Increasing Electric Vehicle Production and Sales Drive Global Lithium Carbonate Market Growth

According to the latest market study on “Lithium Carbonate Market Forecast to 2030 – COVID-19 Impact and Global Analysis – by Grade and Application,” the global lithium carbonate market size was valued at US$ 5,280.92 million in 2022 and is projected to reach US$ 7,024.31 million by 2030; it is anticipated to record a CAGR of 3.6% from 2022 to 2030. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Lithium carbonate is a lithium salt of carbonic acid that is soluble in water. Lithium carbonate is the most common form of lithium salt used in various applications. It is used in the pharmaceutical industry as a mood stabilizer used to treat bipolar disorder. It is a major component in lithium-ion batteries used in several electronic devices. It also finds application in the production of ceramics and glass to enhance the strength and durability of finished products. The impurities from aluminum and other metals are eliminated by the application of lithium carbonate in the metallurgy industry.

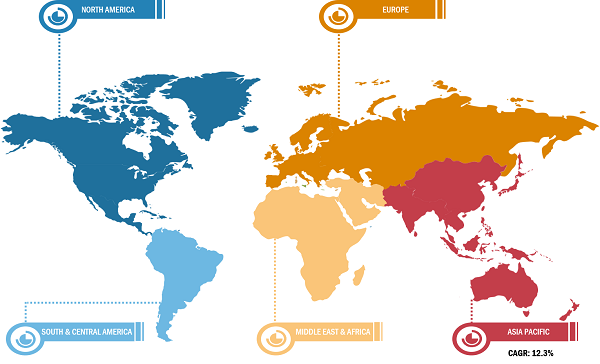

Global Lithium Carbonate Market Breakdown – by Region

Lithium Carbonate Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Grade (Industrial Grade, Pharmaceutical Grade, and Battery Grade) and Application (Batteries, Ceramic and Glass Production, Lubricants, Pharmaceuticals, Metallurgy, and Others)

Lithium Carbonate Market Size and CAGR by 2031

Download Free Sample

In the past few years, electric vehicle production has increased due to factors such as government incentives, technological advancement, rising environmental concerns, and growing adoption of electric vehicles. Electric vehicles produce zero tailpipe emissions, which helps to reduce air pollution and greenhouse gas emissions. This is a major advantage over gasoline-powered vehicles, which are the main source of air pollution and greenhouse gas emissions. Electric vehicles are more affordable and efficient due to technological advancement. In the past few years, several research and development activities have been conducted to make batteries more efficient and less expensive. Further, governments of several economies in Europe, Asia Pacific, and North America offer incentives, subsidies, and tax breaks to encourage the purchase of electric vehicles.

Consumers' preference for electric vehicles has increased due to rising petroleum prices and growing awareness regarding environmental concerns about gasoline-powered vehicles. As a result of these factors, electric vehicle production is expected to continue to grow in the next few years. According to a report by the International Energy Agency in 2022, 2.3 million electric vehicles were sold in Europe in 2021 (a rise from 1.4 million in 2020). According to a report published by the China Passenger Car Association, in 2022, Tesla Inc. delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles from 2021. The growth of the electric vehicle market has put a strain on existing lithium supplies. This has further increased lithium carbonate prices. Therefore, there is also growing interest in the development of new sources of lithium, such as brine source.

Albemarle Corporation, SQM SA, Targray, Noah Chemicals, Livent, Imerys, Tianqi Lithium, Alfa Aesar, Otto Chemie Pvt Ltd, and Celtic Chemicals Ltd are among the key players operating in the global lithium carbonate market.

Impact of COVID-19 Pandemic on Global Lithium Carbonate Market Growth

During the COVID-19 pandemic, disruptions in chemical and materials manufacturing operations severely impacted global supply chains and hindered product manufacturing activities, delivery schedules, and sales. Various chemicals and materials companies reported product delivery delays and sales slump in 2020. Moreover, restrictions on international travel imposed by governments of various European and Asia Pacific countries compelled manufacturers and suppliers to discontinue their business strategies, such as partnerships, temporarily. All these factors hampered many sectors during the pandemic and restrained the growth of the chemicals & materials industry. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created demand and supply gaps, adversely affecting the growth of the lithium carbonate market.

The automotive sector, a major consumer of lithium-ion batteries, witnessed a downturn as vehicle production slowed down due to factory closures and decreased consumer demand. This resulted in decreased demand for lithium carbonate used in battery production for electric vehicles. In 2020, supply chain shortages, increased labor costs, and high demand for raw materials resulted in price inflation of materials required in the automotive industry across various regions. In 2021, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to a conducive environment for automobile producers and other materials industries. By the end of 2021, the sales of lithium carbonate increased with the resumption of production and sales operations of companies operating in the automotive industry.

The "Global Lithium Carbonate Market Analysis and Forecast to 2030" is a specialized and in-depth study of the chemicals & materials industry, focusing on the global lithium carbonate market trend analysis. The report aims to provide an overview of the market with detailed market segmentation. The global lithium carbonate market is divided on the basis of grade and application. Based on grade, the lithium carbonate market is segmented into pharmaceutical grade, industrial grade, and battery grade. Based on application, the market is segmented into batteries, ceramic and glass production, lubricants, pharmaceuticals, metallurgy, and others. Pharmaceutical-grade lithium carbonate is used in medical and laboratory applications and has a high purity level. Industrial-grade lithium carbonate is used in the production of glass, ceramics, lubricants, polymers, cement additives, and frits. It has a slightly lower purity level than battery-grade lithium carbonate. Battery-grade lithium carbonate is used to produce lithium-ion batteries. The particle size of lithium carbonate is controlled to meet the specifications of battery manufacturers, thereby optimizing electrode performance.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com