2D Handheld Ultrasound Scanners Held Largest Share in Handheld Ultrasound Scanners Market in 2023

According to our new research study on "Handheld Ultrasound Scanners Market Forecast to 2031 – Global Analysis – by Product Type, Application, and End User," the market is expected to grow from US$ 354.60 million in 2023 to US$ 1,404.397 million by 2031; it is anticipated to record a CAGR of 18.8% from 2023 to 2031. The market report emphasizes trends prevalent in the global market, along with drivers and deterrents affecting its growth. Increased adoption of handheld point-of-care ultrasound (POCUS) devices in hospitals and the rise in demand for image-based diagnostic systems and real-time delivery are among the prominent factors driving the handheld ultrasound scanners market growth. However, shortage of skilled professionals and the limited battery life of portable ultrasound scanners is hampering the growth of the market.

AI algorithms can analyze ultrasound images with exceptional speed and precision, identifying subtle patterns and abnormalities the human eye may miss. This can lead to earlier disease detection, better severity assessment, and more targeted treatment plans. AI-powered features can also assist in guiding image acquisition, optimizing image quality, and providing real-time feedback to the operator, enhancing the overall examination process. The integration of AI will also lead to the development of novel applications for handheld ultrasound scanners. For instance, in April 2024, GE HealthCare launched Caption AI, an AI-driven software, to provide quick cardiac assessments at the point of care on Vscan Air SL. With Caption AI technology, medical professionals utilizing the Vscan Air SL handheld ultrasound device will now obtain automated ejection fraction estimation to support clinical judgments in various cardiac scenarios and real-time, step-by-step guidance for capturing diagnostic-quality images.

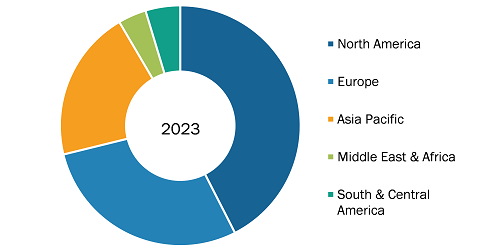

Handheld Ultrasound Scanners Market, by Region, 2023 (%)

Handheld Ultrasound Scanners Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (2D Handheld Ultrasound Scanners, 3D/4D Handheld Ultrasound Scanners, and Doppler Ultrasound), Application (Gynecology, Neurology, Cardiology, Urology, Aesthetics, Musculoskeletal, Veterinary, and Other Applications), End User (Hospitals and Ambulatory Care Centers, Diagnostic Centers, Military Usage, Remote Areas, Primary Care/Family Medicine, Medical/Nurse Education, Veterinary Clinics, and Others), and Geography

Handheld Ultrasound Scanners Market Dynamics by 2031

Download Free Sample

Source: The Insight Partners Analysis

Developing AI-powered cloud-based platforms for image analysis and data storage will facilitate the sharing of ultrasound images and data among healthcare providers, enabling collaborative decision-making and improved patient outcomes. This will also foster research and development, allowing the creation of new AI models and applications for handheld ultrasound. As AI technology advances, more handheld ultrasound scanners with sophisticated AI features are expected. This trend will not only improve the accuracy and efficiency of diagnostic imaging but also unlock new possibilities for personalized healthcare, remote monitoring, and disease management. Thus, the integration of artificial intelligence (AI) is expected to bring new handheld ultrasound scanners market trends in the coming years.

However, the shortage of skilled professionals and the limited battery life of portable ultrasound scanners hamper the handheld ultrasound scanners market growth. The increasing adoption of portable ultrasound devices requires a larger pool of trained healthcare professionals capable of operating and interpreting the images generated. While many physicians embrace point-of-care ultrasound, the lack of comprehensive training programs and standardized certification processes presents a challenge. This shortage of skilled professionals can lead to inconsistent image quality, inaccurate interpretations, and potentially delayed or incorrect diagnoses, hindering the full potential of these devices. Ultrasound is routinely used in hospitals for various imaging tests during pregnancy and cancer screenings. As per the new ultrasound study in NHS hospital departments in England, 43.4 million imaging examinations were recorded between February 2022 and January 2023. According to reports, 3.41 million of these imaging examinations were performed in January 2023, increasing imaging examinations and creating a shortage of ultrasound personnel (sonographers) in the country. This shortage has resulted in delays in diagnosis and cancellations of operations.

The handheld ultrasound scanners market analysis has been carried out by considering the following segments: product type, application, end user, and geography. The market, by product type, is segmented into 2D handheld ultrasound scanners, 3D/ 4D handheld ultrasound scanners, and Doppler ultrasound. The 2D handheld ultrasound scanners segment held the largest handheld ultrasound scanners market share in 2023 and is expected to record the highest CAGR by 2031. 2D handheld ultrasound scanners are the most common portable ultrasound devices, offering a cost-effective and versatile solution for point-of-care imaging. These devices use a single transducer to produce two-dimensional images, providing clear visual representations of internal structures. While they may not offer the same level of detail as high-end 3D or 4D systems, 2D handheld scanners are well-suited for various clinical applications, including musculoskeletal imaging, abdominal assessments, cardiac evaluations, and even essential fetal monitoring. Their portability, ease of use, and affordability make them a valuable tool for healthcare professionals across different specialties, contributing to faster diagnoses, improved patient care, and enhanced diagnostic accuracy in various clinical settings.

Based on application, the handheld ultrasound scanners market is classified into gynecology, neurology, cardiology, urology, aesthetics, musculoskeletal, veterinary, and other applications. The gynecology segment held the largest share in the handheld ultrasound scanners market in 2023 and is expected to register the highest CAGR during the forecast period.

Based on end user, the market is segmented into hospitals and ambulatory care centers, diagnostic centers, military usage, remote areas, primary care/family medicine, medical/nurse education, veterinary clinics, and others. The hospitals and ambulatory care centers segment held the largest handheld ultrasound scanners market share in 2023 and is expected to register the highest CAGR during 2023–2031. A hospital is a healthcare institution that treats people through specialized scientific equipment and trained staff. Vascular surgeons, radiologists, cardiovascular specialists, and general practitioners who need to image blood flow, flow blockages, and vascular structure and for guidance during vascular surgery use Blow flow imaging, ICE, Doppler, IMT, and other popular vascular features to diagnose and direct treatment. Hospitals play a significant role by providing extensive medical services to the patient population suffering from a wide variety of diseases.

Ambulatory surgery centers (ASCs) are modern healthcare facilities that provide same-day surgical care, which include diagnostic and preventive procedures.

The geographic scope of handheld ultrasound scanners market report entails North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). In terms of revenue, North America accounted for the largest market share in 2023. Factors such as the rise in the prevalence of chronic diseases such as cancer, cardiovascular diseases, and respiratory diseases and the development of innovative products are driving the market growth in the region. For instance, in April 2022, Clarius Mobile Health, a leading medical technology company in Canada, received approval from Health Canada for its third-generation product line of high-performance handheld ultrasound scanners. These pocket-sized, lightweight, and affordable scanners are made available across Canada with new features and groundbreaking pricing, making premium handheld ultrasound technology more accessible to clinicians. GE Healthcare, Fujifilm Sonosite, and Butterfly Network Inc are among the major handheld ultrasound scanner manufacturers operating in the region, which contribute notably to the expansion of the handheld ultrasound scanners market size.

Competitive Landscape

GE HealthCare Technologies Inc; Siemens Healthineers AG; Koninklijke Philips NV; FUJIFILM SonoSite Inc; EchoNous Inc; Sonoscanner; Healcerion Co., Ltd; Shenzhen Mindray Bio-Medical Electronics Co Ltd; Clarius Mobile Health Corp; Butterfly Network Inc; TERASON DIVISION TERATECH CORPORATION; Guangzhou SonoHealth Medical Technologies Co., Ltd; CHISON Medical Technologies Co., Ltd.; Vave Health; Nipro Medical Corp; ASUSTek Computer Inc; and FUKUDA DENSHI are among the leading companies profiled in the handheld ultrasound scanners market report. The companies implement both organic (such as product launches, expansion, and product approvals) and inorganic (such as collaborations and partnerships) strategies to stay competitive in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com