According to the new research report published by The Insight Partners, titled “Credit Insurance- Global Analysis and Forecast to 2025”, the global credit insurance market is expected to reach US$ 10.77 Bn in 2025, registering a CAGR of 2.9% during the forecast period 2017-2025.

In 2017, Europe accounted for the largest revenue share of more than one-third of the total market share, followed by North America.

Strong domestic trade policies, presence of good manufacturing industries for different industry verticals, high awareness and stable Governmental policies on the trade carried out in the region are some of the prime factors that have facilitated the high penetration of credit insurance in this region.

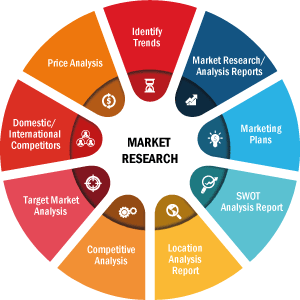

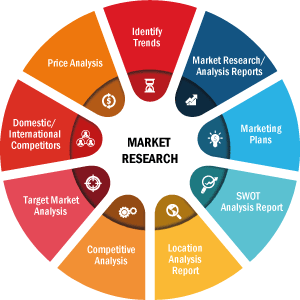

Credit insurance market is broadly segmented into components, enterprise size, and application. The companies operating in the global credit insurance market design robust products and services depending upon the requirements of their customers or clients. The global credit insurance market is further bifurcated on the basis of enterprise size as small & medium enterprises (SMEs) and large enterprises. The large enterprises capture a significant market share in the global credit insurance market over the years. The different types of applications of credit insurance include domestic trading market and export trading market. The export segment in the applications is much more prominent, and the demand for credit insurance products and services are gaining importance in the domestic market in the current years.

Credit Insurance Market

Credit Insurance Market Key Findings and Share by 2025

Download Free Sample

Credit Insurance Market to 2025 - Global Analysis and Forecasts by Component (Products, and Services); Enterprise Size (Small & Medium Enterprise, and Large Enterprise); & Application (Domestic, and Export)

The primary benefit of credit insurance which attracts the consumers is that the insurance policies protect the companies from non-payment of commercial debts. The global trade sector is experiencing significant growth in both the domestic market as well as international market, with Europe and North America being the leaders in the exporting various goods and products.

Key findings of the study:

- Europe is anticipated to account the largest share of credit insurance market and would register a CAGR of 2.1%.

- Based on the component type, products segment is projected to dominate the market.

Europe holds the second largest market share owing to its strong economy and developed infrastructure to support upcoming technological trends in almost all industry sectors and a stable regulatory framework laid down to carry domestic as well as international trades. The domestic trade between the EU countries is carried without any taxation or charges and is considered to be one of the strongest principles for this region. The EU is the biggest exporter in the world for manufactured goods and services as well as is the biggest import market for more than 100 countries of the world.

Growing trade of South East Asian countries with the Western countries of the world provides huge potential for the credit insurance market to prosper. South China Sea has been an important hub for carrying trade between the Asian and western countries and thereby opportunities in this region for the players is ample in the coming years.

The key companies profiled in this report include Atradius N.V., Coface SA, Euler Hermes, Zurich Insurance Group Ltd., Credendo Group, QBE Insurance Ltd., CESCE, American International Group Inc., Export Development Canada, and China Export & Credit Insurance Corporation (Sinosure).

Contact Us

Phone: +1-646-491-9876