Polyether Ether Ketone (PEEK) Segment to Bolster Cranial Implants Market Growth During 2023–2031

According to our new research study on "Cranial Implants Market Forecast to 2031 – Global Analysis – by Type, Material, and End User," the market was valued at US$ 1.42 billion in 2023 and is projected to reach US$ 2.44 billion by 2031; it is anticipated to record a CAGR of 6.9% from 2023 to 2031.

The report emphasizes the cranial implants market trends, along with drivers and deterrents affecting the market growth. An increase in the prevalence of traumatic brain injuries and a surge in elderly populations are contributing to the growing cranial implants market size. However, the risk of implant failure hampers the market growth. Further, customized implants are expected to emerge as new market trends in the coming years.

Cranial Implants Market Share, by Region, 2023 (%)

Cranial Implants Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Parietal, Frontal, Occipital, Temporal, and Sphenoid), Material (Polymethyl Methacrylate, Polyether Ether Ketone, Titanium, and Others), End User (Hospitals, Trauma Centers and Others), and Geography

Cranial Implants Market Size and CAGR by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increase in Prevalence of Traumatic Brain Injuries Bolsters Cranial Implants Market Growth

Traumatic brain injuries (TBIs) constitute one of the significant public health concerns as they interrupt the normal functioning of the brain due to external mechanical force. The common causes of TBIs include falls, motor vehicle accidents, and sports injuries, mainly affecting younger adults and older adults. TBIs vary from mild concussions to severe injuries that result in lifelong cognitive, physical, and emotional disabilities. According to a report published in The Lancet Neurology Commissions in 2022, TBI is one of the leading causes of injury-related death and disability, affecting 55 million people worldwide and costing over US$ 400 billion every year. Similarly, as per the Brain Injury Association of Waterloo-Wellington, TBIs occur in 500 out of 100,000 people yearly in Canada; over 6,000 patients become permanently disabled each year due to a TBI. Furthermore, according to the Bolt Burdon Kemp 2024 report, about 10,000–20,000 severe traumatic brain injuries occur every year in the country. The demand for effective treatment options, particularly cranial implants, is on the rise due to the increasing number of TBI cases. These implants play a crucial role in treating patients with severe head injuries by safeguarding the brain from further trauma and assisting in the restoration of the skull's protective function. Thus, the rising prevalence of TBI drives the demand for cranial implants.

Cranial Implants Market Report Scope:

The cranial implants market analysis has been carried out by considering the following segments: type, material, end user, and geography. Based on type, the market is segmented into parietal, frontal, occipital, temporal, and sphenoid. The parietal segment held the largest cranial implants market share in 2023. The parietal region, located on the sides of the head, is frequently involved in implantation procedures. Parietal cranial implants are medical devices designed to replace sections of the skull, typically following trauma, surgery, or congenital deformities. These implants aim to restore both the shape and function of the skull and maintain cranial symmetry, in addition to protecting the brain from external damage. Parietal cranial implants can significantly enhance a patient's quality of life by restoring their physical appearance and neurological function while also reducing the risks of brain injury or infection that may arise from exposed areas of the skull. Advancements in technologies such as 3D printing with the incorporation of original multilayer technology and an increasing demand for reconstructive procedures following head trauma, cranial deformities, and surgeries are further likely to benefit the market for parietal cranial implants in the coming years. Major companies engaging in the development and production of parietal cranial implants are Medtronic, Stryker, and Johnson & Johnson, among others.

In terms of material, the cranial implants market is categorized into polymethyl methacrylate, porous polyethylene, and titanium. The polymethyl methacrylate segment dominated the market in 2023. Polymethyl methacrylate (PMMA), a widely used material for manufacturing cranial implants, is appreciated for its versatility, ease of use, and cost-effectiveness. PMMA is a strong, transparent, and biocompatible thermoplastic polymer, which is also known as acrylic polymer; these attributes make it an ideal choice for cranial reconstruction in cases of trauma, congenital deformities, or skull surgeries. One of PMMA's main advantages is its ability to be molded into custom shapes, allowing for the creation of personalized implants that fit the patient's anatomy precisely. Moreover, PMMA is relatively inexpensive compared to other materials such as titanium or PEEK, making it more accessible for hospitals and healthcare providers, particularly in resource-constrained settings. Therefore, despite its lower durability than materials such as titanium, PMMA's lower cost, ease of use, and customization potential contribute to its growing popularity as a cranial implant material. Calavera Surgical offers cranial implants made from PMMA.

In terms of end user, the cranial implants market is categorized into hospitals, trauma centers, and ambulatory surgical centers. The hospitals segment dominated the market in 2023. Hospitals play a crucial role in the cranial implants market as they serve as essential care providers in healthcare systems. They are responsible for diagnosing and treating conditions such as TBIs, skull defects, and neurological disorders that necessitate implantation, including titanium plates and custom 3D-printed implants, to restore skull integrity and protect the brain, alongside retaining aesthetic aspects. According to the Brain Injury Canada report, TBI is the prominent cause of disability, as 2% of the Canadian population suffers from these injuries, with over 18,000 TBI hospitalizations annually.

Hospitals collaborate with medical device manufacturers to design personalized implants, often utilizing advanced technologies such as 3D imaging and printing. They also participate in the conduct of clinical trials, contributing to the development of innovative implant materials and surgical techniques. Moreover, they have the potential to influence market trends by adopting cutting-edge materials such as bioresorbable implants or lightweight alloys, which help improve care standards. They shape market demand by offering specialized services, educating patients, and training healthcare professionals in the latest implant technologies and procedures. In October 2023, 3D Systems introduced its advanced extrusion 3D printing technology for producing patient-specific cranial implants in hospitals across Europe. The company announced that a cranial implant, custom-made using its extrusion technology, was successfully utilized in a cranioplasty procedure at the University Hospital Basel. Hospitals can also navigate the regulatory landscape to ensure that implants meet safety standards and assist in the reimbursement process, making treatments more accessible.

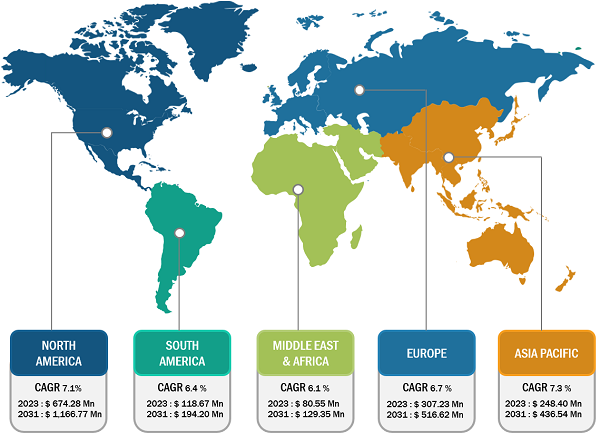

Cranial Implants Market Analysis: Based on Geography

The geographic scope of the cranial implants market report includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa).

The Bolt Burdon Kemp 2024 report, Government of Canada, Head Injuries in Australia Report, World Health Organization, Brain Injury Association of Waterloo-Wellington are among the primary and secondary sources referred to while preparing the cranial implants market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com