Natural Biomaterials Segment to Bolster Europe Regenerative Dentistry Market Growth During 2025–2031

According to our new research study on "Europe Regenerative Dentistry Market Forecast to 2031 – Regional Analysis – by Product Type, Technology, Application, and End User," the market is projected to reach US$ 1,269.60 million by 2031 from US$ 836.50 million in 2024. The market is expected to register a CAGR of 6.3% during 2025–2031.

The report emphasizes the Europe regenerative dentistry market trends, along with drivers and deterrents affecting the market growth. The increasing prevalence of dental disorders in aging population and increasing demand for cosmetic dentistry are contributing to the growing Europe regenerative dentistry market size. However, high-cost barriers in dental regeneration treatment hamper the market growth. Further, the increased adoption of tissue regeneration is expected to emerge as a new market trend in the coming years.

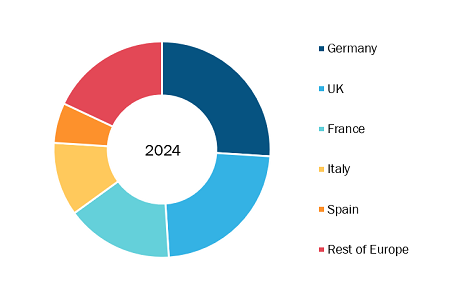

Europe Regenerative Dentistry Market, by region, 2024 (%)

Europe Regenerative Dentistry Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Natural Biomaterials and Synthetic Biomaterials), Technology (Tissue Engineering, Stem Cell Therapy, and Others), Application (Periodontal Regeneration, Endodontic Regeneration, Tooth Reconstruction, Bone Regeneration, and Others), Age Group (Adult and Pediatric), End User (Hospitals, Dental Clinics, and Others), and Region

Europe Regenerative Dentistry Market Key Findings, Share 2031

Download Free Sample

Source: The Insight Partners Analysis

Rising Prevalence of Dental Disorders in Aging Population Bolsters Europe Regenerative Dentistry Market Growth

As life expectancy rises across European nations, a larger segment of the population experiences age-related dental issues such as periodontitis, edentulism (tooth loss), and alveolar bone resorption. According to the World Health Organization (WHO) 2022, severe periodontal disease affects nearly 10% of the global population, with higher rates among older adults. According to Eurostat, as of January 1, 2024, the European Union's (EU) population was estimated at 449.3 million people. Of this total, more than one-fifth (21.6%) were aged 65 years and over. This demographic shift indicates a significant aging within the EU, with the proportion of older individuals aged above 65 years. For instance, the share of persons aged 65 and over rose from 16.2% at the beginning of 2003 to 21.3% at the beginning of 2023. In Europe, nearly 30% of individuals aged 65 and above suffer from edentulism, creating a growing need for innovative dental solutions.

Regenerative dentistry plays a crucial role in addressing these challenges by offering advanced treatment modalities such as stem cell therapies, platelet-rich plasma (PRP) applications, and bioengineered scaffolds for tissue regeneration. These technologies help restore lost dental structures, improve oral function, and enhance the overall quality of life for elderly patients. Additionally, government initiatives and healthcare policies promoting oral health awareness are encouraging the adoption of regenerative dental treatments. As a result, the rising prevalence of dental disorders, combined with an aging population, is significantly driving the expansion of the regenerative dentistry market in Europe.

Europe Regenerative Dentistry Market Report Scope:

The Europe regenerative dentistry market analysis has been carried out by considering the following segments: product type, technology, application, and end user.

Based on product type, the Europe regenerative dentistry market is bifurcated into natural biomaterials and synthetic biomaterials. The natural biomaterials segment held a larger share of the Europe regenerative dentistry market in 2024. Natural biomaterials, including collagen, demineralized bone matrix (DBM), and hyaluronic acid, play a crucial role in regenerative dentistry due to their high biocompatibility and ability to integrate with human tissues. These materials are widely used in bone grafting, periodontal regeneration, and guided tissue regeneration (GTR). Across Europe, natural biomaterials are preferred due to their bioactivity and lower risk of immune rejection compared to synthetic alternatives. Leading dental research institutions continue to explore new sources, such as marine-derived collagen and plant-based biomaterials, to enhance clinical outcomes. However, challenges such as high production costs, limited mechanical strength, and potential variability in properties have spurred further research into synthetic alternatives. The rising adoption of minimally invasive procedures has also increased the demand for natural biomaterials that promote rapid healing. Despite their limitations, they remain a cornerstone of regenerative dentistry in Europe, supported by ongoing advancements in bioengineering and tissue regeneration techniques.

By technology, the Europe regenerative dentistry market is segmented into tissue engineering, stem cell therapy, and others. The tissue engineering segment held the largest share of the Europe regenerative dentistry market in 2024. Tissue engineering is one of the most widely adopted regenerative approaches in Europe’s dental sector, particularly for periodontal and bone regeneration. This technology integrates biomaterials, growth factors, and cellular components to repair or replace damaged tissues, making it a preferred method in implantology and reconstructive dentistry. European universities and research institutions have been pioneers in developing tissue-engineered solutions, including biomimetic scaffolds and bioactive hydrogels that promote cellular proliferation and differentiation. The increasing use of polymer-based and ceramic-based biomaterials, along with advancements in 3D printing, has enhanced the precision and effectiveness of these treatments. Additionally, European dental professionals have been early adopters of guided tissue regeneration (GTR) and growth factor therapies, significantly improving patient outcomes. The widespread clinical acceptance of tissue engineering is further supported by professional training programs, regulatory approvals, and funding initiatives aimed at advancing regenerative technologies in dentistry.

According to application, the Europe regenerative dentistry market is segmented into periodontal regeneration, endodontic regeneration, tooth reconstruction, bone regeneration, and others. The periodontal regeneration segment held the largest share of the Europe regenerative dentistry market in 2024. Periodontal diseases, such as gingivitis and periodontitis, are prevalent in Europe, affecting millions of individuals. Periodontal regeneration focuses on restoring the bone, ligaments, and tissues surrounding the teeth that are damaged due to periodontitis. Techniques such as guided tissue regeneration (GTR), enamel matrix derivatives (EMD), and growth factor application are widely used to stimulate natural healing. European dental research institutions are actively investigating advanced biomaterials and stem-cell-based approaches to enhance treatment success rates. The increasing adoption of minimally invasive regenerative procedures, such as the Minimally Invasive Surgical Technique (MIST) and Modified Minimally Invasive Surgical Technique (M-MIST), is expected to further drive advancements in this segment. Studies and clinical trials across Europe have demonstrated the effectiveness of these techniques in improving periodontal tissue regeneration, leading to a shift toward biological approaches over traditional surgical interventions.

In terms of age group, the market is bifurcated into pediatric and adults. The adult segment held a larger share of the Europe regenerative dentistry market in 2024.

Based on end user, the market is segmented into hospitals, dental clinics, and others. The dental clinics segment held the largest share in the Europe regenerative dentistry market in 2024.

Europe Regenerative Dentistry Market Analysis: By Region

The regional scope of the Europe regenerative dentistry market includes the assessment of the market performance in Germany, the UK, France, Italy, Spain, and the Rest of Europe. Germany dominated the Europe regenerative dentistry market in 2024, and it will continue to dominate the market during the forecast period. The aging population has been a major contributor to the elevated demand for regenerative dentistry in Germany. A rise in the volume of dental diseases can be directly linked to the ever-increasing number of elderly people, triggering the demand for regenerative dental products. As per the Statista, in 2022, ~23 million people in the country were aged between 40 and 59, making it the largest age group in the country. People aged 65 years and above have been identified as the next largest age group, with 18.44 million people belonging to this group.

Market players are launching various innovative products in the regenerative dentistry market. For instance, in August 2021, Botiss Biomaterials GmbH (a German company) made a groundbreaking advancement in regenerative dentistry by developing the first-ever dental magnesium biomaterial to receive CE approval. This innovative technology marks a significant step forward in the field. The launch of the NOVAMag product line offers dentists a new option for a biomaterial that is mechanically strong yet completely bioresorbable, allowing it to be gradually replaced by natural bone over time.

The National Research Council, Italian National Institute of Statistics, World Health Organization, and Universal Healthcare System are among the secondary sources referred to while preparing the Europe regenerative dentistry market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com