Rising Infrastructure Sector Contributes to Dubai Concrete and Concrete Products Market Growth

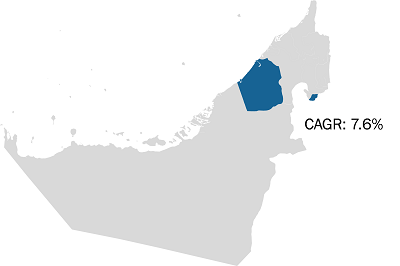

According to the latest market study on “Dubai Concrete and Concrete Products Market Forecast to 2031 – Regional Share, Trend, and Growth Opportunity Analysis – by Type and End Use,” the market was valued at US$ 2.85 billion in 2023 and is projected to reach US$ 5.13 billion by 2031; it is anticipated to record a CAGR of 7.6% from 2023 to 2031. The report highlights key factors contributing to the Dubai concrete and concrete products market size and prominent players, along with their developments in the market.

Dubai has diverse and extensive infrastructure demands owing to an ever-expanding urban landscape and ambitious development projects. The city continuously invests in expanding its transportation networks, utilities, and public amenities to support the burgeoning economy and cater to the needs of businesses, residents, and visitors. This translates into a significant demand for concrete for building roads, bridges, tunnels, and other critical infrastructure. Dubai's ambitious infrastructure vision includes mega-projects such as the Dubai Metro expansion and the upcoming Dubai Airport expansion. In 2023, Dubai Airports announced a plan to construct a larger airport—Al Maktoum International Airport—in the outskirts, aiming to replace the Dubai International Airport in the 2030s. At its full potential, this airport is expected to handle nearly 260 million passengers and 15 million tonnes of cargo annually. The construction of new airport terminals, runways, taxiways, and associated infrastructure necessitates substantial quantities of concrete. Concrete is integral to the structural integrity and operational efficiency of an airport as it is used in the construction of almost every area of these facilities, ranging from foundations of terminal buildings to pavements of runways and aprons. Additionally, the construction of ancillary facilities such as parking structures, hangars, and access roads further adds to the demand for concrete and concrete products.

Dubai Concrete and Concrete Products Market Breakdown – by Region

Dubai Concrete and Concrete Products Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Cement, Ready-Mix Concrete, and Concrete Products) and End Use (Residential, Commercial, Infrastructure, and Others)

Dubai Concrete and Concrete Products Market Forecast by 2031

Download Free Sample

According to the Roads and Transport Authority (RTA), Dubai Metro was the most popular mode of transport, serving 260 million riders in 2023, recording a surge of 15% compared to 2022. In November 2023, Sheikh Mohammed bin Rashid Al Maktoum, the Vice President and Prime Minister of the UAE as well as the Ruler of Dubai, approved the project Blue Line worth US$ 4.9 billion (AED 18 billion), a 30 km extension project of the Dubai Metro. The Blue Line will feature 14 stations, including 3 interchange stations connecting the existing Red and Green lines. Concrete is the primary material used for the construction of metro station platforms, structural elements, and tunnel linings, subsequently ensuring the safety, durability, and operational efficiency of the transit system. As Dubai continues to expand its public transportation network and aviation capabilities, enhance its airport facilities, and invest in sustainable urban infrastructure, the demand for high-quality concrete and concrete products remains strong in the city.

Dubai concrete and concrete products market trends include the rising adoption of green construction. Dubai emphasizes on sustainability and environmental consciousness. As a result, developers, architects, contractors, and other stakeholders in the construction industry are prioritizing environmentally friendly building materials and practices. Concrete is a versatile material that fits well in the concept of green and sustainable construction due to its durability, thermal mass properties, and recycling potential. With sustainability being a key focus of urban development initiatives, concrete is being used in innovative ways across the city to reduce environmental impact and enhance energy efficiency. One way in which concrete contributes to green construction is through the use of recycled materials in its production. Recycled aggregates such as crushed concrete and asphalt pavement can be incorporated into concrete mixes, reducing the need for virgin materials and utilizing waste from landfills. The recycling process helps conserve natural resources and reduce the carbon footprint of concrete production. Additionally, advancements in concrete manufacturing technology have led to the development of high-performance, eco-friendly concrete mixes. These mixes often incorporate supplementary cementitious materials, such as fly ash, slag, or silica fume, which can replace a portion of the cement content in concrete. By reducing cement consumption, these materials help lower carbon emissions associated with concrete production while improving its performance and durability. Major players operating in the construction industry in Dubai also pay high attention to Leadership in Energy and Environmental Design (LEED) ratings, green points, and sustainable buildings. Developers, investors, and end users increasingly prioritize green buildings due to their environmental benefits, economic advantages, and positive impact on occupant health and well-being. As a result, there is a growing market demand for construction materials and practices that meet LEED requirements. Environmental benefits and economic advantages of green buildings are evident through lower operating costs, increased property value, and improved occupant health and well-being. As a result, many new construction projects aim for green certification, whether for residential, commercial, or industrial structures.

In 2010, the UAE government approved the Green Building and Sustainable Building standards, and mandated their application across the country. It also introduced green building regulations containing 79 specifications, which were made mandatory for all development projects. In November 2014, Dubai Municipality passed a circular recommending the use of sustainable concrete in all new projects as part of the Dubai 2020 Urban Master Plan to become one of the environmentally sustainable cities. Further, its use was made compulsory on April 1, 2015, to reduce carbon emissions and to strategically position the UAE among countries pioneering green building and urban planning. As a result, the demand for green construction practices and materials, including concrete, continues to rise in Dubai. Therefore, the surging demand for green construction is expected to emerge as a new trend that would drive the Dubai concrete and concrete products market growth during the forecast period.

The Dubai concrete and concrete products market analysis is carried out by identifying and evaluating key players in the market across this city. Ducon Industries, Fujairah Cement Industries, Gulf Cement Company, Jebel Ali Cement, Lafarge Emirates Cement LLC, National Cement Co, CEMEX Topmix LLC, UltraTech Cement Ltd, Union Cement Company, Ras Al Khaimah Cement Company LLC, FAST Concrete Products Factory LLC, Berisha Brick Factory, Phoenix Concrete Products, TransGulf Cement Products LLC, and BILDCO Aerated Concrete LLC among the key players profiled in the Dubai concrete and concrete products market report.

Dubai Concrete and Concrete Products Market Segmentation:

The scope of the Dubai concrete and concrete products market report encompasses type and end use. Based on type, the market is segmented into cement, ready-mix concrete, and concrete products. The cement segment is further segregated into Portland cement, rapid hardening cement, low-heat cement, white cement, high-alumina cement, and others. The ready-mix concrete type is bifurcated into with reinforcement and without reinforcement. The concrete products segment is divided into pavement tiles, concrete blocks, interlock blocks, and road dividers. In terms of end use, the Dubai concrete and concrete products market is segmented into residential, commercial, infrastructure, and others.

In terms of type, the ready-mix concrete segment held the largest Dubai concrete and concrete products market share in 2023. Ready-mix concrete is manufactured in a batch plant as per each specific requirement on the job site. Transit-mixed concrete, shrink-mixed concrete, and central-mixed concrete are some of the commonly used ready-mix concrete types. The ready-mix concrete is of higher quality and precision, which makes it a preferable choice over alternatives. Ready-mix concrete is also sustainable and has high durability, which has led to higher growth of the market for this segment.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com