Flourishing E-Commerce Industry Drives the Frozen Entrée Market

According to our new research study titled "Frozen Entree Market to Forecast 2030 – COVID-19 Impact and Global Analysis – by Type, Category, and Distribution Channel," the market size was valued at US$ 39,925.58 million in 2022 and is projected to reach US$ 57,054.53 million by 2030; it is expected to register a CAGR of 4.6% from 2022 to 2030.

The frozen entrées are ready-to-eat meals, which saves time on food preparation. Due to hectic work schedules, millennials prefer quick and easy meals without compromising on taste and nutrition. These factors are significantly promoting the demand for convenience food among consumers, thereby propelling the frozen entrée market growth. The percentage of households with one or two persons is growing in countries such as the US, Canada, the UK, and Germany. There were 36.1 million single-person households in the US, i.e., 28% of all households, according to the 2020 Current Population Survey. The growing number of one or two-person families has surged the demand for ready-to-eat convenience food, which further drive the frozen entrée market growth.

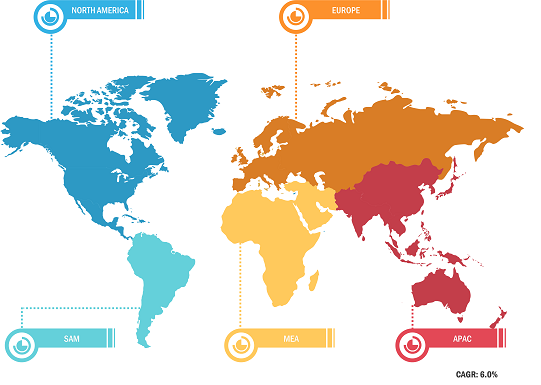

Frozen Entree Market Breakdown – by Region

Frozen Entree Market Forecast to 2030 - Global Analysis by Type [Meat-Based Entrees and Plant-Based Entrees (Plant-Based Meat Entrees, Sweet Potato Entrees, Vegetable Entrees, and Others)], Category (Organic and Conventional), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Frozen Entree Market Forecast and Size by 2030

Download Free Sample

In recent years, the emergence of e-commerce has revolutionized consumer shopping and spending habits. Smartphone and internet penetration, emerging technologies, rising purchasing power, and convenience provided by online retail shopping platforms from anywhere at any time are among the key factors favoring the e-commerce industry. According to the US Department of Commerce Retail Indicator Division, e-commerce sales in the US reached US$ 870 billion in 2021, up by 14.2% from 2020. Online grocery sales grew by 170% in 2021, accounting for 9.6% of total grocery sales in the US.

According to American Frozen Food Institute, online sales of frozen food products increased by 75% in 2020 compared to a year ago, with frozen dinners/entrees, meat, poultry, and seafood being the biggest online sellers. During the pandemic, online sales of food and beverages rose significantly due to the shutdown of brick-and-mortar stores and the social restrictions imposed by governments.

Heavy discounts, wide availability of brands under one roof, and home delivery options are the key factors driving consumers’ focus toward online shopping. Frozen entrees are easily available across well-known online retail platforms such as Amazon, Lidl, and Walmart. This factor contributes to the growth of the frozen entrée market by eliminating the dependency on brick-and-mortar stores.

Impossible Foods Inc, Kellogg Co, Conagra Brands Inc, Daiya Foods Inc, Nestle SA, Del monte Foods Inc, B&G Foods Inc, Waffle Waffle LLC, Mars Inc, and Amy's Kitchen Inc. are among the key players operating in the global frozen entree market. Manufacturers of frozen entrée are making significant investments in product innovation to expand their customer base and meet emerging consumer demands. They are focusing on providing sugar-free, organic, gluten-free, plant-based, and clean-labeled products, as well as products suitable for a keto diet to suffice the varied requirements of consumers.

Impact of COVID-19 Pandemic on Frozen Entree Market

Before the pandemic, many countries were experiencing economic growth and increased consumer spending power. Factors such as increasing working women population and consumer’s inclination toward convenient meals, frequent small meals, and on-the-go meals influenced the growth of frozen entrée market. However, the outbreak of COVID-19 adversely impacted various industries, including the food & beverages industry. Due to the nationwide lockdown and border restrictions, there was a significant disruption in the supply chain. Raw material and labor shortages created operational difficulties for food processors across various countries. During the initial phase of the pandemic, people were restricted from going outside their houses. This global panic situation has propelled the demand for frozen food products owing to their higher shelf life.

The sales of frozen food items through online retail platforms increased dramatically as the e-commerce operators continued to operate even during lockdowns. People stayed at home due to work from home mandates and stocked various food items including prepared meals to save cooking time and efforts. This factor had a positive impact on the frozen entree market.

The report segments of frozen entree market as follows:

Based on type, the frozen entree market is segmented into meat-based entrees and plant-based entrees. The plant-based entrees segment is further divided into plant-based meat entrees, sweet potato entrees, vegetable entrees, and other plant-based entrees. Based on category, the frozen entrée market is bifurcated into organic and conventional. Based on distribution channel, the frozen entree market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The frozen entree market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com