Reagents and Consumables Segment to Bolster Digital PCR and Real-Time PCR Market Growth During 2024–2031

According to our new research study on "Digital PCR and Real-Time PCR Market Forecast to 2031 – Global Analysis – by Product and Services, Applications, Type, and End User," the market was valued at US$ 9.55 billion in 2024 and is projected to reach US$ 17.54 billion by 2031; it is estimated to register a CAGR of 9.1% during 2025–2031. The digital PCR and real-time PCR market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

Increasing incidence of genetic and infectious diseases and rising investments and funds for gene synthesis and PCR technologies are contributing to the growing digital PCR and real-time PCR market size. However, the high costs of PCR systems hamper the growth of the market. Further, the development of droplet digital PCR is expected to bring new digital PCR and real-time PCR market trends in the coming years.

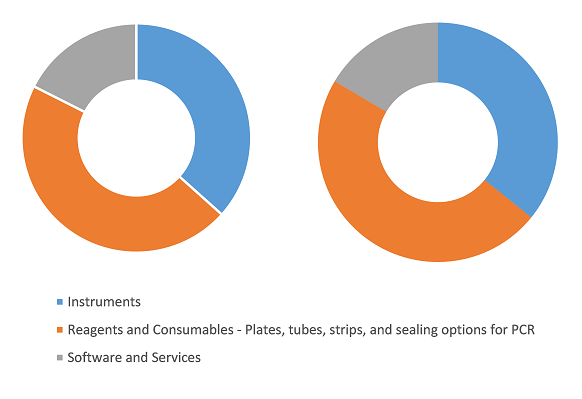

Digital PCR and Real-Time PCR Market Share, by Product and Services, 2024 (%)

Digital PCR and Real-Time PCR Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product and Services (Instruments, Reagents and Consumables, and Software and Services), Applications (Infectious Diseases Testing, Oncology Testing, Blood Screening, Transplant Diagnostics, and Others), End User (Hospitals and Diagnostic Centers, Research Laboratories and Academic Institutes, Pharmaceutical and Biotechnology Companies, Clinical Research Organizations, and Forensic Laboratories), Type (Digital PCR and Real-Time PCR), and Geography

Digital PCR and Real-Time PCR Market Research Report 2031

Download Free Sample

Increasing Incidence of Genetic and Infectious Diseases Bolsters Digital PCR and Real-Time PCR Market Growth

According to the National Organization's information on genetic conditions or congenital disabilities, though individual genetic disorders are rare, collectively, over 15,500 people are diagnosed with genetic disorders each year. A report by MJH Life Sciences (US) in 2022 estimated that 300,000 newborns worldwide are born with sickle cell disease every year, accounting for ∼5% of the global population. In the US, it is one of the most prevalent genetic conditions. Also, according to the CDC, 1 in 500 African Americans is affected by sickle cell disease, and ∼1 in 12 of them suffers from the autosomal recessive mutation. As per Novartis AG report in June 2020, ∼15,000 individuals have sickle cell disease, and 270 newborns are diagnosed with the condition every year. Furthermore, the disease is most prevalent in emerging nations such as India. Among India's tribal communities, ∼18 million people are affected by sickle cell trait (SCT), and 1.4 million people are suffering from sickle cell disease (SCD). The adoption of digital PCR is improving as pathologists are trying to use this technology to target various specific DNA sequences and diagnose and design various clinical tests. Digital PCR can target specific DNA sequences in just one molecule of DNA. This new tool allows researchers to isolate rare genetic mutations that are too difficult to segregate with real-time PCR.

The COVID-19 outbreak had a significant effect on the digital PCR and real-time PCR market growth. The growing demand from clinical diagnostics has a favorable effect on the PCR industry. Almost all diagnostic tests utilized RT-PCR to test individuals with COVID-19 symptoms, and healthcare experts recommended that they undergo diagnostic testing. However, authorities did not endorse viral culture tests. The majority of biotech and pharmaceutical businesses were concentrating their efforts on research and development divisions to find novel compounds or therapy approaches for COVID-19. In February 2022, Roche added the Cobas 5800 System, a newly released molecular laboratory instrument, to its COVID-19 PCR portfolio for use in nations that accept the CE certification. The portfolio includes the cobas SARS-CoV-2 and influenza A/B tests, as well as the cobas SARS-CoV-2 qualitative test. By offering uniform performance and efficiency across low-, medium-, and high-volume molecular laboratory testing needs, these products broaden the Roche Diagnostics molecular portfolio offering. Additionally, healthcare organizations with limited space or resources can have comprehensive access owing to the new, compact Cobas 5800 System. Moreover, nations or settings where larger equipment cannot be accommodated due to the lack of resources or space can have access to better testing due to this system.

Thus, the increasing incidence of genetic and infectious diseases in which dPCR and qPCR techniques can be used for diagnosis and treatments supports the growth of the digital PCR and real-time PCR market.

The digital PCR and real-time PCR market analysis has been carried out by considering the following segments: product and services, applications, end user, type, and geography. The digital PCR and real-time PCR market, based on product and services, is divided into instruments, reagents and consumables, and software and services. The reagents and consumables segment held the largest share of the digital PCR and real-time PCR market in 2024, and it is expected to register the highest CAGR during 2024–2031. The reagents and consumables segment is the most promising segment of the digital PCR and real-time PCR market, and it significantly contributes to the market growth. Reagents and consumables are essential parts of the dPCR and qPCR (real-time PCR) procedures. The reagents include buffers, probes, enzymes, dyes, vials, kits, and panels. Also, there are several kits available for gene expression analysis, SNP genotyping analysis, and microRNA analysis. The growing need for earlier detection of disease, widespread use of consumables and reagents, and expanding demand for PCRs for healthcare, research, and other purposes have significantly fueled the market growth for the segment.

Manufacturers such as Thermo Fisher Scientific, Kaneka Eurogentec S.A., and QIAGEN provide reagents and consumables. Developments, frequent product launches, rising acceptance of technological innovations, and increasing availability of the products are among the major factors contributing to the market growth for the segment. For instance, in July 2023, QIAGEN launched the CGT Viral Vector Lysis kit for the biopharmaceutical industry, expanding its range of dPCR kits and services.

By applications, the market is segmented into infectious diseases testing, oncology testing, blood screening, transplant diagnostics, and others. dPCR and qPCR are widely used in infectious disease testing. Rapid and accurate detection of infectious pathogens such as viruses, bacteria, and fungi is crucial for controlling outbreaks and initiating treatment. PCR-based methods, including dPCR and qPCR, are valuable in detecting low levels of pathogens. dPCR offers higher sensitivity and specificity than traditional PCR methods, which is essential for detecting rare pathogens, especially in immunocompromised patients. The increasing prevalence of infectious diseases is likely to increase the demand for dPCR and qPCR products. As per the World Health Organization (WHO), in 2023, 10.8 million people suffered from tuberculosis across the globe, of which ~6.0 million were men, ~3.6 million were women, and ~1.3 million were children.

The geographic scope of the digital PCR and real-time PCR market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

The US holds the largest market share, followed by Canada. The US is at the forefront of digital PCR (dPCR) and real-time PCR (qPCR) adoption, driven by a robust healthcare infrastructure, cutting-edge research, and strong government and private-sector investments. For instance, as per the article published in Medicaid 2025, the federal government spent US$ 1.9 trillion on healthcare programs and services in fiscal year 2024, representing 27% of all federal outlays, with Medicare accounting for 12% and Medicaid for 8%. These programs provide critical support for the adoption of PCR technologies, particularly in genetic testing, oncology, and infectious disease diagnostics. Moreover, the country leads in the development of next-generation PCR technologies, with a focus on precision medicine, infectious disease control, and genetic research. The National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), and the Food and Drug Administration (FDA) play a crucial role in funding and regulating PCR-based diagnostics, ensuring high standards for clinical use.

One key driver of PCR adoption in the US is its highly developed biotechnology and pharmaceutical industry. Major biotech hubs in California, Massachusetts, and North Carolina are home to leading PCR manufacturers and research institutions, fostering innovation in genomic medicine, oncology, and pathogen detection. PCR technology has become essential for biopharmaceutical production, gene therapy development, and vaccine research, with companies investing heavily in automation and AI-powered data analysis to enhance efficiency.

Another significant trend shaping the market is the rise of at-home and point-of-care (PoC) testing. In response to increasing consumer demand for faster and more accessible diagnostics, companies are developing compact and user-friendly PCR devices that enable rapid detection of infectious diseases, such as influenza and sexually transmitted infections (STIs), and antimicrobial resistance genes. Retail pharmacies and telehealth providers have started integrating these PCR-based tests into their services, expanding access to high-quality diagnostics beyond traditional clinical settings.

Academic and research institutions in the US are also pushing the boundaries of PCR applications, exploring their use in environmental monitoring, food safety, and forensic science. Advancements in multiplex PCR assays and high-throughput screening platforms are enabling researchers to analyze complex genetic data with unprecedented speed and accuracy. As artificial intelligence and cloud-based computing become more integrated with PCR workflows, data-driven diagnostics are expected to become more efficient and scalable.

Despite its leadership in PCR technology, the US market faces regulatory and cost-related challenges. FDA approval processes for new PCR assays remain complex, often requiring extensive clinical validation, which can slow down commercialization. Additionally, high costs associated with dPCR platforms and consumables create barriers for smaller diagnostic labs and research facilities. However, ongoing efforts to develop cost-effective, high-throughput solutions are expected to drive broader adoption.

The US digital PCR and real-time PCR market will continue to expand, fueled by innovations in personalized medicine, AI-driven diagnostics, and decentralized testing solutions. With sustained investment in biotechnology, infectious disease preparedness, and genomic research, the country remains a global leader in PCR development and application.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com