Procedures Segment to Dominate Fill Finish Manufacturing Market During 2022–2030

According to our new research study on "Fill Finish Manufacturing Market Size and Forecast to 2030 – by Product, Modality, and End User" the fill finish manufacturing market size is expected to grow from US$ 8,705.58 million in 2022 and to reach a value of US$ 17,165.41 million by 2030; it is anticipated to record a CAGR of 8.9% from 2022 to 2030. Key factors driving the market are the rising adoption of prefilled syringes for parenteral administration and elevating demand for biologics. However, the growing competition in the biopharmaceutical contract manufacturing industry hinders the fill finish manufacturing market growth.

Parenteral administration is one of the most prominent routes chosen to stimulate immediate immune response and ensure the complete bioavailability of pharmaceutical products. A steady rise in the development and market availability of parenteral drugs has propelled the demand for advanced, cost-effective drug delivery devices that promise ease of administration. The benefits of prefilled syringes over traditional delivery systems include easy administration, improved safety, accurate dosing, and reduced contamination risks. Among drug delivery devices, prefilled syringes represent one of the fastest-growing primary packaging formats, which are designed for dose administration. In the past ten years, there has been an evident increase in the development of parenteral drugs (especially with the introduction of several classes of biologics), which has resulted in approximately three-fold increase in the consumption of prefilled syringes. The sustained preference for the prefilled syringes is attributed to the safety and ease of use of these products. Recent variants are designed with provisions to reduce errors in dosing, risk of occlusions, leakage of fluids (i.e., extravasation), and inflammation of veins (phlebitis). Owing to the benefits mentioned above, several injectable drugs—Humira, Enbrel, Avastin, PREVNAR 13, ALPROLIX, and Benefix, among others—diluents and other products requiring parenteral administration are packaged in prefilled syringes.

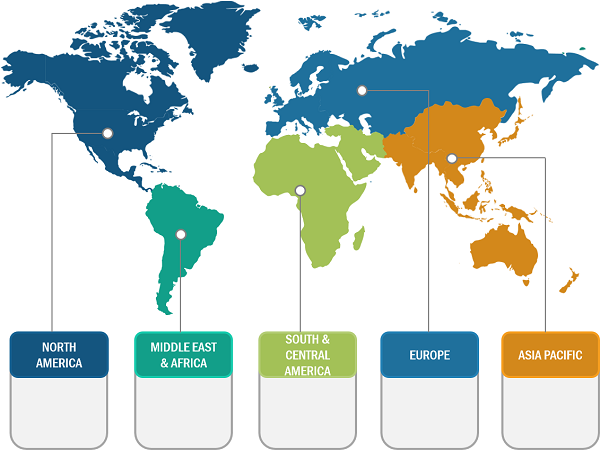

Fill Finish Manufacturing Market, by Geography, 2022 (%)

Fill Finish Manufacturing Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product [Consumables (Prefilled Syringes, Glass Vials/Plastic Vials, Cartridges, and Others), and Instruments], Modality (Recombinant Proteins, Monoclonal Antibodies, Vaccines, Cell Therapies and Biological Therapies, Gene Therapies, and Others), and End User (Contract Manufacturing Organizations, Biopharmaceutical Companies, and Others)

Fill Finish Manufacturing Market Opportunities by 2030

Download Free Sample

Source: The Insight Partners Analysis

Over the past seven years, ~90 drugs have been approved in the prefilled syringe packaging form across different geographies, including North America, Europe, and Asia Pacific. Several drugs in the clinical stages of drug development are being evaluated in combination with prefilled syringes.

The loading of sterile drugs into prefilled syringes is considered one of the most crucial steps in the pharmaceutical production process. Proper fill/finish operations are necessarily carried out under aseptic conditions to maintain pharmacological efficacy and quality and to ensure the safety of end users. The prefilled syringe filling is a complex operation as it requires extremely close monitoring of both the syringe fill volume and the headspace between the liquid filled in the syringe and the bottom of the plunger. In addition, the rise in complexity of small molecule APIs and the increasing diversity of biological drugs contribute to the demand for advanced aseptic fill finish operations.

Companies, including small enterprises and large businesses, outsource their respective fill finish operations to contract service providers. Per the 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, manufacturers of biological have been observed to outsource more than 30% of their fill finish operations. With the rise in the demand for prefilled syringes and the growing complexity of fill finish processes, outsourcing these operations is likely to increase in the future. Over 100 companies across the globe are providing fill finish services for prefilled syringe manufacturers. To cater to the growing demand for pharmaceutical products, service providers are actively investing in expanding their existing infrastructure and capabilities; they have also expanded their clientele through service agreements over the past few years. As injectables account for ~55% of drug candidates in the global R&D pipeline, the businesses of prefilled syringe manufacturers and associated service providers are also growing. Due to the emergence of the COVID-19 crisis, vaccine development initiatives have increased across the globe, which significantly boosted the demand for prefilled syringes. Thus, the rising adoption of prefilled syringes for parenteral administration drives the fill finish manufacturing market.

The report segments the fill finish manufacturing market as follows:

The fill finish manufacturing market, by product, is bifurcated into consumables and instruments. The consumable segment is further segmented into prefilled syringes, glass vials/plastic vials, cartridges, and others. The fill finish manufacturing market, by modality, is segmented into recombinant proteins, monoclonal antibodies, vaccines, cell therapies and biological therapies, gene therapies, and others. The fill finish manufacturing market, by end user, is segmented into contract manufacturing organizations, biopharmaceutical companies, and others. Based on geography, the fill finish manufacturing market is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com