Strong Growth of Automotive Industry Europe Silver Paste Market Growth

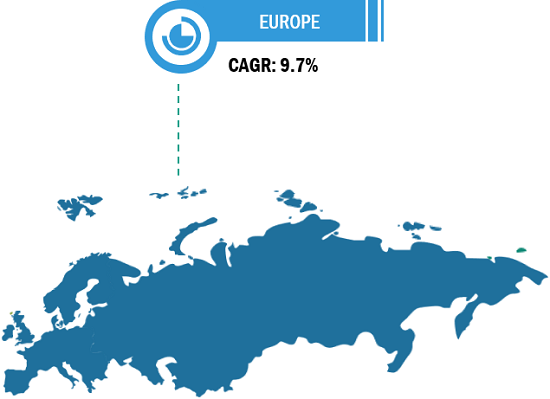

According to the latest market study on "Europe Silver Paste Market Forecast to 2031 — Regional Share, Trend, and Growth Opportunity Analysis — by Type, Product Type, Application, and Technology," the market was valued at US$ 932.80 million in 2023 and is projected to reach US$ 1,955.29 million by 2031; it is anticipated to record a CAGR of 9.7% from 2023 to 2031. The report highlights key factors contributing to the growing Europe silver paste market size and prominent players, along with their developments in the market.

Automotive manufacturers integrate advanced electronics into automobiles to enhance vehicle performance, safety, and user experience. Silver paste, with its exceptional electrical conductivity and durability, is integral to the production of high-performance electronic components used in modern vehicles, including electric and hybrid models. The rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) in Europe has significantly boosted the demand for silver paste. These vehicles rely heavily on electronic systems, power inverters, and motor controllers, all of which require conductive materials such as silver paste for efficient energy transfer and reliable operation. As governments of various countries in Europe push for electrification and implement stricter emissions regulations, the adoption of EVs is accelerating, further driving the use of silver paste in automotive electronics. The growth of the automotive industry in Europe leads to a higher production volume of vehicles. This, in turn, boosts the need for a larger quantity of tribological components such as bearings, gears, and seals. According to the European Automobile Manufacturers' Association, 13.1 million motor vehicles are manufactured annually in the European Union (EU). With over 10.5 million new registrations, EU car sales surged by ~14% in 2023. Battery-electric sales soared by 37%, accounting for approximately 15% of total car sales in the EU. In addition, in 2023, the EU solidified its position as the second-largest global car producer as production reached 12.1 million units, a growth of over 11%.

Europe Silver Paste Market Breakdown – by Country

Europe Silver Paste Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Silver Epoxy, Silver Polyurethane, and Others), Product Type (Front-Side Silver Paste, Back-Side Silver Paste, Die-Attach Paste, and Others), Application [Photovoltaic (Front-Side Metallization, Back-Side Metallization, and Others), Electronics (Multilayer Ceramic Capacitors, Printed Circuit Boards, Membrane Switches, and Others), Automotive (Sensors, Heating Elements, LED Components, and Others), Healthcare (Electrodes, Biosensors, and Others), and Others], Technology (Screen Printing, Inkjet Printing, Flexographic Printing, and Others), and Country

Europe Silver Paste Market Research Report by 2031

Download Free Sample

Advancements in automotive safety and connectivity systems, such as advanced driver-assistance systems (ADAS) and in-car infotainment, have amplified the demand for complex electronic components. Silver paste is used in the production of sensors, radar modules, and PCBs that power these systems, ensuring their precision and reliability. As these technologies become standard features in vehicles, the need for silver paste continues to grow. The automotive lighting sector has a wide range of applications for silver paste. With the transition to LED lighting in vehicles, silver paste is extensively used in LED chip packaging to create conductive pathways, further ensuring efficient energy usage, durability, and thermal management in automotive lighting systems. Thus, the expanding automotive industry fuels the Europe silver paste market growth.

The Europe silver paste market trends include the increasing demand from the renewable energy sector. Europe's strong commitment to reducing carbon emissions and transitioning to clean energy sources is leading to rapid growth in the adoption of solar photovoltaics (PV), wind power, and other renewable technologies. Advancements in energy technologies and the region's focus on sustainability are collectively driving the demand for innovative and high-performance silver paste formulations. Silver paste, a critical material in solar cell manufacturing, benefits directly from this shift, as it helps enhance the efficiency and reliability of solar panels. Europe's renewable energy initiatives are mainly focused on solar energy, driven by ambitious targets set under frameworks such as the European Green Deal and REPowerEU Plan. In September 2024, The European Investment Bank (EIB) signed a ~US$ 174 million (€166 million) loan with BNZ, an independent power producer, to finance the construction of 17 solar photovoltaic power plants in Southern Europe. This financing represents the first tranche of ~US$ 523 million (€500 million) approved by the EIB to support the installation of 1.7 GW of solar capacity in this region by 2026. In addition, on October 21, 2024, the European Commission announced more than US$ 398.18 million (€380 million) in grants to 133 new projects across Europe to achieve the EU Green Deal's broad range of climate, energy, and environmental goals—including the EU's aim to become climate-neutral by 2050 as well as stop and reverse biodiversity loss by 2030. Silver paste is widely used in solar PV applications, particularly in front-side and rear-side metallization of solar cells, where its excellent conductivity and adhesion properties contribute to high energy conversion efficiency. As solar installations across Europe expand, the demand for advanced silver paste formulations is expected to surge in the coming years. The transition to renewable energy is also impacting the development of decentralized energy systems, including building-integrated photovoltaics (BIPV) and smart energy grids. Silver paste is integral to the production of PV components used in these systems, which are gaining traction in Europe due to their ability to integrate clean energy solutions into urban infrastructure.

The Europe silver paste market analysis is carried out by identifying and evaluating key players operating in the market. Heraeus Group; Vibrantz Technologies Inc; DuPont de Nemours Inc; Dycotec Materials Ltd; Daejoo Electronic Materials Co., Ltd.; FENZI SpA; Noritake Co Ltd; Monocrystal; MG Chemicals; and Sun Chemical are among the key players profiled in the Europe silver paste market report.

Europe Silver Paste Market Segmentation:

The market is segmented on the basis of type, product type, application, and technology. Based on type, the Europe silver paste market is segmented into silver epoxy, silver polyurethane, and others. By product type, the market is categorized into front-side silver paste, back-side silver paste, die-attach paste, and others. In terms of application, the market is categorized into photovoltaic (front-side metallization, back-side metallization, and others), electronics (multilayer ceramic capacitors, printed circuit boards, membrane switches, and others), automotive (sensors, heating elements, LED components, and others), healthcare (electrodes, biosensors, and others) and others. On the basis of technology, the market is categorized into screen printing, inkjet printing, flexographic printing, and others. The geographic scope of the Europe silver paste market report focuses on Germany, France, the UK, Italy, Russia, and the Rest of Europe. Further, Germany held the largest Europe silver paste market share in 2023.

Based on type, the silver epoxy segment held the largest Europe silver paste market share in 2023, and is expected to register the highest CAGR from 2023 to 2031. Silver epoxy paste is designed as a conductive thermosetting silver preparation for screen printing applications. Its unique composition provides high electrical and thermal conductivity with excellent bond strength after appropriate cure. Silver epoxy paste is used instead of lead-tin solders to avoid flux contamination or exposure to excessive temperature as well as process simplification by screening on contacts. Silver epoxy is widely utilized in industries such as electronics and automotive, as well as for coating purposes. Its unique properties, such as excellent thermal and electrical conductivity, strong adhesive, and resistance to environmental factors, make it a preferred choice for applications requiring durability and high performance. In the electronics industry, silver epoxy is primarily used as a solder replacement for bonding heat-sensitive electronic components. It allows quick cold soldering repairs and effectively bonds heat sinks to other components and printed circuit boards (PCBs). These factors led to the growth of the silver epoxy segment in the Europe silver paste market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com