Growing Prevalence of Gluten Intolerance and Surging Demand for Organic Products Boost Gluten-Free Breakfast Cereal Market

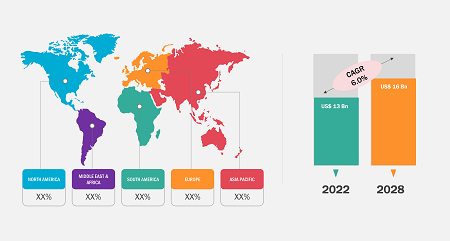

According to our latest study, titled "Gluten-free Breakfast Cereals Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product Type, Category, and Distribution Channel," the gluten-free breakfast cereals market is expected to grow from US$ 13 billion in 2022 to US$ 16 billion by 2028; it is expected to grow at a CAGR of 6% from 2022 to 2028.

Gluten-free Breakfast Cereals Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Category (Organic, Conventional); Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online retail, Others) , and Geography (North America, Europe, Asia Pacific, and South and Central America)

Gluten-free Breakfast Cereals Market Drivers [2021-2031]

Download Free Sample

One of the key factors driving gluten-free breakfast cereals market growth is the increasing prevalence of gluten intolerance, irritable bowel syndrome (IBS), and celiac disease across the world. According to the Celiac Disease Foundation, more than 3 million Americans have celiac disease. The prevalence of this disease has increased 4- or 5-fold since 1950 for unknown reasons. Growing consumer awareness of the preventive measures that can be taken to manage such ailments is fueling demand for easy-to-digest, gluten-free products. Moreover, due to hectic lifestyles and schedules, the demand for gluten-free, ready-to-eat meals, pasta, and baby food products has surged in recent years. Consumers mostly prefer organic food due to attributes such as nutritional value, taste, freshness, and appearance of these products. These factors fuel the gluten-free breakfast cereals market growth.

Based on product type, the gluten-free breakfast cereals market is segmented into hot cereals and ready-to-eat cereals. The market for the ready-to-eat (RTE) cereals segment is growing significantly. Ready-to-eat foods include pre-washed, cooked, mostly packaged food that needs to prior preparation or cooking. Western culture has a strong influence on consumers from other countries. Moreover, the popularity of ready-to-eat breakfast cereals is growing due to tight schedules. Thus, people are currently looking for faster, easier-to-prepare, and healthier meals and quick snacking options.

Owing to hectic work schedules, millennials prefer to use their time efficiently rather than wasting it on tedious tasks. They are more likely to spend their money on convenience. Thus, they increasingly prefer packaged RTE products such as baked products, snacks, and dairy products. According to the data by Hartman Group, 96% of millennials say they replace a meal once a week with a snack and 58% say they snack 4–5 times a day. Moreover, and convenience and taste are still the main desired attributes. 91% of consumers say they eat snacks throughout the day, while 8% forget all meals and just snack throughout the day. These factors are contributing to the demand for RTE products among millennials, which boosts the ready-to-eat breakfast cereals market.

Based on distribution channel, the gluten-free breakfast cereals market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The market for the online retail segment is growing significantly as people prefer online retail platforms for purchasing breakfast cereals. In recent years, the organized retail sector has undergone a massive transformation. The emergence of e-commerce has resulted in considerable changes in how people shop and spend their money. The increasing penetration of smartphones and the internet, easy access to emerging technologies, rising purchasing power, and convenience associated with online retail platforms (shopping from anywhere at any time) are a few of the key factors driving customers toward e-commerce platforms. According to the Retail Indicator Division of the US Department of Commerce, e-commerce sales in the US reached US$ 870 billion in 2021, up by 14.2% from 2020. E-commerce for groceries grew by 170% in 2021, accounting for 9.6% of total grocery sales in the US.

General Mills Inc., Kellogg's Company, Nestlé SA, Bob’s Red Mill Natural Foods, Nature's Path Foods, Hometown Food Company, purely Elizabeth, The Quaker Oats Company, Quinoa Corporation, and Gluten-Free Prairie are a few of the key players profiled in the study of the gluten-free breakfast cereals market. Several other major companies were analyzed in this research study to get a holistic view of the market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com