Increasing Investments in Oil and Gas Sector Boost Hydrogen Compressors Market Growth

According to our latest study on "Hydrogen Compressors Market Analysis and Forecast to 2035 – by Type, Technology, and End-user," the market was valued at US$ 1,913.04 million in 2023 and is projected to reach US$ 3,740.52 million by 2035; it is anticipated to record a CAGR of 6.0% from 2023 to 2035. The report includes growth prospects owing to the current hydrogen compressors market trends and their foreseeable impact during the forecast period.

The need for oil and gas has grown significantly in developing and developed nations, leading to increased production activities such as investments and research and development activities. In January 2023, during a conference on oil and gas wells enhancing recovery, the CEO of the National Iranian Oil Company (NIOC) announced that the company invested US$ 1 billion in the development of the joint Sohrab field in Khuzestan Province. The CEO also announced the company's plans to sign contracts with local companies to enhance the productivity of 600–700 low-efficient wells. In April 2022, China National Offshore Oil Corporation, a leading national oil company in China, announced the country's first successful operation of an offshore large-scale super-heavy thermal oil recovery oilfield development model. In April 2023, the Oil and Natural Gas Corporation (ONGC) collected US$ 7 billion in investments for the next 3–4 years to support oil and gas production. Further, the Government of Indonesia has shown support for developing the Enhanced Oil Recovery (EOR) industry. Policies and regulations are implemented to encourage oil companies to adopt EOR technologies. For instance, in September 2021, the Energy Minister of Indonesia, Arifin Tasri, announced plans to increase production to 1 million barrels/day. The Government of Indonesia is implementing several strategies to achieve several targets, including optimizing existing oil resources, transforming resources for production, accelerating enhanced oil recovery and massive exploration for significant discoveries, as well as developing unconventional oil. Thus, the growing demand for hydrogen compressors in the oil and gas industry boosts the hydrogen compressors market growth.

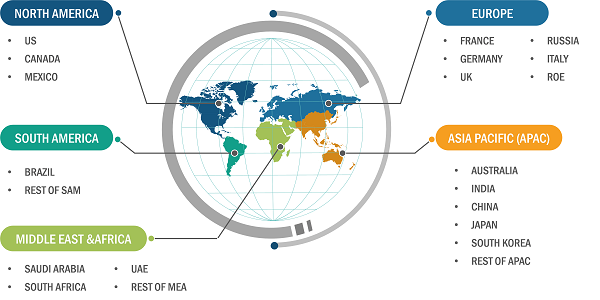

Hydrogen Compressors Market Share — by Region, 2023

Hydrogen Compressors Market Size and Forecast (2021–2035), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Lubricated and Oil-Free), Technology (Reciprocating Hydrogen Compressors, Diaphragm Hydrogen Compressors, Nonmechanical Hydrogen Compressor, and Others), End-user (Power Plants, Oil and Gas, Food and Beverages, Petrochemical and Chemical, Hydrogen Fueling Station, Hydrogen Storage, and Others), and Geography

Hydrogen Compressors Market Key Findings and Share by 2035

Download Free Sample

Source: The Insight Partners Analysis

The development of an electrochemical hydrogen compressor (EHC) is necessary to meet the critical requirements of higher efficiency, lower cost, and improved durability. For instance, HyET Group offers electrochemical hydrogen compression technology, which is exclusively designed to operate the compression and purification step utilizing one piece of equipment. This results in a compact, energy-efficient, and cost-effective electromechanical hydrogen compressor. Furthermore, this technology minimizes downtime, as electrochemical compression stacks are static equipment; as a result, the compressor does not have the wear and tear issue. The modular design of EHC systems facilitates concurrent operation in case one of the compressor stacks requires maintenance or inspection after some period. Also, in September 2023, Atlas Copco launched an H2P hydrogen compressor that is capable of electrochemical electrolysis production. The company introduced speed-controlled technologies to compensate for fluctuations in hydrogen production and ensure optimal efficiency by reducing energy losses. These unique technologies launched by the key players are contributing to the growing hydrogen compressors market size.

The scope of the hydrogen compressors market report focuses on North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). APAC held the largest hydrogen compressors market share in 2023 and is projected to maintain its dominance during the forecast period. Europe is the second-largest contributor to the global hydrogen compressors market, followed by North America.

In 2023, the US was the second-largest hub for manufacturing and industrial production after China. The manufacturing sector contributed nearly US$ 2,900 billion and accounted for more than 12% of the total US GDP. There is a continuous need to boost investments in hydrogen infrastructure development and expansion to raise the industrial output at the same pace in the future, which, in turn, is expected to create a demand for hydrogen compressors in the coming years. The current infrastructure in the US is aging and needs upgrades and capacity expansion, especially in sectors such as oil and gas, energy, refinery, petrochemicals, and aviation. With an upsurge in investments toward upgrading the infrastructure of these industries, there will be a rise in demand for hydrogen as a transition fuel in the US. Further, the growing upstream and downstream activities, and rising power generation and transmission projects by the government are propelling the market growth. Hydrogen compressors are extensively used in electricity storage networks in nuclear power plants and industrial manufacturing.

The growing oil and gas exploration activities with the US government support and initiatives lead to significant growth in the hydrogen compressors market size. The US government planned to invest US$ 50 billion to promote a Clean Hydrogen Economy by building seven clean hydrogen hubs in the country. The growth in the power generation capacity is the most substantial factor driving the market in the country. The hydrogen compressor is extensively used in the electricity storage network in nuclear power plants and industrial manufacturing; thus, it is likely to boost the market growth in the coming years. In addition, the government and various companies in the US are investing in clean energy projects. In March 2022, the US Department of Energy planned to invest US$ 750 million in research and development in hydrogen production for making clean hydrogen. The investment was increased to US$ 1.5 billion in 2022 to reduce the additional costs of clean energy hydrogen production. The total funding from the federal government is supported by Plug Power Inc's research and development activities.

Atlas Copco AB; Fluitron, Inc.; Gardner Denver Nash, LLC; Burckhardt Compression AG; HAUG Sauer Kompressoren AG; Howden Group; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; PDC Machines Inc.; Sundyne; and Ariel Corporation are among the key players profiled in the hydrogen compressors market report. Companies in the hydrogen compressors market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com