Biosimilars Segment to Hold Significant Europe Contract Research Organization Share During 2024–2031

According to our latest study on " Europe Contract Research Organization Market Forecast to 2031 – Regional Analysis – Service Type, Product Type, Type, Application, End User, and Country," the market is expected to reach US$ 40,023.68 million by 2031 from US$ 22,885.00 million in 2024; it is estimated to register the CAGR of 8.3% during 2024–2031. The market report emphasizes the key factors driving the market and developments by prominent players. Increased outsourcing of R&D and rising demand for clinical trials bolster the Europe contract research organization market. The report also includes growth prospects owing to the current Europe contract research organization market trends and their foreseeable impact during the forecast period.

A Contract Research Organization (CRO) provides outsourced research services to pharmaceutical, biotechnology, and medical device industries to develop new drugs and medical technologies. CROs handle various stages of research, including pre-clinical testing, clinical trials, regulatory compliance, and data analysis, ensuring that new treatments are safe and effective. By managing the complex and time-consuming aspects of drug development, CROs enable pharmaceutical companies to focus on innovation while expediting the approval process. Their expertise helps reduce costs, streamline research, and bring life-saving treatments to market faster, ultimately benefiting both businesses and patients worldwide.

Europe Contract Research Organization Market, by region, 2024 (%)

Europe Contract Research Organization Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Early Phase Development Services, Clinical Research Services, Laboratory Services, and Post-Approval Services), Product type (Cell and Gene Therapy, Biosimilars, Antibody Drug Conjugates, and Others), Type (In-house and Outsource), Application (Oncology, Neurology, Cardiology, Infectious Diseases, Metabolic Disorder, Nephrology, Respiratory, Dermatology, Ophthalmology, Hematology and Others), and End User (Pharmaceutical and Biotech Companies, Medical Device Companies, and Academic and Research Institutes)

Europe Contract Research Organization (CRO) Market Size 2025

Download Free Sample

Source: The Insight Partners Analysis

Rising Demand for Clinical Trials Drives Europe Contract Research Organization Market Growth

Europe is the global leader in healthcare innovation and has seen a surge in clinical trial activity due to its diverse patient population, advanced healthcare infrastructure, and strong regulatory framework. The need for faster drug development and approval timelines fuels the reliance on CROs to execute clinical trials efficiently. According to the European Medicines Agency 2021, The EU Clinical Trials Register displays 44,302 clinical trials with an EudraCT protocol, of which 7,355 are clinical trials conducted with subjects under 18 years old. According to the Association of the British Pharmaceutical Industry (ABPI), the total number of clinical trials increased by 4.3% per year, from 394 trials in 2021 to 411 in 2022. The UK government provides funding to encourage clinical trials. For instance, in August 2024, the UK secured a US$ 445.35 million investment by the UK government to boost clinical trials. The investments are expected to support faster patient access to cutting-edge treatments, strengthen clinical trials, and improve medicines manufacturing in the UK.

Sponsors tend to outsource these trials to CROs to access their specialized skill sets, exposure to innovative technologies, and established networks for trial management and patient recruitment. In Europe, the introduction of the EU Clinical Trials Regulation (CTR) has centralized the clinical trial application procedure in all the member states, making it an attractive place for sponsors from other parts of the world. CROs become invaluable resources for handling such regulatory needs, compliance, and minimizing administrative burdens for the sponsors.

Europe hosted the highest proportion of clinical trials worldwide, with Germany, the UK, France, and Spain in 2021, proving to be primary centers based on the strength of their healthcare infrastructures and conducive regulatory landscapes. Small and medium-sized enterprises (SMEs) increasingly resorted to the cost-saving offerings of CROs while frequently pioneering innovation with having limited funds for running in-house clinical trials. Increased demand for clinical trials has also been fueled by the expanding pipeline of new drugs, especially in oncology, immunology, and neurology, where clinical trials are essential to prove efficacy and safety. CROs offer full-service support, from protocol development and patient enrollment to data analysis and reporting, allowing sponsors to concentrate on their core strengths while guaranteeing high-quality trial execution.

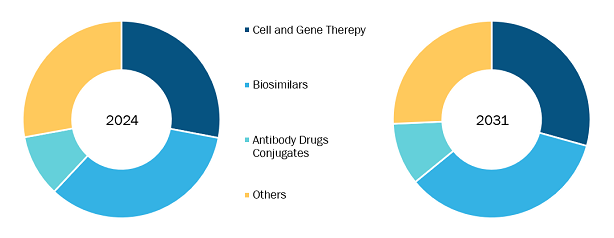

Europe Contract Research Organization Market by Product Type:

Based on product type, the Europe contract research organization market is segmented into cell and gene therapy, biosimilars, antibody drug conjugates, and others. Biosimilars segment held the largest share of the market in 2024 and is anticipated to register the second-highest CAGR during 2024–2031.

Biosimilar Contract Research Organization (CRO) is a specialized research partner that helps pharmaceutical and biotech companies develop biosimilars, which are highly similar to existing biologic drugs. These organizations manage crucial aspects of the process, from laboratory testing and clinical trials to regulatory approvals, ensuring that biosimilars meet strict safety, efficacy, and quality standards. With deep scientific expertise and regulatory know-how, Biosimilar CROs streamline the development process, reducing costs and accelerating the availability of affordable, high-quality treatments. Their work plays a vital role in making life-saving medicines more accessible to patients while supporting innovation in the healthcare industry.

Europe Contract Research Organization Market by Type:

In terms of type, the Europe contract research organization market is bifurcated into in-house and outsource. The outsource segment held a larger market share in 2024 and is anticipated to register a higher CAGR during 2024–2031. Outsourcing CRO functions involves an organization contracting a third-party contract research organization to conduct certain parts or all parts of the research activity. These tasks may include managing clinical trials, regulatory affairs, clinical data management, and pre-clinical studies.

Outsourcing offers benefits such as exposure to specialized expertise, such as regulatory, clinical, and statistical expertise; the ability to scale up or down resources according to the requirements of projects; cost-effective solutions, especially for smaller companies or start-ups that lack internal resources; more efficient and quicker delivery of projects using processes and systems in place.

Outsourcing enables organizations to concentrate on core areas (e.g., product development or drug discovery). Small biotech firms, start-ups, or big firms without the capability to perform specific parts of a clinical trial may outsource their regulatory filings, clinical trials, as well as data analysis to contract research organizations such as Covance, Syneos Health, or Parexel.

Europe Contract Research Organization Market by End User:

By end user, the market is divided into pharmaceutical and biotech companies, medical device companies, and academic and research institutes. The pharmaceutical and biotech companies segment dominated the Europe contract research organization market share in 2024, and the same segment is anticipated to register the highest CAGR during 2024–2031.

Europe Contract Research Organization Market Analysis, by Country

The growth of the Europe contract research organization market is attributed to the surging chronic disease prevalence, expanding healthcare infrastructure, and advancements in medical gas delivery systems. Furthermore, the presence of manufacturers and their distributors across the region drives the expansion of the overall Europe contract research organization market size. The scope of the Europe contract research organization market report covers seven countries: The United Kingdom, Germany, France, Italy, Spain, Netherlands, Greece, and the Rest of Europe. The market in the UK is expected to reach 10762.60 million by 2031, at an estimated CAGR of 9.4% during 2024–2031.

The UK holds the largest share of the Europe contract research organization, and the market growth in this country can be attributed to the surge in clinical trials and a rise in demand for outsourced drug discovery services.

Apart from presenting the factors driving the market, the Europe contract research organization report also emphasizes major developments by prominent players.

Parexel International Corp, Thermo Fisher Scientific (PPD Inc), Precision Medicine Group, LLC, ProPharma Group, Medpace Holdings Inc, O4 Research Ltd, Julius Clinical, Siron Clinical, Clinmark sp. z o.o., Pharmaxi LL are among the prominent players operating in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com