Improved Functional Performance and Capabilities is Boosting the Green Cement and Concrete Market

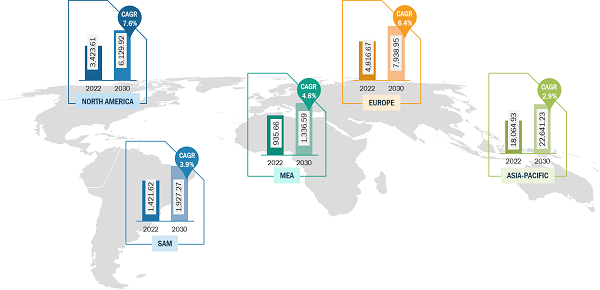

According to our latest market study on "Green Cement and Concrete Market Forecast to 2030 –Global Analysis – by Offerings and End-user," the market is expected to grow from US$ 28,662.51 million in 2022 to US$ 39,973.97 million by 2030; it is anticipated to grow at a CAGR of 4.2% from 2022 to 2030.

The production of green cement requires the application of byproducts, such as blast furnace slag, fly ash silica, and iron, which are cost-effective. Green cement possesses 0.5–0.6% iron dioxide in its properties, which offers strength to the solidity and color of the cement. This cement dries out quickly and has a minimal rate of shrinkage. It endures longer and makes for a more sustainable alternative for the environment. Green cement also provides superior thermal insulation and high fire resistance. Green cement is a more viable choice for high-traffic areas such as bridges, roads, and airports, as it can endure heavy loads. Additionally, green cement can preserve natural resources, such as clay and limestone, which are limited resources that are becoming rare. Thus, green cement's higher performance level and capabilities in terms of durability, strength, and resistance propel the green cement and concrete market share.

Green Cement and Concrete Market Share — by Region, 2022

Green Cement and Concrete Market Growth Report by 2030

Download Free SampleGreen Cement and Concrete Market Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Fly Ash Based, Geopolymer, Slag Based, and Others), End-user (Commercial and Public Infrastructure, Industrial, and Residential), and Geography

Source: The Insight Partners Analysis

The ongoing infrastructure development activities in Canada influence the green cement and concrete market growth. The country's growing population and urban expansion have surged in the demand for residential and commercial construction. As per the data provided by the Canadian Construction Association (CCA), the construction sector in Canada generates US$ 151 billion annually, accounting for 7.4% of Canada's gross domestic product (GDP). Canada's green cement and concrete industry is flourishing due to a strong national focus on sustainability and environmental responsibility. The Canadian government has introduced robust regulations and initiatives to reduce carbon emissions from cement production, fostering the adoption of cleaner technologies within the industry. In 2023, the Cement Association of Canada presented a Concrete Zero action plan to achieve carbon emission reductions in Canada's cement and concrete industry. In addition, in 2023, the Government of Canada and Heidelberg Materials partnered to decarbonize the cement and concrete industry. Key industry players such as Lafarge Canada, CRH Canada, and St. Marys Cement are actively engaged in developing and implementing sustainable solutions. Thus, the government initiatives in carbon emission reduction are expected to increase the green cement and concrete market growth in the coming years.

Germany is Europe's largest construction market, recording a revenue of US$ 175 billion in 2020, as per the data provided by the Germany Trade and Invest (GTAI). The German cement industry produces ~20 million metric ton of CO2 annually, thus becoming one of the top carbon-emitting countries in Europe. As a result, the government passed stringent regulations to reduce carbon emissions. In 2020, the Verein Deutscher Zementwerke e.v. (VDZ), the German Cement Association presented plans for decarbonizing cement and concrete by 2050. Germany's commitment to sustainable construction is significantly influencing the green cement and concrete market. Key players such as Heidelberg Cement, LafargeHolcim, and Buzzi Unicem actively invest in sustainable solutions to reduce carbon emissions. With stringent regulations, key player activities are expected to drive the green cement and concrete market in Germany. The Hauptverband Deutsche Bauindustrie (HDB) is a German construction industry association that predicts that the construction industry will contribute significantly to Germany's GDP in the coming years. The expansion of this industry is majorly attributed to the rise in residential and commercial or public infrastructure construction projects. As the country is one of the popular tourist destinations across the region, there is constant growth in the construction of hotels and malls in the country. With the rising construction of the mentioned commercial buildings, the demand for green cement and concrete is also increasing.

ACC Cement (Adani Group), China National Building Material Company Limited (CNBM), Green Cement Inc, Anhui Conch Cement, Holcim Ltd., JSW Cement Limited, and Navarattan Group are among the key green cement and concrete market players profiled during this study. In addition, several other important green cement and concrete market players have been studied and analyzed during the study to get a holistic view of the green cement and concrete market and its ecosystem.

Contact Us

Contact Person: Sameer Joshi

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com