Pressing Need for Energy Efficient and Eco-Friendly Solutions Boosts India Domestic and Commercial Air Cooler Market Growth

According to our latest study titled "India Domestic and Commercial Air Cooler Market Forecast to 2031 – Trend and Growth Opportunity Analysis – by Type, Distribution Channel, Area, Tank Size, Air Delivery, and End User," the market was valued at US$ 549.53 million in 2024 and is projected to reach US$ 1,134.01 million by 2031; it is estimated to register a CAGR of 10.9% from 2024 to 2031. The report includes growth prospects in light of current India domestic and commercial air cooler market trends and factors influencing the market growth.

India Domestic and Commercial Air Cooler Market

India Domestic and Commercial Air Cooler Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Desert, Room, Tower, and Window), Distribution Channel (Offline and Online), Area (Urban and Rural), Tank Size (50–125 Liters, 20–50 Liters, and Above 125 Liters), Air Delivery (1000–8500 CMH, 8500–20000 CMH, and Above 20000 CMH), End User (Residential, Commercial, and Industrial), and Geography

India Domestic and Commercial Air Cooler Market Size by 2031

Download Free Sample

The demand for energy-efficient air coolers in India is being driven by a mix of environmental awareness, a rise in energy costs, and customers' inclination toward sustainable living. As the country grapples with rising temperatures, cooling options such as air conditioners have become popular; however, they are energy-intensive and expensive. This has led people to look for solutions that deliver adequate cooling without dramatically increasing electricity costs. Energy-efficient air coolers are designed to use substantially less power than air conditioners. Their cooling system is based on fans and water evaporation, which uses little energy. Also, air coolers are often recognized as the more environmentally beneficial option. They utilize significantly less electricity than air conditioners, often working at 80–150 watts, lowering their carbon impact. Their reliance on water for evaporative cooling is efficient because water consumption is restricted and managed with suitable refilling techniques. Additionally, air coolers do not use toxic refrigerants; therefore, they are free of ozone-depleting compounds and greenhouse gases.

The rising cost of electricity has made customers more cost-conscious, encouraging them to look into alternatives to lower their monthly energy bills. According to an article by Voltas, running an air cooler for 8 hours costs roughly INR 200–400 per month, while an air conditioner, particularly a 1.5-ton one, can add INR 2,000–4,000 or more to the monthly electrical bill. As a result, the growing need for sustainable cooling solutions, continuous changes in the climatic conditions in the country, and rising energy costs are fueling the demand for products in the India domestic and commercial air cooler market.

The India domestic and commercial air cooler market analysis has been carried out by considering the following segments: type, distribution channel, area, tank size, air delivery, and end user. In terms of type, the India domestic and commercial air cooler market is segmented into desert, room, tower, and window. Based on distribution channel, the India domestic and commercial air cooler market is segmented into offline and online. In terms of area, the India domestic and commercial air cooler market is segmented into urban and rural. Based on tank size, the India domestic and commercial air cooler market is segmented into 50–125 liters, 20–50 liters, and above 125 liters. In terms of air delivery, the India domestic and commercial air cooler market is segmented into 1000–8500 CMH, 8500–20000 CMH, and above 20000 CMH. Based on end user, the India domestic and commercial air cooler market is segmented into residential, commercial, and industrial. The residential segment held the largest share in the India domestic and commercial air cooler market in 2024.

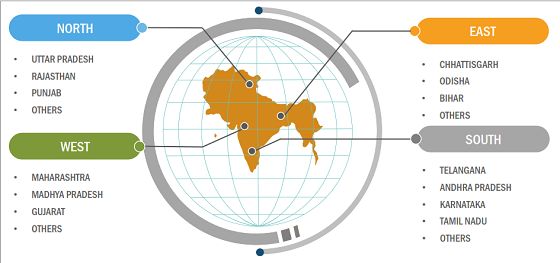

The scope of the India domestic and commercial air cooler market report focuses on Central and North (Uttar Pradesh, Rajasthan, Punjab, and Rest of Central and North), West (Maharashtra, Madhya Pradesh, Gujarat, and Rest of West), East (Chhattisgarh, Odisha, Bihar, and Rest of East), and South (Telangana, Andhra Pradesh, Karnataka, Tamil Nadu, Rest of South India). Central and North India accounted for the largest India domestic and commercial air cooler market share in 2024. The Central and North region comprises Uttar Pradesh, Rajasthan, Punjab, Delhi, Haryana, Jammu and Kashmir, Uttarakhand, Himachal Pradesh, and Chandigarh. Delhi, the capital of India, experiences extreme weather conditions in summer. During this season, continental air sweeps across the city, making the temperature extremely dry and scorching. During the summer, temperatures can reach ~45°C. Haryana and Rajasthan experience similar weather conditions. In May 2024, the majority of Haryana, Chandigarh, Delhi, and West Rajasthan experienced high temperatures between 46 and 50°C. In addition, this region experienced severe heatwave conditions. Furthermore, in the first two weeks of June 2024, the northwest and central regions had maximum temperatures of 42–44°C. The region's hot summer is raising the demand for air coolers to cool the indoor space.

Symphony Ltd, Bajaj Electricals Ltd, Havells India Ltd, Honeywell International Inc, Crompton Greaves Consumer Electricals Ltd, Intex Technologies India Ltd, Voltas Ltd, Blue Star Ltd, Hindware Home Innovation Ltd, and Orient Electric Ltd are among the key players profiled in the India domestic and commercial air cooler market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com