Frozen Sweet Potato Market: Key Insights

According to our new research study on "Frozen Sweet Potato Market Forecast to 2030 — COVID-19 Impact and Global Analysis — by Type, Category, End User, and Geography," the frozen sweet potato market size was valued at US$ 3,982.50 million in 2022 and is expected to reach US$ 6,105.37 million by 2030; the market is expected to register a CAGR of 5.5% from 2022 to 2030.

Frozen sweet potato products offer a convenient and versatile option for incorporating these nutritious root vegetables into one meal. Whether in the form of fries, wedges, nuggets, hashbrowns, or other products, these frozen products provide a time-saving solution for busy individuals seeking a healthy addition to their diet. Changing people's lifestyles and hectic work schedules drive the demand for convenience food. People are shifting toward products that provide them convenience and help them save time. These factors are driving the demand for frozen food. Frozen food is easy to prepare at home with no time. Further, it has an extended shelf life and is easy to store. Frozen sweet potatoes are becoming popular snack items among younger populations and kids due to their versatile flavor and crispy texture. Thus, the rising demand for frozen food and the increasing popularity of frozen sweet potato products drive the market growth.

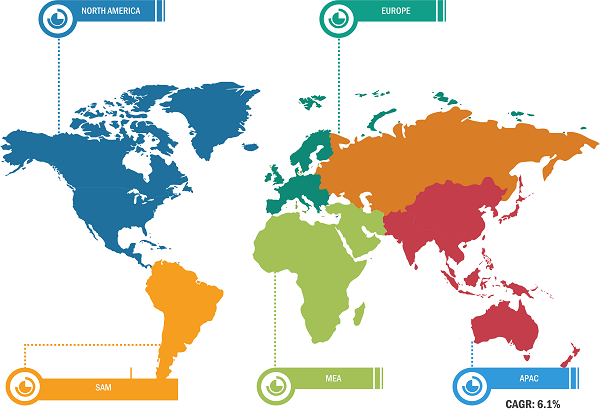

Frozen Sweet Potato Market Breakdown – by Region

Frozen Sweet Potato Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Fries, Nuggets and Puffs, Wedges, Hashbrowns, and Others), Category (Organic and Conventional), and End User (Food Service and Food Retail)

Frozen Sweet Potato Market Size & Share Analysis Report 2030

Download Free Sample

North America held the most significant global frozen sweet potato market share in 2022. Asia Pacific is anticipated to grow at the fastest CAGR in the frozen sweet potato market analysis from 2022 to 2030. The Asia Pacific frozen sweet potato market growth is attributed to the rising demand for frozen snacks, appetizers, and ready meals and the growing consumption of convenience food products. Further, the growth of the middle-class population and the rising disposable income of consumers are a few of the major factors driving the consumption of frozen food in the region. According to the Japan Frozen Food Association, the frozen food production value in Japan increased from US$ 6,421.06 million in 2019 to US$ 6,629.02 million in 2020.

Increasing Demand for Healthy Alternatives to Conventional Snacking Items to Provide Lucrative Opportunities to Frozen Sweet Potato Market

Health-conscious consumers prefer sweet potato products over regular potato products owing to the lower glycemic index of sweet potatoes than potatoes. Low glycemic index foods provide sustained energy and help stabilize blood sugar levels, thus beneficial for diabetic patients. Sweet potatoes are a rich source of fiber, vitamins, minerals, and antioxidants and are a preferred choice of starchy food in many regions. According to a report published by the CBI Ministry of Foreign Affairs (Europe) in 2023, product promotion and diversification of sweet potatoes drive the demand for sweet potatoes and associated value-added products in Europe. Also, manufacturers are promoting processed sweet potato products in Europe. The UK is a mature market for sweet potatoes in terms of consumption and import volume in 2021. Further, the UK, Germany, and other major sweet potato-producing countries hold ample potential in the sweet potato processing industry to produce frozen fries, crisps, hash browns, and wedges.

Frozen Sweet Potato Market: Segmental Overview

Based on end user, the frozen sweet potato market is divided into food service and food retail. The food service segment holds a significant frozen sweet potato market share, and the food retail segment is expected to grow considerably during the forecast period. The food service sector is a key end user of frozen sweet potatoes. In recent years, the demand for different types of frozen sweet potato products has increased from hotels, quick service restaurants (QSRs), and fast-food chains. The frozen sweet potato products offer convenience to chefs and food service establishments, allowing for easy incorporation into various dishes without the time-consuming process of peeling and chopping fresh sweet potatoes. In addition, frozen sweet potatoes provide consistency in quality and taste, ensuring a reliable ingredient for chefs aiming to maintain a standardized menu.

Impact of COVID-19 Pandemic on Frozen Sweet Potato Market

The COVID-19 pandemic affected industries in various countries, influencing their economic conditions. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) negatively affected the growth of various industries, including the food & beverages. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products. In 2020, various companies announced possible delays in product deliveries and a slump in future sales of their products. In addition, the bans imposed by governments of various countries in Europe, Asia Pacific, and North America on international travel forced several companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the global frozen sweet potato market.

In 2021, governments of several countries announced relaxation in lockdown restrictions and permitted the manufacturers to operate at full capacity. As a result, the manufacturers procured raw materials smoothly and bridged the demand and supply gap. They further plan to expand their production capabilities due to the availability of abundant resources and laborers after the relaxation of restrictions. All these factors positively impacted the frozen sweet potato market. In addition, increasing demand for healthier snacking alternatives such as frozen sweet potato has gained popularity during the COVID-19 pandemic, contributing to the frozen sweet potato market growth.

Frozen Sweet Potato Market Report: Competitive Landscape

Conagra Brands Inc, Ardo Foods NV, Aviko BV, Birds Eye Ltd, Lamb Weston Holdings Inc, Le Duc Fine Food BV, McCain Foods Ltd, Mondial Foods BV, Handy Food Innovation Ltd, and Sunbulah Food & Fine Pastries Manufacturing Co Ltd are among the major players operating in the global frozen sweet potato market report. They are focused on product innovation, expansion, merger and acquisition, and innovative marketing strategies, which are expected to open new opportunities in the coming years. For instance, in February 2020, Slimming World launched Slimming World frozen sweet potato fries in Iceland with an aim to cater to the growing consumer demand for healthy alternatives. Such initiatives by key market players further drive the growth of the frozen sweet potato market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com