth

Viral infections such as colds or influenza are among the common causes of sore throat. A sore throat can also indicate strep throat, common cold, allergies, or other upper respiratory illnesses. According to the World Health Organization (WHO), approximately 1 billion cases of seasonal influenza are recorded every year across the world, including 3–5 million cases of severe illness. Symptoms typically start 1–4 days after infection and persist for about a week. The common cold, flu, and seasonal allergies are widespread respiratory issues that significantly increase the demand for cough relief products as people seek immediate relief from coughing, throat irritation, and other symptoms causing discomfort.

Deteriorating air quality due to rapid-paced urbanization has been a significant concern for health systems across the world, contributing to a rise in cases of respiratory illnesses. Pollutants can worsen the health conditions of asthma and bronchitis patients, leading to more frequent coughing episodes. Consequently, consumers are increasingly seeking cough drops for relief from these symptoms. The geriatric population is particularly vulnerable to respiratory disorders due to decreased immunity and pre-existing health conditions. The world's population is aging at an unparalleled rate. According to the WHO facts published in October 2022, 1 in 6 individuals worldwide would be aged 60 or more by 2030. Thus, the number of people from this age group would increase from 1 billion in 2020 to 1.4 billion by 2030; the population would rise by quadruple to 2.1 billion by 2050. Furthermore, it is anticipated that the population of those aged 80 or older will triple between 2020 and 2050, reaching 426 million. As people age, they are more likely to experience chronic illnesses that require symptom management, including the use of cough drops for relief from coughing associated with infections or chronic conditions. According to an article published in Annals of Research Hospitals in 2018, the rising prevalence of chronic lung diseases and iatrogenic immunosuppression are leading to an increase in respiratory infections in an aging population. Moreover, 2 billion people worldwide will be older than 65 years, and more than 1 billion individuals will have a preventable chronic lung disease by 2050.

In response to the rising incidence of respiratory disorders, manufacturers in the cough drops market are innovating their product lines and adopting development strategies such as collaborations and partnerships to expand their businesses. For instance, in June 2024, Vicks India, a brand of Procter & Gamble, announced the launch of Vicks Double Power Cough Drops, a groundbreaking transformation of India’s iconic triangular Vicks Cough Drops. These new drops have been formulated based on consumer feedback, addressing the demand for a larger cough drop size that effectively relieves symptoms of throat irritation and cough. Thus, the rising burden of respiratory diseases causing soar throat fuels the growth of the cough drops market across the world.

The cough drops market analysis has been carried out by considering the following segments: product, application, distribution channel, and geography. The cough drops market, based on product, is divided into gluten free, sugar free, and others. The sugar free segment held the largest share of the cough drops market in 2023, and it is expected to register the highest CAGR during 2023–2031. Sugar-free cough drops are designed to soothe sore throats and suppress cough without sugar. They use artificial sweeteners such as aspartame or sorbitol, making them suitable for those who need to monitor and manage their sugar intake due to diabetes, weight concerns, or dental health issues. Dental professionals often recommend sugar-free cough drops because they do not contribute to tooth decay, which is a common health issue associated with traditional sugary lozenges. This endorsement boosts consumer confidence and encourages purchases among those concerned about maintaining oral health while seeking relief from coughs and sore throats. The demand for sugar-free alternatives has surged owing to the rising consumer awareness of health risks related to sugar consumption, including obesity and diabetes. This trend encourages manufacturers to expand their product lines to include more sugar-free options. The availability of sugar-free options broadens the appeal of cough drops to various demographics, including children and health-conscious individuals. This diversification helps manufacturers capture a wider audience, driving overall market growth.

Market players such as Himalaya Wellness Company, Ricola, and Walgreens offer sugar-free cough drops in different flavors. Recent advancements in the form of the introduction of artificial sweeteners and natural ingredients have led to a broader variety of flavors and formulations in the cough drops market. Brands are expanding their offerings to include unique combinations such as honey-lemon, cherry, and menthol, thereby catering to diverse taste preferences and enhancing consumer choice. For instance, in October 2021, HALLS announced the launch of HALLS minis sugar-free cough drops. These minis are available in cherry, honey lemon, and mentho-lyptus flavors. Packaged in a convenient flip-top container, these miniature, unwrapped lozenges provide temporary relief for sore throats and coughs on the go.

The market, based on application, is segmented into cough drops market, adults, and children. The adults segment held the largest cough drops market share in 2023. There is an increasing trend of self-medication among adults, with many preferring over-the-counter solutions such as cough drops for symptomatic relief against sore throat. The focus on preventive care encourages consumers to prioritize throat health as part of their wellness routines, in turn boosting the cough drop market. Cough drops specifically designed for adults contain ingredients aimed at soothing throat irritation and reducing the frequency of coughing. Brands focused on creating products that cater to adults offer sugar-free formulations and options made with natural ingredients. In September 2023, Ricola introduced a new cough drop to enhance its expanding line of cough and throat relief products in the US. The new Ricola Throat Balm is designed to coat and protect consumer's throats from daily irritations. It features a liquid center surrounded by a smooth caramel-flavored shell blended with Ricola's signature Swiss herbal flavor. Halls brand offers new Halls Minis sugar-free cough drops, a convenient option for individuals with busy schedules. These mini cough drops come in a pocket-sized container with a flip-top design, making them easy to carry. The miniature, unwrapped cough drops are available in three flavors: cherry, honey lemon, and mentho-lyptus. The rise of e-commerce has also facilitated access to various cough drop products tailored for adults; online shopping allows for easy comparison of products and reviews.

The geographic scope of the cough drops market report includes the assessment of the market performance in North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. North America accounted for the largest cough drops market share in 2023. The US cough drops market is fueled by catering to evolving consumer preferences and increasing awareness for health and wellness. The increasing prevalence of respiratory ailments, such as colds and allergies, led to a surging demand for over-the-counter (OTC) cough and throat-soothing products. As more individuals seek effective relief from coughs and sore throats, the cough drops market has expanded to meet this demand with various flavors, formulations, and ingredients. The trend toward natural and herbal remedies is reshaping the market landscape, as consumers are becoming more health-conscious and prefer products that incorporate natural ingredients over synthetic additives. This has resulted in manufacturers innovating and launching products that feature herbal extracts, vitamins, and essential oils, appealing to the growing segment of health-aware consumers. For instance, in October 2021, HALLS, the trusted cough and throat drop brand, introduced its most convenient innovation, HALLS minis Sugar-Free Cough Drops, in collaboration with legendary sportscaster Joe Buck.

E-commerce has transformed cough drop purchases by increasing accessibility. Online platforms provide convenience, allowing consumers to compare products, read reviews, and access a broader range of options than traditional brick-and-mortar stores. The shift in respiratory illnesses during seasonal peaks drives up sales as consumers stock up on cough relief products. Marketing strategies emphasizing user engagement through social media and online advertisements have also played a crucial role in increasing brand visibility and attracting younger demographics to purchase cough drops online.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com